Groww Nifty Total Market Index Fund: Broadest market exposure through low cost index fund

Current market context

The stock market is trading at all time high. The leading bell weather indices, Nifty and Sensex are trading above the psychologically important 25,000 and 80,000 levels respectively. Positive macro factors (strong GDP growth forecast, narrowing fiscal deficit and stable currency) and bullish investor sentiments are supporting the rally in Indian equities. Global equity markets, especially the US market, have also supported the momentum in Indian equities. The rally has been broad based with the broader market (including midcaps and small caps) outperforming the Nifty 50.

Why you should take broad market exposure through index funds?

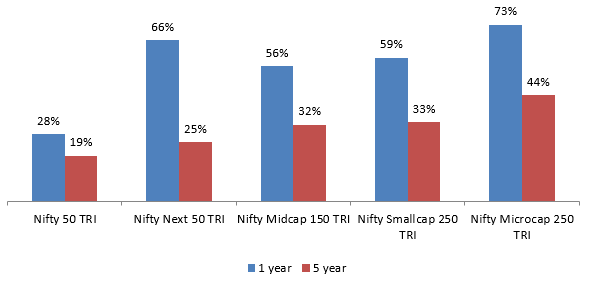

Index funds have grown in popularity with retail investors over the past few years. Index Fund assets under management (AUM) have grown 50X in the last 5 years (source: AMFI, as on 31st July 2024). Number of index funds folios has grown from 3.3 lakhs to nearly 1 crore in the last 5 years (source: AMFI, as on 31st July 2024). Most investors usually associate index funds with Nifty or Sensex. However, according to the historical data, the broader market has the potential outperformed the Nifty (see the chart below). Nifty Total Market index, which includes 750 stocks, covering all market cap segments, large cap, midcap, small cap, micro cap etc, can provide you the broadest exposure to equities.

Source: NSE, as on 31st July 2024. All indices are TRI. 5 year returns are in CAGR. Disclaimer: Past performance may or may not be sustained in the future

Characteristics of different market cap segments

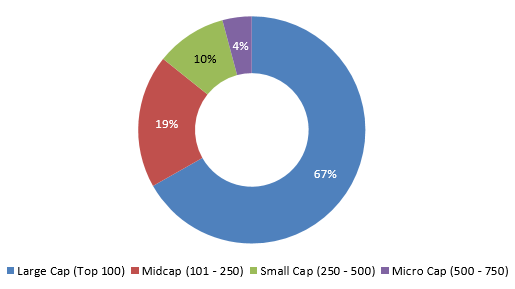

- Large Cap: The top 100 stocks by market cap are classified as large cap. These companies are established conglomerates with large balance sheets and market share leadership. They provide relative stability to equity portfolio.

- Midcap: 101st to 250th stocks by market cap are classified as midcaps. These companies have growing businesses. Companies that are midcap today have the potential of becoming large cap in the future.

- Small Cap: 251st to 500th stocks by market cap are classified as small cap stocks. Companies in this stage are usually scaling up their business, which can result in significantly higher revenue and earnings growth over long investment horizons compared to larger companies. Some of these stocks can be multibaggers stocks.

- Micro Cap: 501st to 750th stocks by market cap are classified as micro cap stocks. These companies are often suppliers are to large companies and can benefit from the growth of the industry sector, as well as growth in the overall economy.

About Groww Nifty Total Market Index Fund

Groww Nifty Total Market Index Fund was launched in October 2023. The fund tracks the Nifty Total Market Index. The TER of the regular plan is 1.00% and that of the direct plan is 0.25% (as on 31st July 2024). Abhishek Jain is the fund manager of the scheme. Groww Nifty Total Market Index Fund is the first and one of only two index funds tracking the Nifty Total Market Index.

Why invest in Groww Nifty Total Market Index Fund?

- Nifty Total Market Index includes the top 750 stocks by market capitalization listed on the National Stock Exchange. Nifty Total Market Index covers 95% of the market cap of the entire listed universe in NSE.

Source: Market cap classification of NSE stocks as on 30th June 2024

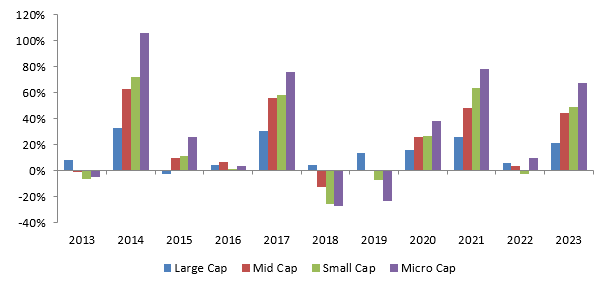

- Winners rotate across different market cap segments in different market conditions (see the chart below). This highlights the fluctuating nature of the market. The Nifty Total Market Index diversifies across all market cap segments.

Source: NSE, as on 31st December 2023. Large Cap: Nifty 100 TRI, Mid Cap: Nifty Midcap 150 TRI, Small Cap: Nifty Smallcap 250 TRI, Micro Cap: Nifty Microcap 250 TRI.

- Nifty Total Market Index covers 95% of the listed universe, whereas the most popular index i.e. Nifty 50 covers only 52% of the listed universe.

- Nifty Total Market Index provides much wider industry coverage. It covers 22 industry sectors, out which only 13 sectors are represented in Nifty 50.

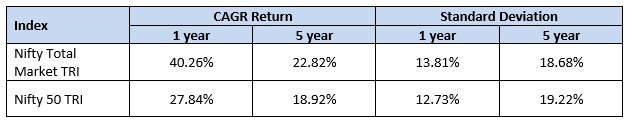

- Nifty Total Market Index has the potential of giving superior risk adjusted returns compared to Nifty 50 (see the table below). You can see that the Total Market Index outperformed Nifty 50 across different time-scales, but the volatility of the Total Market Index was similar or even lower (over long investment tenures) compared to Nifty 50 over 5 year tenure.

Source: NSE, as on 31st July 2023

- Index funds have significantly lower Total Expense Ratios (TERs) compared to actively managed funds.

- Index funds have no fund manager bias. They are simple and convenient investment options.

- Groww Nifty Total Market Index Fund offers the convenience and flexibility of mutual funds. Demat account is not mandatory for investing in this fund. If you need liquidity for any reason, you can redeem units of your scheme at any time, subject to exit load structure.

- You can invest from your regular through Systematic Investment Plan (SIP) according to your investment needs.

Who should invest in Groww Nifty Total Market Index Fund?

- Investors looking for capital appreciation over long investment horizon

- Investors with high risk appetites

- Investors with minimum 3 – 5 years investment tenures

- This fund is suitable for both first time and seasoned investors

- You can invest in this fund either in lump sum or SIP depending on your investment needs and financial situation

Investors should consult their financial advisors or mutual fund distributors if Groww Nifty Total Market Index Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Groww Mutual Fund is sponsored by Groww Invest Tech Private Limited. Groww Invest Tech is a SEBI registered Stock Broker, Depository Participant, Research Analyst and AMFI registered Mutual Fund Distributor.

Investor Centre

Follow Groww Mutual Fund

More About Groww Mutual Fund

POST A QUERY