Groww Nifty Non-Cyclical Consumer Index Fund: A good thematic passive investment for long term investors

Index funds are gaining rapid popularity in India. In the last 4 years, as per AMFI data, the assets under management index funds multiplied by 20 times (source: AMFI, as on 31st October 2024). Retail investors usually associate index funds investments with Nifty 50 and BSE Sensex indices. However, thematic index funds may have the potential of outperforming over long investment horizons. In this article we will discuss about one such fund, Groww Nifty Non-Cyclical Consumer Index Fund, which is a passive thematic fund tracking the Nifty Non-Cyclical Consumer Index. The fund was launched in May 2024 and tracks the Nifty Non-Cyclical Consumer Index. The Total Expense Ratio (TER) of the Direct Plan is 0.4%, while that of the Regular Plan is 1% (as on 31st October 2024).

About Nifty Non-Cyclical Consumer Index

Nifty Non-Cyclical Consumer Index which aims to track the performance of portfolio of stocks that broadly represent the Non-Cyclical Consumer theme. Stocks forming part / going to form part of the Nifty 500 at the time of review are eligible for inclusion in the index. The largest 30 stocks from eligible basic industries are chosen based on 6 month average free-float market capitalisation. Stock The weight of the stocks in the index is based on their free-float market capitalization. Stock weights are capped at 10%. The index is rebalanced semi-annually.

What are non cyclical consumer sectors?

Cyclical industries are the ones, where the consumption demand changes based on economic cycles. In cyclical industries demand goes up in times of economic growth and goes down in times of economic slowdown or recession. Non cyclical industries are the ones, where consumption demand is relatively less impacted by economic cycles. Examples of non cyclical industries are FMCG, Dairy Products, Edible Oil, Education, Footwear, Household appliances, Personal Care, Paints, Packaged food, Plastic Products, Sugar, Tea and Coffee, Telecom services etc.

Nifty Non-Cyclical Consumer Index outperformed Nifty 50

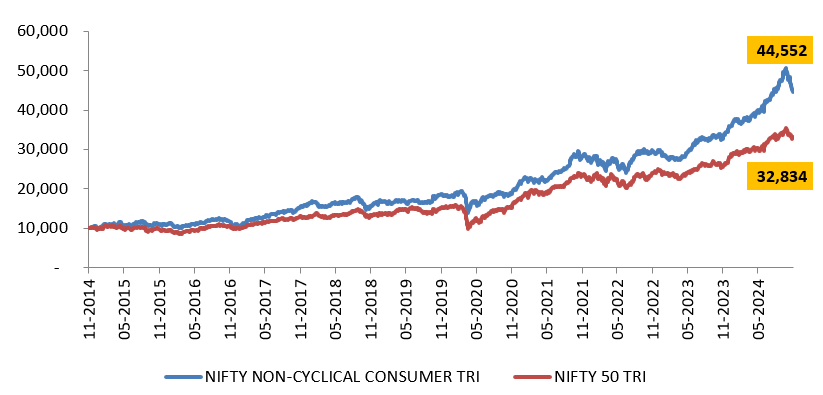

The chart below shows the growth of Rs 10,000 investment Nifty Non-Cyclical Consumer TRI versus Nifty 50 TRI over the last 10 years (as on 31st October 2024). You can see that Nifty Non-Cyclical Consumer Index outperformed the broad market Nifty 50 Index.

Source: National Stock Exchange, Advisorkhoj Research, as on 31.10.2024

Outperformed Nifty 50 over different periods

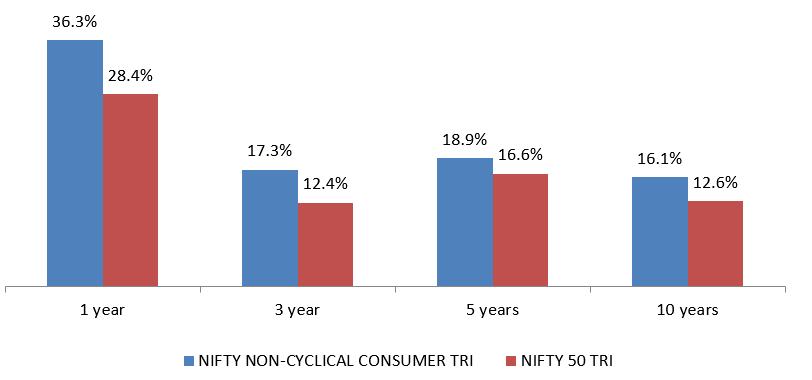

The chart below shows the 1 year, 3 years, 5 years and 10 years returns of Nifty Non-Cyclical Consumer TRI versus Nifty 50 TRI. You can see that the Nifty Non-Cyclical Consumer index outperformed Nifty 50 over long investment tenures.

Source: National Stock Exchange, Advisorkhoj Research, as on 31.10.2024

Lower volatility compared to Nifty 50

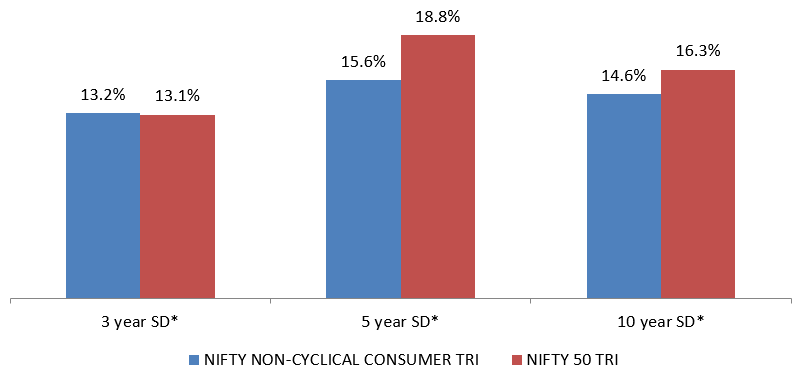

The chart below shows the standard deviations of Nifty Non-Cyclical Consumer Index versus Nifty 50 over different investment periods. Standard deviation is a measure of volatility. You can see that despite giving higher returns, the volatility of the Nifty Non-Cyclical Consumer Index is lower than that of Nifty 50. This shows the potential of Nifty Non-Cyclical Consumer Index to give superior risk adjusted returns relative to Nifty 50.

Source: National Stock Exchange, Advisorkhoj Research,as on 31.10.2024. SD is annualized standard deviation of monthly index returns over different investment periods.

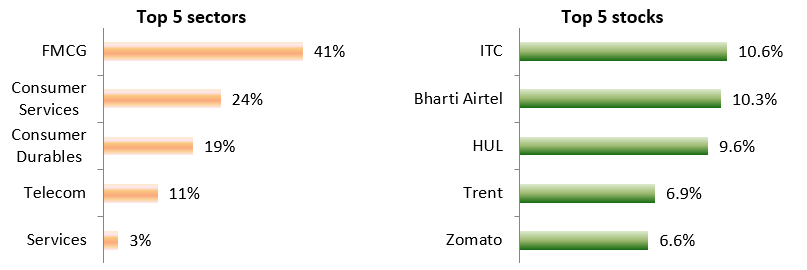

Composition of Nifty Non-Cyclical Consumer Index

Source: National Stock Exchange, as on 31st October 2024

Why invest in Groww Nifty Non-Cyclical Consumer Index Fund?

- Low cost exposures to non-cyclical consumer industries.

- Nifty Non-Cyclical Consumer Indexoutperformed the broad market index (Nifty 50) over long investment horizon.

- Nifty Non-Cyclical Consumer Index was relatively less volatile over longer investment tenures compared to Nifty 50.

- No unsystematic risks like stock picking and fund manager biases.

- Non-demat account holders can invest in this fund.

- Option of investing through Systematic Investment Plan (SIP).

Who should invest in Groww Nifty Non-Cyclical Consumer Index Fund?

- Investors looking for capital appreciation over long investment tenures through passive investing.

- Investors who want to tactical allocations tonon cyclical consumer industriesin their investment portfolio.

- Investors with high risk appetites.

- You should have minimum investment tenure of 3 to 5 years.

- You can invest either in lump sum or SIP depending on your investment needs.

Investors should consult with their financial advisors or mutual fund distributors if Groww Nifty Non-Cyclical Consumer Index Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Groww Mutual Fund is sponsored by Groww Invest Tech Private Limited. Groww Invest Tech is a SEBI registered Stock Broker, Depository Participant, Research Analyst and AMFI registered Mutual Fund Distributor.

Investor Centre

Follow Groww Mutual Fund

More About Groww Mutual Fund

POST A QUERY