Groww Nifty India Railways PSU Index Fund: India's first Railway PSU Index Fund

Groww Mutual Fund has launched a New Fund Offer (NFO), Groww Nifty India Railways PSU Index Fund. The fund will track the Nifty India Railways PSU Index Fund. The index comprises of Public Sector Undertakings (PSU) and other organizations functioning under the Ministry of Railways. Stocks from the eligible universe that do not function directly under Ministry of Railways, but supply products, raw materials, or provide services such as technology, electricity, consulting, etc., to Indian Railways, or have any revenue or trade receivables from Indian Railways are also part of Nifty India Railways PSU Index Fund. The NFO has opened for subscription on 16th January 2025 and will close on 30th January 2025.

Indian Railways – Growth Journey

- Passenger traffic for FY 2024 was 6.7 billion, nearly equivalent to the world’s population

- India has the 3rd highest number of railway stations in the world (7,325) after Russia (13,746)

- In FY24, freight loading crossed 1,588 metric tonnes against the previous year’s loading of 1512 metric tonnes.

- As of March 31, 2023, the Indian Railway network spanned 68,584 km (42,616 mi) in route length - this is the fourth longest in the world

- 97% of the Indian rail network is now electrified

Freight Traffic - Growth drivers

- Indian Railways generates 72% of its revenues from freight traffic.

- Freight traffic is expected to rise due to industrialization (growth in manufacturing sectors). The Government aims to increase the share of railways in freight transportation from 27% to 45% by 2030

- Freight transit times are expected to come down due to increase in the average speed of freight trains to 50 km/h.

- The Government plans to establish 100 more Gati Shakti cargo terminal to enhance fright / goods handling capacity

Passenger Traffic – Growth drivers

- Indian Railways aims to transport around 830 crore passengers in 2024-25

- India’s rising per capita GDP will also drive growth in passenger traffic

- Indian Railways will manufacture 400 more energy efficient Vande Bharat trains.

- Indian Railways has plans of track expansions and upgradation for 44,000+ kms costing Rs. 7.44 lakh crore.

- More than 1,300 railways stations will be modernized

- Kavach (automatic train protection system) expansion is underway with plans to cover more than 6,000 kms

Government investments for Railways modernization

- A record allocation of Rs. 2.62 lakh crore has been made as Capex for Indian Railways for FY 2024-25

- The Government has an ambitious modernisation plan for Railways. It has committed Rs. 10-12 lakh crore over the next five years to transform the railway landscape

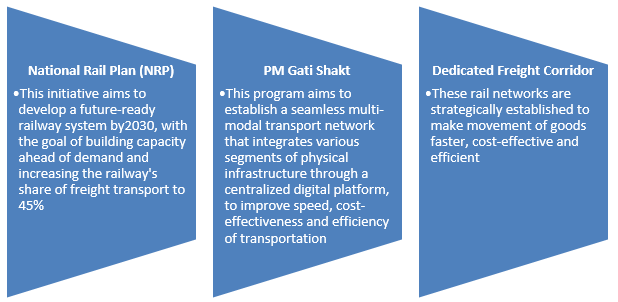

Government initiatives for freight

About Nifty India Railways PSU Index

- Core stocks: Public Sector Undertakings (PSU) and other organizations functioning under the Ministry of Railways. The aggregate weight of stocks belonging to the core group is capped at 80%

- Non-core stocks: Stocks from the eligible universe that are not part of the core group mentioned above, but supply products, raw materials, or provide services such as technology, electricity, consulting, etc., to Indian Railways, or have any revenue or trade receivables from Indian Railways. The aggregate weight of stocks belonging to the non-core group is capped at 20%

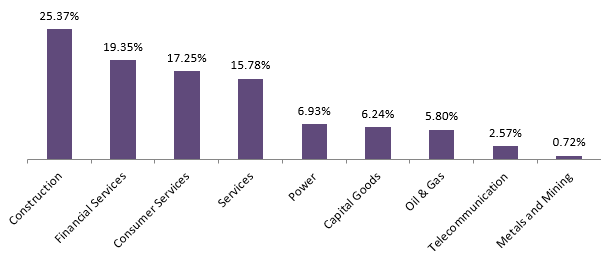

Spread of sectors in Nifty India Railways PSU Index

Source: National Stock Exchange, 31st December 2024

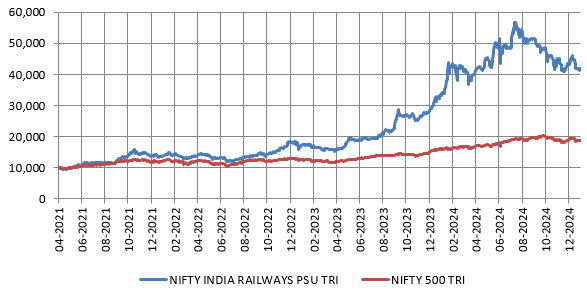

Nifty India Railways PSU Index outperformed the broad market index

The chart below shows the growth of Rs 10,000 lump sum investment in Nifty India Railways PSU TRI versus Nifty 500 TRI since the inception of the index.

Source: National Stock Exchange, 31st December 2024

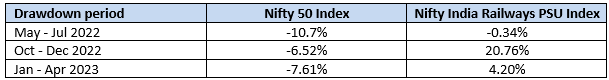

Resilience in volatile market conditions

Source: National Stock Exchange, 31st December 2024

Why invest in Groww Nifty India Railways PSU Index Fund?

- Railways are a critical infrastructure sector for India's economy, serving as the backbone of both passenger travel and logistics

- Supported by government capital investment, the sector aims to achieve the dual goals of: modernising passenger services and enhancing transport efficiency

- Groww Nifty India Railways PSU Index Fund is India’s first Railway PSU Index Fund

- Groww Nifty India Railways PSU Index Fund provides exposure to a true-to-label Railways PSU index, which has stocks with growth potential.

Who may consider invest in Groww Nifty India Railways PSU Index Fund?

- Investor looking for allocations to their satellite portfolio for long term capital appreciation

- Investors who want exposure to the railway sector and PSU companies

- Investors with long investment tenures – minimum 5 years

- Investors with very high risk appetite

- You can invest in this fund through SIP

- Investors should consult their financial advisors or mutual fund distributors if Groww Nifty India Railways PSU Index Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Groww Mutual Fund is sponsored by Groww Invest Tech Private Limited. Groww Invest Tech is a SEBI registered Stock Broker, Depository Participant, Research Analyst and AMFI registered Mutual Fund Distributor.

Investor Centre

Follow Groww Mutual Fund

More About Groww Mutual Fund

POST A QUERY