Groww Nifty EV and New Age Automotive ETF and FOF NFO

Groww MF is has launched an NFO, Groww Nifty EV and New Age Automotive ETF and Groww Nifty EV and New Age Automotive Fund of Fund (FOF). Groww Nifty EV and New Age Automotive ETF will track the Nifty EV and New Age Automotive index. The FOF will invest in units of Groww Nifty EV and New Age Automotive ETF. You need to have Demat account to invest in Groww Nifty EV and New Age Automotive ETF. If you do not have a Demat account you can invest in Groww Nifty EV and New Age Automotive Fund of Fund. The NFO has opened for subscription on 24th July and will close on 07th August.

How do Electric Vehicles work?

An electric vehicle (EV) is a battery powered vehicle, which runs on an electric motor instead of an Internal Combustion Engine (ICE) used by traditional vehicles. By combustion of petrol or diesel, ICE generates power which is transmitted to the wheels of the vehicle. EVs on the other hand are powered by a battery which drives the motor to propel the vehicle.

Why are countries pushing for Electric Vehicles?

Carbon emissions by road vehicles (e.g. cars, two-wheelers, buses, trucks etc) is one the biggest sources of pollution. The Glasgow UN Climate Change Conference attended by 120 world leaders in 2021 targeted carbon neutrality (i.e. zero net carbon emissions) by 2050. In COP26, India has committed to reducing by 50% by the year 20230 and carbon neutrality by 2070. Electric Vehicles will be the key in achieving zero emission targets. For major oil importers like India, EVs will also reduce reliance on crude oil imports which will improve balance of trade.

Growth potential of Electric Vehicles industry in India

- India’s electric vehicles penetration (1.1% in 2022) is significantly lower than Asian average of 17.3%

- The Government has a set a target of increasing EV penetration to 30% by 2030.

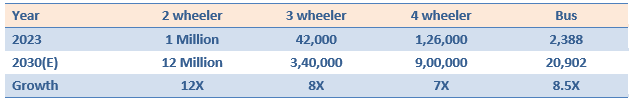

- Electric vehicle adoption in India is expected to reach 13 million by 2030. See the table below for segment wise growth estimates.

Source: Groww MF

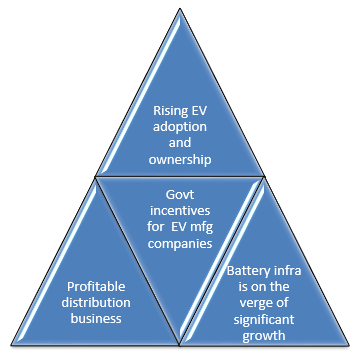

Growth drivers of EV market

What will drive higher EV adoption?

- Total cost of ownership (which includes upfront vehicle costs in addition to fuel costs over the vehicle’s lifetime, financing and other maintenance costs, salvage value, etc) of all electric vehicles, except buses, is lower than ICE (petrol, diesel, CNG etc) vehicles.

- The government offers different types of financial incentives to make electric vehicles more affordable for the owners, e.g. direct discount, registration and road tax waiver etc. With these incentives the cost advantage of EVs over ICE vehicles is even higher.

- Large banks are offering EV loans at competitive interest rates

- Lack of variety and choice of models have been one of the main deterrents for potential EV buyers. This is now being addressed with more Original Equipment Manufacturers (OEMs) offering EV models

- Lack of charging infrastructure is a major deterrent for EV adoption in India. To address this deficiency, the Government has announced a number of measures for development of public EV charging infrastructure.

- Under the Faster Adoption and Manufacturing of (Hybrid and) Electric Vehicles (FAME) – II scheme, the Department of Heavy Industries has also sanctioned 2,636 charging stations in 62 cities across 24 States/UTs (source: e-AMRIT, Niti Aayog, Govt of India).

- In addition to public charging infrastructure, we are also likely to see growth in semi public charging infrastructure, e.g. apartment complexes, malls, hospitals, universities, Government buildings etc.

- Battery swapping, whereby you will replace a discharged battery with a fully charged battery will reduce charging time, improve vehicle reliability and improve consumer experience

- Rising number of market participants in the battery value chain

About Nifty EV and New Age Automotive Index

The Nifty EV & New Age Automotive Index aims to track the performance of companies which form a part of the EV ecosystem or are involved in the development of new age automotive vehicles or related technology. Stocks forming a part of the Nifty 500 are eligible to be a part of the index provided they are involved in the production and supply of electric or new age automotive vehicles, batteries, components, raw materials, and technology.

Nifty EV and New Age Automotive Index - Investment Universe

The Index with select from the following groups of stocks:-

- Group A: Manufacturing of 2W/3W/4W/PV/CV Electric and New age automotive vehicles.

- Group B: Manufacturing of batteries for Electric and New age automotive vehicles.

- Group C.1: Manufacturing of components for Electric and New age automotive vehicles / Electric and New age automotive vehicles.

- Group C.2: Manufacturing/ Supply of raw material for Electric and New age automotive

- Vehicles / batteries / components.

- Group C.3: Provide advanced automotive technology for Electric and New age automotive vehicles.

- Group D: Part of eligible universe of Group A, B or C and PLI for Advanced Automotive or ACC batteries or FAME or SMEV.

Nifty EV and New Age Automotive Index – Methodology

- Select all stocks forming part of the Group A and Group B.

- Select top 5 stocks based on 6 month average free-float market capitalization from each of the Group C.1, Group C.2 and Group C.3.

- Select top 5 stocks based on 6 month average free-float market capitalization from Group D that are not selected in any of the steps mentioned above

- The index is rebalanced quarterly. The weight of Group A stocks is capped at 40%, weights of individual stocks in Group A are capped at 8% and weight of all other constituents are capped at 4%.

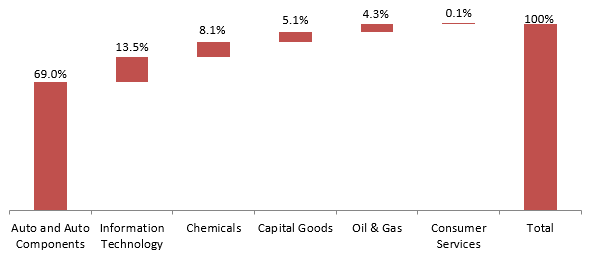

Nifty EV and New Age Automotive Index – Sector Composition

Source: NSE factsheet, as on 28th June 2024

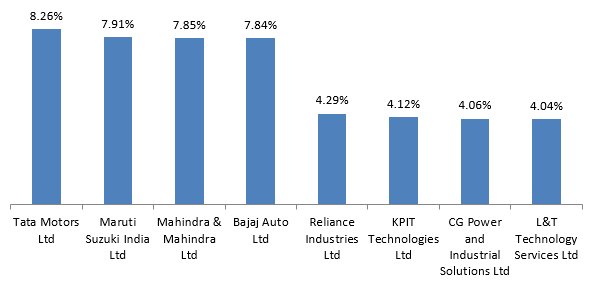

Nifty EV and New Age Automotive Index – Top 10 constituents

Source: NSE factsheet, as on 28th June 2024

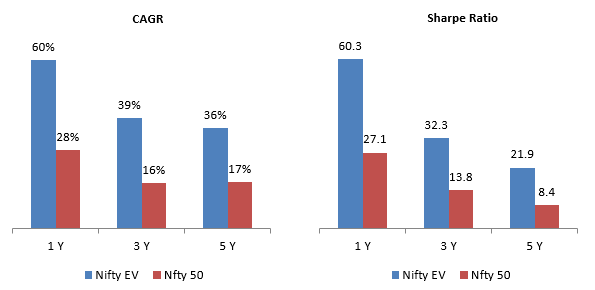

Nifty EV and New Age Automotive Index versus Nifty 50

Superior performance and risk adjusted returns across different investment periods, both short term and long term.

Source: NSE factsheet, as on 28th June 2024

Who should invest Groww Nifty EV and New Age Automotive ETF and FOF NFO?

- Investors looking for capital appreciation over long investment tenures through passive investing

- Investors with very high risk appetites

- You should have minimum investment tenure of 5 years

- You can invest in Groww Nifty EV and New Age Automotive ETF if you have Demat accounts

- You can invest in Groww Nifty EV and New Age Automotive FOF if you do not have Demat accounts

Investors should consult with their financial advisors or mutual fund distributors if Groww Nifty EV and New Age Automotive ETF or FOF are suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Groww Mutual Fund is sponsored by Groww Invest Tech Private Limited. Groww Invest Tech is a SEBI registered Stock Broker, Depository Participant, Research Analyst and AMFI registered Mutual Fund Distributor.

Investor Centre

Follow Groww Mutual Fund

More About Groww Mutual Fund

POST A QUERY