Groww Nifty 500 Momentum 50 ETF Fund of Fund: Investing in winners

Groww Mutual Fund has launched an NFO, Groww Nifty 500 Momentum 50 ETF as well as a Fund of Fund, Groww Nifty 500 Momentum 50 ETF FOF. As the name suggests Groww Nifty 500 Momentum 50 ETF is an exchange traded fund which will track the Nifty 500 Momentum 50 Index. The Nifty 500 Momentum 50 Index comprises of 50 high momentum stocks (stocks that are trending upwards) from the Nifty 500 universe. Historical data suggests that globally momentum stocks have outperformed the broad market over long investment horizons. The is fund of fund will invest in Groww Nifty 500 Momentum 50 ETF, providing investors who do not have demat accounts to invest in the Nifty 500 Momentum 50 Index. The NFO has opened for subscription on 3rd April 2025 and will close on 17th April 2025. In this article we will review Groww Nifty 500 Momentum 50 ETF and the Fund of Fund (FOF).

What is momentum?

Momentum, in the context of equity markets, refers to the tendency of stock price trends to persist. Recent winners in stock markets will continue to remain winners in the near term, and similarly losers will remain losers. Momentum factor investing refers to taking advantage of this market behaviour to generate better returns than markets. It is essentially based on owning securities that have shown favourable price trends. Instead of the conventional, "buy low, sell high" approach, momentum strategy is essentially, "buying high and sell higher".

How momentum investing works?

- Momentum works on behavioural biases of humans. As investor behaviour often deviates from perfect rationality, these market inefficiencies present opportunities for momentum strategies to capitalize on trends arising from these anomalies.

- The momentum takes into consideration the relative performance of stocks over recent history - the past 6 months and 12 months.

- Momentum strategy evolves with market trends by changing the style, sectors and stocks in the portfolio.

Momentum investing has outperformed broad market

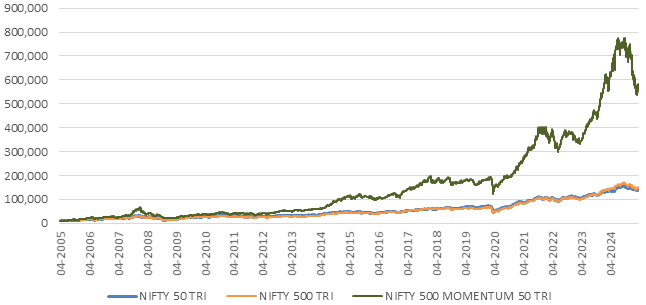

The chart below shows the growth of Rs 10,000 investment in Nifty 500 Momentum 50 TRI versus the broad market index, Nifty 500 TRI since the inception of the momentum index. You can see significant outperformance by the Nifty 500 Momentum 50 TRI.

Source: National Stock Exchange, Data 1st April 2005 to 31st March 2025

Outperformed broad market consistently in bull markets

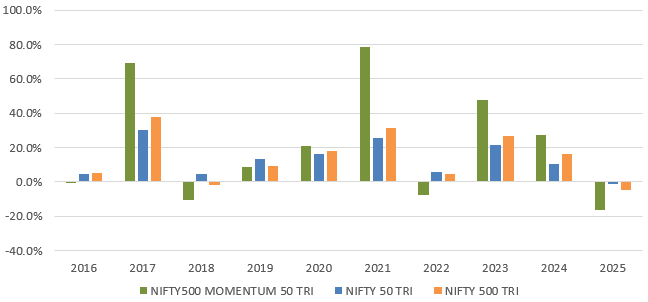

The chart below shows the calendar year returns of Nifty 500 Momentum 50 TRI versus the broad market indices, Nifty 50 TRI and Nifty 500 TRI over the last 10 years. You can see that the momentum index outperformed the broad market index in 5 out of 10 calendar years – outperformance in bull market years were significant.

Source: National Stock Exchange, Data 01-01-2016 to 31-03-2025

Outperformed broad market over different investment tenures

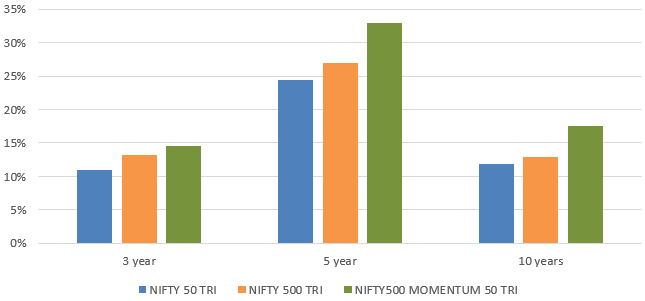

There is a perception that momentum strategy is for traders or investors who want time the market / exit at peaks. The chart below shows the trailing returns of the momentum index versus the broad market indices across different investment periods. You can that momentum outperformed the broad market over long investment tenures, which included both bull and bear market periods.

Source: National Stock Exchange, Data 01-01-2016 to 31-03-2025

Is this a good time to invest in momentum index?

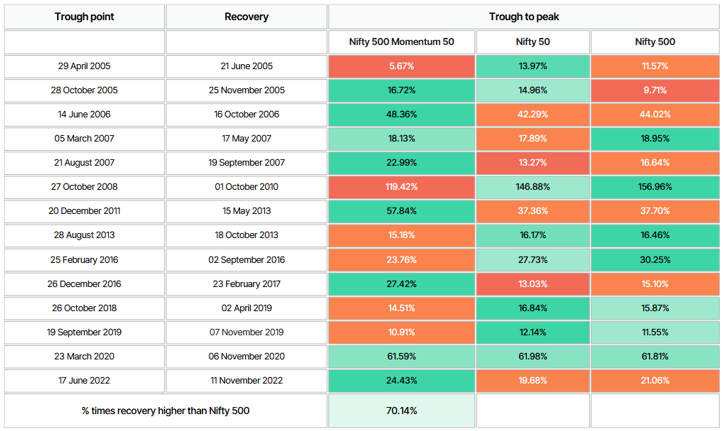

Momentum investing may be used as a potential strategy to benefit from market recovery. Historical data shows that momentum index has outperformed the broad market in market recovery phases. Since Nifty 500 is down almost 15% from its peak, long term investors may benefit from momentum strategy

Source: Groww MF

Who should invest in Groww Nifty 500 Momentum 50 ETF and FOF?

- Investors with a high-risk appetite

- Investors having a long-term investment horizon (minimum 5 years)

- Investors seeking to add aggressive strategy to their portfolio

Investors should consult their financial advisors if Groww Nifty 500 Momentum 50 ETF FOF is suitable for their investment needs. You need demat and trading account to invest in Groww Nifty 500 Momentum 50 ETF. If you do not have demat or trading accounts, you can invest in Groww Nifty 500 Momentum 50 ETF Fund of Fund (FOF).

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Groww Mutual Fund is sponsored by Groww Invest Tech Private Limited. Groww Invest Tech is a SEBI registered Stock Broker, Depository Participant, Research Analyst and AMFI registered Mutual Fund Distributor.

Investor Centre

Follow Groww Mutual Fund

More About Groww Mutual Fund

POST A QUERY