Groww Multicap Fund: Promising investment in current market conditions

Current Market Scenario

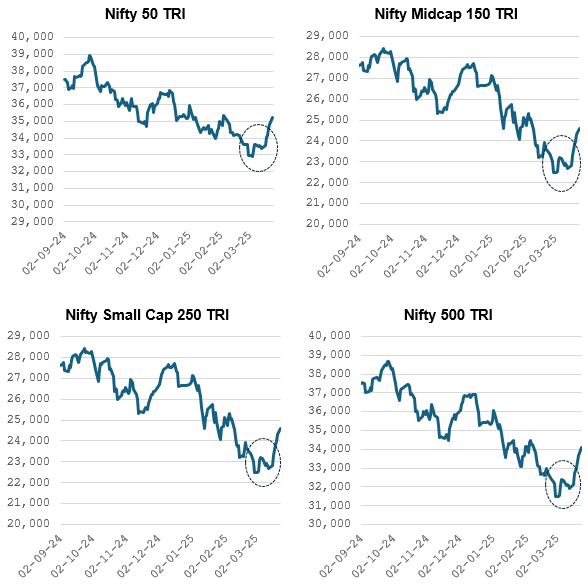

Heavy selling by Foreign Institutional Investors' (FII) in the last 4 months led to deep correction, with large cap stocks falling nearly 17% from 52-week highs. Concerns about Trump Administration's trade policies, earnings growth outlook and weakening Rupee resulted in bearish conditions in the broad market. The midcap index (Nifty Midcap 150 TRI) entered the bear territory in March following a 20% correction from 52 week high, while small caps fell by 26%.

Market bounced back following positive global cues

The market has bounced back in the last few days on the hopes of softening stance on trade policies by the US Government. Cooling inflation in India also creates conditions for RBI rate cut in the next MPC meeting. Though it is too early to say whether the market has bottomed out, we are seeing signs of consolidation (see the graphic below).

Source: NSE, Advisorkhoj. As on 24th March 2025

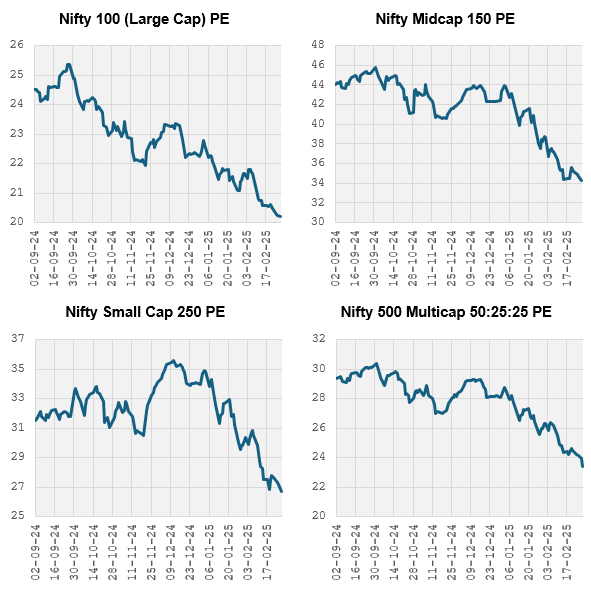

Valuations have come down across all market cap segments

The sharp correction has brought down valuations across all the market cap segments, especially large caps (see the chart below). Though we may have to see some more pain in midcaps and small caps, a multi-cap strategy may be suitable for long term investors. In this article, we will review Groww Multicap Fund which was launched a few months back.

Source: NSE, Advisorkhoj. As on 28th February 2025

The case for Multicap strategy for long term investors

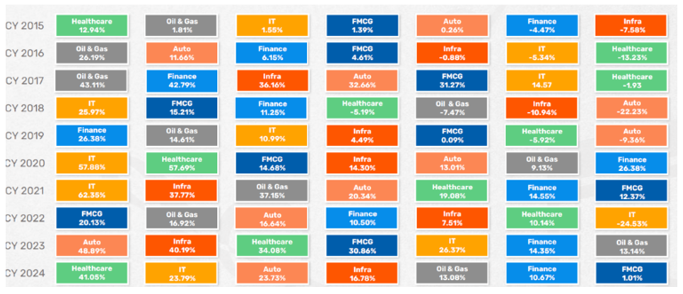

- Winners keep rotating between market cap segments depending on market conditions investment cycles.

Source: NSE, Advisorkhoj. As on 31st December 2024

- Winners continually rotate among various sectors, making broad sector exposure an important factor to consider, when aiming to enhance opportunities.

Source: NSE, Advisorkhoj. As on 31st December 2024

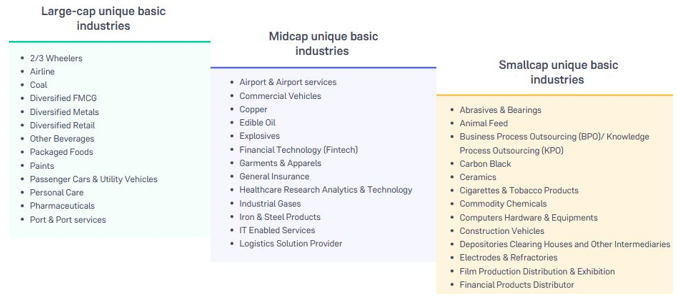

- Each market cap segment has unique industries, making Multicap funds one of the potentially most efficient ways to aim for diversification of a portfolio. Certain sectors have market leaders beyond large caps. Exposure to market leaders might require diversification across market caps. Multicap is an effective strategy to capture the diverse opportunity set in the India Growth Story

Source: Groww MF

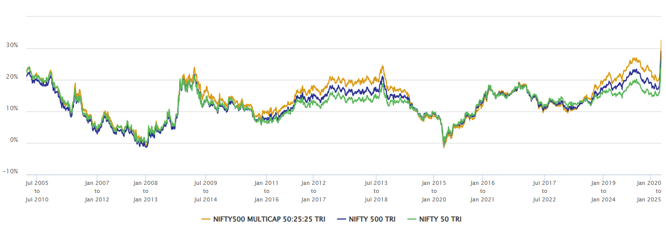

- Multicap index has outperformed the market cap weighted broad market indices like Nifty 50 and Nifty 500 TRI over 5-year investment tenures since the inception of the multicap index (see the chart below).

Source: NSE, Advisorkhoj. As on 24th March 2025

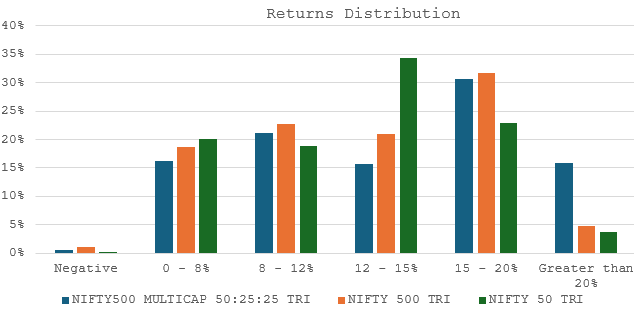

- The chart below shows the 5 year returns distribution of multicap index versus other broad market indices like Nifty 500 TRI and Nifty 50 TRI since the inception of the multicap index. You can see that, based on historical returns, the probability of getting higher returns (15%+ CAGR returns) is significantly higher for multicap.

Source: NSE, Advisorkhoj. As on 24th March 2025

Investment philosophy of Groww Multicap Fund

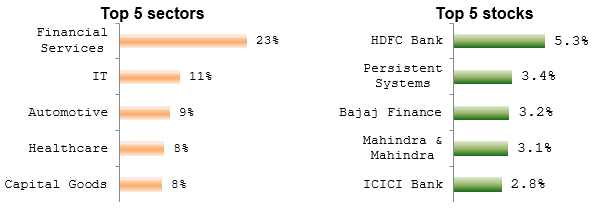

Current Portfolio Positioning

Source: Groww MF, as on 28th February 2025

Why invest in Groww Multicap Fund?

- Capitalize on diverse growth opportunities in the India growth story. Winners can emerge from anywhere, and winners keep changing

- Mid Cap and Small Cap categories can be growth pockets.

- Among themes / sectors, export, premium consumption, financialization, infrastructure and import substitution can provide attractive growth opportunities

- True to label Multicap with the flexibility of allocating of the remaining 25% depending on market conditions to maximize returns or optimize risks

Who should invest in Groww Multicap Fund?

- Investors who are looking for capital appreciation over long investment horizon

- Investors with high to very high-risk appetites

- Investors with minimum 5 years investment tenures

- You can invest in this scheme either in lump sum or SIP depending on your investment needs

- Investors should consult with their financial advisors or mutual fund distributors if Groww Multicap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Groww Mutual Fund is sponsored by Groww Invest Tech Private Limited. Groww Invest Tech is a SEBI registered Stock Broker, Depository Participant, Research Analyst and AMFI registered Mutual Fund Distributor.

Investor Centre

Follow Groww Mutual Fund

More About Groww Mutual Fund

POST A QUERY