Groww Multicap Fund: A good investment in market recovery phase

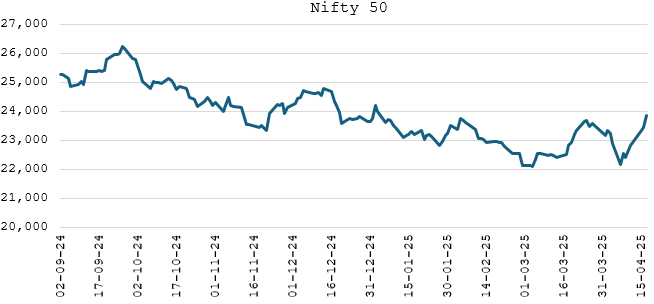

After months of volatility the market is in the recovery phase after President Trump announced a 90 day pause on high tariffs imposed by the United States Government on exports to the United States. In the last 10 days or so, Nifty has gained nearly 1,700 points (see the chart below). Positive global risk sentiments, with S&P 500 gaining 6% in the last 10 days, have aided market recovery. The market recovery has been broad based with Nifty Midcap 150 gaining 6.35% and Nifty Small Cap 250 gaining 7.71% respectively. Hopes of mutually satisfactory resolution of trade related issues and interest rate cuts by RBI and ECB.

Source: NSE, Advisorkhoj. As on 17th April 2025.

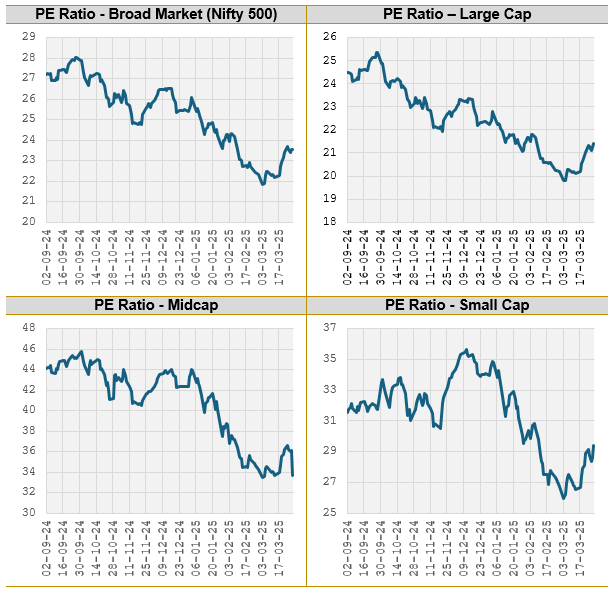

Valuations have come down across all market cap segments

The sharp correction has brought down valuations across all the market cap segments (see the chart below).

Source: NSE, Advisorkhoj. As on 31st March 2025

In the current valuation scenario, a multi-cap strategy may be suitable for long term investors. In this article, we will review Groww Multicap Fund, which was launched in December 2024. Though the fund has just completed only 4 months, the investment strategy of the fund, focusing on earnings growth, quality and valuations seems promising in the current environment.

The case for Multicap strategy for long term investors

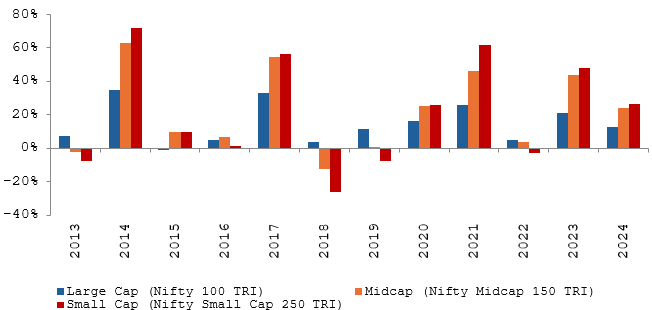

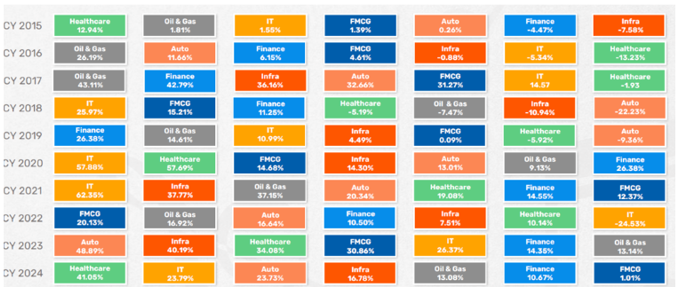

- Winners keep rotating between market cap segments depending on market conditions investment cycles.

Source: NSE, Advisorkhoj. As on 31st December 2024

- Winners continually rotate among various sectors, making broad sector exposure an important factor to consider, when aiming to enhance opportunities.

Source: NSE, Advisorkhoj. As on 31st December 2024

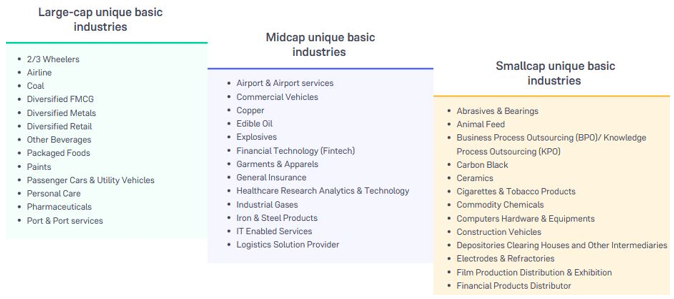

- Each market cap segment has unique industries, making Multicap funds one of the potentially most efficient ways to aim for diversification of a portfolio. Certain sectors have market leaders beyond large caps. Exposure to market leaders might require diversification across market caps. Multicap is an effective strategy to capture the diverse opportunity set in the India Growth Story

Source: Groww MF

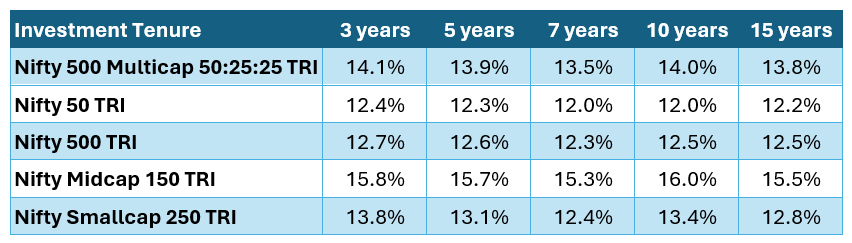

- Multicap index has outperformed the market cap weighted broad market indices like Nifty 50 and Nifty 500 TRI over different investment tenures across different market conditions. The table below shows the average rolling returns of Nifty 500 Multicap 50:25:25 Index versus broad market indices since the inception (base date) of the multicap index. You can see that the multicap index outperformed Nifty 50, Nifty 500 and even the small cap (Nifty Small Cap 250) index over different investment tenures. As such, multicap can be a suitable strategy for investors with high risk appetite and long investment tenures

Source: NSE, Advisorkhoj. As on 31st March 2025.

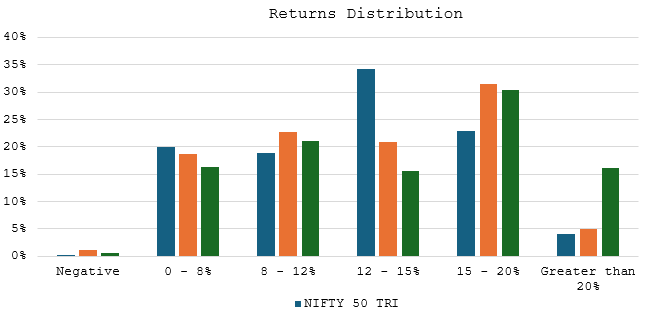

- Multicap strategy has the potential of generating higher returns compared to broad market indices. The chart below shows the 5 year returns distribution of multicap index versus other broad market indices like Nifty 500 TRI and Nifty 50 TRI since the inception of the multicap index. You can see that, based on historical returns, the probability of getting higher returns (15%+ CAGR returns) is significantly higher for multicap.

Source: NSE, Advisorkhoj. As on 31st March 2025

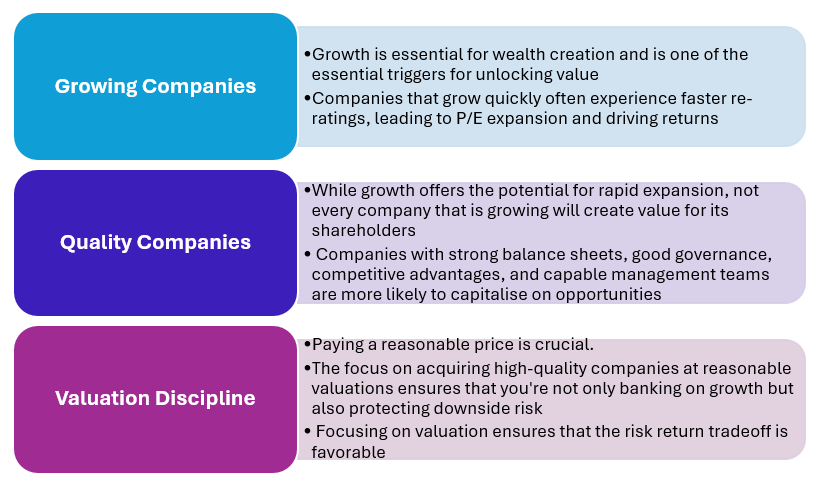

Investment philosophy of Groww Multicap Fund

Current Portfolio Positioning

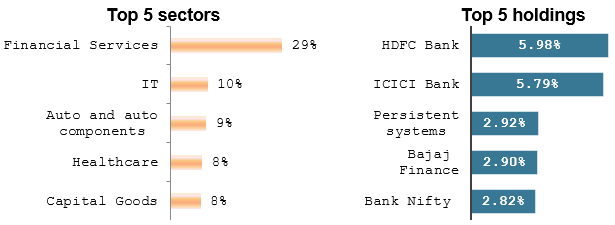

The fund currently has 35% allocation to large cap, 25% to midcap and 25% to small caps, in other words a true to label Multicap Fund. The fund is well diversified across sectors and has low concentration risk

Source: Groww MF, as on 31st March 2025

Why invest in Groww Multicap Fund?

- Capitalize on diverse growth opportunities in the India growth story. Winners can emerge from anywhere, and winners keep changing

- Mid Cap and Small Cap categories can be growth pockets.

- Among themes / sectors, export, premium consumption, financialization, infrastructure and import substitution can provide attractive growth opportunities

- True to label Multicap with the flexibility of allocating of the remaining 25% depending on market conditions to maximize returns or optimize risks

Who should invest in Groww Multicap Fund?

- Investors who are looking for capital appreciation over long investment horizon

- Investors with high to very high-risk appetites

- Investors with minimum 5 years investment tenures

- You can invest in this scheme either in lump sum or SIP depending on your investment needs

- Investors should consult with their financial advisors or mutual fund distributors if Groww Multicap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Groww Mutual Fund is sponsored by Groww Invest Tech Private Limited. Groww Invest Tech is a SEBI registered Stock Broker, Depository Participant, Research Analyst and AMFI registered Mutual Fund Distributor.

Investor Centre

Follow Groww Mutual Fund

More About Groww Mutual Fund

POST A QUERY