Groww Multicap Fund NFO: Invest in multiple growth opportunities in India Growth Story

Groww MF has launched a new fund offer (NFO), Groww Multicap Fund. As per SEBI’s mandate a multicap fund should invest minimum 25% of their assets in each of the three market capitalization segments i.e. minimum 25% in large cap (top 100 stocks by market cap), minimum 25% in midcap (101st to 250th stocks by market cap) and minimum 25% in small cap (251st to 500th stocks by market cap). The NFO has opened for subscription on 26th November 2024 and will close on 10th December 2024.

The case for Indian equities

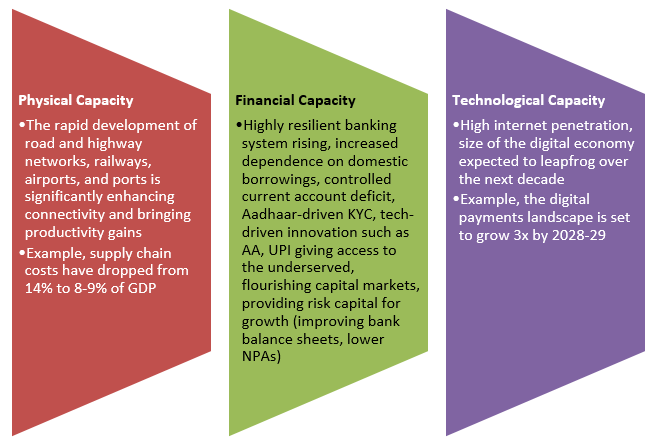

Growing capacity

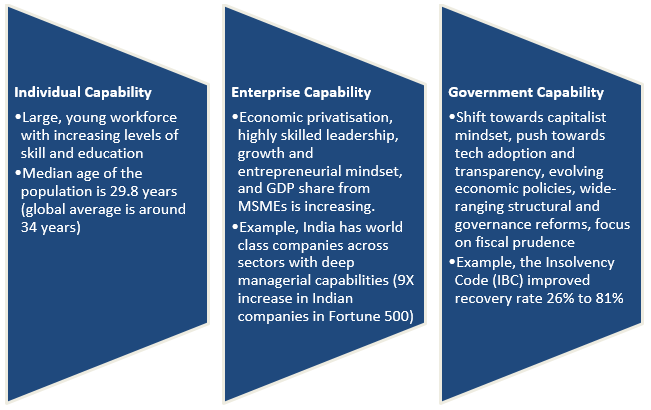

Growing capabilities

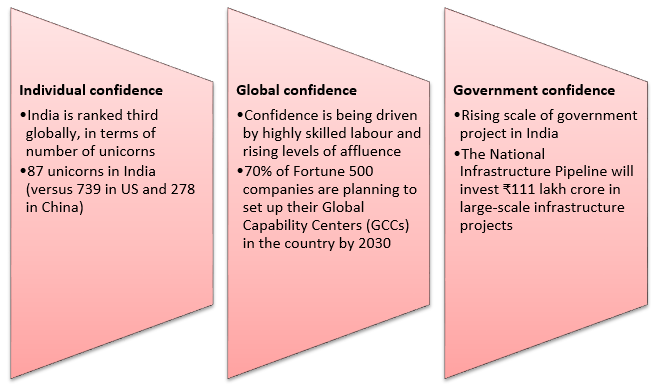

Confidence in Indian economy

The case for multicap strategy in India

- India's markets are driven by a diverse mix of mid, small, and micro-cap companies, highlighting the value of broad exposure.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st October 2024

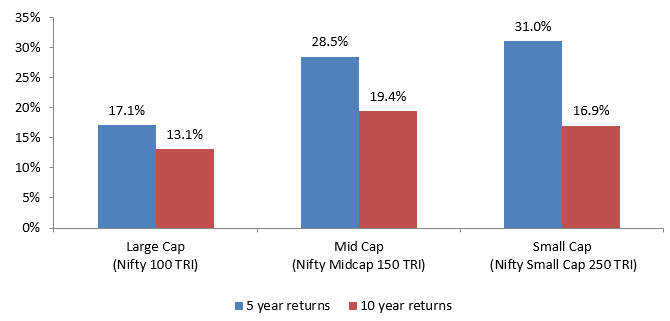

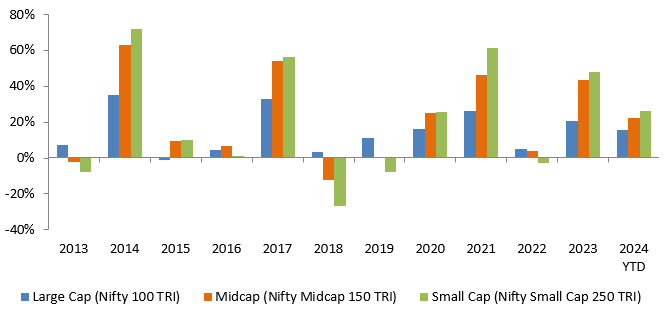

- Winners keep rotating between market cap segments depending on market conditions / investment cycles.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st October 2024

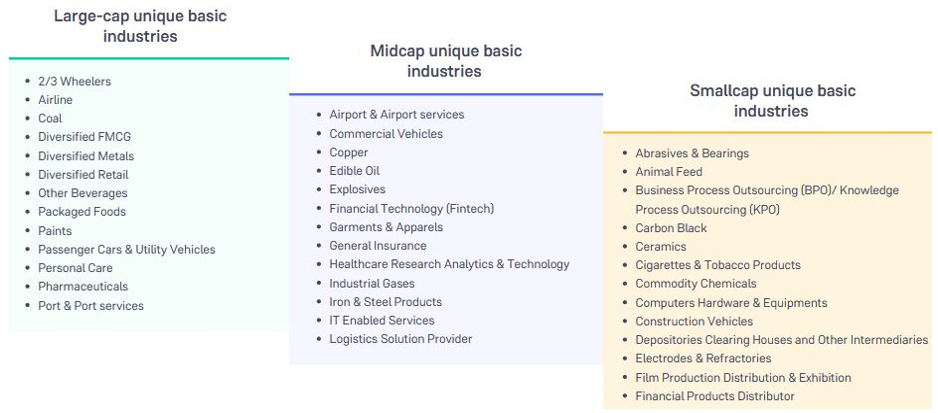

- Winners continually rotate among various sectors, making broad sector exposure an important factor to consider, when aiming to enhance opportunities.

Source: National Stock Exchange, Groww MF

- Each market cap segments has unique industries, making Multicap funds one of the potentially most efficient ways to aim for diversification of a portfolio. Certain sectors have market leaders beyond large caps. Exposure to market leaders might require diversification across market caps. Multicap is an effective strategy to capture the diverse opportunity set in the India Growth Story.

Source: National Stock Exchange, as on 31st August 2024

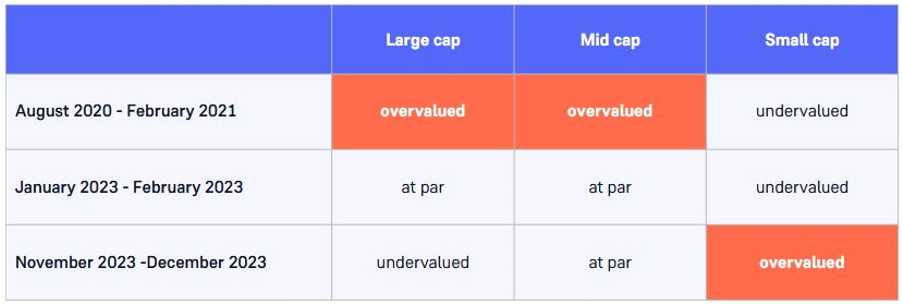

- In India, markets are dynamic. Valuations may vary across market cap segments making timing tough – different market cap segments can be over-valued or under-valued in different market phases. Exposure to all market cap segments helps in rupee cost averaging.

Source: NSE, August 26, 2024. Note: A P/E above the 5-year average signals overvaluation; below suggests undervaluation

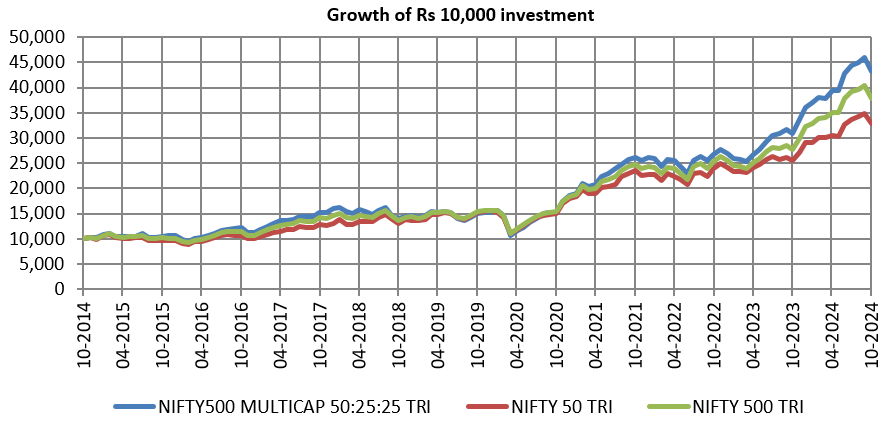

- Multicap index has outperformed the market cap weighted indices like Nifty 50 and Nifty 500 TRI over the last 10 years

Source: NSE, Advisorkhoj Research, October 31, 2024.

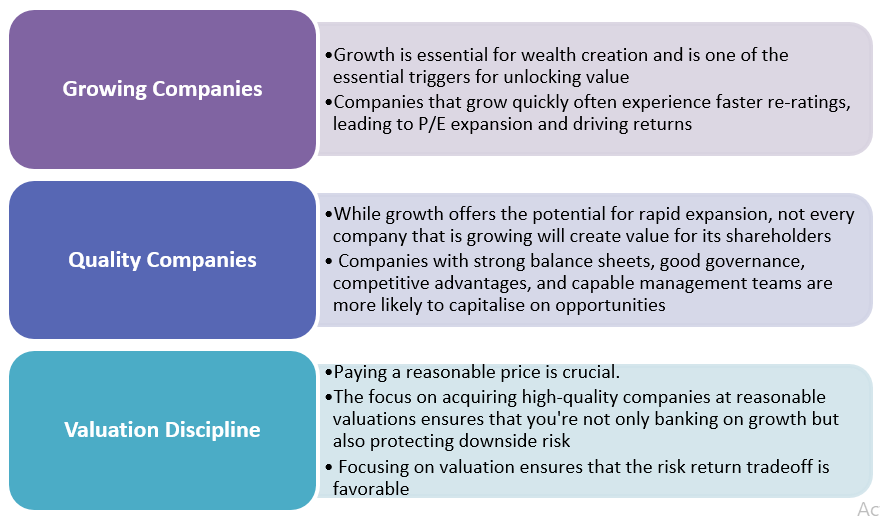

Investment philosophy of Groww Multicap Fund

Why invest in Groww Multicap Fund NFO?

- Capitalize on diverse growth opportunities in the India growth story. Winners can emerge from anywhere, and winners keep changing

- Mid Cap and Small Cap categories can be growth pockets.

- Among themes / sectors, Export, premium consumption, financialisation, infrastructure and import substitution can provide attractive growth opportunities

- Fresh portfolio with no legacy stocks

- True to label Multicap with the flexibility of allocating of the remaining 25% depending on market conditions to maximize returns or optimize risks

Who should invest in Groww Multicap Fund NFO?

- Investors who are looking for capital appreciation over long investment horizon

- Investors with high to very high risk appetites

- Investors with minimum 5 years investment tenures

- You can invest in this scheme either in lump sum or SIP depending on your investment needs

- Investors should consult with their financial advisors or mutual fund distributors if Groww Multicap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Groww Mutual Fund is sponsored by Groww Invest Tech Private Limited. Groww Invest Tech is a SEBI registered Stock Broker, Depository Participant, Research Analyst and AMFI registered Mutual Fund Distributor.

Investor Centre

Follow Groww Mutual Fund

More About Groww Mutual Fund

POST A QUERY