Groww Large Cap Fund: Track record of wealth creation

As per SEBI guidelines, the top 100 stocks in India by market capitalization are called Large Cap stocks. The core sectors like petroleum products, oil and gas, coal, power, cement steel, oil and gas etc. comprise the large cap companies. Large cap funds invest at least 80% of their assets in large cap stocks.

Why invest in Large Cap Companies?

- During economic downturns and recessive markets, Large Cap funds are likely to face fewer financial upheavals. Large Cap Companies are market leaders in their respective industries and can weather volatility better than the mid or small cap companies.

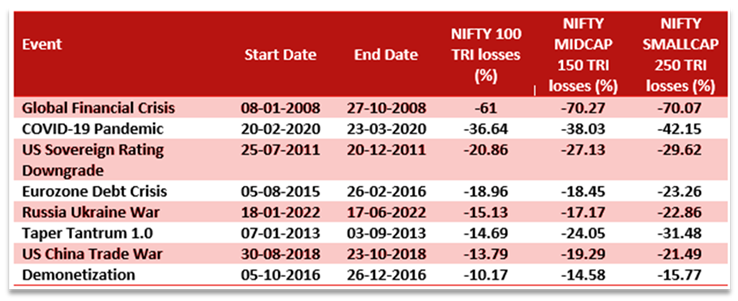

- Large cap stocks tend to be less volatile than midcap and small cap stocks, especially in deep corrections or bear markets. The chart below shows the biggest drawdowns in the market over the last 20 years. You can see large caps suffered less drawdowns compared to small / midcaps.

Source: National Stock Exchange, Advisorkhoj Research

- Large Cap funds are the highest traded stocks on the stock exchange. So, they are highly liquid. One of the biggest advantages of liquidity in large cap funds is that the fund manager can meet redemption pressures without incurring high impact costs. Impact cost is the cost that a buyer or seller of stocks incurs while executing a transaction due to the prevailing liquidity condition on the counter. A major disadvantage of stocks with low liquidity is that the fund manager may have to sell a stock at a much lower price to meet redemption needs.

- Since midcaps and small caps have relatively less free-floating shares, their trading volumes are thinner. As a result, the prices of these stocks can run up much higher – high demand and less supply. Large caps, on the other hand, do not have this problem because there is always a good supply of shares in large cap stocks due to high public ownership (institutional and retail).

- The Indian economy has strong resilience amidst slowdown in other major economies. The IMF has revised FY 2024-25 GDP growth from 6.5% to 6.8%, on the back of strong domestic demand and a rising working-age population. As per IMF projections given in its World Economic Outlook database for April 2024 are right, India will overtake Japan to become the fourth largest economy in the world by 2025 and overtake Germany to become the third largest by 2027. The changing global supply chain dynamics e.g. China + 1 strategy is likely to benefit Indian companies. In the medium to long term, large cap Indian companies are likely to benefit from the structural reforms made by the Government.

In this article we will discuss the Groww Large Cap Fund as an investment option.

Groww Large Cap Fund Regular Growth Option

Groww Large Cap Fund, erstwhile Indiabulls Large Cap Fund, is a large cap equity scheme with inception date of February 2012. On 27th October 2023, Groww Nifty 50 Exchange Traded Fund and Groww Arbitrage Fund were merged into the Groww Large Cap Fund. As of 29th May 2024, the fund has an Asset under Management of 120.26 Crores. The Benchmark for the fund is Nifty 100 TRI. The expense ratio of the scheme regular plan is 2.29% as on 28th May 2024. The fund is managed by Mr. Anupam Tiwari and Mr. Kaustabh Sule.

Performance of Groww Large Cap Fund Regular Growth –

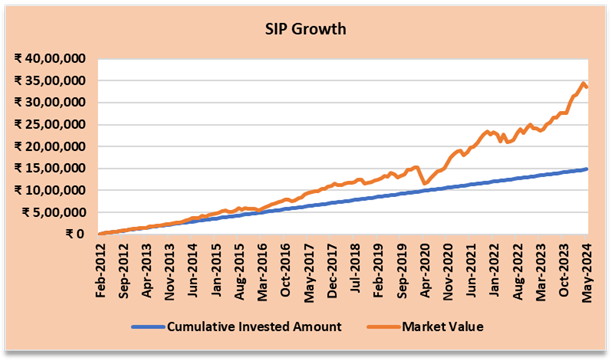

SIP Returns: A monthly SIP of Rs 10,000/- started at the inception of the fund would have grown to Rs 35.47 lakhs as on 28th May 2024 against a total investment of Rs 14.80 Lakhs – giving an XIRR return of 13.38%. The chart below shows the growth of your investment (as on 28th May 2024).

Source: Advisorkhoj Research. Disclaimer: Past performance may or may not be repeated in future.

Lumpsum Returns: If you had invested Rs 1 lakh into the fund at its inception, the value of your initial investment would have grown to Rs 4.09 Lakhs as on 28th May 2024 increasing your money by 4X times in a matter of about 12 years.

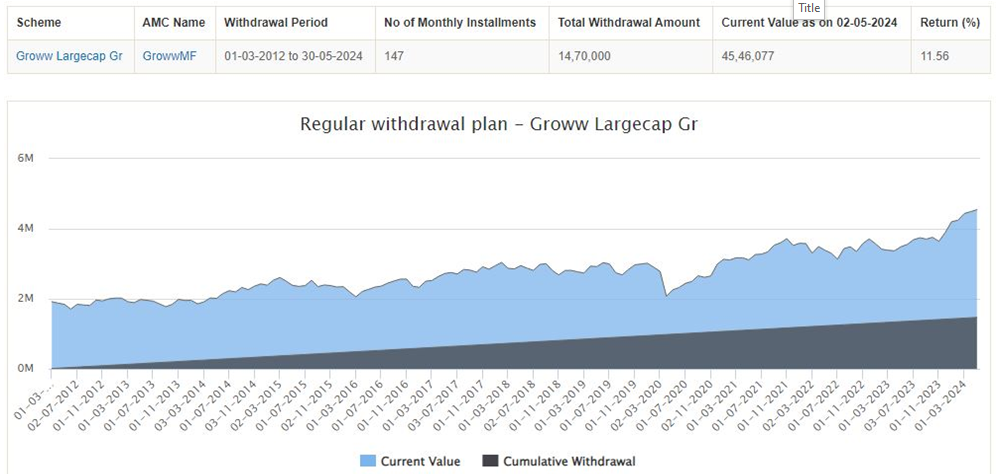

Regular cash-flows through SWP

If you had started with a lumpsum amount of Rs 20 lakhs in the fund at its inception, and withdrawn Rs 10,000/- monthly through SWP starting March 2012, your investment would have grown to Rs 45.46 Lakhs (as on 30th May 2024), even after you would have withdrawn Rs 14.7 lakhs cumulatively. For moderate rates of withdrawal, SWP can generate regular cash-flows, as well as potential capital appreciation. Groww large cap fund is a testimony of the power of SWP.

Source: Advisorkhoj SWP Returns Calculator. Disclaimer: Past performance may or may not be repeated in future

Outperformance versus peers

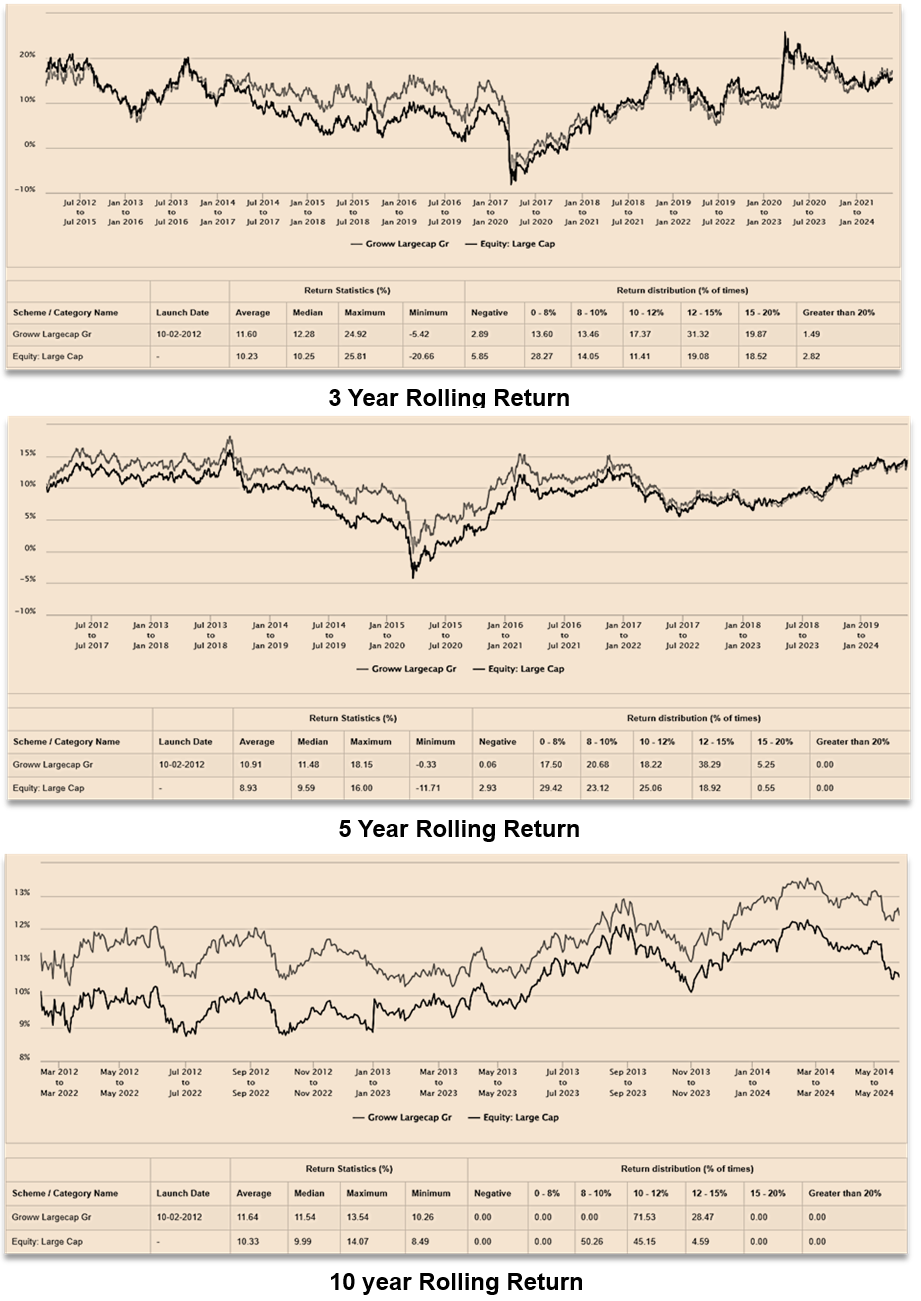

Given below are the rolling returns of the fund compared to the average rolling returns of the peer funds (large cap category). You will see that the fund has consistently beaten the category average over longer investment tenures. While investing in equity funds, investors should always have long-term investment horizon.

Source: Advisorkhoj Research as on 28th May 2024

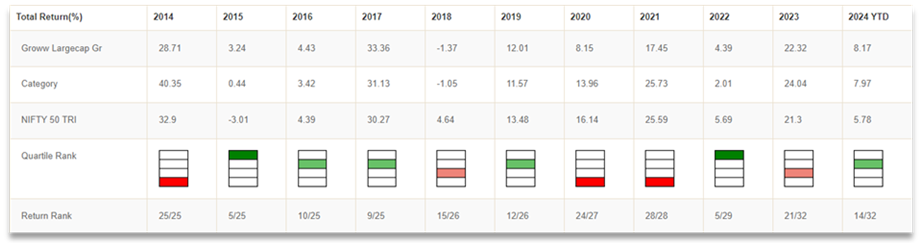

Quartile Ranking

The fund ranked in the top two quartiles in 6 of the 10 years, showing strong performance consistency. Every fund goes through ups and downs depending on market conditions, but a key aspect of strong fund management is the ability to bounce back - Groww Large Cap Fund is a great example.

Source: Advisorkhoj Research as on 28th May 2024

Market Capture Ratio

The Groww Large Cap Fund (Regular Growth) had a capture ratio of 1.51 in the last one year. A high capture ratio (above 1) shows that the fund has given higher risk adjusted returns compared to its benchmark. The downmarket capture ratio and the upmarket capture ratio of the fund in the last 1 year was 82% and 124% respectively. This shows that the fund manager has been able to provide better risk adjusted returns in falling markets and that the fund has performed better than its benchmark in upmarket situations during this period.

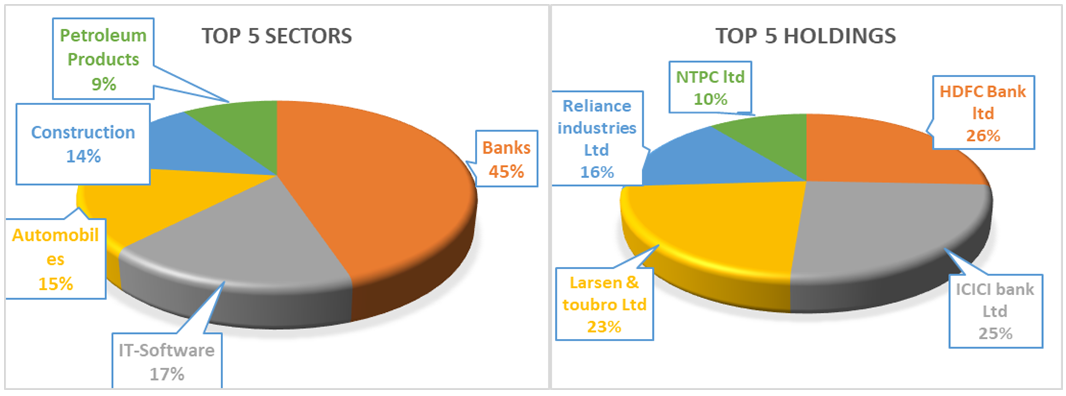

Portfolio Allocation:

Source: Fund Factsheet(as on 30th April 2024)

Who should invest in Groww Large Cap Fund?

The Groww Large Cap Fund is suitable for:

- Investors who have a moderately high to high-risk appetite with a goal of creating a corpus through long term capital appreciation.

- It is suited for investors looking to invest for their long-term financial goals like retirement planning, children’s higher education, children’s marriage, wealth creation etc.

- New and young investors who would like to start their investment journey with a low volatile equity fund as large cap funds are less volatile compared to midcap or small cap funds.

- Investors who have at least 5 years investment horizon.

Investors may contact their mutual fund distributor or advisor to understand how the fund can align with their investment goals.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Groww Mutual Fund is sponsored by Groww Invest Tech Private Limited. Groww Invest Tech is a SEBI registered Stock Broker, Depository Participant, Research Analyst and AMFI registered Mutual Fund Distributor.

Investor Centre

Follow Groww Mutual Fund

More About Groww Mutual Fund

POST A QUERY