Groww Gilt Fund: A suitable fixed income investment option in current interest rate environment

Groww Mutual Fund has launched a New Fund Offer (NFO), Groww Gilt Fund. This is a debt scheme which will invest in Government Securities across different maturities. Government Securities have "Sovereign Guarantee", in other words, interest (coupon) and principal repayment are guaranteed by the Government. Gilt funds can benefit from income and capital appreciation in a falling interest scenario. With bond yields falling across the yield curve, Groww Gilt Fund may be a suitable investment option in the current interest rate environment. Groww Gilt Fund New Fund Offer has opened for subscription on 23rd April 2025 and closes on 7th May 2025.

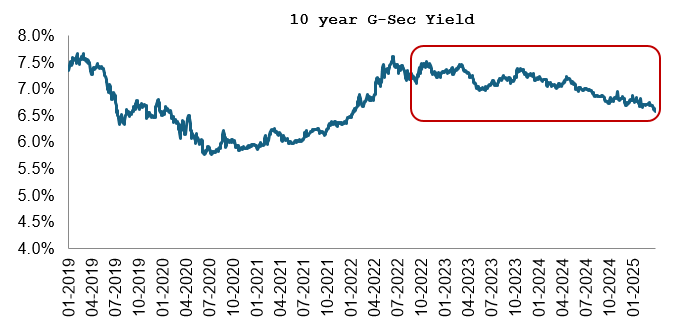

Current Yield Scenario

Bond yields have been declining for past 2 years in anticipation of interest rate cuts. The RBI has cut repo rate twice during the calendar year 2025, bringing down repo rate by 50 bps. The bond market is expecting more rate cuts this year.

Source: Investing.com, as on 31st March 2025

Why are interest rates expected to go down?

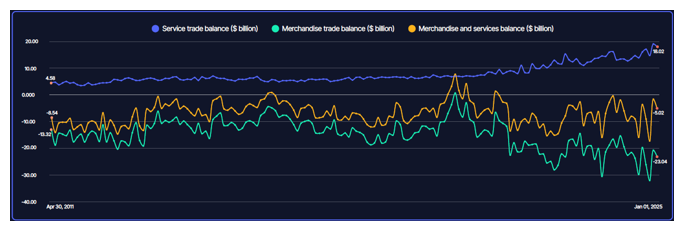

- Current account deficit is reducing (see the chart below) due to robust IT and business services exports growth. Merchandise trade deficit has also been improving.

Source: Groww MF, as on 28th March 2025

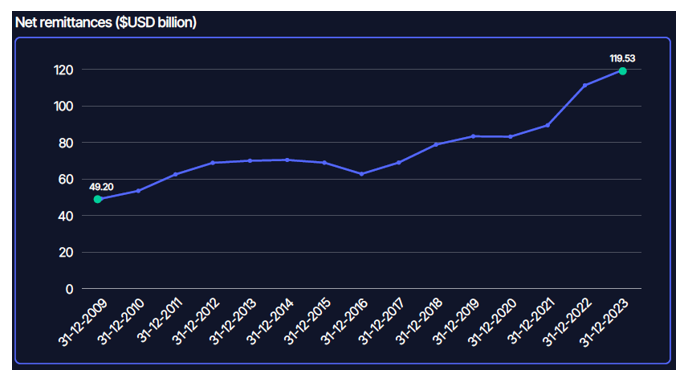

- Higher remittances from Indian diaspora has also contributed to lowering of current account deficit.

Source: Groww MF, as on 28th March 2025

- There is a direct relationship between an economy's current account deficit and exchange rate. If current account deficit increases, demand for foreign currency e.g. US Dollar will also increase, and this will cause the local currency e.g. INR to depreciate and vice versa.

- There is a relationship between a currency's exchange rate and interest rates. If interest rates go up, exchange rate also increases i.e. currency appreciates and vice versa. Improving current account deficit will allow RBI to cut interest rates without causing significant INR depreciation.

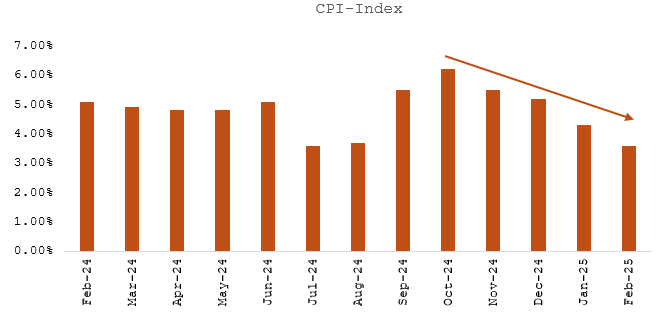

- Moderating inflation (see the chart below) also creates suitable conditions for RBI to cut interest rates.

Source: Groww MF, as on 28th March 2025

- Inflation can cool even further due lower energy costs and weakening Chinese Yuan (largest exporter to India). With escalating trade war between United States and China the Yuan (Renminbi) may depreciate more, lowering import costs and inflation in India.

- GDP growth is slowing down (see the chart below) creating the need to cut interest rates to boost economic growth.

Source: Groww MF, as on 24th March 2025

- Money supply growth (which tends to have an impact on short term demand in the economy) is also below long-term trends. Interest rates is one of the levers available to the RBI to increase money supply.

Source: Groww MF, as on 24th March 2025

- Global economic slowdown has triggered interest rate cuts by central banks around the world e.g. Fed, ECB, BOE etc.

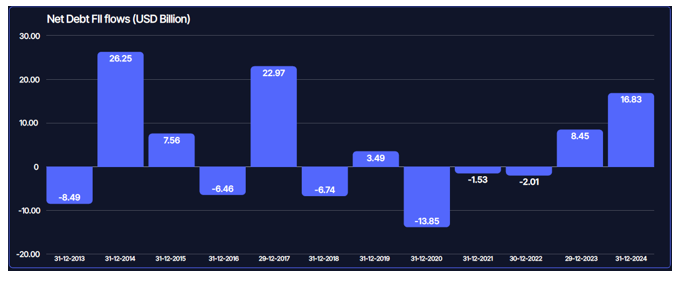

- Growing FII demand for Indian G-Secs will drive up prices, resulting in yields falling and capital appreciation. Inclusion of G-Secs in JP Morgan and Bloomberg EM Index will lead to higher FII investments in G-Secs.

Source: Groww MF, as on 25th March 2025

Who should invest in Groww Gilt Fund

- Investors looking for income and relative stability

- Investors looking for higher returns than traditional fixed income investments e.g. bank FDs, Government Small Savings Schemes

- Investors with minimum 2-to-3-year investment tenures

- Investors should be prepared for moderate volatility

Investors should consult with the financial advisors or mutual fund distributors if Groww Gilt Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Groww Mutual Fund is sponsored by Groww Invest Tech Private Limited. Groww Invest Tech is a SEBI registered Stock Broker, Depository Participant, Research Analyst and AMFI registered Mutual Fund Distributor.

Investor Centre

Follow Groww Mutual Fund

More About Groww Mutual Fund

POST A QUERY