Groww ELSS Tax Saver Fund: Upturn in performance

We are about to enter the final quarter of FY 2024-25. Investors in the old tax regime should ensure that they complete the tax planning for FY 25 well before the deadline of 31st March. In the old tax regime, tax payers can claim a deduction of up to Rs 1.5 lakhs from their taxable income by investing in some specified schemes under Section 80C of Income Tax Act. Mutual fund Equity Linked Savings Schemes (ELSS) have become very popular with investors with around Rs 2.45 lakh crores of assets under management (AUM) as on 30th November 2024 (source: AMFI).

What is ELSS?

Equity Linked Savings Schemes are diversified equity funds with a lock-in period of 3 years. These funds diversify across different industry sectors and market capitalization segments. You can start investing in ELSS with Rs 100 only. There is no upper limit of investments in ELSS; however, you can claim tax deduction of up to Rs 1.5 lakhs u/s 80C.

Why invest in ELSS for tax savings?

- Equity linked savings schemes are equity market linked investments. Though equity, as an asset class, can be volatile, historical data shows that equity has the potential of giving superior returns in the long term.

- In the last 20 years (ending 30th November 2024) Nifty 50 TRI (index of 50 largest stocks by market capitalization) has given 14.8% CAGR returns (source: Advisorkhoj, NSE, as on 30th November 2024). This is significantly higher than the prevailing interest rates of the Government Small Savings Schemes u/s 80C the India over the last 20 years, making ELSS more attractive from a wealth creation perspective compared to Government Small Savings Schemes.

- Since ELSS funds can invest across market capitalizations segments, there is opportunity for fund managers to create alphas by investing in a bigger universe of stocks.

- The three year lock-in period of ELSS enables fund managers to invest in high conviction stocks for a long period of time because of relatively less redemption pressure.

- ELSS is the most liquid investment option u/s 80C. ELSS has lock-in period of three years, whereas minimum lock-in period of other 80C investment options is 5 years.

- ELSS is one of the most tax efficient investment options u/s 80C. Capital gains in ELSS are tax exempt up to Rs 1.25 lakhs and taxed at 12.5% thereafter.

In this article we will review Groww ELSS Tax Saver Fund.

About Groww ELSS Tax Saver Fund

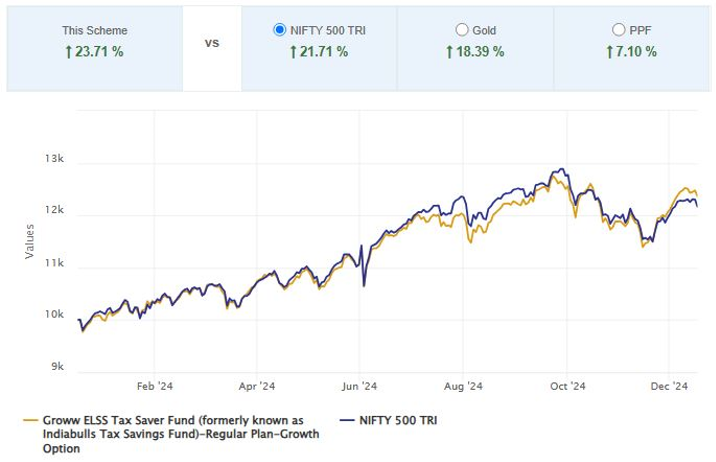

Groww ELSS Tax Saver Fund (formerly known as Indiabulls Tax Savings Fund) was launched in 2017. In 2023 Groww Mutual Fund acquired Indiabulls MF and subsequently the name of Indiabulls Tax Savings Fund was changed to Groww ELSS Tax Saver Fund. Mr. Anupam Tiwari, Head – Equity, Groww MF, has been managing this fund since May 11, 2023. The fund has outperformed the broad market index, Nifty 500 TRI in the last 1 year (see the chart below).

Source: Advisorkhoj Research, as on 17th December 2024

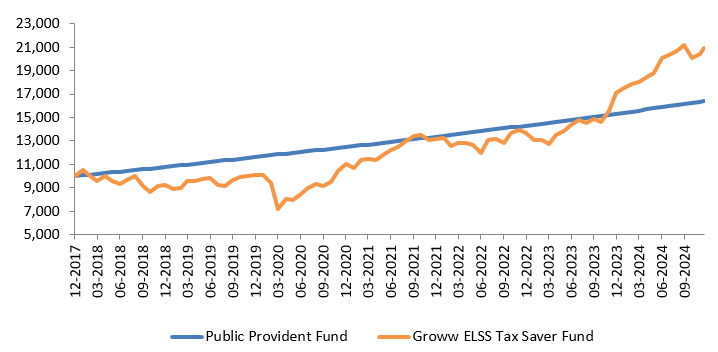

Groww ELSS Tax Saver Fund versus PPF

The chart below shows the growth of Rs 10,000 in Groww ELSS Tax Saver Fund versus PPF since the inception of the fund. You can see that, despite higher volatility, the fund created significantly more wealth than PPF.

Source: Advisorkhoj Research, as on 17th December 2024

Groww ELSS Tax Saver Fund - Upturn in performance

Though the fund had lagged behind its peers in the past, we have seen an upturn in performance in the last year or so.

Source: Advisorkhoj Research, as on 17th December 2024

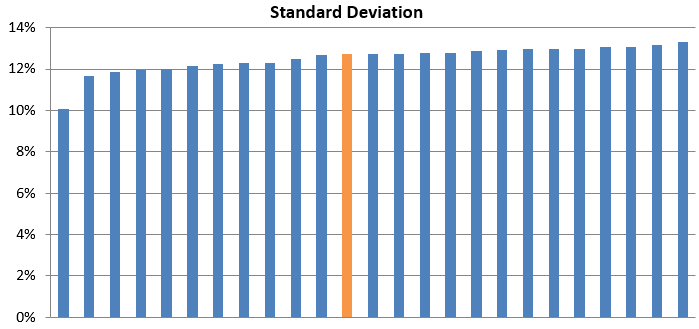

Groww ELSS Tax Saver Fund - Lower volatility compared to its peers

We looked at the standard deviations of all ELSS funds which have completed 3 years. Groww ELSS Tax Saver Fund has lower volatility relative to most its peers

Source: Advisorkhoj Research, as on 17th December 2024

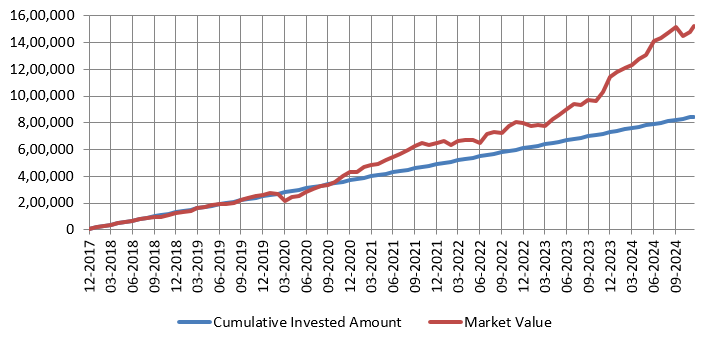

Groww ELSS Tax Saver Fund - Wealth creation through SIP

The chart below shows the growth of Rs 10,000 monthly SIP in Groww ELSS Tax Saver Fund since the inception of the scheme. You can see that with a cumulative investment of Rs 8.4 lakhs, you could have accumulated a corpus of more than Rs 15 lakhs. SIP is an efficient way making your tax savings investment. It not only keeps you disciplined in your tax planning & it also avoids last minute hassle, you can also benefit from market volatility through Rupee Cost Averaging.

Source: Advisorkhoj Research, as on 17th December 2024

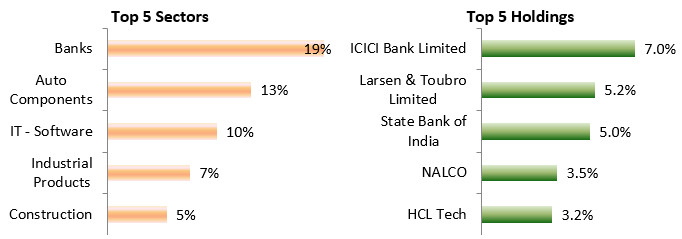

Groww ELSS Tax Saver Fund - Current portfolio positioning

Source: Groww MF Fund Factsheet, as on 30th November 2024

Who should invest in Groww ELSS Tax Saver Fund?

- Investors looking for capital appreciation or wealth creation over long investment horizon

- Investors who can stay invested for minimum 3-5 years period

- Investors who have high risk appetite

Consult your financial advisor or mutual fund distributor to understand if the Groww ELSS Tax Saver Fund can align to your financial goals.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Groww Mutual Fund is sponsored by Groww Invest Tech Private Limited. Groww Invest Tech is a SEBI registered Stock Broker, Depository Participant, Research Analyst and AMFI registered Mutual Fund Distributor.

Investor Centre

Follow Groww Mutual Fund

More About Groww Mutual Fund

POST A QUERY