Groww Banking and Financial Services: Attractive investment option for long term investors

Role of banking and financial services in the economy

Banking and financial services sector is the one of the main driver's of a nation's economy. Banks facilitate flow of money into the markets. They place a key role in economic growth of a country by providing credit both to consumers and business. Since India is largely a consumption driven economy, growth in consumption expenditure is essential to maintain GDP growth. Capital expenditure results in employment growth and also future revenue growth. Financial services (ex banks) provide important services to both consumers and business like insurance, investment management, payments etc, which are essential for well being of individuals, families and businesses.

Banking sector and financial services in India

The Indian banking system consists of 13 public sector banks, 21 private sector banks, 44 foreign banks, 12 small finance banks and 44 regional rural banks (source: Department of Financial Services, Ministry of Finance). The Government has taken a number of steps to reform and strengthen the banking sector. The Pradhan Mantri Jan Dhan Yojana (PMJDY) aimed at providing financial inclusion to all Indians has brought nearly 54 crore Indians under the banking system with nearly Rs 2.4 lakh crores of balance in PMJDY accounts. Total time and demand deposits in the banking system in India stood at Rs 218 Trillion with a year on year growth of Rs 23 Trillion (as on 20th September 2024, source: RBI).

As far as the insurance sector is concerned apart from the 7 public sector insurance companies covering both life and non life (health, general insurance etc) insurance, there are 23 private sector life insurance companies, 21 general insurance companies and 5 health insurance companies (source: Department of Financial Services, Ministry of Finance).

The Government has made a major thrust for digitization of payments through the Jan Dhan, Aadhaar and Mobile (JAM) trinity. UPI has revolutionized digital payments in India. Unified Payments Interface (UPI) recorded 15 billion transactions in the month of September 2024, valued at over Rs 20 lakh crores. UPI has become the world's largest digital payment system.

Banking sector and stock market

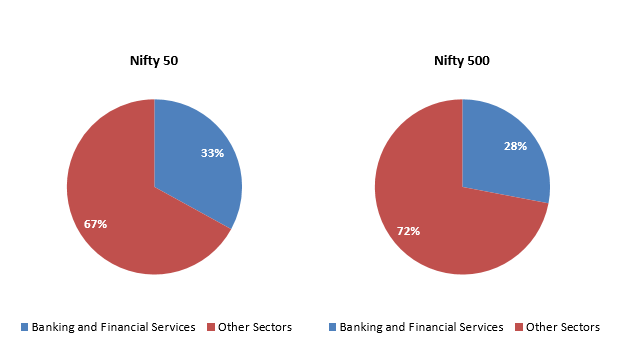

The weight of Banking & Financial Services in the Indian stock market has been going up steadily over the last decade or so and it is now the largest sector in the key equity market benchmark indices such as Nifty 50 and Nifty 500 (see the charts below). There were 4 banking and financial services companies in the Top 10 companies by market capitalization in both Nifty 50 and Nifty 500 indices (as on 30th September 2024).

Source: National Stock Exchange, As on 30th September 2024

Financial Services have outperformed the broad market

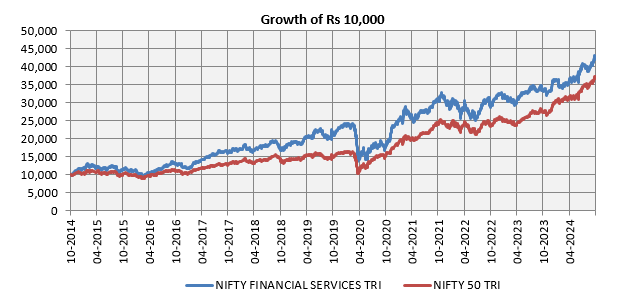

Nifty Financial Services Index which comprises of the 20 largest financial services companies by market cap in the NSE has outperformed the leading broad market benchmark index (Nifty 50) over long investment horizons. The chart below shows the growth of Rs 10,000 investment in Nifty Financial Services Index and Nifty 50 TRI over the last 10 years (ending 30th September 2023)

Source: National Stock Exchange, Advisorkhoj Research, As on 30th September 2024

Financial Services performance in economic cycles

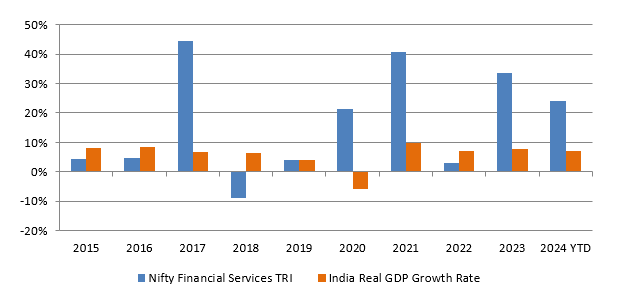

Financial Services sector is closely related to the overall economy. The sector does well when demand is increasing (economic expansion) and underperforms when demand slows down or contracts (economic slowdown). The charts below show the returns of Nifty Financial Services TRI over the last 10 years (ending 30th September) in relation to India's real GDP growth rate over the same period. You can see that returns of financial services were lower when the GDP growth rate slowed down. With acceleration of GDP growth rate in the medium to long term, we can expect the financial services to do well as an investment theme.

Source: Nifty Financial Services TRI data from National Stock Exchange (as on 30th September 2024), GDP growth data from World Bank (2015 to 2029), 2024 GDP forecast based on RBI forecast.

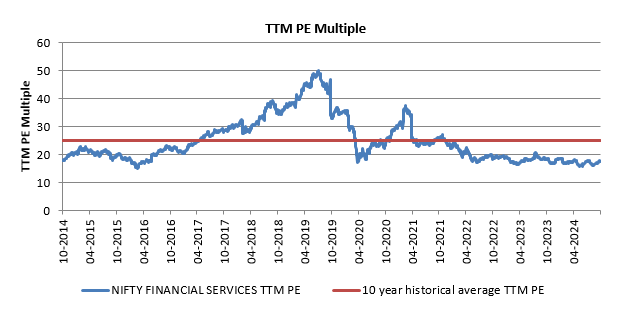

Why invest now - Valuations are below historical average

The chart below shows the Trailing Twelve Months PE Multiples of Nifty Financial Services Index versus its 10 year historical average. You can see that current valuations are significantly below the historical average. Current valuations, which are near 10 year lows, can be attractive investment opportunities for long term investors.

Not just banks

Many investors associate financial services primarily with banks. With banks are a very important part of financial services, the financial services sector is much broader than purely the banking sector. The financial services sector includes the following sub-sectors:-

- Term lending institutions

- Housing finance companies

- Leasing and hire purchase companies

- Life insurance companies

- General insurance companies

- Capital markets (asset management companies, stock broking, stock exchanges, depositories, distribution companies)

About Groww Banking and Financial Services Fund

Groww Banking and Financial Services Fund was launched in February 2024. The fund aims to capitalize on the growth opportunities and growth potential of various sub-sectors within the Banking, Financial Services and insurance sector, including (but not limited to) banks, NBFCs, insurance companies, asset management companies, capital market participants, fintech players etc. Anupam Tiwari (head of equities in Groww MF) is managing this fund. The TER of the regular plan is 2.3%, while that of the direct plan is 0.36%. The fund has given 9.6% YTD returns (as on 9th October 2024).

Groww Banking and Financial Services Fund Investment Strategy

- The scheme has a flexible approach, avoiding style or market cap bias. This is done to adapt to market changes and BFSI sub-sectors, with investments having a time horizon of around 5+ years.

- The emphasis is on large and emerging financial services businesses, utilising both top-down and bottom-up approaches.

- The predominant focus is on equity and equity-related securities in banking and financial services while also allowing up to 20% allocation to other sectors.

- The strategy includes participation in IPOs, emerging sectors, and primary market offerings, alongside potential investments in debt or money market securities within defined limits.

Who should invest in Groww Banking and Financial Services Fund?

- Those who have a goal of long-term capital appreciation, with a targeted investment horizon of 5 to 10 years

- Those who are aiming to capitalise on the growth potential within banking, financial services, and related sectors

- Those who have a well-diversified portfolio and are seeking some level of concentration for the potential of outsized returns

- Those who have a higher risk appetites

- You can invest in the fund over long investment horizon from your regular income through SIP

- You can take advantage of the recent market correction to tactically invest in lump sum with long investment horizon

Investors should consult with their financial advisors or mutual fund distributors, if Groww Banking and Financial Services Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Groww Mutual Fund is sponsored by Groww Invest Tech Private Limited. Groww Invest Tech is a SEBI registered Stock Broker, Depository Participant, Research Analyst and AMFI registered Mutual Fund Distributor.

Investor Centre

Follow Groww Mutual Fund

More About Groww Mutual Fund

POST A QUERY