Groww Aggressive Hybrid Fund: Wealth Creation during Volatility

Aggressive Hybrid Funds invest 65-80% of their funds in equity and equity related instruments while the rest 20- 35% is invested in debt and money market instruments. This ensures long term capital appreciation due to the equity exposure coupled with downside protection offered by the debt side of the fund. Investors can thus benefit from this diversified approach to investing and enjoy reasonable stability even in volatile markets. The short-term capital gains arising from holding these investments for a period of less than 12 months are taxed at 15%. The long-term capital gains that arise from holding the investments for a period of more than 12 months, exceeding Rs 1 lakh, are taxed at 10%. In this article, we will discuss about Groww Aggressive hybrid Fund.

Groww Aggressive Hybrid Fund Regular Growth Plan

The Groww Aggressive Hybrid Fund was formerly known as the Indiabulls Equity Hybrid Fund and was launched in December 2018. The fund is managed by Mr. Anupam Tiwari for the Equity allocation and Mr. Kaustubh Sule who looks after the debt side of the portfolio. The AUM of the fund as on April 30th 2024 was 41.37 crores and the TER of the Regular growth plan of the scheme on the same date was 2.29%.

Wealth creation with Groww Aggressive Hybrid Fund

If you had invested Rs 1 lakh in the fund at its inception, the value of your investment would have grown to Rs 2 lakhs as on 11th June 2024, giving a CAGR of 13.6%.

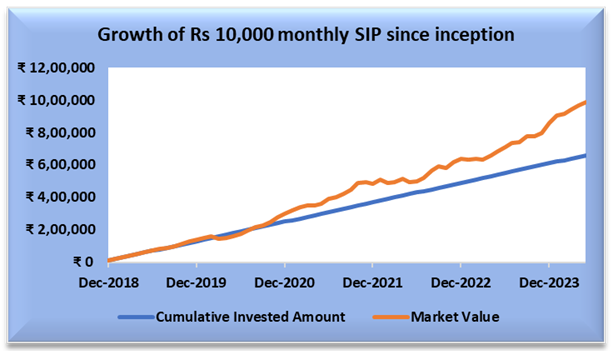

The chart below shows the growth of a monthly SIP of Rs 10,000/ since inception which would have grown to a corpus of Rs 10.37 lakhs against a cumulative investment of 6.6 lakhs giving an XIRR of 16. 42%. (as on 11th June 2024)

(Source: Advisorkhoj research as on 11th June 2024. Disclaimer: past performance may or may not be sustained in future.)

Rolling Returns

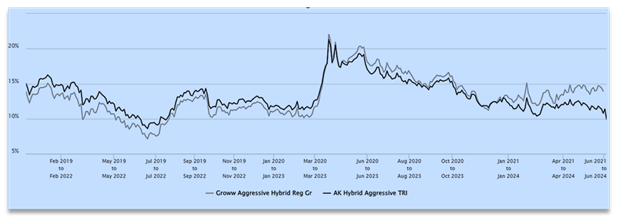

The chart below represents the 3-year rolling return of the fund vs our benchmark for aggressive hybrid funds. Our benchmark comprises of 65% Nifty 50 TRI + 35% Nifty 10-year G-Sec Index, rebalanced monthly. As can be seen the fund has consistently beaten our aggressive hybrid index since COVID-19.

(Source: Advisorkhoj research as on 11th June 2024. Disclaimer: past performance may or may not be sustained in future.)

Superior Downside Protection

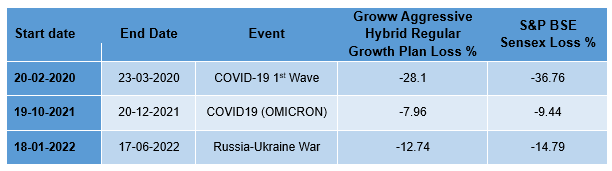

The table below shows the impact of the 3 largest drawdowns in the equity market over the last 6 years on Groww Aggressive Hybrid Fund since its inception compared to the category S&P BSE Sensex TRI. You can see that the drawdown in the scheme was much smaller than that of S&P BSE Sensex TRI. The asset allocation of the scheme was able to limit the downside risk for investors in the volatile market.

(Source: Advisorkhoj research as on 11th June 2024. Disclaimer: past performance may or may not be sustained in future)

Portfolio Allocation

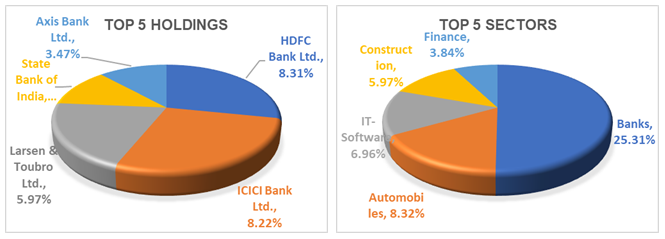

The Scheme seeks to generate periodic return and long-term capital appreciation from a judicious mix of equity and debt instruments. The fund invests in 15.66% of its debt holdings in GOI securities lending stability to the portfolio.

(Source: Fund Factsheet as on 30th April 2024)

Why is this a good time to invest in Aggressive Hybrid Funds?

India is in a macro sweet spot being the 5th largest economy in the world and is expected to become the 3rd largest economy by 2027 (as per IMF’s forecasts). Our GDP grew by 8.2% in FY 2023-24 exceeding earlier forecasts. IMF is forecasting India’s GDP to grow by 6.8% in FY 2025, making it the fastest growing G-20 economy. India’s fiscal deficit in FY 2023-24 is estimated to be 5.8% and will be pared down to 5.1% in FY 2024-25.

In the Debt market, the 10-year Government bond yields declined by 17 bps, while the 1-year (364-day T-Bill) yields softened by 4 bps, indicating gradual mean reversion of the yield curve. The current yields provide attractive investment opportunities for longer duration debt fund investors since they can benefit from price (NAV) appreciation as interest rates fall.

Policy continuity with the formation of a stable Government and impending change in the interest rate cycle provides a favourable environment for both equity and debt investors. It is important for investors to review their asset allocation and ensure that their portfolio is suitably diversified. Since the equity market has climbed back to record highs after the post poll rebound, hybrid funds can add stability and diversification to your investment portfolio.

Why you should invest in Groww Aggressive Hybrid Fund?

- Compared to other asset classes, equity has demonstrated the highest potential of wealth creation in the long term. The scheme invests 65 – 80% of its assets in equity.

- The fund is expected to generate capital appreciation for investors in the long term even in volatile market conditions where equity has a pull back.

- The debt portion in the scheme minimizes downside risks and provides stability during volatility.

- As compared to investors managing asset allocations at their end, the fund offers cost & operational efficiency for them.

Who should invest in Groww Aggressive Hybrid Fund?

- Investors who want capital appreciation and income over long investment horizons.

- Investors who do not want too much volatility in their investments e.g. new investors.

- Investors who aim to earn better returns compared to traditional savings products albeit with higher risks.

- Investors who have a moderately high to high-risk appetite.

- Investors should have minimum 3-to-5-years of investment horizon.

Consult with your financial advisors or mutual fund distributor, if Groww Aggressive Hybrid Fund is suitable for your long-term investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Groww Mutual Fund is sponsored by Groww Invest Tech Private Limited. Groww Invest Tech is a SEBI registered Stock Broker, Depository Participant, Research Analyst and AMFI registered Mutual Fund Distributor.

Investor Centre

Follow Groww Mutual Fund

More About Groww Mutual Fund

POST A QUERY