Why Continue with SIPs even When Market Crashes [Updated]

Over the past month or so, we are experiencing a period of heightened volatility in the stock market, primarily driven by weak macroeconomics and IL&FS crises. The Nifty has corrected by more than 1,000 points from its last peak.In past, such volatile conditions would have seen large scale mutual fund redemptions and Systematic Investment Plan (SIP) cancellations. But even in current trying times, we witnessed record inflows via SIP mode in September 2018. This is a testimony of the growing maturity amongst Indian investorsHowever, if the market continues to remain volatile and decline further from the current levels, it may cause uncertainty and fear among less experienced investors.

Characteristics of deep corrections

Though we are technically not in a bear market, we will explain some of the characteristics of a bear market for the benefit of investors who have not yet experienced bear markets or very deep corrections. In such conditions, market continues to fall even after a big decline; the Sensex may fall by 1,000 points in a week and then fall again the following week. There may be the occasional pullback rallies which may give hope to investors, but in such rallies stocks are sold by traders and the market falls again. Two questions confront investors in such times:-

- Should I remain invested in stock (or equity mutual funds) or sell (redeem)?

- Should I continue to invest through SIP or stop it?

We will address both these questions in our subsequent sections.

Should you remain invested or redeem?

In big corrections, your mutual fund values may fall every other day or week; it may be tempting to stop the loss by redeeming your investment. However, you should remember that if you have a long investment tenor, correction only causes a notional loss to your investment and not a permanent one, as long as you remain invested. If you have a long investment horizon, you can wait for the market to recover and resume its long term secular growth trend.

In the last 20 years, the Nifty 100 has given 18% annualized total returns, despite at least 4 major (20%+) corrections in the interim. But if you redeem when the market has fallen, the notional loss becomes a permanent loss. If you have a sufficiently long investment horizon, it is unwise to sell or redeem your mutual fund investments after a crash.

Should you continue your SIP when market crashes?

Investors may be tempted to stop / cancel their mutual fund SIPs, when market crashes because the marked to market value of the SIP can keep falling for weeks or months even when you keep investing through SIP. But stopping SIPs when the market is falling defeats the very purpose of SIPs. SIPs work on the principle of Rupee Cost Averaging. By reducing your average cost of acquisition during corrections, SIPs enable you to earn higher returns in the long term. By stopping your SIPs in a falling market, you are depriving yourself of the opportunity to buy units at lower cost. The opportunity cost of SIP cancelation can be substantial in the long term.

Let us explain this further, with the help of an example.

Example

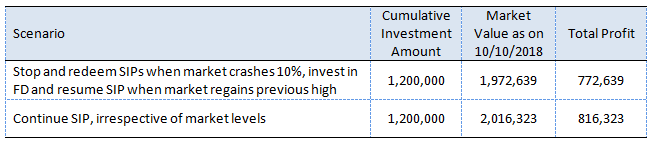

Let us assume you started your monthly SIP investment of Rs 10,000 in Nifty 10 years back. Let us examine two scenarios. In the first scenario, you stopped your SIP every time Nifty declined 10% from its previous high, redeemed all your units and parked your redemption proceeds in a fixed deposit paying an interest rate of 8%. Then you waited the market to get back to its previous high to resume your SIP. When you resume your SIP, you also re-invested the redemption proceeds parked in FD along with the missed SIP instalments, which we assume were invested in a recurring deposit account (paying 8%) for the time the SIP was stopped. For sake of simplicity, let us ignore premature FD withdrawal charges and exit loads.

In the second scenario, you kept on investing through monthly SIP, irrespective of market levels. Let us now see how much corpus you would have accumulated. With a cumulative investment of Rs 12 Lakhs, you would have accumulated a corpus of Rs 19.7 Lakhs in the first scenario and a corpus of Rs 20.2 Lakhs in the second scenario (where you simply continued your SIP). For all the effort you put in scenario 1, you made less money than scenario 2, where you simply remained disciplined.

Conclusion

- The benefits of Rupee Cost Averaging over a long investment tenor covering several market cycles enables investors to benefit from volatility

- Power of compounding unlocks the real value of SIP mode of investment over a long investment horizon.

- SIP is the best way of investing in a disciplined manner for your long term financial goals. You should continue to invest irrespective of market levels till your financial goal is achieved.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

#Wise With Edelweiss – An Investor Education Initiative by Edelweiss Mutual Fund.

EAML is amongst the fastest growing asset management companies, being an asset management subsidiary of Edelweiss Financial Services Ltd., one of Indias leading financial services group since last 21 years with a proven track record of quality and innovation. Edelweiss AML is present across 11 locations across the country. EAML offers a suite of differentiated asset management products and the unique knowledge proposition focusing on building a strong connect with Distributors and customers. At Edelweiss AMC, the aim is to come up with truly innovative ideas that doesnt exist today and bridge the gap between what investors want and what the industry has to offer.

Quick Links

Contact Us

- Toll Free : 1800 425 0090

- Non Toll Free : +91-40-23001181

- EMFHelp@edelweissfin.com

- distributor.amc@edelweissfin.com

POST A QUERY