Should you invest in Bharat Bond ETF

What is Bharat Bond ETF?

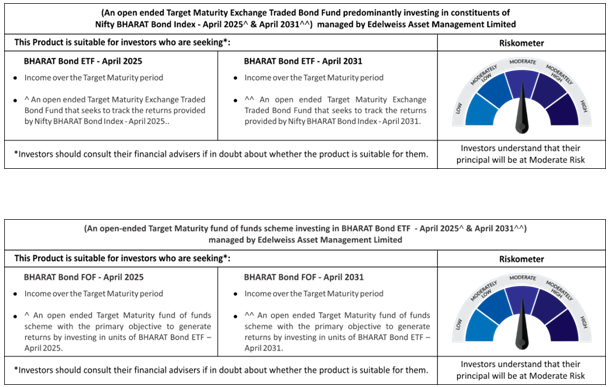

Bharat Bond ETF, A Government of India initiative,is a fixed income exchange traded fund (ETF). The ETF has fixed maturity dates. The ETF invests in Public Sector Undertaking bonds maturing on or before scheme maturity. If you have a demataccount you can buy the ETF from stock exchange. If you do not have a demataccount then you can invest in Bharat Bond Fund of Funds. Apart from the existing ETFs which are already trading in the stock exchange, Bharat Bond ETF NFO will be launched – NFO Period 14th July, 2020 – 17th July, 2020.

Bharat Bond ETF is a Government of India initiative and is managed byEdelweiss Asset Management Ltd.

Characteristics of Bharat Bond ETF

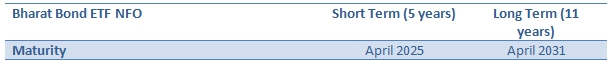

Fixed maturity:- The ETFs have fixed maturity. Upon maturity you will get your investment amount along with returns. Please note that there is no assurance of capital protection or returns. There are 2 options as shown in the table below to invest in Bharat Bond ETF– 1) BHARAT Bond ETF - April 2025 and BHARAT Bond ETF- April 2035

Source: bharatbond.in

- High credit quality: The fund invests in AAA rated bonds of Public Sector Undertakings. PSUs are backed by the Government of India and PSU bonds as such have quasi sovereign status. 5% of the fund’s assets are in Government Securities and TREPs (which are overnight instruments) to ensure liquidity. Since the fund invests only in AAA rated PSU bonds the credit quality of the fund is very high.

- Accrual strategy: The fund will hold the bonds in its portfolio till maturity. The coupons paid by the bond are re-invested. Interest rate changes may cause volatility in prices or NAVs but if bonds are held till maturity then interest rate changes will have no effect on maturity amount.

Tax Benefits

Bharat Bond ETF held till the fund maturity will enjoy significant tax advantage over traditional fixed income investments e.g. bank FDs.

Long term capital gains in Bharat Bond ETF will be taxed at 20% after allowing for indexation benefits.

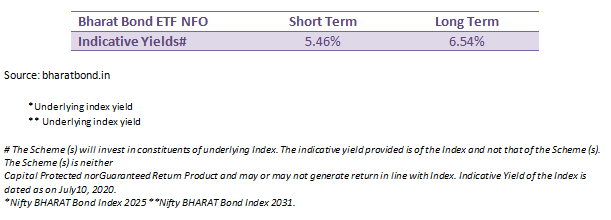

The table below shows examples the tax advantage of indexation versus traditional fixed income investments which are taxed as per the income tax rate of the investors. Please note that figures are purely illustrative.

Source: Advisorkhoj assumptions – Above is only for illustration purposes. Please consult your Tax Advisor before making any investment 4% inflation rate

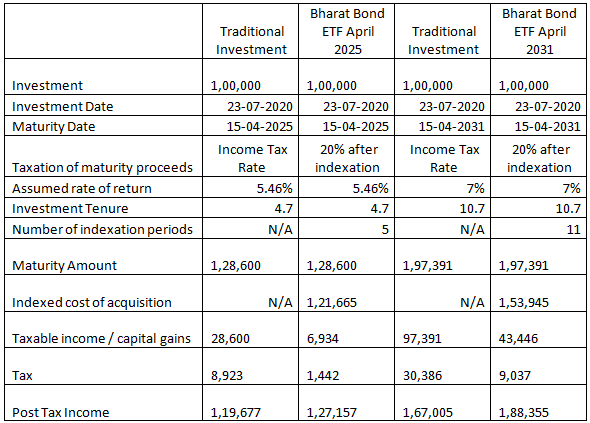

Who should invest in Bharat Bond ETF?

- Investors who have low risk appetite and are looking for absolute safety - These constituents will comprise of high-quality AAA-rated Public Sector bonds, thus have the highest degree of safety.

- Investors whose investment tenure matches with the maturity of the different options – April 2025 and April 2031.As the fund has a fixed maturity date, you will get back your money along with returns on maturity. However, you can also buy / sell on stock exchanges.

- However, investors should consult their financial advisors, if in doubt, about whether the product is suitable for them.

Conclusion: Why Bharat Bond ETF

- Stability and Predictability: The fund has fixed maturity. It will invest in bonds maturing along with the fund, thus offering predictable returns.

- Highest Safety: Investment in diversified basket of Public Sector Bonds with highest rating of AAA

- Transparency through daily disclosure of portfolio constituents and live NAV periodically through the day

- No Lock-in: Buy / Sell on exchange anytime or through AMC in specific basket size for ETF

- Lower Tax: Tax efficient compared to traditional fixed income investment avenues. Taxed at only 20% after indexation

- Low Cost: The ETF will be managed at very low cost – 0.0005%. Maximum Re.1 for Rs 200,000 worth investment.

- Low investment amount: Minimuminvestment amountfor retail investor is Rs 1,001 and in multiples of Re.1/- thereafter, subject to maximum investment of Rs 200,000

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

#Wise With Edelweiss – An Investor Education Initiative by Edelweiss Mutual Fund.

EAML is amongst the fastest growing asset management companies, being an asset management subsidiary of Edelweiss Financial Services Ltd., one of Indias leading financial services group since last 21 years with a proven track record of quality and innovation. Edelweiss AML is present across 11 locations across the country. EAML offers a suite of differentiated asset management products and the unique knowledge proposition focusing on building a strong connect with Distributors and customers. At Edelweiss AMC, the aim is to come up with truly innovative ideas that doesnt exist today and bridge the gap between what investors want and what the industry has to offer.

Quick Links

Contact Us

- Toll Free : 1800 425 0090

- Non Toll Free : +91-40-23001181

- EMFHelp@edelweissfin.com

- distributor.amc@edelweissfin.com

POST A QUERY