Bond Laddering can provide stability to your fixed income portfolio

What is a bond ladder?

A bond ladder is a portfolio of fixed income securities (debt and money market) maturing at different dates. For example, a bond ladder may have securities that are maturing in 1 year, 3 years, 5 years, 7 years and 10 years. The purpose of a bond ladder is to protect investors from interest rate risks. In this article, we will discuss about bond laddering and how it can benefit fixed income investors in different interest rate scenarios. However, you need to know a few other concepts in order to get an understanding of bond laddering.

Yield to maturity

Yield to Maturity (also known as the yield) is the expected annualized return from your fixed income (e.g., CPs, CDs, NCD, bonds etc) investments, if you hold these fixed income securities till their maturity. The cash-flows are the coupon payments made by the bonds. The last cash-flow will have both coupon and the maturity amount (face value).

Yield curve

Yield curve is also known as the term structure of interest rates. It is a chart showing yields of fixed income securities (e.g. CPs, CDs, NCD, bonds etc) of different maturities. The shape of yield curve is usually upward sloping i.e. longer the maturity of a fixed income security or bond, higher is the yield of the security.

Interest rate risk

Bond prices are inversely related to interest rate changes. Bond prices fall when interest rates go up and vice versa. Interest rate risk is an important consideration in fixed income investing because your fixed income portfolio value will fall if interest rate rises and vice versa.

Interest rate sensitivity or duration risk

Bonds of different maturities have different price sensitivities to interest rate changes. Interest rate sensitivity of a bond is directly related to the bond maturity. The longer the maturity of a bond, thehigher is its sensitivity to interest rate changes. Interest rate sensitivity of a bond is also known as duration of the bond.

Managing interest rate risk with bond ladder

Let us suppose that you want to invest Rs 1 lakh in fixed income securities. If you invest the entire amount in bonds or debt funds that have short maturities, your interest rate risk will be lower, but your yields will also be lower. On the other hand, if you invest the entire amount in bonds or debt funds that have longer maturities, your yields will be higher, but your interest rate risk will be higher. You should be aware of this risk-return trade off.

Bond laddering in different interest rate scenarios

You can manage this risk return trade off by investing equal amounts in bonds of different maturities. As and when shorter term bonds mature, you can invest the maturity proceeds in the longer maturity bonds. If interest rates rise, you will benefit from higher yields for your re-invested maturity proceeds in longer maturity bonds. If interest rates fall, you will be re-investing in lower yields than before but the bonds at the end of the ladder will have locked in higher yields already providing stabilityto your income from your bond portfolio. The advantage of bond laddering strategy is that it works in both rising and falling interest rate scenarios.

How to construct a bond ladder?

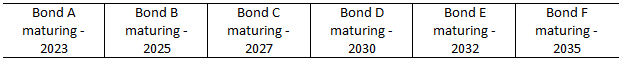

A bond ladder is constructed by buying bonds of different maturities. Suppose we are in 2021 and you buy bonds of different maturity dates as shown in the hypothetical bond ladder (imagine a ladder in horizontal position). You can see that the bonds will mature at different times. When Bond A matures in 2023, you can invest the maturity proceeds in a Bond that matures in 2035. If interest rates rise, you will get higher yield in Bond F (maturing in 2035). If interest rates fall, you will still be enjoying the relatively higher yieldsthat you have locked-in bonds B, C,D and E prior to the rise in interest rates.

The other advantage of a bond ladder is that you can change the duration of your portfolio according to your risk appetite, by re-investing the maturity proceeds of one bond in durationsof other bonds that suit your risk appetite. Typically, maturities of different bonds in a bond ladder portfolio are spaced equally but you invest in different maturities depending on your cash-flow needs and tax situation.

Building a bond ladder with target maturity ETFs

You can also build a bond ladder with target maturity ETFs instead of investing directly in bonds or other fixed income securities. A target maturity fund has a defined maturity date and upon maturity you will get back your investment proceeds along with accrued returns. A target maturity ETF combines features of a bond (fixed maturity date) and mutual fund (diversification, liquidity etc). Building a bond ladder with target maturity ETFs has several advantages for retail investors:-

- You can invest in different type of debt and money market securities e.g., commercial papers, certificates of deposits, non-convertible debentures (corporate bonds), State Development Loans etc. to build your bond ladder.

- You get a superior risk-return trade off from the standpoint of credit risk and yield levels considering your investments in ETFs are managed by professional fund managers who have experience and expertise in the fixed income markets.

- NCDs / corporate bonds are not very liquid, since trading volumes are relatively thin in secondary markets. ETFs can provide high liquidity in secondary market (stock exchanges) through market makers and also through the Asset Management Companies (if you are transacting in basket sizes).

- Target maturity funds are far more effective than open ended debt mutual funds for building bond ladders because the duration of target maturity funds reduces over time, while that of open endeddebt funds do not.

Benefits of bond laddering strategy

- Manage interest rate risks by spreading your portfolio across different maturities.

- Get relatively stable returns in both rising and falling interest rate scenarios.

- You have the option of re-investing the maturity proceeds in longer maturity bonds or getting cash-flows based on your needs.

- Advantage of long term capital gains taxation.

Investors should consult with their financial advisors if bond laddering strategy is suitable for their fixed income investments and how to build a bond ladder.

An investor education initiative by Edelweiss Mutual Fund

All Mutual Fund Investors have to go through a onetime KYC process. Investor should deal only with Registered Mutual Fund (RMF). For more info on KYC, RMF and procedure to lodge/redress any complaints, visit - https://www.edelweissmf.com/kyc-norms

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

EAML is amongst the fastest growing asset management companies, being an asset management subsidiary of Edelweiss Financial Services Ltd., one of Indias leading financial services group since last 21 years with a proven track record of quality and innovation. Edelweiss AML is present across 11 locations across the country. EAML offers a suite of differentiated asset management products and the unique knowledge proposition focusing on building a strong connect with Distributors and customers. At Edelweiss AMC, the aim is to come up with truly innovative ideas that doesnt exist today and bridge the gap between what investors want and what the industry has to offer.

Quick Links

Contact Us

- Toll Free : 1800 425 0090

- Non Toll Free : +91-40-23001181

- EMFHelp@edelweissfin.com

- distributor.amc@edelweissfin.com

POST A QUERY