Know your mutual fund tax obligations to manage your investments effectively

An important aspect of investment planning is to assess the impact of taxes on your investment returns, so that you can make the right investment decision and also file your income tax return correctly. Investors often tend to ignore the impact of taxes on their investment planning. Taxes, however, have a significant impact on the returns earned by the investor and therefore investors should pay due attention to the tax treatment of their investment returns and plan their investments accordingly. Mutual funds are amongst the most tax efficient investment options available to investor in India, compared to a lot of other investment options. If we educate ourselves on tax impact of mutual fund investments and plan our mutual fund investments carefully, we will be able to make the most tax efficient investment decisions.

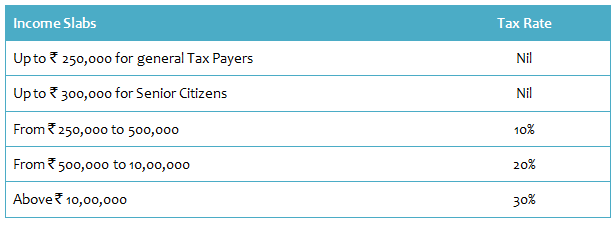

Before we into the details of mutual fund taxation, let us recap the exemption limits, income tax slabs and key deductions, since some important changes were introduced by the Government over the past 24 months.

Income tax Slabs

The table below summarizes the income tax rates for individuals and Hindu Undivided Families.

Allowable Deductions

Various deductions are allowed from your gross taxable income under various provisions.

Section 80C:

A deduction ofर1.5 lacs from your gross taxable income is allowed for investments under Section 80C. Among other investment options, you can save taxes under Section 80C by investing in mutual fund Equity Linked Savings Schemes (ELSS).Section 80CCD:

A further deduction ofर50,000, over and above the Section 80C limit ofर1.5 lacs, has been allowed for investment in the National Pension Scheme. Therefore the total deduction allowed under Section 80C and 80CCD is nowर2 lacs.Section D:

Maximum allowable deduction for health insurance or Mediclaim premium under Section 80D has been increased toर25,000 for self, spouse and dependent children. The applicable deduction for senior citizens isर30,000.Section 24:

The maximum deduction on account of interest paid on home loan for a self occupied property has been raised toर2 lacs per annum.Transport Allowance:

Deduction towards Transport Allowance has been increased fromर800 toर1600 per month.

While a number of other changes have also been introduced, which will discuss in another blog, the Finance Minister said in his last Budget speech that the total tax benefits available to individual taxpayer will now be र 4.44 lacs.

As a mutual fund investor, you should remember five important points related to your tax obligation:-

An incidence of taxation arises only when you sell your mutual fund units:

You need to pay taxes only when you sell the units of your mutual fund and you make a profit, subject to mutual fund tax provisions. Incidence of taxation arises whether you redeem your units partially or fully. If you bought 100 units of mutual fund scheme and you sold just 20 units at a profit an incidence of capital gains will arise, as per the mutual fund tax provisions. On the other hand, if you bought 100 units of a mutual fund scheme and you are still holding it, you do not have any obligation to pay taxes if you are still holding all the units.There is no tax deducted at source for mutual fund investors who are residents of India:

If you are a resident of India from a tax jurisdiction perspective, the mutual fund company will not deduct any tax at source (for NRIs it is different, but more about that in a separate post), when you redeem your mutual fund units. However, just because tax is not deducted at source (TDS), it does not relieve you of the obligation to pay taxes on your mutual fund profits. You should declare your mutual fund profits in your income tax returns (ITR), as per the mutual fund tax provisions and pay tax accordingly. Failure to declare your income correctly in your income tax is illegal and may lead to adverse consequences.Mutual fund dividends are tax free in the hands of the investors:

Remember dividends paid by your mutual fund units are tax free in your hands. The mutual fund company may have to dividend distribution taxes, depending on the income tax provisions, but in your hands the dividends are tax free.Mutual Fund switches are subject to tax:

Many investors think that, if instead of booking mutual fund profits, they switch from one scheme to another they will avoid short term capital gains tax. Investors should remember that, from a tax perspective, a switch is treated as a redemption combined with a fresh purchase. For example, if you switched from an equity fund scheme where you made a profit within 1 year from the date of investment to another mutual fund scheme, you will be liable to pay short term capital gains tax.Systematic Transfer Plans (STP) from Liquid Fund to Equity Fund:

If you are making systematic transfers from a lump sum liquid fund investment to an equity fund over a period of time, you will be liable to pay short term capital gains tax on the redemption of liquid fund units for transfer to the equity fund scheme, if the NAVs of the liquid fund units is higher at the time of the transfer than the NAV of the units at the time of purchase.Systematic Investment Plan (SIP) redemptions:

In the case of a SIP, each instalment is treated as a fresh investment from a tax perspective. Therefore, in the case of redemptions from accumulated units through a SIP in an equity mutual fund scheme, the units purchased less than 12 months prior to the date of date of redemption, will be subject to short term capital gains tax. In the case of redemptions from accumulated units through a SIP in a debt mutual fund scheme, the units purchased less than 36 months prior to the date of date of redemption, will be subject to short term capital gains tax. However, in the case of partial redemptions from units accumulated through SIP, the accounting principle of First In - First Out (FIFO) method applies. Therefore, you will be at an advantage, if you have been doing SIPs over a long investment horizon.

Let us now discuss how mutual fund returns are taxed. There are the two different kinds of returns from mutual funds:-

Capital Gains:

Capital gain is the appreciation in the value of the units of a mutual fund at the time of the sale. From a tax standpoint, there are two types of capital gains.

- Short term capital gain: If the units are sold within the period defined under tax laws, then it leads to short term capital gain.

- Long term capital gain: If the units are sold after a period defined under tax laws, then it leads to long term capital gain.

Dividends:

Dividends are profits returned by the mutual fund to the investor at regular intervals. However, the intervals are not certain and dividend amount is also not fixed.

The tax treatment of capital gains and dividend incomes are different. Tax treatment is also for different types of mutual funds. Let us discuss it one by one.

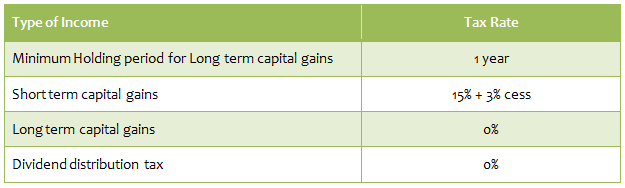

Equity Funds

From a tax perspective, a fund which has at least 65% of the portfolio allocated to equities is an equity fund. Diversified equity funds, sector funds, ELSS and balanced funds with more than 65% of its portfolio allocated to equities are categorized as equity funds from a tax standpoint. The minimum holding period for long term capital gains in equity funds is one year. Short term capital gains (if the units are sold before one year) in equity funds are taxed at the rate of 15% plus 3% cess. There is an additional surcharge for investors whose annual income exceeds र 1 crore. There is no capital gains tax on the sale of equity fund units held for a period of more than one year. While dividends of mutual funds are tax free in the hands of the investors, for equity funds the dividend distribution tax is zero even for the fund house. Here is a quick recap of tax treatment of equity funds.

Debt Funds

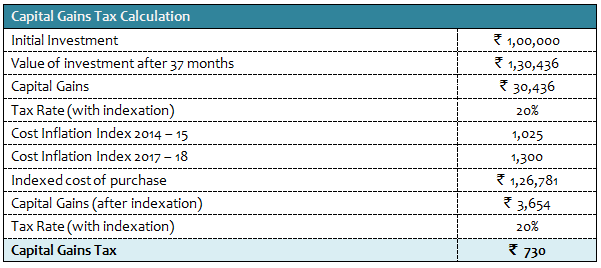

A number of changes have been introduced in the taxation of debt funds over the last 24 months. From a tax perspective, a fund in which less than 65% of its portfolio allocated to equities is a debt fund. Debt funds from a tax standpoint include liquid funds, ultra short term debt funds (formerly also known as liquid plus funds), short term debt funds, income funds, gilt funds and also monthly income plans. The minimum holding period for long term capital gains in debt funds is now three years. Short term capital gains (if the units are sold before three years) in debt funds are taxed as per applicable tax rate of the investor. Assuming your taxable income is above र 10 lacs, then short term capital gains tax of your debt fund (investment holding period of less than 3 years) redemptions will be 30% plus applicable cess and surcharges. If your investment holding period is more than 3 years, the long term capital gains of debt fund will be taxed at 20% after allowing for indexation benefits. To calculate capital gains with indexation, you should index your purchasing cost by multiplying the purchasing cost with the ratio of the cost of inflation index of the year of sale and cost of inflation index of the year of purchase, and then subtract the indexed purchasing cost from sales value. Let us understand how to calculate long term capital gains tax with indexation with the help of an example. Let us suppose you want to invest र 1 lac in an income fund for 37 months. Assume, the pre-tax return of your investment will be 9% on a compounded annualized basis. You are in the 30% tax bracket. The cost inflation index in 2014 – 2015 was 1,025. Let us assume the cost inflation index in 2017 – 2018 is 1,300. The table below shows the calculation of long term capital gains tax with indexation.

In the case of debt mutual funds, while dividends are tax free in the hands of the investor, the mutual fund company pays dividend distribution tax (DDT) before distributing dividends to investors. A number of changes have been announced in the past 12 months with respect to divided distribution tax in debt funds. The surcharge has been increased to 12% and method of calculating dividend distribution tax has been changed. The dividend distribution tax on dividends declared by debt fund schemes is 25% plus 12% surcharge plus 3% cess. Prior to FY 2015, dividend distribution tax was calculated on the net dividends received by the investor, but from July 2014 dividend distribution tax is calculated on the gross dividend, i.e. the dividends declared before DDT. The change in DDT computation method will result in slightly lower dividends compared debt fund dividends prior to FY 2015.

Here is a quick recap of tax treatment of debt funds.

Gold Funds

Tax treatment of Gold ETFs and Gold fund of funds is the same as that of debt funds.

Fund of Funds

Tax treatment of Fund of Funds is the same as that of debt funds.

Arbitrage Funds

Arbitrage funds aim to give risk free returns to the investors. Since arbitrage funds are risk free by definition, they are often compared to liquid funds. However, the tax treatment of arbitrage funds is same as equity funds, since these funds invest in equity instruments. If you opt for the dividend option in an arbitrage fund, then the fund does not have to pay dividend distribution tax, unlike debt and liquid funds. If you hold your arbitrage fund for over a year, the long term capital gains tax is nil.

How to effectively manage the taxation of returns of your mutual fund investments

- If you are investing in equity funds and your investment horizon is less than a year (though it is never recommended to have a short investment horizon for equity funds), from a tax perspective, you will be better off investing in dividend payout (if you need the cash-flows) or dividend reinvestment options of equity fund schemes. Dividends are tax free, while short term capital gains tax, for an investment holding period of less than a year, is 15%.

- If you are in the highest tax bracket, for your short term (less than 1 year), low risk investment, you should evaluate whether liquid funds or arbitrage funds will give you better returns. Liquid fund returns will be taxed at your income tax rate, for investment holding period of less than 3 years. Arbitrage funds returns, on the other hand, for an investment holding period of less than a year will be taxed at 15%. For example, if you are in the 30% tax bracket, if an arbitrage fund gives you an annualized return of 7%, while a liquid fund gives you a return of 8%, you will be better off, from a post tax perspective, investing in the arbitrage fund. If your investment horizon is more than a year, the advantage of arbitrage funds versus liquid funds increases further. For an investment holding period of more than a year, arbitrage fund profits are tax free.

- If you are a debt fund investor, with an investment horizon of less than 3 years let your tax status inform your investment option. If you are in the highest tax bracket, you will be slightly better off, by opting for dividend (if you need the cash flows) or dividend reinvestment option versus the growth option. The DDT deducted by mutual fund house is slightly lower than the highest tax rate. On the other hand, if you are in the lower tax brackets (e.g. 10% or 20%), you will be better off, investing in the growth options of debt mutual funds. The DDT deducted by mutual fund house is higher than the low lower tax slab rates. If you need regular income you can opt for a Systematic Withdrawal Program (SWP). This will ensure that, you have regular cash flows, while reducing your taxes.

- If you are a debt fund investor, with an investment horizon of more than 3 years, growth option is better from a tax perspective, if you are in the higher tax brackets (e.g. 20% or 20%). The long term capital gains of debt fund will be taxed at 20% after allowing for indexation benefits, while DDT will be 25% plus 12% surcharge plus 3% cess. If you want regular income from your debt funds, you can opt for a Systematic Withdrawal Program (SWP). This will ensure that, you have regular cash flows, while reducing your taxes. Retirees should pay careful attention to this, in order to maximize their post tax income.

Conclusion

In this article, we have discussed the effect of taxes on your mutual fund investment. You should pay due attention to the impact of taxes on your investments and plan your investments accordingly, so that you achieve your investment objectives by maximizing the post tax returns from your investment.

Disclaimer:

Any information contained in this article is only for informational purpose and does not constitute advice or offer to sell/purchase units of the schemes of SBI Mutual Fund. Information and content developed in this article has been provided by Advisorkhoj.com and is to be read from an investment awareness and education perspective only. SBI Mutual Fund’s participation in this article is as an advertiser only and the views / content expressed herein do not constitute the opinions of SBI Mutual Fund or recommendation of any course of action to be followed by the reader

So #TodayIsTheDay you look at saving taxes with Mutual Funds. Click here to know more.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Asset Allocation is much more important than fund selection

- How do you know if you have good funds in your mutual funds portfolio: part 2

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY