Investing in Bull and Bear Markets: Part 2

In part 1 of this blog post, Bull and Bear Market Investing: Part 1, we had discussed that, if investors have long investment horizon, then they do not need to worry about timing the market. Even if investors get their timing horribly wrong, they can recover their losses and get good returns, simply by staying invested.

We had also discussed that, bear markets, stressful as they may be, are actually terrific investment opportunities. In this post, we will discuss some simple but effective investment strategies, which retail investors can employ in bull and bear markets. Regular readers of our blog are probably aware of our strong belief that systematic investing is best approach to achieving financial goals. Systematic investing will be the underlying theme as we discuss investing in bull and bear markets. We have done two simulations in this post. We have taken two time periods, 2000 - 2008 and 2008 - 2016, to see what results would systematic investing have yielded in these two time periods. Before we get to the results of our simulation, let us understand, what systematic investment and why is it beneficial. Later in this post, we will try to dispel some wrong notions about systematic investing.

Systematic Investing

Systematic Investing is simply investing systematically at a regular frequency. In the mutual fund parlance, this is known as Systematic Investment Plan (SIP). In systematic investing, you invest a fixed amount of money at a regular frequency, e.g. monthly, quarterly, half yearly etc, irrespective of market levels. There are three major benefits of systematic investing:-

- It ensures disciplined savings habit. If you know that, you will invest a sum of money every month, you will not spend the money in discretionary expenses.

- It is convenient and will not require you to track the market for price / valuation related investment opportunities, which is often very difficult.

- You can get higher returns on investment, through rupee cost averaging of your purchase price.

There are several misconceptions about systematic investing. Some people believe that, systematic investing or SIP works in certain market conditions and does not work in other conditions. Some people believe that systematic investing is always better than one-time or lump sum investments. There is another school of thought, which says, lump sum investment is always better than systematic investing. They say that, systematic investment works in bear markets, where you buy at lower costs but does not work in bull markets, because you will be buying at higher costs. Our take on this, is different from the common narrative these days. Lump sum investing and systematic investing, simply, are apples and oranges and cannot be compared (please see our blog post, Is Mutual Fund Systematic Investment Plans really the Best Mode of Investing). As discussed earlier, systematic investing will be the underlying of this post, but we will also discuss lump sum investing.

Systematic Investing in 2000 to 2008

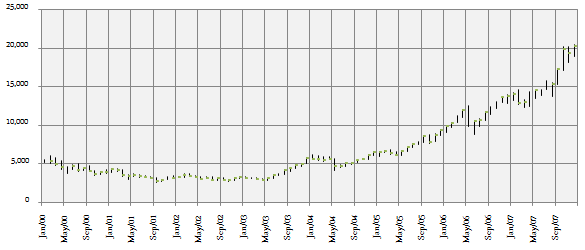

We had given some thought to the time periods chosen for our simulation. Both the time periods chosen for analysis, 2000 - 2008 and 2008 – 2016, had both bull and bear market phases. But the trends and global macro-economic situations were different in these two time periods. Let us first talk about the 2000 to 2008 time period. Though we had bearish conditions in the 2000 to 2003 period, if we consider the entire period (2000 to 2008), it was a secular bull market. In the 8 year period from 2000 to 2008, the Sensex grew at a CAGR of 18.5%, undoubtedly one of the best periods for Indian stock market. The chart below shows the month price chart of Sensex from 2000 to 2008.

Source: Bombay Stock Exchange

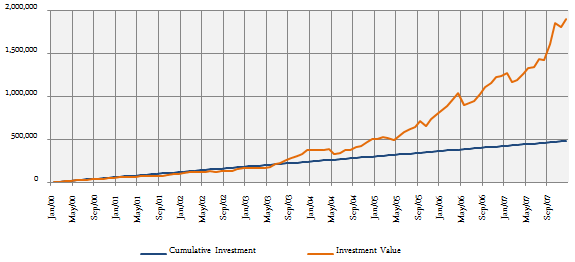

Let us now see, how much money you would have made, if you invested र 5,000 at the end of every month in the Sensex, from January 2000 to January 2008.

You can see in the chart above that, by investing र 5,000 systematically every month from January 2000 onwards, the value of your investment would have been nearly र 19 lacs by January 2008, while your cumulative investment over the entire period would have been र 4.8 lacs only. The annualized return (XIRR) of your investment would have been nearly 34%. Recall that, the Sensex CAGR over this period was 18.5%. In percentage terms, the annualized returns of systematic investing (SIP) was almost double. Hopefully, the result of this simulation dispels the notion that systematic investing (SIP) gives lower returns than lump sum investing in long term bull markets. The fundamental reason behind the result is intrinsic volatility of equity as an asset class. Stock markets move up and down. There are bear markets and bull markets, and even within bull markets there are sharp corrections. SIP takes advantage of volatility to give higher returns to investors.

Systematic Investing in 2008 to 2016

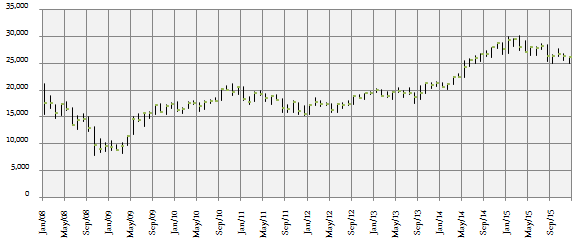

The 2008 to 2016 period was a very difficult period for the equity market, probably one of the most difficult periods ever in the history of stock markets. In 2008, we had the worst financial crisis, the world had seen since the Great Depression of 1930s. The aftermath of the 2008 recession is still lingering, after 8 years, in many economies around the globe. Though we had bull market periods from 2008 to 2016, if we look at the entire period on the average, the global risk sentiments were weak. There is a common saying that, a picture explains a thousand words. In Finance, a chart explains a thousand words. The chart below shows the month price chart of Sensex from 2008 to 2016.

Source: Bombay Stock Exchange

The chart tells you, the market conditions have been very difficult in the last 8 years. In the 8 year period from 2008 to 2016, the Sensex grew at a CAGR of just 5%, lower than the return from risk free assets in India. In the 2000 to 2008, we had bearish conditions from 2000 to the middle of 2003 and then largely a bull run from then onwards till 2008 (except a sharp correction when NDA -1 lost the general elections in 2004). On the other hand, from 2008 to 2016, while we had intermediate bull runs, we also had 3 bear market periods (while 2015 was not technically a bear market, if you consider the March 2015 to March 2016 period, it was a bear market). Let us now see, how much money you would have made, if you invested र 5,000 at the end of every month in the Sensex, from 2008 to 2016.

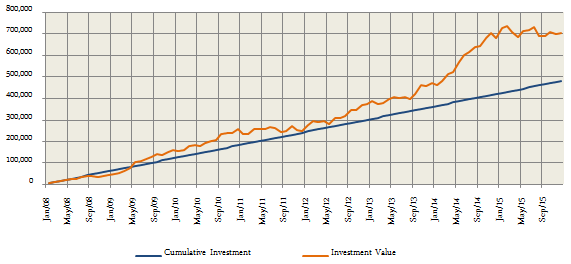

You can see in the chart above that, by investing र 5,000 systematically every month from January 2008 onwards, the value of your investment would have been little over र 7 lacs by January 2016, while your cumulative investment over the entire period would have been र 4.8 lacs. The annualized return (XIRR) of your investment would have been 9.4%. Recall that, the Sensex CAGR over this period was 5%. While most equity investors in India would expect higher than 9.4% returns, to put this in perspective with other asset classes, 9.4% compounded annual returns is still much higher than post tax returns of risk free fixed income investments. The average 10 year Government Bond yield, which can be treated as proxy for risk free returns, from 2008 to 2016 was 8.3%. For the investors in the highest tax bracket, the post tax returns would have been 5.6%. Long term capital gains is tax free for equity and therefore, systematic investing in the Sensex, over this period would have comfortably, post tax risk free returns How did gold, as an asset class, do during this period (2008 to 2016)? Gold, as an asset class, gave 2.9% returns from 2008 to 2016, even lower than fixed income.

What about real estate? Real estate, actually, enjoyed a good run for a few years even after the financial crisis of 2008, but the prices have been stagnating or even declining in many cities since 2013. As per National Housing Board and data from other sources, residential property prices in Mumbai have grown at a CAGR of just about 10% from 2008 to 2016. If you factor in interest costs (home loan), then return of real estate investment is lower than risk free return and real estate is second worst performing asset class after gold. In summary, we have seen that, systematic investing in equity in weak market conditions give good results.

Use market corrections to tactically add equities to your asset allocation

So far, we have discussed only systematic investing. While bear markets are usually shorter in length compared to bull markets, they are usually more volatile than bull markets. You can take advantage of big corrections in bear markets (and also bull markets) to tactically increase your asset allocation in equities by investing in lump sum. These tactical investments can give excellent returns in the long term. We all would like to invest at market bottoms, but the bottom is extremely difficult, if not impossible to catch. In the bear markets of 2008 or 2011, even if you invested 2 – 3 months before the market found its bottom, you could have got annualized returns of 15 – 18% on your investments, even after the market declined 15% from its highs in 2015.

Focus on quality

The legendary investor, Warren Buffet famously said that, “only when the tide goes out do you discover who has been swimming naked”. In a bull market, most investments go up and so you cannot see the problems in your portfolio. Difficult market conditions test the quality of your portfolio. It is therefore important to focus on quality, especially in bear markets. Quality investments eventually deliver outstanding returns in the long term. Identifying fundamentally strong stocks with good growth potential at attractive valuations, requires expertise and experience, which average retail investors do not possess. However, mutual fund managers possess the requisite skills and experience to select stocks that can outperform the market in the long term and create wealth for the investors.

For example, we saw that, systematic monthly investing in the Sensex from 2008 to 2016 would have yielded an annualized return of 9.4%. Monthly SIP in top performing diversified equity funds over the same period gave 18 – 24% annualized returns (please see Top Performing Systematic Investment Plan - Equity Funds Diversified in our MF Research Section). When selecting mutual funds, investors should remember that, there is a big performance differential between top performing funds and average or below average performers. Investors should not go by recent performance of a fund, but they should evaluate the long term performance of the mutual fund scheme and the fund manager, especially with respect to creating alphas. The fund manager is part of an organization and therefore, track record of the fund house is also something that, investors should consider.

We have observed that, many investors like to trade in stocks. In bull markets momentum stocks find favor with investors, who want to make short term trading profits. However, this can be very risky in the longer, especially with the onset of bear market. Investors who were active in stock markets before 2008 would recall that, high beta momentum stocks of a particular industrial group was very popular in the bull market years of 2005 to 2008. However, those stocks took a big beating in 2008 and even afterwards and many of those are still languishing. We would like to remind you again of what Warren Buffet said and unless you have the necessary expertise in share trading, it is much safer to stick to good quality mutual funds.

Conclusion

Bull and bear markets are part of economic cycles. One will inevitably follow the other. However, irrespective of what the market does, your financial goals do not change. Therefore, it is important that you stay disciplined through the course. At the cost of repetition, we would like stress again that, systematic investing is the best possible approach in bull and bear markets. However, savvy investors also take advantage of one time opportunities like big corrections to tactically increase their allocation in equities. Finally, for retail investors mutual funds are ideal options to invest in equities and get superior returns in the long term.

All the data/graph/information contained in this document is compiled from third party sources. Whilst Mirae Asset Global Investments (India) Private Limited has to the best of its endeavor ensured that such information is accurate, complete and up-to-date, and has taken care in accurately reproducing the information, it shall have no responsibility or liability whatsoever for the accuracy of such information or any use or reliance thereof. This document shall not be deemed to constitute any offer to sell the schemes of Mirae Asset Mutual Fund.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY

RECOMMENDED READS

Mirae Asset Global Investments is the leading independent asset management firm in Asia. With our unique culture of entrepreneurship, enthusiasm and innovation, we employ our expertise in emerging markets to provide exceptional investments opportunities for our clients.

Quick Links

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Fund Review - Mirae Asset Emerging Bluechip Fund : Best Midcap Mutual Fund in the last 6 years

- Fund Review - Mirae Asset India Opportunities Fund: One of the best SIP returns in last 8 years

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Our Articles

- Our Website

- Investor Centre

- Mirae Asset Knowledge Academy

- Knowledge Centre

- Investor Awarness Programs

Follow Mirae Assets MF

More About Mirae Assets MF

POST A QUERY