Bandhan Nifty Total Market Index Fund: Broadest equity exposure in mutual funds

Bandhan Mutual Fund has launched a passive fund, Bandhan Nifty Total Market Index Fund. Index funds are passive mutual fund schemes which track a market index. As the scheme name suggests, the fund will track the Nifty Total Market Index. The NFO has opened for subscription on 24th June 2024 and will close on 5th July 2024. In this article we will review the NFO.

The case for Indian equities

India currently enjoys a favourable economic position. The International Monetary Fund (IMF) predicts India’s GDP to grow by 6.8% in FY 2025, positioning it as the fastest-growing G-20 economy. Additionally, the IMF forecasts that India will become the third-largest economy by 2028. In terms of fiscal consolidation, India’s fiscal deficit is estimated to be 5.8% in FY 2023-24, with a projected reduction to 5.1% in FY 2024-25. The government aims to achieve the long-term target of a 4.5% fiscal deficit as a percentage of GDP by FY 2025-26.

Interest rates seem to have peaked, and the market anticipates that the US Federal Reserve may begin reducing interest rates later this year. Lower interest rates could stimulate demand and capital expenditure (capex), leading to increased revenues and earnings growth. Notably, corporate earnings have shown robust growth, with Nifty 50 earnings per share (EPS) rising by 22% in the past year (source: NSE, as of May 31, 2024). Although the market expects EPS growth to moderate in FY 2024-25, Nifty EPS is still projected to grow by 15% (source: Mint, March 2024), which indicates a healthy growth trajectory.

Broader market outperformance

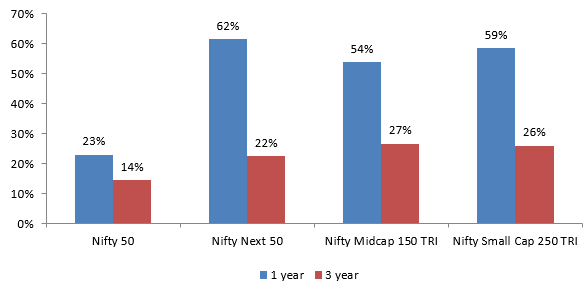

Most investors associate index funds with the Nifty 50 or Sensex. However, according to the historical data, the broader market has the potential outperformed the Nifty 50 (see the chart below). The broader market can provide you exposure to many more industry sectors and investment opportunities compared to the Top 30 or 50 stocks. Nifty Total Market index, which includes 750 stocks, covering all market cap segments, large cap, midcap, small cap, micro etc, can provide you the broadest exposure to equities.

Source: NSE, as on 31st May 2024. All indices are TRI. 3 year returns are in CAGR. Disclaimer: Past performance may or may not be sustained in the future

Characteristics of different market cap segments

- Large Cap: The top 100 stocks by market cap are classified as large cap. These companies are established conglomerates with large balance sheets and market share leadership. They provide stability and are usually pay dividends to shareholders / investors

- Midcap: 101st to 250th stocks by market cap are classified as midcaps. These companies have growing businesses. They have the potential of expanding their product range and market shares in new geographies. Companies that are midcap today have the potential of becoming large cap in the future

- Small Cap: 251st to 500th stocks by market cap are classified as small cap stocks. These are usually young companies with high growth potential. Companies in this stage are usually scaling up their business, which can result in significantly higher revenue and earnings growth over long investment horizons compared to large cap and midcap stocks. Companies that are small cap today have the potential of becoming midcaps in the future

- Micro Cap: 501st to 750th stocks by market cap are classified as micro cap stocks. These companies are often suppliers are to large companies and can benefit from the growth of the industry sector, as well as growth in the overall economy.

About Nifty Total Market Index

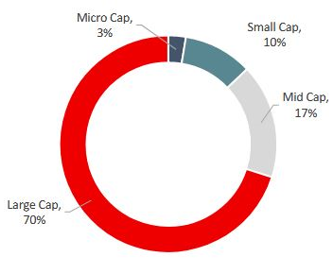

Nifty Total Market Index includes the top 750 stocks by market capitalization listed on the National Stock Exchange. Nifty Total Market Index covers 95% of the market cap of the entire listed universe in NSE.

Source: NSE, as on 31st May 2024, Market cap classification of NSE stocks as on 31st January 2024

Why invest in Bandhan Nifty Total Market Index Fund?

- Globally, Total Market Funds are popular. The 4 largest ETFs in the world track total market indices. The top 3 ETFs track S&P 500 which covers 80% of the US equity market, while the 4th largest ETF tracks total market index covering 98% of the US equity market.

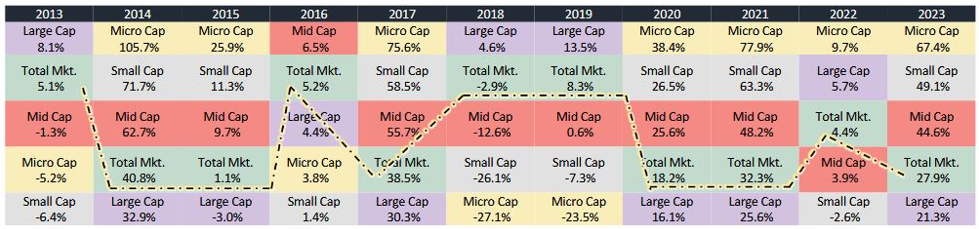

- Winners rotate across different market cap segments in different market conditions (see the chart below). This highlights the fluctuating nature of the market. The Nifty Total Market Index covers all segments, mitigating the risk of being the worst performer

Source: NSE, as on 31st December 2023. Disclaimer: Past performance may or may not be sustained in the future

- Nifty Total Market Index covers 95% of the listed universe, whereas the most popular index i.e. Nifty 50 covers only 48% of the listed universe.

- Nifty Total Market Index provides much wider industry coverage. It covers 22 industry sectors, out which only 13 sectors are represented in Nifty 50.

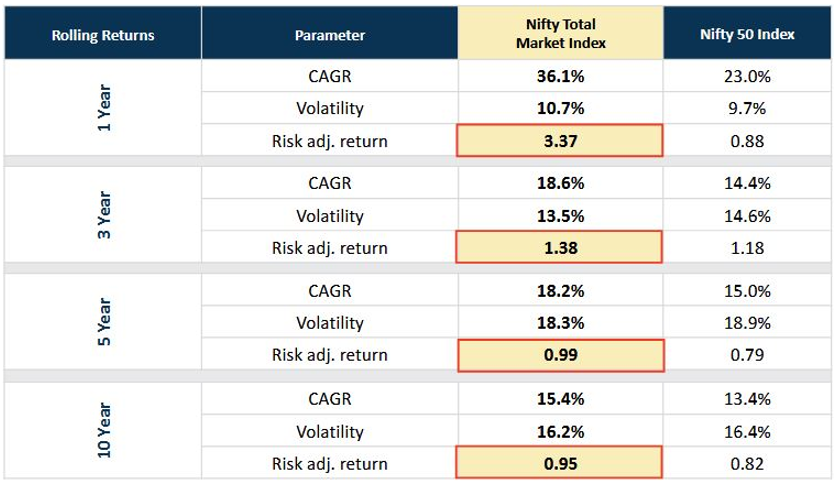

- Nifty Total Market Index has the potential of giving superior risk adjusted returns compared to Nifty 50 (see the table below). You can see that the Total Market Index outperformed Nifty 50 across different time periods, but the volatility of the Total Market Index was similar or even lower (over long investment tenures) compared to Nifty 50.

Source: Bandhan MF, NSE, From 1st April 2005 on 31st May 2024. Disclaimer: Past performance may or may not be sustained in the future

- Index funds have significantly lower Total Expense Ratios (TERs) compared to actively managed funds.

- Index funds have no fund manager bias. They are simple and convenient investment options.

- Bandhan Nifty Total Market Index Fund offers the convenience and flexibility of mutual funds. Demat account is not mandatory for investing in this fund. If you need liquidity for any reason, you can redeem units of your scheme at any time, subject to exit load structure.

- You can invest from your regular through Systematic Investment Plan (SIP) according to your investment needs.

Who should invest in Bandhan Nifty Total Market Index Fund?

- Investors looking for capital appreciation over long investment horizon

- Investors with high risk appetites

- Investors with minimum 3 – 5 years investment tenures

- This fund is suitable for both first time and seasoned investors

- You can invest in this fund either in lump sum or SIP depending on your investment needs and financial situation

Investors should consult their financial advisors or mutual fund distributors if Bandhan Nifty Total Market Index Fund is suitable for their investment needs.

Disclaimer:

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of Bandhan Mutual Fund (formerly known as IDFC Mutual Fund). The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme’s portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither Bandhan Mutual Fund (formerly known as IDFC Mutual Fund)/ Bandhan Mutual Fund Trustee Limited (formerly IDFC AMC Trustee Company Limited) / Bandhan AMC Limited (formerly IDFC Asset Management Company Limited), its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

Bandhan AMC Limited (formerly IDFC Asset Management Company Limited), established in 2000, is one of India's Top 10 fund houses in terms of Asset Under Management. It has an experienced investment team with an on-the-ground presence in over 60 cities. Bandhan Mutual Fund is focused on helping savers become investors and create wealth. To support this objective, the fund house's equity and fixed-income offerings aim to provide performance consistent with their well-defined objectives. It is having its Registered Office at - Bandhan AMC Limited, One World Center, 6th floor, Jupiter Mills Compound,841, Senapati Bapat Marg, Elphinstone Road, Mumbai: 400 013

Investor Centre

Follow Bandan MF

More About Bandan MF

POST A QUERY