Bandhan Nifty Alpha Low Volatility 30 Index fund: A good mix of low volatility and high returns

Bandhan MF is launching a new passive fund, the Bandhan Nifty Alpha Low Volatility 30 Index Fund. The fund tracks the Nifty Alpha low volatility 30 Indexa multi-factor index designed to reflect the performance of a portfolio consisting of stocks selected for their strong Alpha and low volatility scores.The NFO has opened for subscription on 8th January 2025 and will close on 20th January 2025. In this article we will review this NFO.

What are Factor indices?

Factor indices are types of indices that select stocks based on certain specific criteria like Alpha, value, momentum, quality or low volatility. Picking stocks with specific factors can help investors build a portfolio that may produce relatively superior risk-adjusted returns compared to the market.The core idea behind factor investing is to know which specific factors, beyond the overall market make some investments do better or worse. Factor indices select stocks from an underlying broad market index e.g. Nifty 200, Nifty 100 etc, based on these factors.

The figure below illustrates the 5 most common styles of factor investing.

Source: Bandhan MF

Factor behaviour in different market cycles

Typically, the long-term potential of excess return of each factor is positive over the long term, but it may not be sustained in the short term. This is because factors move in and out of favour during different market cycles. The tendency of different factors in different market phases are typically seen to be as follows:

- Value: Tends to outperform in recovery phases

- Momentum: Tends to outperform in bull markets.

- Low Volatility/Quality: Tends to perform relatively well in bear markets and demonstrates a counter-cyclical behaviour.

The varying behaviour of factors in different market situations make factors cyclical in nature which may lead to underperformance in certain circumstances. Multi-factor investing helps address the challenges of factor cyclicality.

What is Multi Factor Investing?

Multi factor investment strategy involves investment into factors like Momentum/Alpha, Value, Quality, Low Volatility etc by blending the factors that perform differently in different market scenarios. The aim of such a strategy is to enhance the overall portfolio stability by reducingconcentration risk. Multi factor investing allows to create customized portfolios based on investors’ goals and risk profiles, and can potentially offer higher risk adjusted returns.

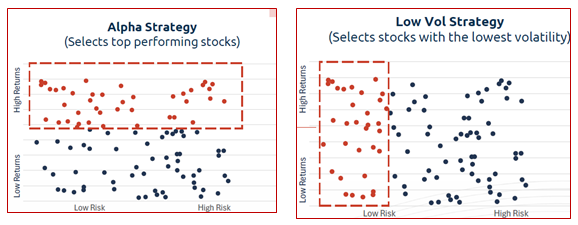

Given below are two approaches to Multi Factor Investing using Alpha and low volatility factors:- The Top down and the Bottom-up approach.

Top-down approach: In this approach, the allocation is 50% each to Alpha and Low Volatility strategy to build a multi-factor portfolio.The scatterplot dots represent stocks across two dimensions: return and risk

Source: Bandhan MF

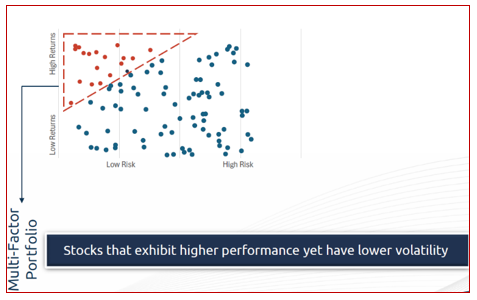

Bottom-upapproach: In this approach we see see a selection of stocks that exhibit high performance (Alpha) and at the same time have Lower VolatilityThe scatterplot dots represent stocks across two dimensions: return and risk.

Source: Bandhan MF

How is the Nifty Alpha Low Volatility 30 Index constructed?

The Nifty Alpha Low Volatility 30 Index is a multi-factor index that takes a bottom-up (integrated) approach.The index consists of 30 stocks selected from Nifty 100 and Nifty Midcap 50 and is designed to reflect the performance of a portfolio of stocks selected based on top combination of Alpha and Low Volatility.It intends to counter the cyclicality of single factor index strategy and provides investors a choice to take exposure to multiple factors through a single index product.

Here, Alpha refers to the potential of stocks to drive excess returns and outperform the broad market indices in up markets. Low Volatility refers to the potential of the stocks to outperform in downcycles.

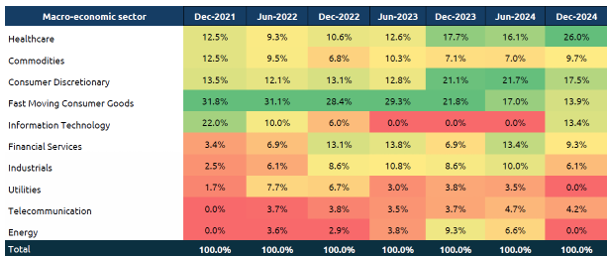

Dynamic Sector Allocation

The table below show the sector allocation in the Nifty Alpha low volatility 30 Index in semi-annual periods since 2021. As you can see that the index offers appropriate diversification across sectorsand circulates the allocation according to changing market dynamicsto create alphas while limiting downsides. FMCGs and Consumer discretionary sectors have been allocated a larger percentage consistently.However, when these sectors underperform and fail to generate alpha, it reduces exposure to them.

Source: Bandhan MF, NSE as on 31st December 2024

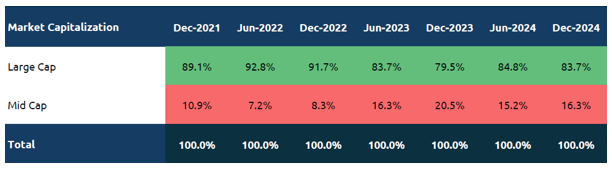

Market Cap Allocation

The table below shows the market cap allocations of Nifty Alpha low volatility 30 Index in different semi-annual periods over the past 5 years. Large Cap allocations ranged from79.5% to 92.8% in this period.

Source: Bandhan MF, NSE as on 31st December 2024

How has Nifty Alpha Low Volatility 30 Index performed versus broad market indices across different market conditions?

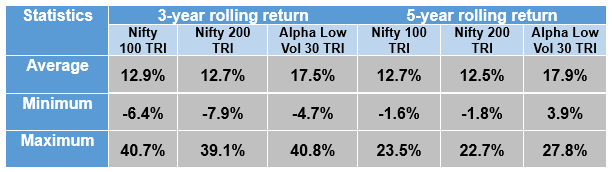

The Nifty Alpha Low Volatility 30TRI has outperformed broader market indices across different market conditions with reasonable downside protection, over sufficiently long investment tenures.

Source: NSE, Bandhan MF, as on 31st December 2024

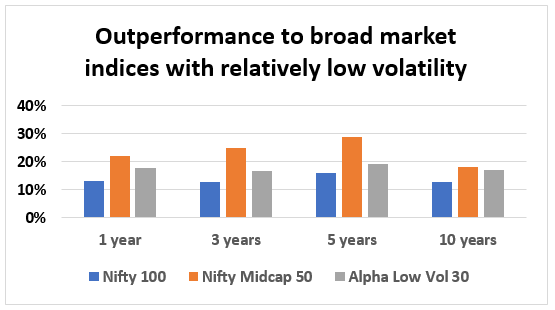

Outperformance to broad market indices with relatively low volatility

Source: Bandhan MF, NSE as on 31st December 2024

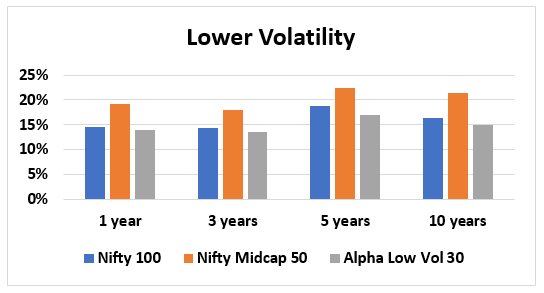

Lower Volatility

Source: Bandhan MF, NSE as on 31st December 2024

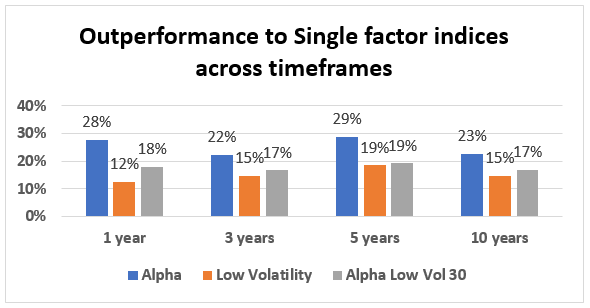

Outperformance to Single factor indices across timeframes

Source: Bandhan MF, NSE as on 31st December 2024

Why should you invest in Bandhan Nifty Alpha low volatility 30 Index Fund

- Steady growth: The combination of Alpha and low volatility potentially offers consistent returns with relatively reduced downside risks.

- Evidence based investing: The rule-based investment approach minimizes human bias and provides a scientific investment framework.

- Diversification: Broad exposure across sectors and market caps offers diversification by reducing concentration risks.

Who should invest in Bandhan Nifty Alpha low volatility 30 Index Fund

The fund is suitable for:

- High risk appetite: The fund is suitable to investors who are looking for investments with an exposure to equity growth coupled with limited downside.

- Diversification: The fund is suitable for investors who are looking to invest in high-risk equity with multi factor strategy.

- Long-term investment horizon: The fund is suited to investors with investment tenures of at least 5 years.

Consult your financial advisor or mutual fund distributor to find out if the Bandhan Nifty Alpha low volatility 30 Index Fund is suitable for their investment needs.

Disclaimer: For expenses, exit load and other scheme related information, read the Scheme Information Document and Key Information Memorandum carefully. Consult with your financial advisor before investing.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Bandhan AMC Limited (formerly IDFC Asset Management Company Limited), established in 2000, is one of India's Top 10 fund houses in terms of Asset Under Management. It has an experienced investment team with an on-the-ground presence in over 60 cities. Bandhan Mutual Fund is focused on helping savers become investors and create wealth. To support this objective, the fund house's equity and fixed-income offerings aim to provide performance consistent with their well-defined objectives. It is having its Registered Office at - Bandhan AMC Limited, One World Center, 6th floor, Jupiter Mills Compound,841, Senapati Bapat Marg, Elphinstone Road, Mumbai: 400 013

Investor Centre

Follow Bandan MF

More About Bandan MF

POST A QUERY