Bandhan Nifty 200 Quality 30 Index Fund: Promising investment option in current market conditions

Current Market Context

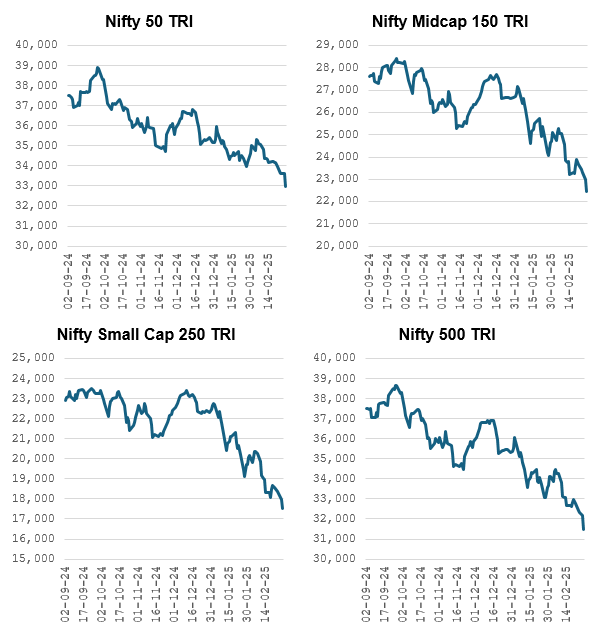

Volatility in the market intensified in the first two months of CY 2025. Concerns about the economic impact of the Trump Administration’s trade policies have roiled the US stock market and global risk-off sentiments. FII sell-off continued in January – February with net sales of Rs 1.12 lakhs in equity (source: NSDL, as of 28th February 2025), and the Nifty 50 closed February 15% down from its all-time high. The broader market has seen deeper cuts in the last months, with small caps correcting by more than 20% (see the graphic below).

Source: NSE. Period: 1st September 2024 to 28th February 2025

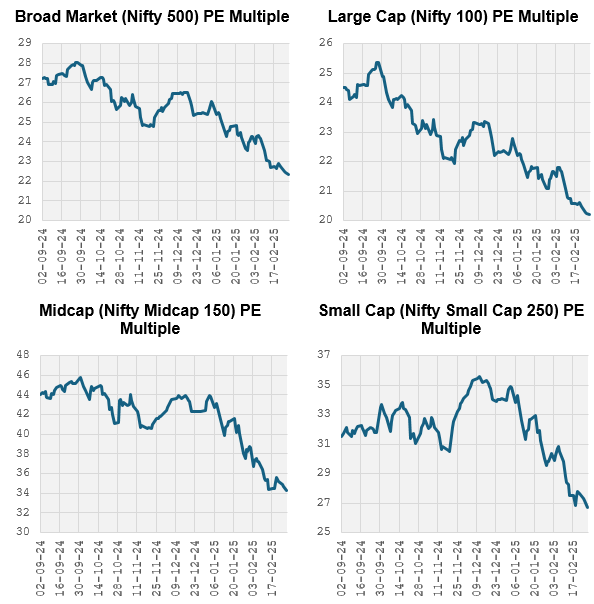

The market breadth was weak. The biggest risk factor for global and Indian equities in current market conditions is that uncertainty caused by Trump’s policies is sparking recession fears. In the current market conditions, with valuations having moderated in all market cap segments, quality stocks can prove to be winners over long investment horizons. Bandhan Nifty 200 Quality 30 Index Fund, which was launched in November 2024, can provide you low-cost exposure to high-quality large and midcap stocks.

Source: NSE. Period: 1st September 2024 to 28th February 2025

What is "Quality" investing?

Quality investing targets companies with strong profitability, stable earnings, and low debt. It aims to capture the premium associated with high-quality stocks. Historical evidence suggests that financially strong companies exhibit superior returns with lower risk.

Why Quality Factor investing works?

Investors tend to reward short-term performance, often overlooking high-quality companies with consistent long-term results, which may lead to their undervaluation. Behavioural factors like herd mentality usually make investors pursue lesser-known opportunities, which become overpriced compared to stable, high-quality firms. In the long-term value discovery process across investment cycles, valuations get re-rated. As a result, high-quality companies tend to outperform in the long term.

How is the Nifty 200 Quality 30 Index constructed?

The top 30 companies from the Nifty 200 universe (200 largest companies by market capitalization trading in NSE) with the highest Quality score based on ROE, D/E Ratio and EPS growth variability analysed during the previous 5 years are selected to be part of the Nifty 200 Quality 30 Index. The index is rebalanced semi-annually.

How are quality stocks filtered?

- Return on Equity (ROE): ROE is an indicator of how efficiently the company is using shareholder’s equity to generate profits. A high ROE indicates that a company utilizes its capital effectively to generate profits, demonstrating operational efficiency.

- Debt to equity ratio (D/E ratio): Debt-to-equity ratio helps to assess a company’s financial leverage; a lower D/E shows prudent risk management. D/E ratio is an indicator of a company’s balance sheet strength. Companies with stronger balance sheets are better equipped to withstand economic downturns.

- EPS growth variability: Quality factor chooses companies with consistent growth in EPS, reflecting healthy earning quality. Companies with consistent financial results are less likely to see extreme price swings, providing steadier returns.

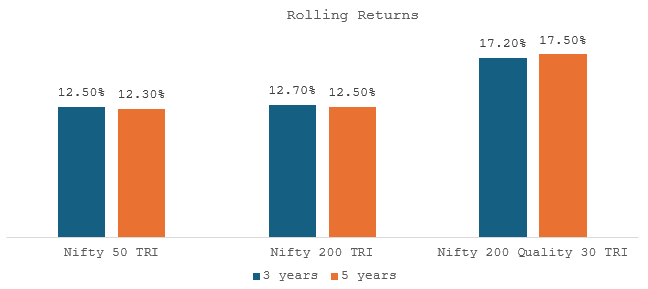

The Quality index has outperformed broad market indices across different market conditions and investment tenures

Source: Bandhan MF, as on 31st January 2025

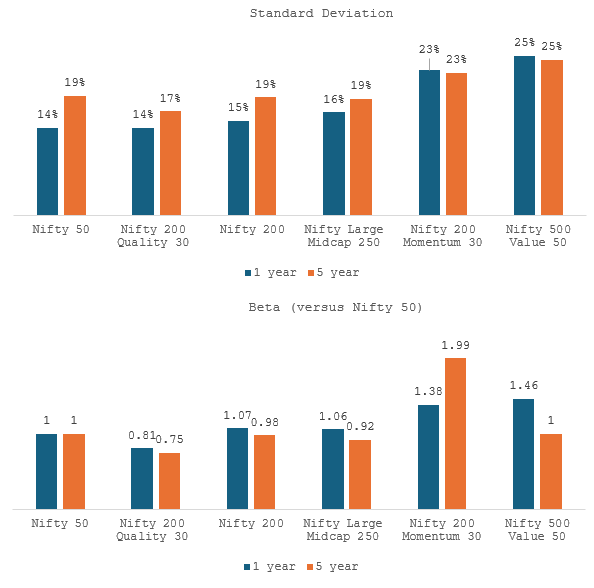

Quality index is less volatile compared to broad market and other factor indices

Source: NSE, as of 28th February 2025

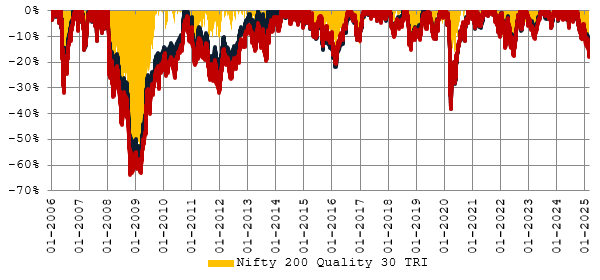

Smaller drawdowns in deep market corrections

The chart below shows the drawdowns of the quality index (Nifty 200 Quality 30 TRI) versus the broad market indices, Nifty 50 TRI, and Nifty 200 TRI from 2006. Nifty 200 Quality 30 Index experienced smaller drawdowns compared to the broad market indices.

Source: NSE, as of 28th February 2025

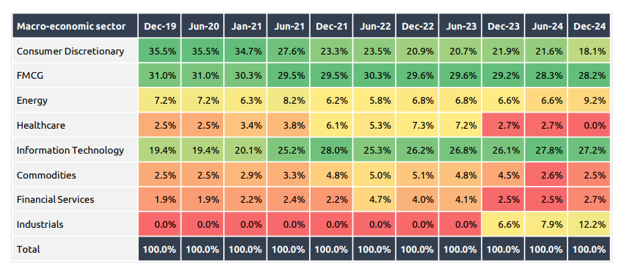

Higher tilt towards defensive sectors

The Quality Factor demonstrates strong leadership within specific sectors like Consumer Discretionary, FMCG & IT (see the graphic below)

Source: Bandhan MF, as of 28th February 2025

Who should invest in Bandhan Nifty 200 Quality 30 Index Fund?

- Investors with long investment horizons seeking relative stability

- Investors with a minimum 3 - 5 years investment tenure

- Investors seeking to add a defensive strategy to their existing portfolio and willing to add potential stability to their portfolio.

In conclusion, why invest in Bandhan Nifty 200 Quality 30 Index Fund?

- Proven Outperformance over Broader Indices

- Lower volatility, higher stability

- Relatively Efficient (higher ROCE), Prudent (lower D/E) and Consistent

- Potential superior risk adjusted returns

- Low costs

- Flexibility of investing through SIP

Investors should consult their financial advisors or mutual fund distributors if Bandhan Nifty 200 Quality 30 Index Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Bandhan AMC Limited (formerly IDFC Asset Management Company Limited), established in 2000, is one of India's Top 10 fund houses in terms of Asset Under Management. It has an experienced investment team with an on-the-ground presence in over 60 cities. Bandhan Mutual Fund is focused on helping savers become investors and create wealth. To support this objective, the fund house's equity and fixed-income offerings aim to provide performance consistent with their well-defined objectives. It is having its Registered Office at - Bandhan AMC Limited, One World Center, 6th floor, Jupiter Mills Compound,841, Senapati Bapat Marg, Elphinstone Road, Mumbai: 400 013

Investor Centre

Follow Bandan MF

More About Bandan MF

POST A QUERY