Bandhan Nifty 200 Quality 30 Index Fund: Passive investment in high quality stocks

Bandhan MF is launching a new passive fund, the Bandhan Nifty 200 Quality 30 Index Fund. As the scheme name suggests, the fund will track the Nifty 200 Quality 30 Index. Nifty 200 Quality 30 Index is a factor index, which selects stocks based on some characteristics. Passive funds tracking factor indices are increasingly becoming popular with investors since these funds have the potential of outperforming the broad market indices. The NFO will open for subscription on 18th November and will close on 29th November. In this article we will review Bandhan Nifty 200 Quality 30 Index Fund NFO.

What are factor indices?

Factors are characteristics that can explain or predict a stock’s behaviour in the market. The core idea behind factor investing is to know which specific factors, beyond the overall market make some investments do better or worse. Factor indices are constructed based on quantitative, rule-based investment strategies based on factors that have historically driven a portfolio's returns and risk. Some of the popular factors are Momentum, Volatility, Beta, Alpha, Dividend Yield, Value, and Quality. Factor indices select stocks from an underlying broad market index e.g. Nifty 200, Nifty 500 etc, based on these factors.

How do factors drive investment returns?

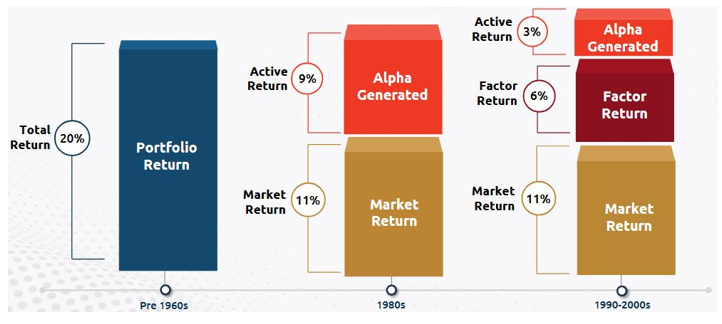

Factor-based index funds are relatively new in India, but active fund managers have been utilizing these factors in their strategies for many years. The infographic illustrates the evolution of portfolio return attribution from the 1960s to the 2000s and emphasizes the growing recognition that specific factors significantly influence investment performance.

Source: Bandhan MF

What is “Quality” investing?

Quality investing targets companies with strong profitability, stable earnings, and low debt. It aims to capture the premium associated with high-quality stocks. Historical evidence suggests that financially strong companies exhibit superior returns with lower risk.

Why Quality Factor investing works?

Investors tend to reward short-term performance, often overlooking high-quality companies with consistent long-term results, which may lead to their undervaluation. Behavioural factors like herd mentality usually make investors chase pursue lesser-known opportunities, which become overpriced compared to stable, high-quality firms. In the long term value discovery process across investment cycles, valuations get re-rated. As a result, high-quality companies tend to outperform in the long run.

How is Nifty 200 Quality 30 Index constructed?

Top 30 companies from Nifty 200 universe (200 largest companies by market capitalization trading in NSE) with highest Qualityscore based on ROE, D/E Ratio and EPS growth variability analysed during the previous 5 years are selected to be part of the Nifty 200 Quality 30 Index. The index is rebalanced semi annually.

How quality stocks are filtered? How does it work?

- Return on Equity (ROE): ROE is an indicator of how efficiently the company is using shareholder’s equity to generate profits. A high ROE indicates that a company utilizes its capital effectively to generate profits, demonstrating operational efficiency.

- Debt to equity ratio (D/E ratio): Debt-to-equity ratio helpsassess a company’s financial leverage, a lowerD/E shows prudent riskmanagement. D/E ratio is an indicator of a company’s balance sheet strength. Companies with stronger balance sheets are better equipped to withstand economic downturns.

- EPS growth variability: Quality factor choosescompanies with consistentgrowth in EPS reflectinghealthy earning quality. Companies with consistent financial results are less likely to see extreme price swings, providing steadier returns.

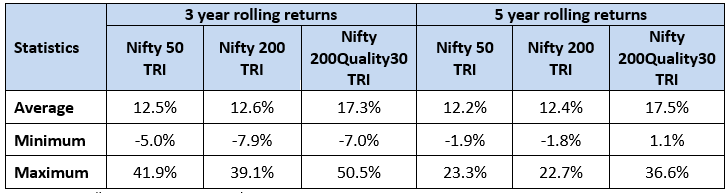

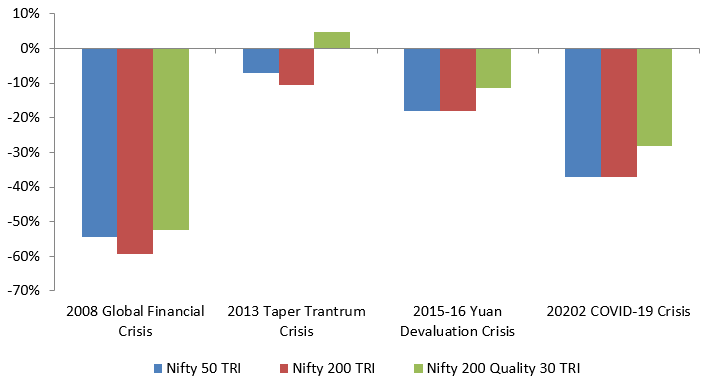

How has Nifty 200 Quality 30 Index performed versus broad market indices across different market conditions?

The Nifty 200 Quality 30 TRI has outperformed broader market indices across different market conditions over sufficiently long investment tenures.

Source: NSE, Bandhan MF, as on 31st October 2024

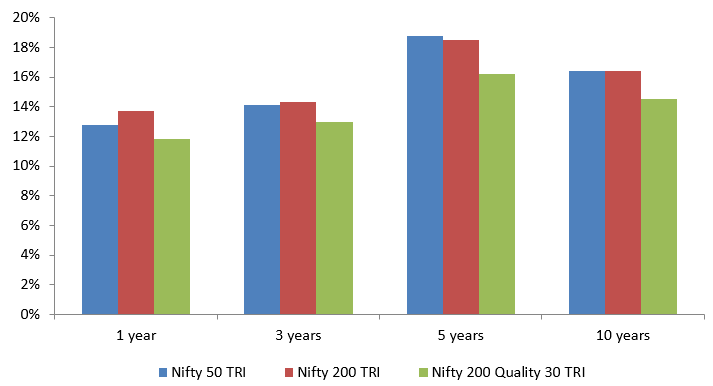

Lower volatility

Source: NSE, Bandhan MF, as on 31st October 2024

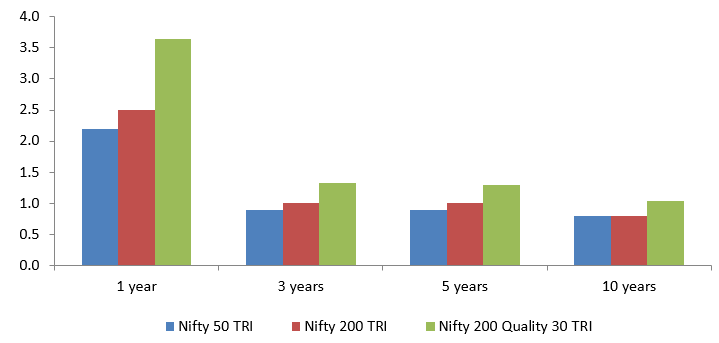

Superior risk adjusted returns

Source: NSE, Bandhan MF, as on 31st October 2024

Smaller drawdowns in deep market corrections

Source: NSE, Bandhan MF

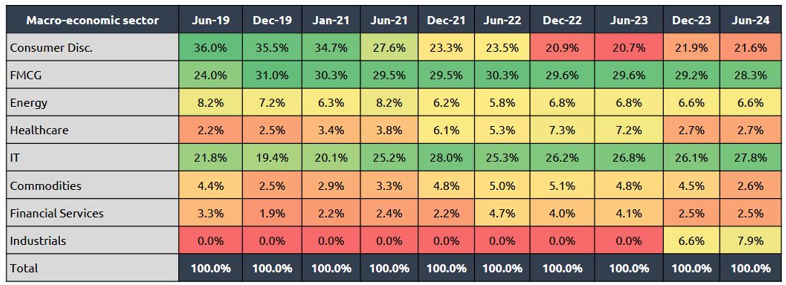

Sector allocation in Quality Index

The table below shows the sector composition of the Nifty 200 Quality 30 Index in different semi-annual periods over the past 5 years. The Quality Factor is more concentrated in certain sectors consistently. Consumer Discretionary, FMCG and IToccupy the top spot.

Source: NSE, Bandhan MF, as on 30th June 2024

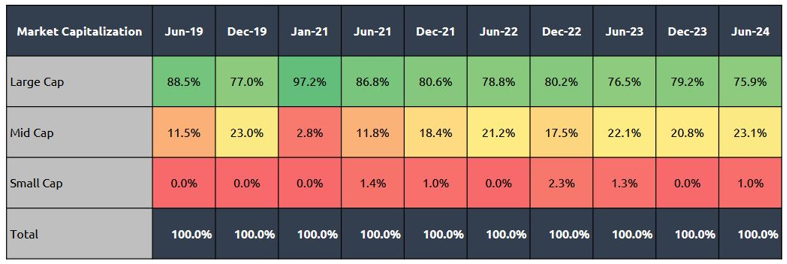

Quality in market cap segments

The table below shows the market cap allocations of Nifty 200 Quality 30 Index in different semi-annual periods over the past 5 years. Large cap allocation ranged from 75.9% to 97.2%, midcap from 11.5% to 23.1% and small cap from 0% to 2.3%.

Source: NSE, Bandhan MF, as on 30th June 2024

Who should invest in Bandhan Nifty 200 Quality 30 Index Fund?

- Risk-averse investors

- Long-term investors (minimum 3 - 5 years investment tenure) looking for stable earnings and sustainable growth)

- Investors seeking to add defensive strategy to their existing portfolio and willing to add potential stability to their portfolio.

Investors should consult their financial advisors or mutual fund distributors if Bandhan Nifty 200 Quality 30 Index Fund is suitable for your investment needs.

Disclaimer:

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of Bandhan Mutual Fund (formerly known as IDFC Mutual Fund). The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme’s portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither Bandhan Mutual Fund (formerly known as IDFC Mutual Fund)/ Bandhan Mutual Fund Trustee Limited (formerly IDFC AMC Trustee Company Limited) / Bandhan AMC Limited (formerly IDFC Asset Management Company Limited), its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

Bandhan AMC Limited (formerly IDFC Asset Management Company Limited), established in 2000, is one of India's Top 10 fund houses in terms of Asset Under Management. It has an experienced investment team with an on-the-ground presence in over 60 cities. Bandhan Mutual Fund is focused on helping savers become investors and create wealth. To support this objective, the fund house's equity and fixed-income offerings aim to provide performance consistent with their well-defined objectives. It is having its Registered Office at - Bandhan AMC Limited, One World Center, 6th floor, Jupiter Mills Compound,841, Senapati Bapat Marg, Elphinstone Road, Mumbai: 400 013

Investor Centre

Follow Bandan MF

More About Bandan MF

POST A QUERY