Bandhan Multi Asset Allocation Fund: Off to a strong start

Current market situation

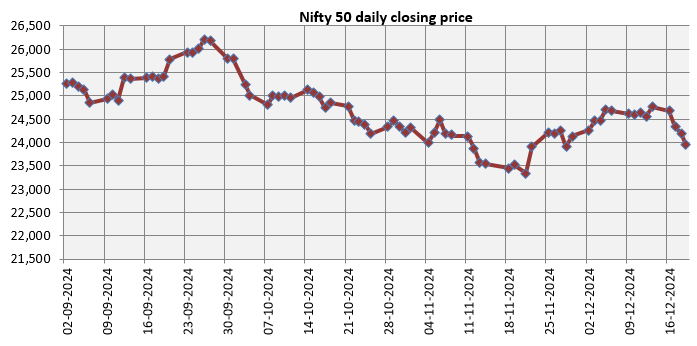

The market has been volatile for the last few months (see the chart below). The Nifty bounced back from 23,500 but has slipped below the psychologically important 24,000 level after the US Federal Reserve indicated fewer rate cuts in 2025. There are several headwinds for the Indian equities namely cut in FY 2025 GDP growth forecast by the RBI, concerns about corporate earnings outlook, uncertainty about rate cuts, strong US Dollar and FII selling. In this situation, a multi asset allocation strategy can provide stability to your portfolio. From a long term perspective, multi asset allocation strategy can provide richer asset class diversification to your portfolio and balance risk / returns across investment cycles.

Source: NSE, Period 01.09.2024 to 19.12.2024

How does multi-asset allocation work?

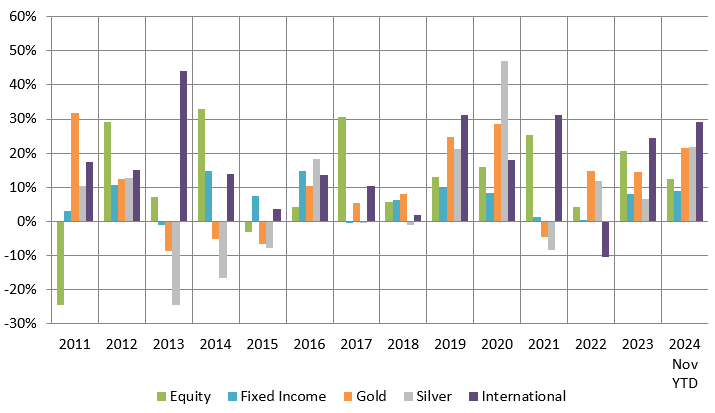

Different asset classes perform different roles in your portfolio e.g. equity provides capital appreciation, debt provides portfolio stability, gold provides inflation protection etc. Different asset classes outperform / underperform each other in different market / economic conditions (see the chart below). You can see that debt is much more stable than equity. Gold and equity are usually counter-cyclical to each other i.e. gold outperforms when equity underperforms and vice versa. There is also low correlation of domestic equities and international equities returns. Combining these asset classes may lead to relatively stable portfolio returns.

Source: National Stock Exchange, MCX, Advisorkhoj Research, as on 30th November 2024. Nifty 50 TRI is used as a proxy for equity as an asset class, Nifty 10 year benchmark G-Sec Index is used as proxy for debt as an asset class, spot price of Gold and Silver (in MCX) is used as proxy for Gold and silver respectively and S&P 500 (in INR) is used as a proxy for international equities. Disclaimer: Past performance may or may not be sustained in the future.

What is Multi Asset Allocation Fund?

Multi Asset Allocation funds are hybrid mutual fund schemes which invest in 3 or more asset classes. According to SEBI regulations, multi-asset allocation funds must invest a minimum of 10% each in at least 3 asset classes. Apart from the two most popular asset classes, debt and equity, these schemes invest in asset classes like commodities (e.g. gold, silver), international equities, real estate investment trusts (REIT), infrastructure investment trusts (InvITs) etc. The fund manager decides the proportional allocation to each asset class based on the market conditions with the objective of balancing risks and returns.

About Bandhan Multi Asset Allocation

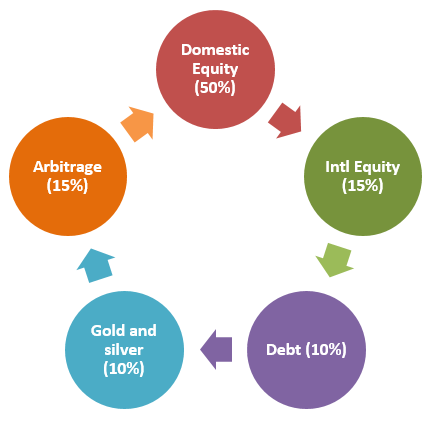

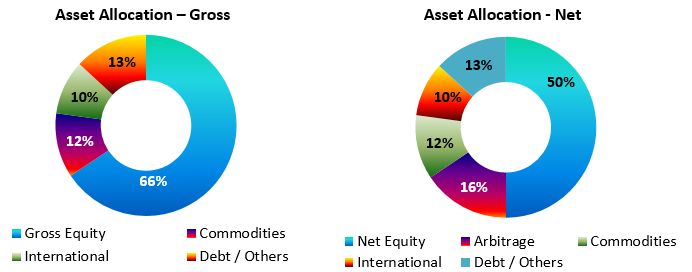

The fund was launched earlier this year. Bandhan Multi Asset Allocation Fund will invest in domestic equities, international equities, fixed income / debt, commodities (gold and silver) and arbitrage (see the graphic below). The asset allocation of the scheme will ensure equity taxation.

Equity portion

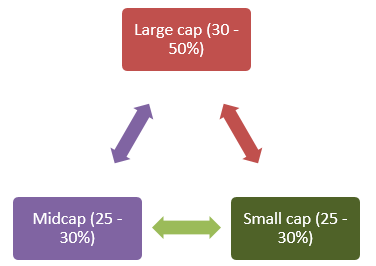

The equity portion of the portfolio is actively managed using the 3D investment framework:-

- Diversity: Diversification across market cap segments and industry sectors

- Discipline: Limits for Mid and Small cap allocation, rebalanced quarterly

- Dependability: Performance track record, quality management and strong balance sheet

Debt portion

- Active duration management depending on interest rate outlook. In the current interest rate environment, the inclination is to build a high duration debt portfolio

- Allocation across Government Bonds, SDL, Corporate Bonds, and Money Market instruments. Preference for high credit quality in debt portfolio

Commodities portion

The fund invests in gold and silver ETFs – passively managed commodities portfolio

International equities portion

- The fund invests in international / overseas ETFs – passively managed international portfolio

- Aims to cover the US, Developed markets ex US and Emerging Markets

Bandhan Multi Asset Allocation Fund – Outperformed the broad market since inception

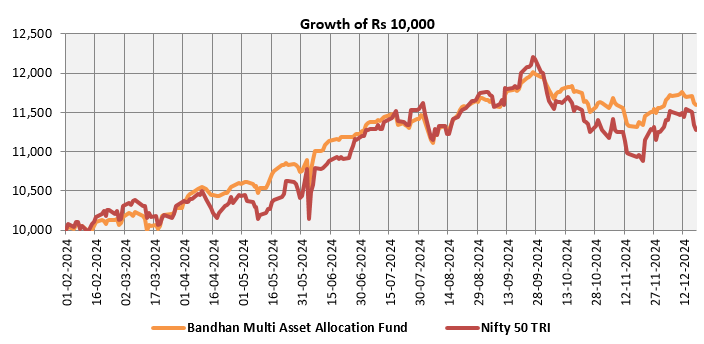

Though the fund has not yet completed one year, it has made a very strong start. The chart below shows the growth of Rs 10,000 investment in Bandhan Multi Asset Allocation Fund versus the broad market index (Nifty 50 TRI) since the inception of the scheme. You can see that fund has outperformed the Nifty.

Source: Advisorkhoj Research, as on 18.12.2024

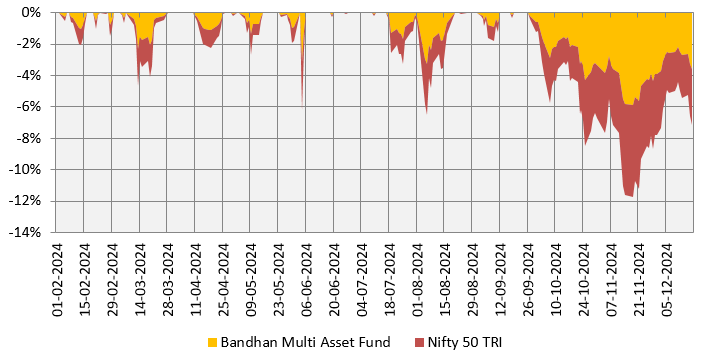

Bandhan Multi Asset Allocation Fund - Downside protection

The chart below shows the drawdowns of Bandhan Multi Asset Allocation Fund versus Nifty 50 TRI. You can see that the fund experienced significantly smaller drawdowns compared to Nifty. This can be attributed to the asset allocation strategy of the fund.

Source: Advisorkhoj Research, as on 18.12.2024

Current portfolio positioning

Source: Bandhan MF Factsheet, as on 30.11.2024

Why invest in Bandhan Multi Asset Allocation Fund?

- Disciplined investment approach with no personal biases can bring consistency in performance over sufficiently long investment horizons

- Diversification across 5 asset classes, with different risk / return profiles

- Potential of generating superior risk adjusted returns

- Benefits of equity taxation

Who should invest in Bandhan Multi Asset Allocation Fund?

- Investors looking for a long-term strategic allocation to different asset classes

- Investors looking for relatively stable returns with low downside risks

- Investors with high to very high risk appetites

- Investors with long investment tenures. We recommend minimum 3 years investment tenures for this scheme.

- Investors should consult with their financial advisors or mutual fund distributors if Bandhan Multi Asset Allocation Fund is suitable for their investment needs.

Disclaimer:

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of Bandhan Mutual Fund (formerly known as IDFC Mutual Fund). The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme’s portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither Bandhan Mutual Fund (formerly known as IDFC Mutual Fund)/ Bandhan Mutual Fund Trustee Limited (formerly IDFC AMC Trustee Company Limited) / Bandhan AMC Limited (formerly IDFC Asset Management Company Limited), its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

Bandhan AMC Limited (formerly IDFC Asset Management Company Limited), established in 2000, is one of India's Top 10 fund houses in terms of Asset Under Management. It has an experienced investment team with an on-the-ground presence in over 60 cities. Bandhan Mutual Fund is focused on helping savers become investors and create wealth. To support this objective, the fund house's equity and fixed-income offerings aim to provide performance consistent with their well-defined objectives. It is having its Registered Office at - Bandhan AMC Limited, One World Center, 6th floor, Jupiter Mills Compound,841, Senapati Bapat Marg, Elphinstone Road, Mumbai: 400 013

Investor Centre

Follow Bandan MF

More About Bandan MF

POST A QUERY