Bandhan Innovation Fund NFO: An increasingly attractive theme for long term investors

Bandhan Mutual Fund has launched a New Fund Offer, Bandhan Innovation Fund, an open ended thematic fund. The NFO opened for subscription on 10th April and closes on 24th April 2024. Mutual Fund industry veteran and Head of Equities at Bandhan AMC, Manish Gunwani will manage this scheme.

Innovation has shaped the progress of human civilization since the earliest days. From the discovery of fire to the invention of wheels, the use of metals, the industrial revolution and computers, innovation has been the bedrock of technological advancement. Today’s competitive landscape heavily relies on innovation. Businesses that make innovation an integral part of their business processes, can improve their market share, increase their productivity, revenues and profits.

Innovation and wealth creation

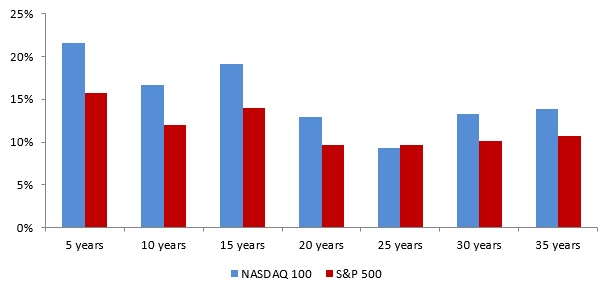

Historical returns data provides sufficient evidence that innovative companies gave significantly higher than average returns compared to the broad market. The chart below shows the returns of the NASDAQ 100 (comprising of companies that are focused not only on technology but also other sectors having an innovation factor present within) versus the S&P 500 (the broad market index in the US). You can see that the NASDAQ-100 outperformed the S&P 500 by large margins across different time-scales.

Source: NASDAQ, S&P, as on 31st December 2023.

Innovation is a diversified investment theme

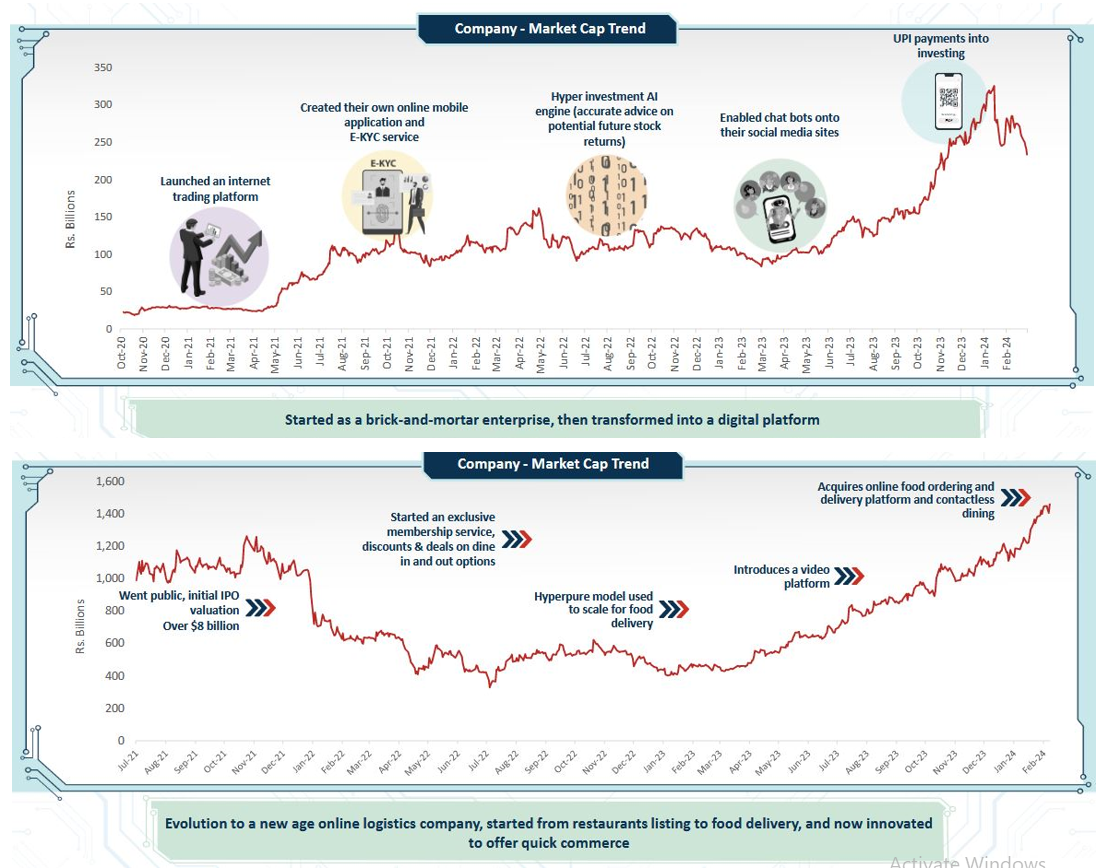

Many investors only associate technology with innovation. However, if you look at the sector composition of NASDAQ, you will see that innovators were spread across different sectors like tech, consumer discretionary, healthcare, telecom, industrials, consumer staples etc. Companies in India, across different industry sectors, have benefitted from innovations. Here are some examples of innovators in our market across diverse industry sectors.

Source: Bandhan MF. Aforesaid mentioned examples are meant for illustration purposes only, and these may or may not form part of the portfolio.

Indian market is ripe to capitalize on innovation theme

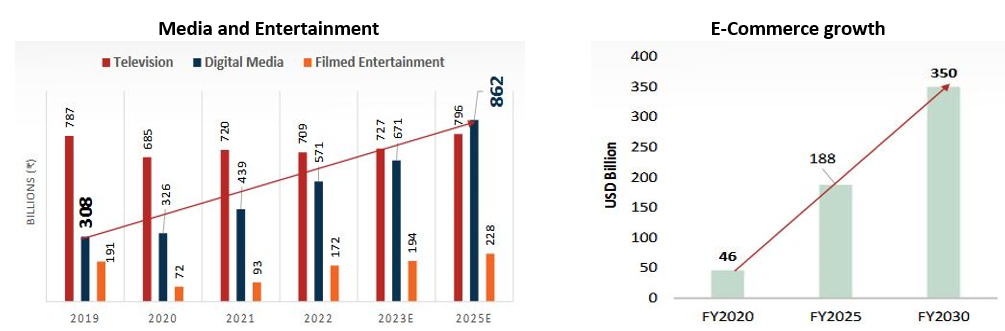

Source: EY, (Investor relation letter) Subscription service platforms, Bandhan MF. Past performance may or may not be sustained in the future.

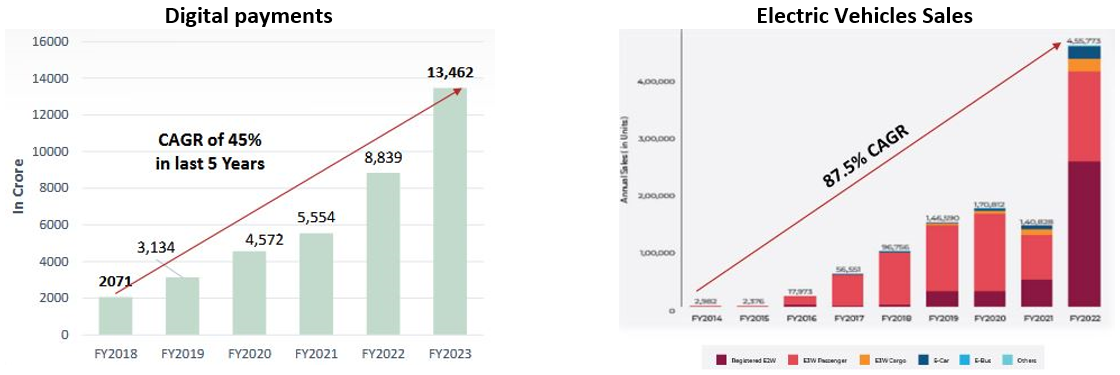

Source: IBEF, RBI, Bandhan MF. Past performance may or may not be sustained in the future.

Government support for innovation

- 10,000 Atal Tinkering Labs (ATL). 1.1 crores+ students actively engaged in ATLs.

- 72 Atal Incubation Centres. 32,000 jobs created

- 3,500+ startups supported. 1,000+ women led startups

- 6,200+ mentors of change

- 14 Atal Community Innovation Centres

- 24 Atal New India challenges

- 40+ domestic and international partnerships

Source: https://aim.gov.in/.

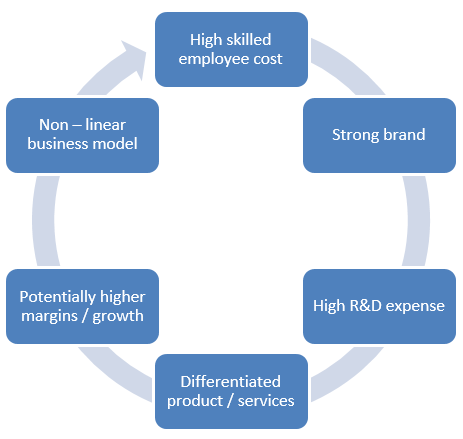

Characteristics of innovative companies

Bandhan Innovation Fund will look for companies with the following characteristics

These companies usually have higher Price-to-Book ratios since there is a higher weight ascribed to intangible assets versus physical assets.

Salient features of the Bandhan Innovation Fund

- Focused approach - A thematic portfolio investing in companies with strong innovationcharacteristics/ frameworks

- Uniqueness - Focus on innovation across market cap segments and investment themes / sectors such as auto, internet-based companies, Fintech etc.

- Long term perspective - Aligned with the growth trajectory of innovation focused companies

- High active share - Aggressive portfolio with significantly high active share.

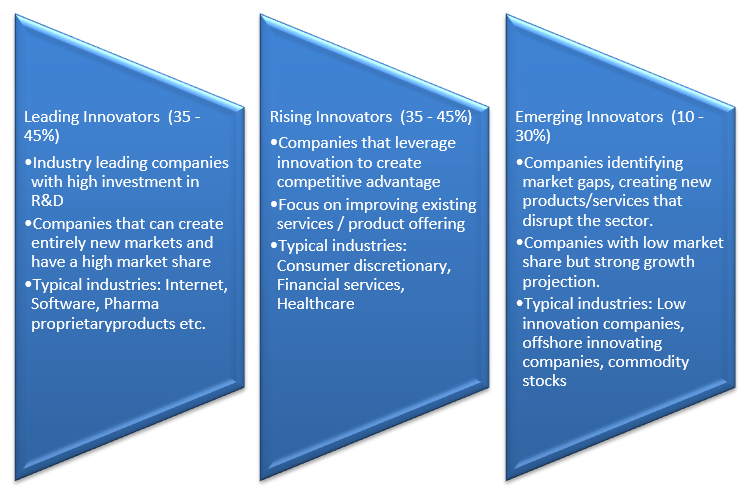

Portfolio construction strategy

Broad allocation approach, which would depend on the portfolio manager approach/ thesis.

Why invest in the Bandhan Innovation Fund?

- Innovation helps the company to survive in a competitive landscape, optimize productivity and efficiency as well as potentially increase revenue/profit margin.

- Innovation is happening across sectors such as Finance, Auto, Technology, Healthcare, Entertainment and Retail, etc.

- Structural initiatives (e.g., Atal Innovation Mission, UPI, PLI, E Biz, G2B portal etc) are fuelling innovation in India. India’s rank leaped from 81 in 2015 to 40 in 2022.

- Huge growth potential in the innovative businesses e.g. Digital media is expected to grow ~3X in 6 years, E-commerce is expected to expand ~7x in 10 Years.

- Bandhan Innovation Fund offers a prospect to invest in a portfolio of tomorrow’s opportunities.

- The fund would seek to invest in innovators having characteristics such as strong brands, potentially higher margins/ growth, differentiated product/ services, high R&D expense, high skilled employee cost as well as non-linear business model.

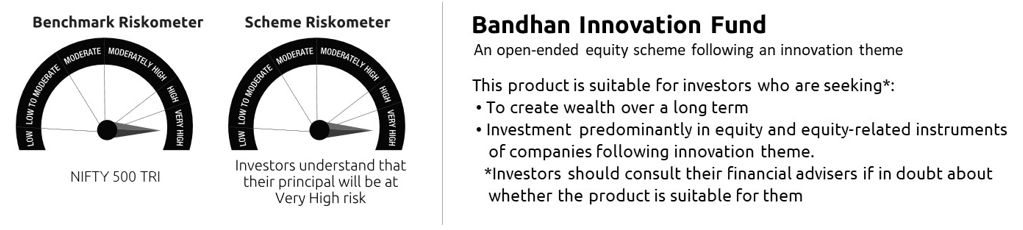

Who can invest in Bandhan Innovation Fund?

- Investors looking for diversification in their satellite portfolio for potential alpha generation

- Investors looking to participate in the innovation theme with a long-term investment horizon, especially through SIP

- Being a thematic fund, investors need to have relatively higher risk appetite for potentially higher returns

- You should have 3 - 5 years plus investment tenure for this fund.

Investors should consult their financial advisors or mutual fund distributors if Bandhan Innovation Fund is suitable for their investment needs.

Product Label::

Disclaimer:

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of Bandhan Mutual Fund (formerly known as IDFC Mutual Fund). The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme’s portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither Bandhan Mutual Fund (formerly known as IDFC Mutual Fund)/ Bandhan Mutual Fund Trustee Limited (formerly IDFC AMC Trustee Company Limited) / Bandhan AMC Limited (formerly IDFC Asset Management Company Limited), its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

Bandhan AMC Limited (formerly IDFC Asset Management Company Limited), established in 2000, is one of India's Top 10 fund houses in terms of Asset Under Management. It has an experienced investment team with an on-the-ground presence in over 60 cities. Bandhan Mutual Fund is focused on helping savers become investors and create wealth. To support this objective, the fund house's equity and fixed-income offerings aim to provide performance consistent with their well-defined objectives. It is having its Registered Office at - Bandhan AMC Limited, One World Center, 6th floor, Jupiter Mills Compound,841, Senapati Bapat Marg, Elphinstone Road, Mumbai: 400 013

Investor Centre

Follow Bandan MF

More About Bandan MF

POST A QUERY