Bandhan Infrastructure Fund: A good thematic investment to capture benefits of India's thrust on infra

Role of Infrastructure India Growth Story

Infrastructure is the foundation for a country and plays a very important role in the growth of the economy. The infrastructure theme covers a variety of sectors like energy, roads, railways, ports, airports, water, urban development, telecommunications and industrials. The government recognizes the gap in India’s infrastructural needs and has developed various policies to address the e.g. setting up the National Investment and Infrastructure Fund (NIIF), the National Infrastructure Pipeline, PM Gati Shakti Master Plan, National Logistics Policy, RCS-UDAN, Sagarmala, Bharatmala, Digital India scheme, Telecom Technology Development Fund, and PLI for manufacturing. Infrastructure development is crucial in achieving the Government’s vision of Viksit Bharat, India transforming into a developed economy. In this article we will discuss about the prospects of the infrastructure sector, infrastructure as an investment theme and one of the best performing thematic infrastructure funds, Bandhan Infrastructure Fund.

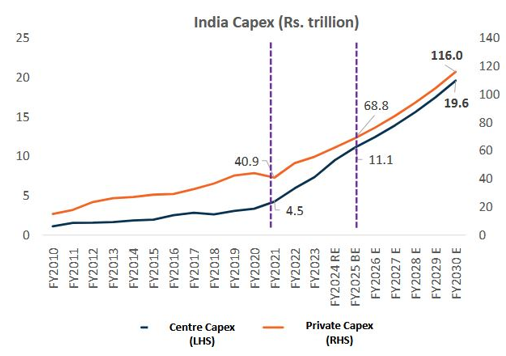

Multiplier effect of Government’s infra spending on private sector capex

In the Union Budget 2023-24, the government emphasized the need for increased spending in the infrastructure sector and nearly trebled its infrastructure spending to 3.3% of GDP compared to its spending in 2019-20. Government infra spending will have a multiplier effect on private sector capex spending (see the chart below).

Source: Union Budget –2010 –2024: Centre Capex is government spend and Private Capex is investment by private companies (GFCF:Gross Fixed Capital Formation), Bandhan MF

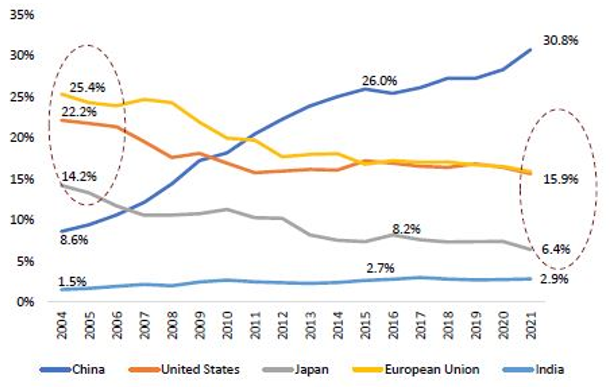

Shift of global manufacturing to India

Developed markets manufacturing share reduced significantly; share had shifted to China, and now India’s share is likely to increase (China +1 and PLI scheme to propel manufacturing sector).

Source: Spark Capital; Bandhan Mutual Fund

Capex spending in different sectors

- Railways: Capex growth of 6.5X in last 15 years (FY 2011 – FY 2025E)

- Roads: Capex growth of 15X in last 15 years (FY 2011 – FY 2025E)

- Defence: Capex growth of 3X in last 15 years (FY 2011 – FY 2025E)

- Housing: Capex growth of 7X in last 12 years (FY 2013 – FY 2025E)

- Water supply and sanitation: Capex growth of 5X in last 8 years (FY 2016 – FY 2025E)

- Power: Renewable energy capacity to increase from 440 GW to 750 GW by 2030

Source: Bandhan Mutual Fund

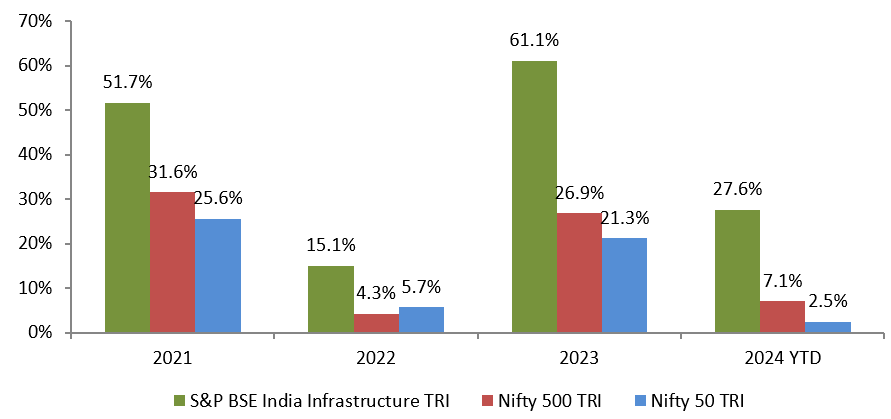

Infra is one of the top performing industry sectors

The infrastructure sector has outperformed the broad market since the economy was opened up after the COVID-19 pandemic in 2020-21 (see the chart below). Government spending on the infrastructure sector since the 2021 Union Budget has benefitted the stocks in this sector and this has in turn helped them in outperforming the market.

Source: Advisorkhoj Research, as on 30th April 2024

About Bandhan Infrastructure Fund

Bandhan Infrastructure Fund, a sectoral fund, focuses on building a portfolio across the infrastructure value chain. The portfolio would include companies that could benefit from infrastructure creation and continued public expenditure. The fund was launched in 2011 and has given 12.44% CAGR returns since inception (as on 30th April 2024). It is ranked in the Top 3 infrastructure funds in the last one year.

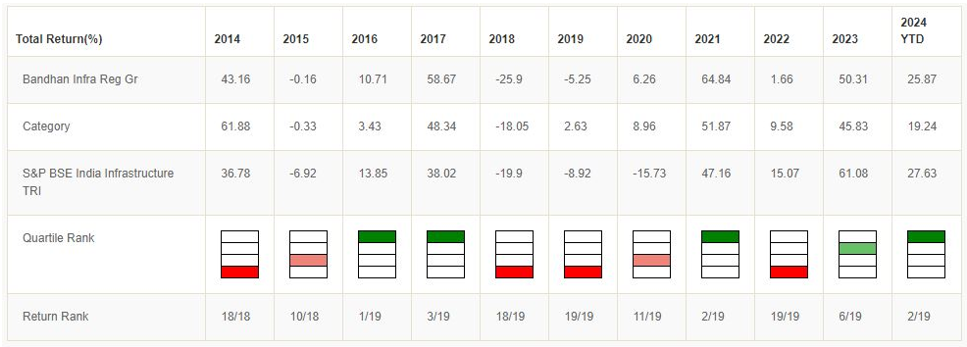

A consistent upper quartiles performer

Bandhan Infrastructure Fund has been in the top 2 quartile 3 times in the last 4 years (see the chart below). Its performance slipped in 2022 but the fund has bounced back strongly and is now a top quartile performer.

Source: Advisorkhoj Quartile Rankings, as on 30th April 2024

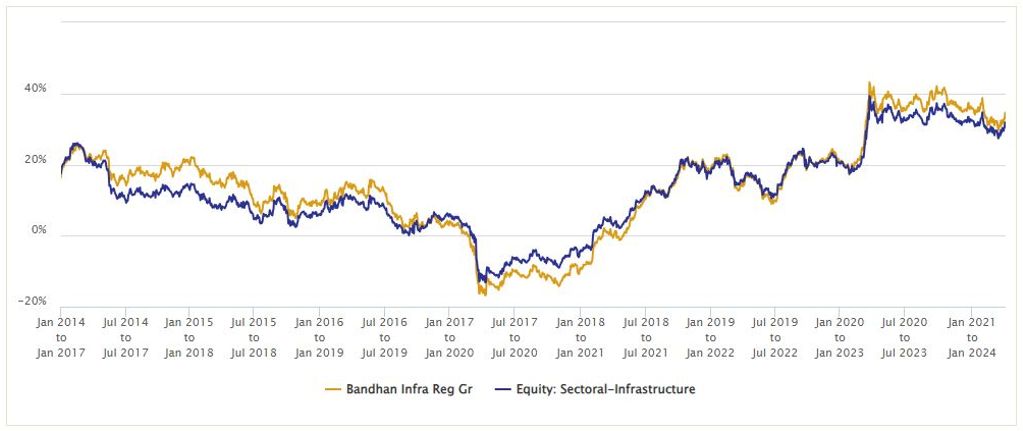

Strong 3 years rolling returns versus peers

In the chart below we have shown the 3 year rolling return of Bandhan Infrastructure Fund versus the infrastructure sector funds category average over the last 10 years or so (from 1st January 2014). You can see that, except a few years, the fund was able the beat the category average over 3 year investment tenures. The average rolling return of Bandhan Infrastructure Fund for 3 year investment tenure was 13.93% (versus category average rolling return of 12.64%). The median rolling return of Bandhan Infrastructure Fund for 3 year investment tenure was 14.71% (versus category median rolling return of 11.55%).

Source: Advisorkhoj Rolling Returns, as on 30th April 2024

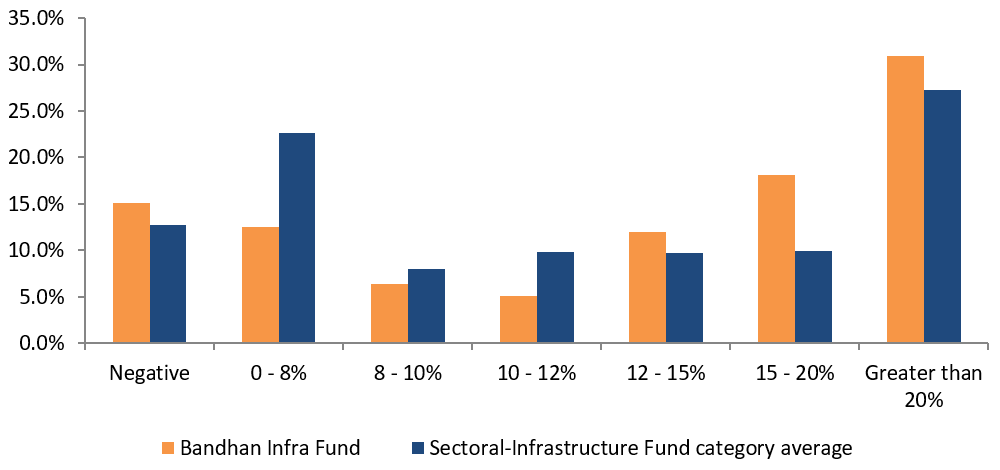

Consistency in delivering superior returns

The chart below shows the 3 year rolling return distribution of Bandhan Infrastructure Fund versus the infrastructure sector funds category average. You can see that the fund was able to give 12%+ CAGR returns much more consistently (nearly 60% of the instances) compared to the peer funds in the infrastructure sector funds category.

Source: Advisorkhoj Rolling Returns, as on 30th,/sup> April 2024

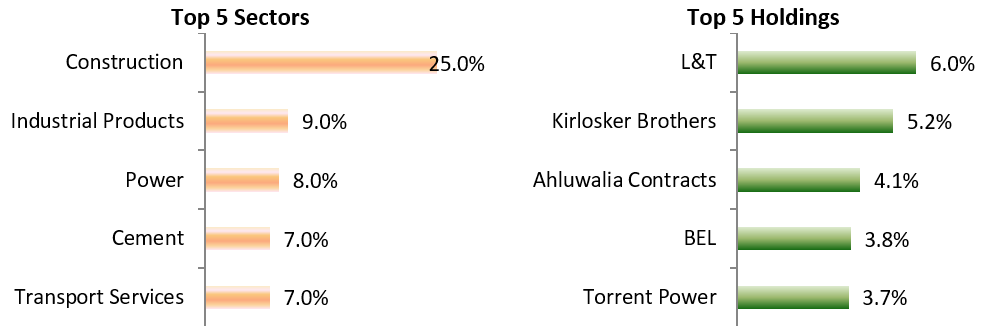

Current portfolio positioning

The fund follows a stock selection approach using the 5-factor framework factors like Management quality, Sector outlook, Company outlook, Earnings growth & resilience and Valuations. The fund’s exposures to sectors not represented in thebenchmark are Capital Goods (23.1%), ConstructionMaterials (13.3%), Metals & Mining (4.9%), Telecom (4.4%)and Realty (1.4%). The fund is biased to small caps at 40% vs 19% in the benchmark, demonstrating the potential for alpha generation. The fund has undertaken churning in the portfolio with 3 new entries and 2 exits in Mar’24 with a total portfolio of 58 stocks.

Source: Bandhan MF, as on 30th April 2024

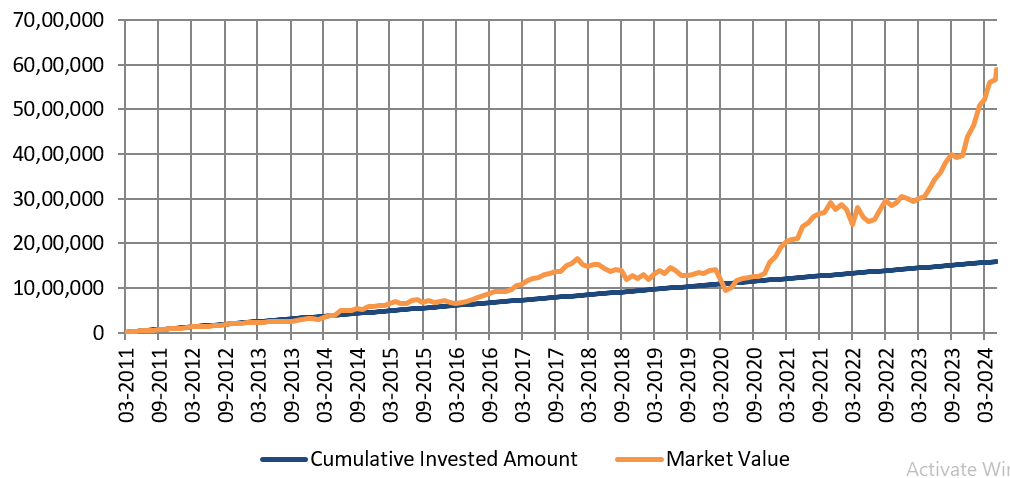

SIP – Wealth creation

The chart below shows the growth of Rs 10,000 monthly SIP in Bandhan Infrastructure Fund since the inception of the scheme. With a cumulative investment of less than Rs 16 lakhs, you can accumulate a corpus of Rs 59 lakhs (as on 15th May 2024). The SIP XIRR inception is 18.6%. Many investors think of thematic funds as tactical investments, where you have to time the market. The long term SIP performance of Bandhan Infrastructure Fund shows that you can invest in this fund systematically over long investment horizon. However, you should be prepared for volatility and remained disciplined in your investment if you want to go through the SIP route.

Source: Advisorkhoj Research, as on 15th April, 2024

Why invest in Bandhan Infrastructure Fund?

- Opportunity to participate in ‘India Growth Story’

- The fund is positioned to tap businesses which are expected to gain multi-fold with the implementation of the government’s reforms

- Bandhan Infrastructure Fund is more diversified than most sector funds as Infrastructure covers various industries – it is relatively more diversified than other single industry specific funds

- The fund has a 13 year track record of wealth creation.

Who should invest in Bandhan Infrastructure Fund?

- Investors willing to have satellite allocation to overall equity portfolio

- Investors looking for capital appreciation over long investment tenures from infrastructure theme

- Investors with very high risk appetites

- Investors with minimum 3 year investment tenures

- You can invest either in lump sum and SIP depending on your investment needs.

Investors should consult their financial advisors or mutual fund distributors if Bandhan Infrastructure Fund is suitable for their investment needs.

Disclaimer:

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of Bandhan Mutual Fund (formerly known as IDFC Mutual Fund). The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme’s portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither Bandhan Mutual Fund (formerly known as IDFC Mutual Fund)/ Bandhan Mutual Fund Trustee Limited (formerly IDFC AMC Trustee Company Limited) / Bandhan AMC Limited (formerly IDFC Asset Management Company Limited), its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

Bandhan AMC Limited (formerly IDFC Asset Management Company Limited), established in 2000, is one of India's Top 10 fund houses in terms of Asset Under Management. It has an experienced investment team with an on-the-ground presence in over 60 cities. Bandhan Mutual Fund is focused on helping savers become investors and create wealth. To support this objective, the fund house's equity and fixed-income offerings aim to provide performance consistent with their well-defined objectives. It is having its Registered Office at - Bandhan AMC Limited, One World Center, 6th floor, Jupiter Mills Compound,841, Senapati Bapat Marg, Elphinstone Road, Mumbai: 400 013

Investor Centre

Follow Bandan MF

More About Bandan MF

POST A QUERY