Bandhan Emerging Businesses Fund: A small-cap offering for long-term investors

Small-cap funds have been one of the most preferred categories among retail investors this year. As per AMFI monthly data, small-cap funds have received the largest inflows among all equity fund categories in FY 2023 – 24, with more than Rs 19,370 crores of net inflows on FY 24 August YTD. Small cap inflows constituted nearly 42% of net inflows of actively managed equity fund categories (Source: AMFI monthly data, April to August 2023). This article will review Bandhan Emerging Businesses Fund, a small-cap fund. Investors should note that Bandhan Emerging Businesses Fund accepts lump sum and SIP investments.

Market context

Small caps have outperformed ever since the market started recovering after the COVID-19 crash in 2020. Small caps outperformed in CY 2020 and 2021 but underperformed in CY 2022. The 2022 correction made small caps attractive and bounced back strongly in 2023. As of 31st August YTD basis, Nifty Small Cap 250 TRI gave more than 25% return, while Nifty 50 TRI has delivered 6.7% return (source: NSE, Advisorkhoj Research, as of 31st August 2023).

Source: National Stock Exchange, Advisorkhoj Research, as of 31st August 2023

What are small-cap funds?

Stocks, i.e., stocks below the top 250 stocks by market capitalization, are classified by SEBI as small-cap stocks. Small-cap funds are equity mutual fund schemes which invest at least 65% of their assets under management (AUM) in small-cap stocks.

Why small cap stocks / funds tend to outperform large cap stocks / funds?

- Small-cap funds enable investors to invest in niche sector opportunities like digital technology businesses, renewables, speciality chemicals, textiles, building materials, etc.

- Since small-cap stocks are under-researched and under-owned by institutional investors, the price discovery in this market cap segment is less efficient than large caps or midcaps. As a result, fund managers of small-cap schemes have greater opportunities to identify small-cap stocks that are currently undervalued in the market (relative to their fair valuations). These stocks can generate considerable alpha relative to the broader market.

- In addition, stocks that are small cap today have the potential to become midcap stocks. When a stock moves from one market cap segment to a higher one, valuation rerating occurs. This can result in small-cap stocks giving multi-bagger returns.

- The universe of small-cap stocks is much larger than large-cap (total 100 stocks) and midcap stocks (total 150 stocks). Large-cap stocks are concentrated in relatively few industry sectors. Sectors like chemicals, packaging, sugar and tea, ceramics and sanitary ware, hotels, logistics and construction can be played better through small-cap stocks. The sectors will play an important role in the domestic consumption-driven India Growth Story.

About Bandhan Emerging Businesses Fund

Bandhan Emerging Businesses Fund was formerly called IDFC Emerging Businesses Fund. The fund was launched in February 2020. The scheme has Rs 2,014 crores of assets under management AUM as on 31st August 2023. The Total Expense Ratio (TER) of the scheme is 2.02%. The scheme has given 33.2% CAGR returns since inception (as of 19th September 2023). After the acquisition of IDFC MF by Bandhan led consortium earlier this year, this fund was renamed Bandhan Emerging Businesses Fund. There was also a change in fund management, with industry veteran Manish Gunwani taking over from the previous manager, Anoop Bhaskar earlier this year. The scheme’s benchmark is S&P BSE 250 SmallCap TRI.

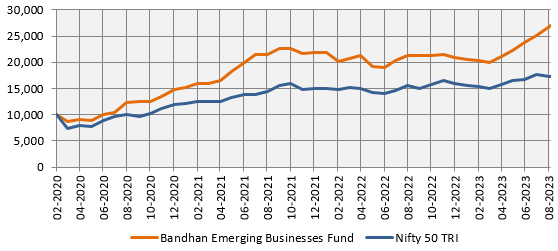

Performance since inception

The chart below shows the Rs 10,000 lump sum investment growth in Bandhan Emerging Businesses Fund since the scheme's inception versus the Nifty 50 Total Returns Index. Your investment would have multiplied nearly 3 times in little more than 3 years.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st August 2023

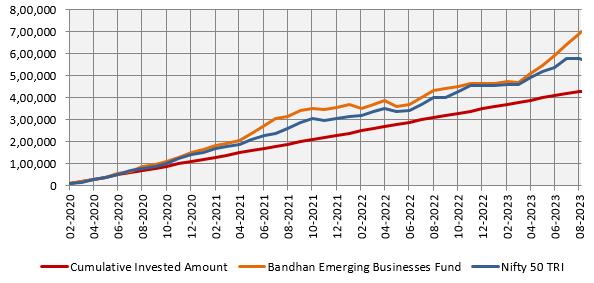

Wealth creation with SIP

The chart below shows the growth of Rs 10,000 monthly SIP investment in Bandhan Emerging Businesses Fund since the scheme's inception. With a cumulative investment of Rs 4.3 lakhs, you could have accumulated a corpus of Rs 7 lakhs by investing through SIP in this scheme. The scheme's annualized SIP returns (XIRR) are nearly 30%, while that of Nifty 50 TRI over the same period was 17%.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st August 2023

Investment strategy of Bandhan Emerging Businesses Fund

- The fund manager follows the Growth at Reasonable Price (GARP), focusing on Quality, Growth and Valuation.

- Quality – Steady cash flows, efficient capital allocation and reasonable return on capital

- Growth – Medium term reasonable visibility of growth and Businesses with higher ROIC.

- Valuations – Investing at reasonable valuations provides a margin of safety to investors.

- The fund manager aims to diversify macro risk by taking exposure across sectors to reduce the impact of risks such as economic, political, regulatory demographic, etc.

- The scheme has the lower portfolio concentration to control liquidity and fundamental risk – Top 10 stocks < 30% of the portfolio.

- The scheme invests in a higher number of stocks to leverage the ideas of an experienced research team.

Key Portfolio Themes of Bandhan Emerging Businesses Fund

- Power capex growth in India & Energy transition globally

- Structurally better placed than larger companies and being the emerging challenger in niche segments.

- Niche sectors having sectoral tailwinds

- Special situations

Recent improvement in performance versus peers

Though we give little importance to short-term performance, since a new fund manager took over Bandhan Emerging Businesses Fund in January of this year, we wanted to see how the scheme performed under the new fund manager. The performance under the new fund manager is promising since the scheme has outperformed the small-cap funds category average. What is also encouraging is that the scheme has performed well in different market conditions. It is very early days, but it is a promising start for Manish Gunwani as the fund manager of this scheme.

Source: National Stock Exchange, Advisorkhoj Research, as on 19th September 2023

Why invest in Bandhan Emerging Businesses Fund?

- Bandhan Emerging Businesses Fund, with its GARP orientation, has a sound investment strategy.

- The fund has support of large research coverage, which provides an opportunity to evaluate and allocate in small cap businesses for long-term wealth creation.

- The recent outperformance of the scheme under the new fund manager bodes well for the future.

Who should invest in Bandhan Emerging Businesses Fund?

- Investors looking for capital appreciation over long investment tenures.

- Investors with high-risk appetites

- Investors with minimum 5-year investment tenures

Suggested Investment Strategies:

- SIP is one of the best modes of investment in small-cap funds over long investment horizons.

- However, investors can also take advantage of deep corrections to tactically invest in a lump sum.

- You can also invest in this fund through 6 – 12 months STP from Bandhan Liquid or Bandhan Ultra Short-Term Fund.

Investors should consult with their mutual fund distributors or financial advisors to see if the Bandhan Emerging Businesses Fund suits their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Bandhan AMC Limited (formerly IDFC Asset Management Company Limited), established in 2000, is one of India's Top 10 fund houses in terms of Asset Under Management. It has an experienced investment team with an on-the-ground presence in over 60 cities. Bandhan Mutual Fund is focused on helping savers become investors and create wealth. To support this objective, the fund house's equity and fixed-income offerings aim to provide performance consistent with their well-defined objectives. It is having its Registered Office at - Bandhan AMC Limited, One World Center, 6th floor, Jupiter Mills Compound,841, Senapati Bapat Marg, Elphinstone Road, Mumbai: 400 013

Investor Centre

Follow Bandan MF

More About Bandan MF

POST A QUERY