Bandhan Business Cycle Fund: Invest in the winners in different business cycles

Bandhan MF has launched a New Fund Offer (NFO), the Bandhan Business Cycle Fund. The fund will invest in sectors that are likely to outperform in the different business cycles, thereby creating alpha opportunity for investors. The NFO has opened for subscription on 10th September 2024 and will close on 24th September 2024. In this article, we will review Bandhan Business Cycle Fund NFO.

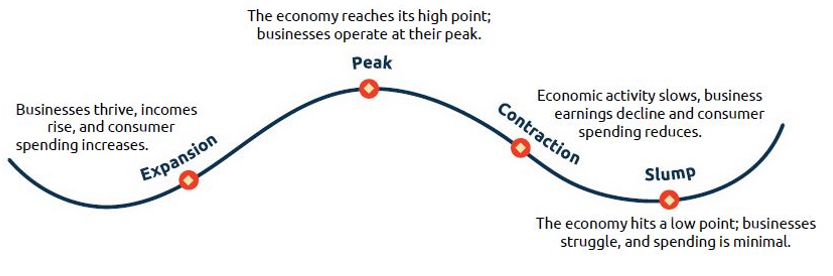

What are business cycles?

All markets go through cycles of economic growth and decline – these are known as business cycles (see the chart below). A business cycle usually has 4 phases – expansion, peak, contraction, and slump. From the slump phase, the economy will recover and move into the expansionary phase again. This cycle keeps repeating over and over again. Each phase influences economic growth, which in turn affects investment decisions. Business cycle investing involves adopting an investment strategy based on the current phase of the economy.

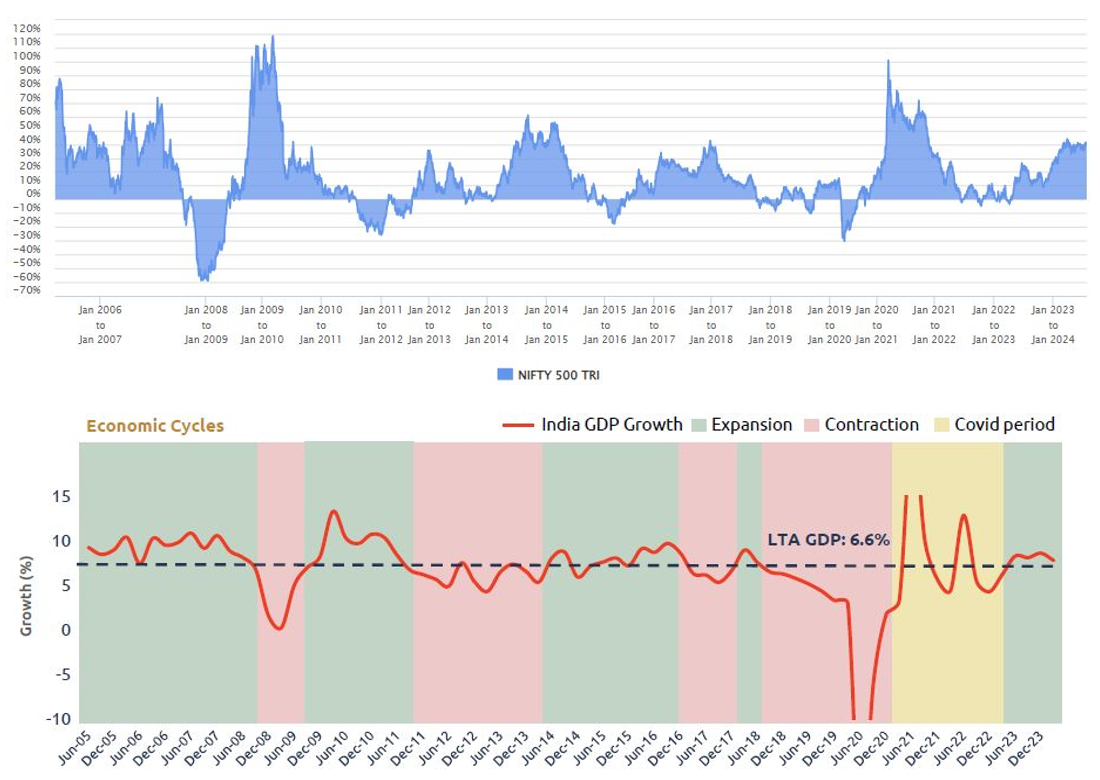

Business cycles affect equity market returns

Phases of the economy also influence the cycles of the equity market. The chart below shows the one-year rolling returns of Nifty 500 TRI (index of the Top 500 listed companies) since FY 2005-06. We have also shown GDP growth and economic cycles below this chart. You can see that the equity market cycles are influenced by economic cycles. The periods of downturns in the market coincide with the periods of downturns in the economy.

Source: NSE, Advisorkhoj Research, Bandhan MF, as on 31st July 2024

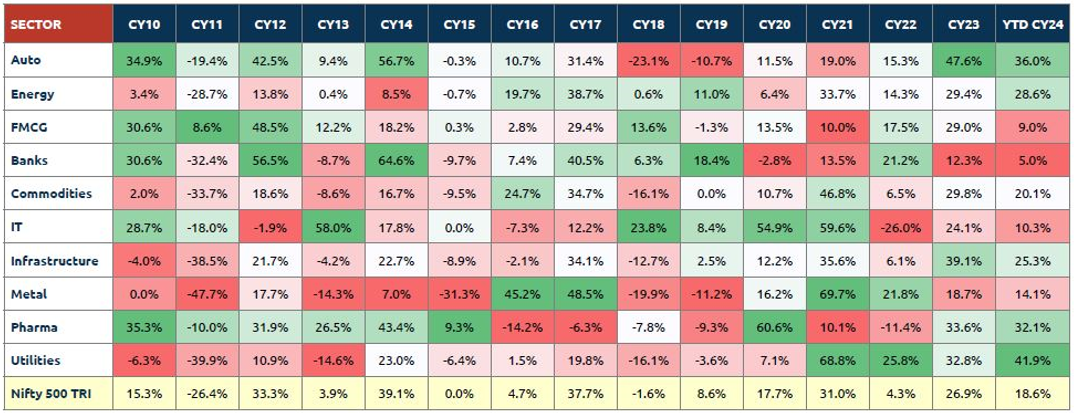

Winners rotate across industry sectors (see the chart below). Identifying which sectors are in the expansion phase of business cycles can generate alphas for investors.

Source: Motilal Oswal MF, as on 11th July 2024

Why invest in a Business Cycle Fund?

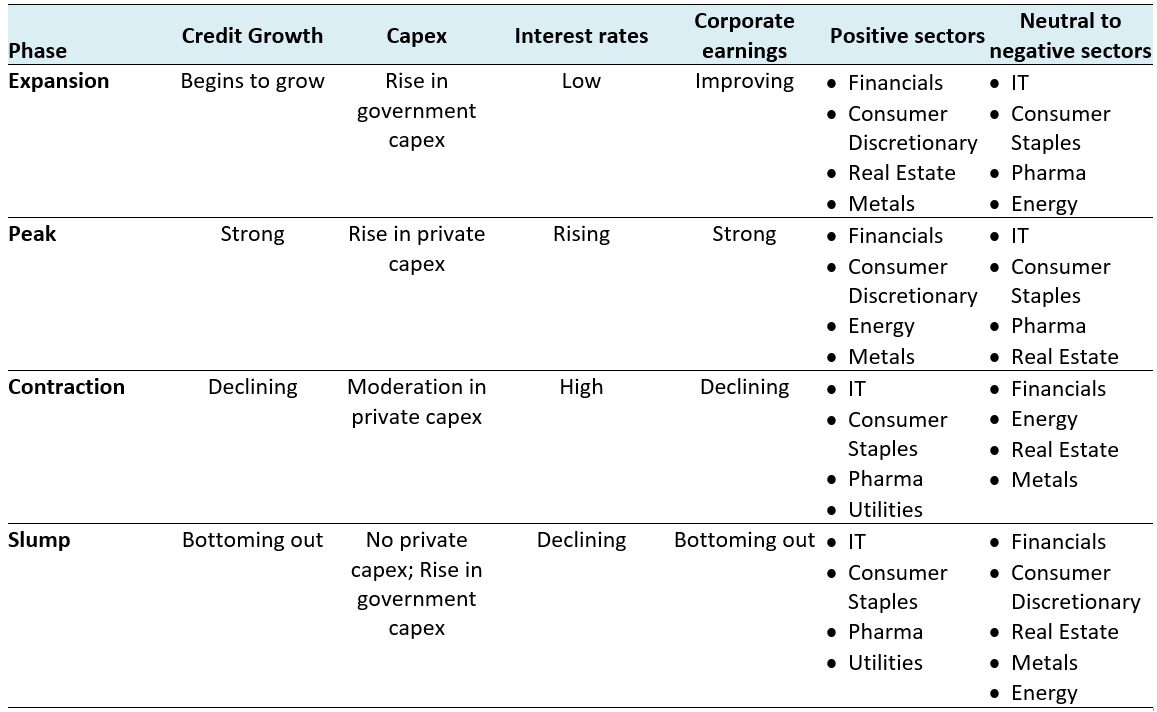

Different sectors outperform/underperform in different phases of business cycles(see the table below). Each phase of the business cycle provides unique investment opportunities. Investing in themes / sectors that are likely to outperform during a particular phase, you tend to generate potentially higher return opportunitiesin your investment portfolios.

Bandhan Business Cycle Fund– Investment approach

Stock selection criteria

Portfolio Construction

Why invest in Bandhan Business Cycles Fund?

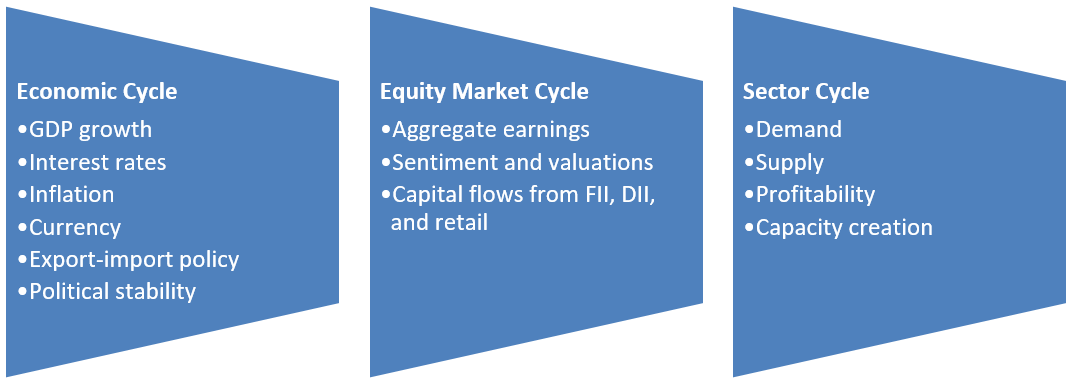

- 360 degree approach: A holistic approach to identify investment opportunities based on economic cycles, market cycles and sector cycles.

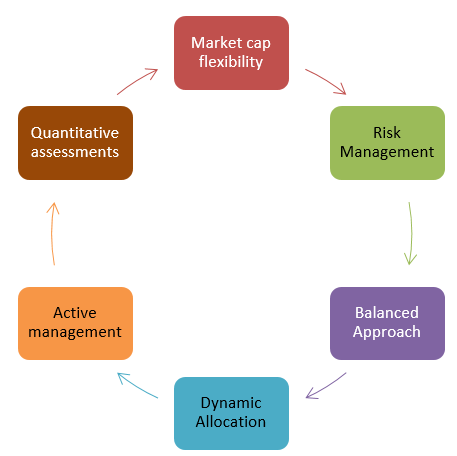

- Agile sector rotation: A nimble style to sector rotation with substantial deviation to at least 3 of the top 5 sectors by weight in the Nifty 500 index sectors.

- Risk Management: Diversification across market caps with a focus on strong businesses. Manage liquidity through a higher cash position of up to 15%.

- Quantitative Analysis: Actively monitor macro-economic indicators, equity market indicators (valuations, returns, etc.) and sector drivers to construct the portfolio.

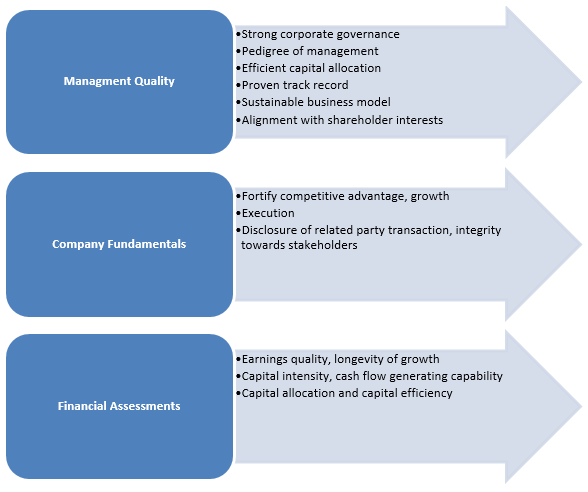

- 3 pronged stock selection: Management quality, Company fundamentals and Valuations.

- Fresh portfolio with no legacy stocks.

- Experienced fund managers.

Who should invest inthe Bandhan Business Cycles Fund?

- Suitable for investors looking for tactical satellite allocations to their overall equity portfolio.

- Investors with a long-term investment horizon, seeking growth through SIP.

- Investors who want superior returns on investment over a sufficiently long investment tenure.

- Investors who are comfortable with higher risk in pursuit of higher returns potential.

- Investors with minimum investment horizon of 3 to 5 years.

- Investors should consult with their financial advisors or mutual fund distributors if Bandhan Business Cycles Fund is suitable for their investment needs.

Disclaimer:

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of Bandhan Mutual Fund (formerly known as IDFC Mutual Fund). The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme’s portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither Bandhan Mutual Fund (formerly known as IDFC Mutual Fund)/ Bandhan Mutual Fund Trustee Limited (formerly IDFC AMC Trustee Company Limited) / Bandhan AMC Limited (formerly IDFC Asset Management Company Limited), its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

Bandhan AMC Limited (formerly IDFC Asset Management Company Limited), established in 2000, is one of India's Top 10 fund houses in terms of Asset Under Management. It has an experienced investment team with an on-the-ground presence in over 60 cities. Bandhan Mutual Fund is focused on helping savers become investors and create wealth. To support this objective, the fund house's equity and fixed-income offerings aim to provide performance consistent with their well-defined objectives. It is having its Registered Office at - Bandhan AMC Limited, One World Center, 6th floor, Jupiter Mills Compound,841, Senapati Bapat Marg, Elphinstone Road, Mumbai: 400 013

Investor Centre

Follow Bandan MF

More About Bandan MF

POST A QUERY