Bandhan BSE Healthcare Index Fund: A Low-cost exposure to the entire healthcare industry

Bandhan MF has launched a New Fund Offer (NFO), the Bandhan BSE Healthcare Index Fund. As the name suggests it will be tracking the BSE Healthcare Index which provides exposure to nearly the entire listed universe of healthcare stocks. Currently, there are three index funds in the pharmaceuticals/healthcare sector, with one of them being exclusively focused on pharmaceuticals. What sets the Bandhan BSE Healthcare Index Fund apart is that it offers comprehensive exposure to the entire healthcare sector. The NFO opened for subscription on 21st August 2024 and will close on 3rd September 2024.

Why invest in Healthcare Index Funds?

- Diversified exposure: Active sector funds may concentrate on specific stocks, potentially increasing risk, whereas passive sector funds tend to offer broader diversification across the sector.

- Low cost: Total Expense Ratios (TERs) of index funds are much lower than actively managed funds. Lower cost can work to the advantage of index funds versus active funds over long investment tenures due to the power of compounding.

- No fund manager bias: Fund manager have their views and biases. Index funds do not have fund manager biases because the fund manager is not actively selecting stocks for the portfolios; they are tracking the benchmark index.

About the Indian Healthcare industry

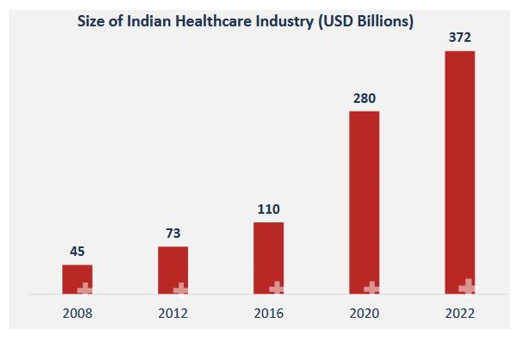

- Between 2008 and 2022, the industry grew at an approximate CAGR of 16%. The momentum is expected to continue, driven by an aging population, burgeoning lifestyle diseases, and rising affordability

Source: Bandhan MF, Statista.com, as of 12th July 2023

- India is the third-largest pharmaceutical manufacturer by volume

- It is the largest provider of generic drugs, globally

- The country supplies 60% of global vaccine demand, making it the largest vaccine producer

- It ranks 10th globally as a medical tourism destination

- Increased health insurance coverage due to Ayushman Bharat, PM Jan Arogya Yojana, and digital initiatives of the Government. As of 30th June 2024, 37% of the population is covered under the Ayushman Bharat / PM JAY

- India’s per capita spending on healthcare has increased from US$158.9 in 2011 to US$212 in 2022

Opportunities in the healthcare sector

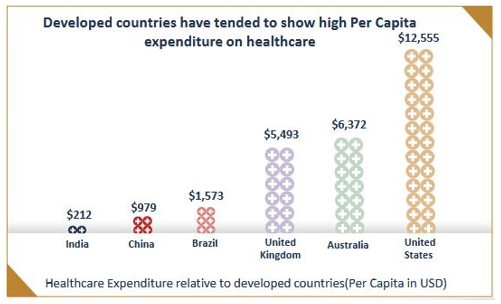

- Per capita spending on healthcare increases significantly as income rises. Developed countries have tended to show high per capita expenditure on healthcare. As our per capita income increases, we are also likely to see significantly higher spending on healthcare.

Source: Bandhan MF, OECD- Health Spending. Latest data available as on 2020

- There is a large healthcare infrastructure gap (number of beds, physicians, nursing staff etc) in India relative to developed nations. This represents an opportunity for the public and private sector players to expand their footprint in the healthcare

- High out-of-pocket expenditure (not covered by health insurance) and medical inflation relative to other emerging economies make affordability a challenging issue for average Indian households.

- The Government is addressing the healthcare affordability issue through the Ayushman Bharat Scheme. 55% of lives will be covered by the Ayushman Bharat Scheme 2025 and this will rise to 69% by 2030.

- India has emerged as one of the top medical tourism hubs in the world. India’s medical tourism provides quality care at a fraction of global prices. India was ranked 10th out of the 46 countries in medical tourism. Currently, the medical tourism market in India is pegged at US $ 6 billion. Medical tourism is expected to grow at a CAGR of 20% from 2023-2027 to more than US $ 35 Billion (source: Bandhan MF, Synergia Foundation. HFS research- published on 13th Oct 2023)

Why invest in the healthcare index fund?

- Rising Income, better health awareness, lifestyle diseases, and increasing access to insurance

- India’s public expenditure on healthcare touched 2.1% of GDP in FY23

- Availability of a large pool of well-trained medical professionals in the country

- Healthcare is often used interchangeably with Pharma. However, there are many investment opportunities in healthcare besides Pharma viz. Hospitals, Diagnostics, Medical equipment and supplies, Research and Analytics, and Biotechnology.

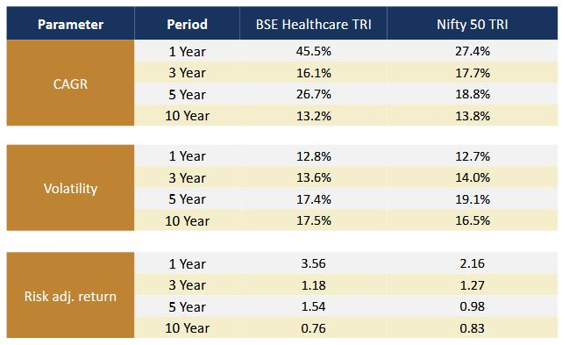

- Historically, healthcare has delivered superior risk-adjusted returns compared to the broad market index (see the table below)

Source: Bandhan MF, BSE. Data as of the end of 31st July 2024

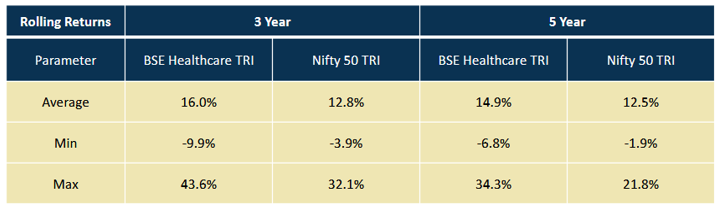

- On a Rolling Return Basis too, the BSE Healthcare Index has Outperformed the Nifty 50 (see the table below)

Source: Bandhan MF, BSE. Data as of the end of 31st July 2024

- Convenience of mutual funds. Investors who do not have Demat accounts can invest. Investors can redeem with the AMC instead of selling their units in stock exchange.

- You can invest from your regular savings through Systematic Investment Plans (SIP).

About BSE Healthcare Index

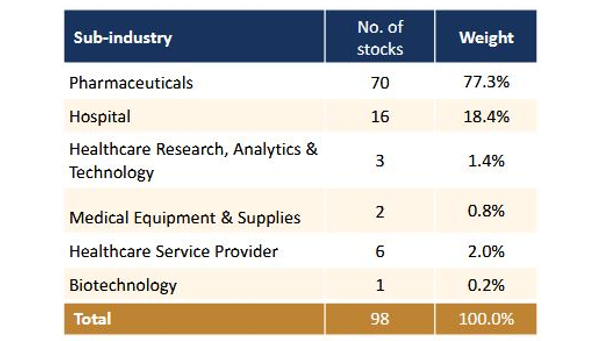

BSE Healthcare Index – Sectors

Source: Bandhan MF, BSE. Data as of the end of 31st July 2024

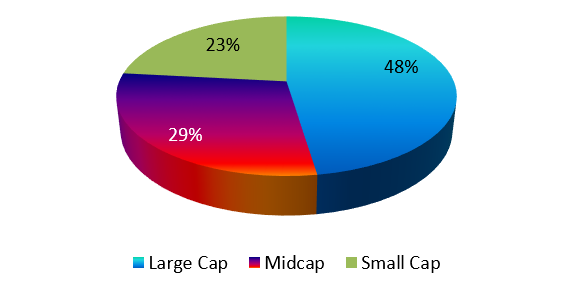

BSE Healthcare Index – Market Cap Segments

Source: Bandhan MF, BSE. Data as of the end of 31st July 2024

Who should invest in Bandhan BSE Healthcare Index Fund?

- Investors looking for capital appreciation over long investment tenures through passive investing

- Investors looking for dedicated exposure to entire healthcare industry

- You should have minimum investment tenure of 5 years

- You do not need Demat accounts to invest in the fund

Investors should consult with their financial advisors or mutual fund distributors if Bandhan BSE Healthcare Index Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Bandhan AMC Limited (formerly IDFC Asset Management Company Limited), established in 2000, is one of India's Top 10 fund houses in terms of Asset Under Management. It has an experienced investment team with an on-the-ground presence in over 60 cities. Bandhan Mutual Fund is focused on helping savers become investors and create wealth. To support this objective, the fund house's equity and fixed-income offerings aim to provide performance consistent with their well-defined objectives. It is having its Registered Office at - Bandhan AMC Limited, One World Center, 6th floor, Jupiter Mills Compound,841, Senapati Bapat Marg, Elphinstone Road, Mumbai: 400 013

Investor Centre

Follow Bandan MF

More About Bandan MF

POST A QUERY