Bandhan Balanced Advantage Fund: A good hybrid fund in the current market conditions

What are Balanced Advantage Funds?

Balanced Advantage Funds, also known as Dynamic Asset Allocation Funds, are hybrid mutual funds which manage their asset allocation dynamically between equity and debt. The asset allocation will change depending on market conditions using quantitative asset allocation models.

How Balanced Advantage Funds work?

- Equity: This is the un-hedged equity exposure of the fund. Net equity allocation is determined by a quantitative dynamic asset allocation model based on market conditions.

- Fixed Income: Fixed income allocation is determined by the asset allocation model but is usually capped at 35% to ensure equity taxation.

- Hedging: This fully hedged equity component is not exposed to market risks. Hedging reduces the net equity exposure and, at the same time, helps to keep the gross equity exposure above 65%, which enables equity taxation.

Bandhan Balanced Advantage Fund

Bandhan Balanced Advantage Fund was launched in 2014 and has given 10.26% CAGR returns in the last three years (as of 31st July 2023). The scheme has Rs 2,470 crores of assets under management (AUM) as of 30th June 2023. Bandhan Balanced Advantage Fund follows a counter-cyclical dynamic asset allocation model. Counter-cyclical asset allocation models buy less equity when markets are expensive and more when markets are cheap. Sachin Relekar (w.e.f. 1st March 2022), Sumit Agrawal (w.e.f. 01st March 2017) and Vishal Biraia (w.e.f. 19th June 2023) manage the equity portion of the fund, while Brijesh Shah (w.e.f. 16th July 2022) manages the debt portion.

Performance of Bandhan Balanced Advantage Fund

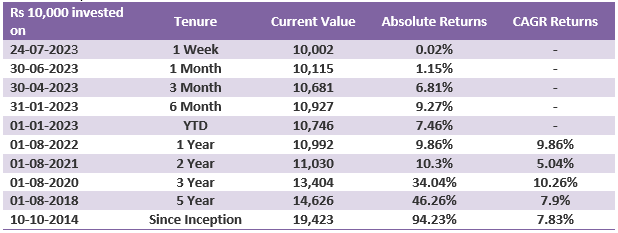

The chart below shows the growth of Rs 10,000 lump sum investment in Bandhan Balanced Advantage over various periods.

Source: Advisorkhoj Research Point to Point Returns, as on 31st July 2023

Lower Downside Risk

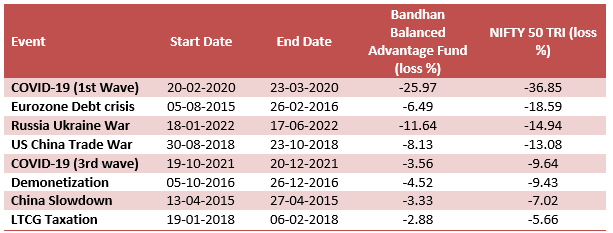

One of the main reasons you invest in a hybrid fund is to provide stability to your portfolio in volatile market conditions. The table below shows some of the most significant corrections in the equity market since the launch of the Bandhan Balanced Advantage Fund. You can see that Bandhan Balanced Advantage Fund usually had smaller drawdowns compared to the market index Nifty 50 TRI. This is due to the dynamic asset allocation strategy of having lower equity allocations at market peaks.

Source: mutualfundtools.com

Steady growth potential through SIP

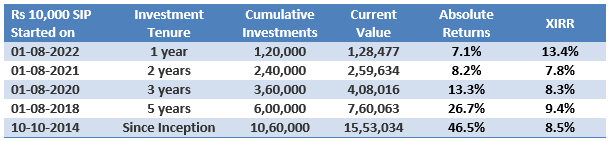

The chart below shows the Rs 10,000 monthly SIP investment growth in Bandhan Balanced Advantage Fund over various periods. You can see that fund created wealth over longer investment tenures.

Source: mutualfundtool.com SIPs with multiple periods, as on 28th April 2023

Dynamic Asset Allocation Model of Bandhan Balanced Advantage Fund has been enhanced

Bandhan Balanced Advantage Fund was using a single-factor Nifty 50 Trailing PE model. The model will increase equity allocations when PE declines and increase equity allocations when PE increases. The dynamic asset allocation model of the fund has now been enhanced to include multiple factors, i.e. multifactor model. The new model will be based on three factors:-

- Valuation Parameter – trailing Nifty 50 PE: It indicates to buy more when the markets are cheaper and sell when it gets expensive, basis valuation

- Fundamental Parameters (real returns, credit spreads and currency valuation): Credit spread is a mean reverting indicator, wherein equity exposure increases when the spread is wide and decreases when the spread is low. Whenever real returns (e.g., Nifty 50 returns adjusted for inflation) are low, it signals an increase in equity allocation and vice versa. If INR depreciation exceeds the usual 3% to 4%, it is suitable for buying equity and vice versa.

- Technical – EM Volatility Index: Emerging Market Volatility Index helps to assess market volatility. The volatility Index is a mean-reverting indicator, signaling to buy more when volatility is high and reduce equity when volatility reduces

Why invest in Bandhan Balanced Advantage Fund now?

- Behavioural biases affect investor returns. Instead of “buying low and selling high” investors usually buy when the market is high, thinking it will go higher. Similarly, investors sell when the market is low, thinking it will fall even lower.

- Balanced advantage funds have an analytical investment approach using a quantitative asset allocation model. Dynamic asset allocation models increase equity allocation / decrease debt allocation when valuations are low and decrease equity allocation / increase debt allocation when valuations are high.

- Balanced advantage funds can implement “buy low, sell high” because they strictly follow model-based investing without human biases. Since Bandhan Balanced Advantage Funds increases its equity asset allocation at low valuations, it can potentially deliver risk-adjusted returns over sufficiently long investment tenures.

- Asset allocation is critical in sideways and volatile markets. Bandhan Balanced Advantage Fund can reduce downside risks in volatile markets and provide relative stability to your portfolio.

- The new multifactor dynamic asset allocation of Bandhan Balanced Advantage Fund can generate superior risk-adjusted returns across different market conditions (e.g. sideways, bear, bull markets).

- The scheme can benefit from equity growth potential and create long-term alpha – through active stock selection. The long-term India Growth Story remains intact, and our economy stands to benefit from the global industrial realignment, e.g. China + 1 strategy etc.

Who should invest in Bandhan Balanced Advantage Fund?

- Investors who want capital appreciation and income over long investment tenures

- Investors who do not want high volatility in their portfolios

- Investors with moderately high-risk appetites

- Investors with a minimum 3 to 5 years investment horizon

- New investors or investors who do not have experience with volatile markets can invest in this scheme

- You should invest according to your risk appetite and asset allocation needs

- Investors should consult with their financial advisors if Bandhan Balanced Advantage Fund is suitable for their investment needs

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Bandhan AMC Limited (formerly IDFC Asset Management Company Limited), established in 2000, is one of India's Top 10 fund houses in terms of Asset Under Management. It has an experienced investment team with an on-the-ground presence in over 60 cities. Bandhan Mutual Fund is focused on helping savers become investors and create wealth. To support this objective, the fund house's equity and fixed-income offerings aim to provide performance consistent with their well-defined objectives. It is having its Registered Office at - Bandhan AMC Limited, One World Center, 6th floor, Jupiter Mills Compound,841, Senapati Bapat Marg, Elphinstone Road, Mumbai: 400 013

Investor Centre

Follow Bandan MF

More About Bandan MF

POST A QUERY