Why invest in Nifty and Bank Nifty ETFs: Bajaj Finserv ETFs NFO

The last 5 years have seen tremendous growth in Exchange Traded Funds (ETF) assets under management. As per AMFI December data, ETF AUM as on 31st December 2023, stood at around Rs 6.5 lakh crores (growing at a CAGR of 42% over the last 5 years, source: AMFI). While a large percentage of ETF investments belong to institutional investors, there is growing interest in ETFs among retail investors also. There has been phenomenal growth in new demat accounts over the last few years. The number of demat accounts in CDSL is 10.47 crores (source: CDSL, as on 31st December 2023), while that in NSDL is 3.45 crores (source: NSDL, as on 31st December 2023). In coming years, we are likely to see higher retail investor participation in stock markets through the ETF route.

What is ETF?

ETFs are passive funds, which invest in a basket of securities which replicate a particular market index. For example, a Nifty 50 ETF will invest in all the 50 stocks which constitute the Nifty 50 index. The weight of each stock in the ETF portfolio will be the same as its weight in the benchmark index. Unlike actively managed funds, ETFs do not aim to beat the market index. The simply track the index, with the aim of providing the index returns.

How to invest in ETFs?

You need to have Demat account to invest in ETFs. During the NFO period, you can invest in the ETF at par value or face value. After the NFO period, you can buy or sell ETF units on the stock exchange at market prices through your trading account. You can also invest or redeem directly with the Asset Management Company if you transacting in lot sizes (creation units). The lot size for creation units are quite large, so for average retail investors, buying or selling on the stock exchange is more viable option.

Why invest in ETFs?

- Total expense ratios (TER) of ETFs are much lower than actively managed funds. The fund manager of an active fund will have to generate significant alphas on a consistent basis to match the performance of an ETF tracking the same benchmark index. Suppose the TER of an active fund is 2%, while that of an ETF tracking the same index is 0.25%. This difference in costs implies that the active fund will have to consistently beat the benchmark by at least 1.75% to match the performance of the ETF. Over long investment horizons, lower costs may result in considerably higher returns due to the compounding effect.

- In order to beat the index, the fund manager of an active fund will have to be overweight or underweight on certain stocks in the index. This will result in unsystematic risk i.e. stock or sector specific risks. While unsystematic risk can lead to outperformance, it can also result in underperformance. Unsystematic risk is an additional risk in investment over and above market risks. There is no unsystematic risk in ETFs.

- As markets become more efficient, with high degree of institutional investor participation / ownership, greater research coverage etc, it becomes increasingly difficult for fund managers to create alphas. In the segments of the market which are more efficient e.g. large cap, the low cost (TER) of ETFs work to its advantage.

- Fund managers are humans and like any other human can make errors in judgement, which can the impact the performance of the schemes managed by them. Furthermore, change in fund manager can have an impact on the performance of an active scheme. There is no human or fund manager bias in ETF – they simply track the index.

Bajaj Finserv Nifty 50 ETF

Bajaj Finserv AMC has launched an ETF which will track the Nifty 50 index, Bajaj Finserv Nifty 50 ETF. The NFO is open for subscription till 18th January 2023. Nifty 50 Index commonly referred to as the Nifty, is the benchmark index that tracks the performance of portfolio of the 50 largest companies by market capitalization on the National Stock Exchange (NSE). Nifty is considered to be the bell weather for Indian stock markets. The index is diversified across 14 industry sectors.

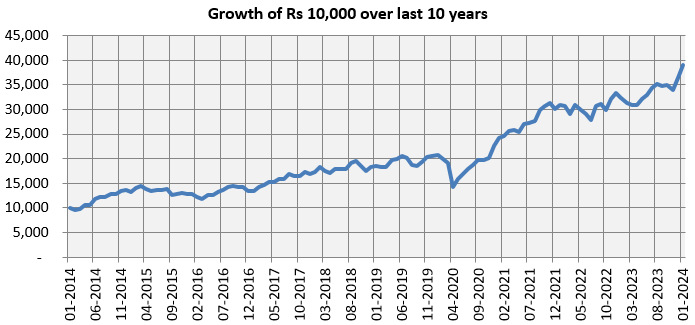

Performance of Nifty 50 TRI

Source: National Stock Exchange, as on 1st January 2023. Disclaimer: Past performance may or may not be sustained in the future.

Bajaj Finserv Bank Nifty ETF

Bajaj Finserv AMC is launching another ETF which will track the Bank Nifty index, Bajaj Finserv Nifty Bank ETF. This NFO is also open for subscription till 18th January 2023. Bank Nifty Index is comprised of the most liquid and large cap Indian Banking stocks. The Index comprises of maximum 12 public and private sector banks listed on NSE. The banking sector is one the most important sectors of any growing economy. The expanding middle class boosts demand for banking services, fostering growth. Initiatives like financial inclusion and digital banking support sector expansion. The NPA situation has improved considerably. The banking sector will play an important role in the long term India Growth Story. Historically, Bank Nifty has outperformed the broad market (e.g. Nifty).

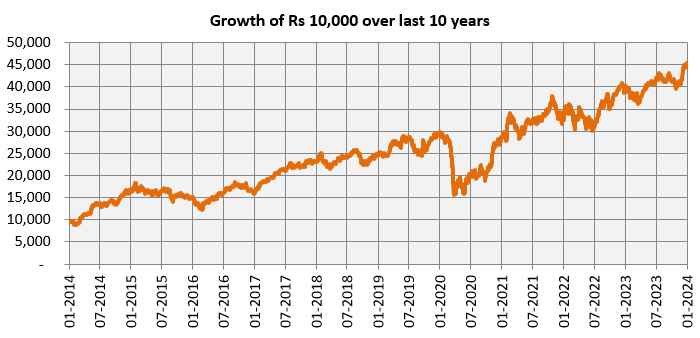

Performance of Bank Nifty TRI

Source: National Stock Exchange, as on 1st January 2023

Why invest in Bajaj Finserv Nifty 50 and Nifty Bank ETFs?

- Exposure to the largest blue chip companies (Nifty 50 ETF) and banks (Nifty Bank ETF) in India

- Lower cost compared to active funds

- Adequate liquidity through market makers – substantial orders can be fulfilled effortlessly

- Aim to keep low bid / ask spread and impact cost – lower trading costs.

- Uninterrupted algorithm powered quoting process

Who should invest in Bajaj Finserv Nifty 50 and Nifty Bank ETFs?

- Investors looking for capital appreciation over long investment tenures

- Investors with very high risk appetites

- Nifty 50 ETF – Investors who seek exposure to large cap stocks with diversification across multiple sectors.

- Nifty Bank ETF: Investors seeking to have single sector exposure in the large cap banking stocks.

While investing in Bajaj Finserv Nifty 50 and Nifty Bank ETFs:

- You should invest according to your risk appetite.

- You may choose any one or both the ETFs according to your risk appetite and investment needs

- You should have minimum investment tenure of 5 years

- You need to have Demat accounts if you want to invest in these ETFs

Investors should consult with their financial advisors if Bajaj Finserv Nifty 50 and / or Nifty Bank ETFs are suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Bajaj Finserv Limited ('Bajaj Finserv', 'BFS' or 'the Company') is a Core Investment Company (CIC) under RBI Regulations 2020 and the holding company for the various financial services businesses under the Bajaj Group. Its vision is to provide financial solutions for retail and SME customers through their life cycle - asset acquisition and lifestyle enhancement through financing, asset protection through insurance, family protection through life and health insurance, healthcare needs for the family, savings & investment products, wealth management, retirement planning and annuities. BFS, through its various businesses, provides these solutions to over 100 million customers.

Investor Centre

Follow Bajaj Finserv

More About Bajaj Finserv

POST A QUERY