Promising Start for Bajaj Finserv Large and Midcap Fund

Key Highlights

- Bajaj Finserv Large and Midcap Fund has given 15% absolute returns in just 3.5 months since inception (as on 14th June 2024)

- The fund has outperformed its benchmark index (Nifty Large Midcap 250 TRI) and the leading market index Nifty 50 TRI creating alphas for investors

- In terms of portfolio positioning fund is well balanced between large and midcap stocks, a prudent strategy in current market scenario

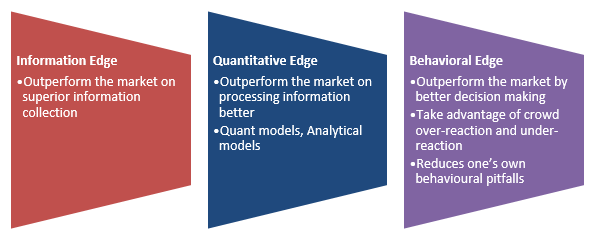

- Bajaj Finserv MF’s unique INQUBE investment philosophy which is based on superior information, quantitative models and investor behaviour can give this fund an edge over peers in the long term

- Fund uses a unique concept of ‘Economic Moat’ in deciding the asset allocation strategies.

Bajaj Finserv MF launched Bajaj Finserv Large and Midcap Fund earlier this year in February. The large and midcap fund was the second active equity fund offering by Bajaj Finserv MF after their flexicap fund. The fund is off to a good start giving 15% absolute return in just about 3.5 months (as on 14th June 2024). The AUM of the fund stood at Rs 981 crores, inching towards the Rs 1,000 crore mark as on 31st May 2024. We covered the NFO of this fund in our blog post, Bajaj Finserv Large and Midcap Fund NFO: Should you invest in a Large and Midcap Fund. In this article, we will discuss why the fund can be suitable investment option for long term investors, especially in the current market context.

Current market context

The market has recovered from the jolt of the Lok Sabha election results and is currently trading at record highs. Buy low and sell high is the mantra of investing. When the market is at all-time high, it is natural that investors may feel nervous. Over the last 1 year or so, we have seen huge inflows in midcaps especially from retail investors through mutual funds. In May 2024, AUM of midcap funds crossed AUM large cap funds for the first time in history. High demand for midcap stocks may have raised prices of these stocks, making investors nervous. Among global risk factors, the possible extent of US economic slowdown at the tail end of the current interest rate cycle can affect global risk sentiments.

Medium to long term outlook

India is in a macro sweet spot. India is expected to become the 3rd largest economy by 2027 (as per IMF’s forecasts). Our GDP grew by 8.2% in FY 2023-24 exceeding earlier forecasts. IMF is forecasting India’s GDP to grow by 6.8% in FY 2025, making it the fastest growing G-20 economy. India’s fiscal deficit in FY 2023-24 is estimated to be 5.8% and will be pared down to 5.1% in FY 2024 -25. Interest rates have peaked and the 10 year G-sec yield has been softening over the past year or so. The macros are favourable for a secular bull run for Indian equities in the long term.

Why invest in large and midcap funds?

- As per SEBI’s mandate for large and midcap funds, the scheme will invest in 35 to 65% in large cap stocks (top 100 stocks by market capitalization) and 35 to 65% in midcap stocks (101st to 250th stocks by market capitalization).

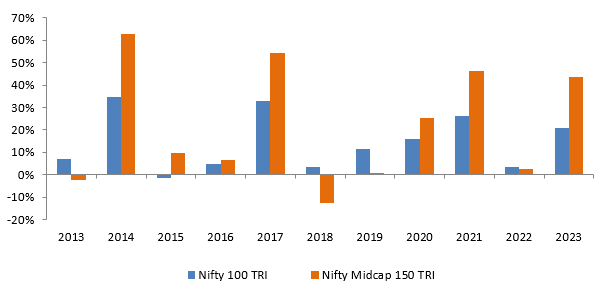

- Winners rotate across market cap segments (see the chart below). A diversified portfolio of large cap and midcap stocks can produce superior long-term returns, while reducing downside risks in volatile markets. Bajaj Finserv Large and Midcap Fund follows moat investing strategy (Quality-oriented) within the ambit of its INQUBE philosophy to generate performance.

Source: National Stock Exchange, Advisorkhoj Research; Period: 01.01.2013 to 31.12.2023. Disclaimer: Past performance may or may be sustained in the future

- Large and midcap funds provide wider exposure to industry sectors and stocks compared to market cap biased funds e.g. large cap funds, midcap funds. The sector exposure of these funds can benefit in the long term from the India Growth story and the structural reforms initiated by the Government.

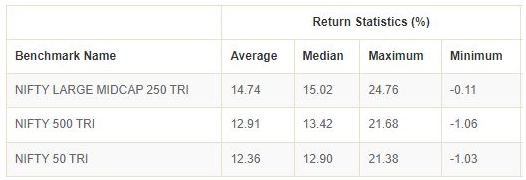

- Large and midcap index offer better risk return trade off compared to broad market indices like Nifty 50 and Nifty 500. 5 year rolling returns data over the last 15 years shows that Nifty Large Midcap 250 TRI outperformed Nifty 500 TRI and Nifty 50 TRI.

Source: Advisorkhoj Research; Period: 01.01.2009 to 31.05.2024. Disclaimer: Past performance may or may be sustained in the future

About Bajaj Finserv Large and Midcap Fund

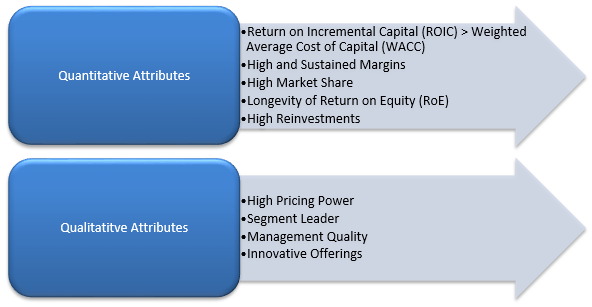

The scheme will invest in 40 – 60 large and midcap stocks of such companies that have long term and durable competitive advantage vis-à-vis their competitors, which Warren Buffet calls as economic moat advantage. Economic moat refers to a powerful and enduring competitive advantage with the following benefits:-

- Enduring Advantage

- Stability amid fluctuations

- Potential profitability

- Long-term growth

- Quality over size

Stock Selection Process: To select such companies that have:

Bajaj Finserv Investment Philosophy – INQUBE

Bajaj Finserv Large and Midcap Fund – Off to a very promising start

Nifty 50 is the bell weather of Indian stock market. If we want to evaluate the performance of any equity fund, then it is very natural that we will see how the fund performed versus Nifty. Though Bajaj Finserv Large and Midcap Fund is still a very young fund, it has outperformed the Nifty since its inception, as on 31st May 2024 (see the chart below). This certainly ticks a box when we evaluate the early performance of this young fund.

Source: Advisorkhoj Research; As on 31.05.2024. Disclaimer: Past performance may or may be sustained in the future

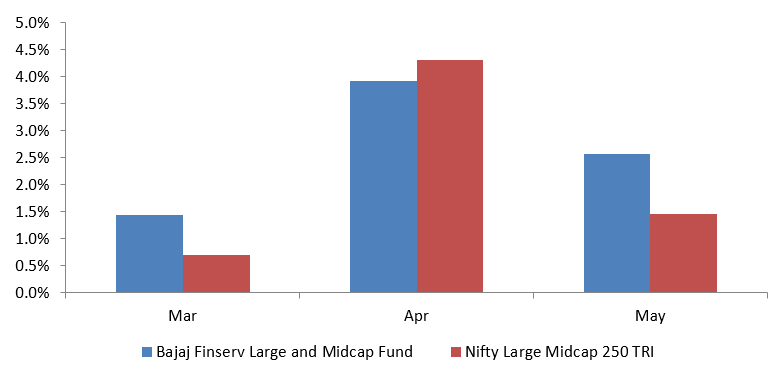

Outperformed the benchmark index in 2 out 3 months since launch

Source: Advisorkhoj Research; As on 31.05.2024. Disclaimer: Past performance may or may be sustained in the future

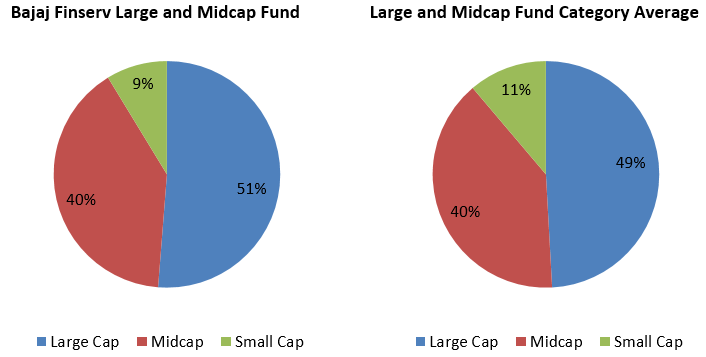

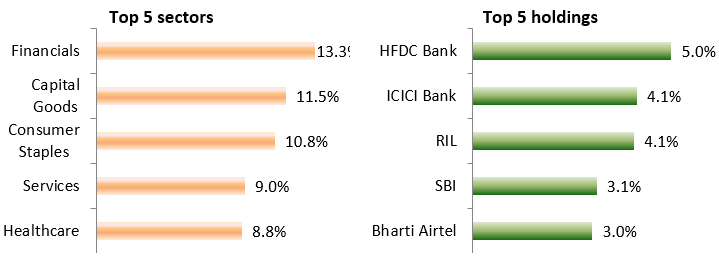

Current portfolio positioning – Well balanced between large and midcaps

The midcap asset allocation is in line with peers, while the large cap allocation is slightly higher and small cap allocation is slightly lower compared to peers’ average market cap allocations. The fund is well diversified across industry sectors and in terms of concentration risk – top 5 stocks comprise less than 20% of the total scheme portfolio asset value.

Source: Advisorkhoj Research, as on 31st May 2024

Source: Advisorkhoj Research, as on 31st May 2024

Why invest in Bajaj Finserv Large and Midcap Fund

Who should invest in Bajaj Finserv Large and Midcap Fund?

- Investors looking for capital appreciation and wealth creation.

- Investors having a 5 year plus investment horizon in this scheme.

- This fund can be suitable for new or first time investors

- Investors with very high risk appetite.

- Investors can invest in this scheme either through lump sum or SIP depending on your investment needs.

Investors should consult with their financial advisors or mutual fund distributors if Bajaj Finserv Large and Midcap Fund will be suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Bajaj Finserv Limited ('Bajaj Finserv', 'BFS' or 'the Company') is a Core Investment Company (CIC) under RBI Regulations 2020 and the holding company for the various financial services businesses under the Bajaj Group. Its vision is to provide financial solutions for retail and SME customers through their life cycle - asset acquisition and lifestyle enhancement through financing, asset protection through insurance, family protection through life and health insurance, healthcare needs for the family, savings & investment products, wealth management, retirement planning and annuities. BFS, through its various businesses, provides these solutions to over 100 million customers.

Investor Centre

Follow Bajaj Finserv

More About Bajaj Finserv

POST A QUERY