How to ride market volatility through SIPs

Equities have rebounded strongly after a period of volatility in September and October 2023 caused by uncertainty about interest rates. When markets turn volatile some investors may be beset with doubts whether to keep investing or wait for the correction to get over. With positive signals coming from the US Federal Reserve on the trajectory of future interest rates, the equity markets bounced back in November and December 2023. In the FOMC meeting held in December, the Fed indicated multiple interest rate cuts in 2024 and the S&P 500 index in the US closed the year 2023 near its all time high. In January 2024, Bloomberg proposed that Indian G-Secs be included in Bloomberg Emerging Markets Bond Index. This is the second EM bond index where Indian G-Secs will be included, the first being JP Morgan EM Index. The Nifty and the Sensex also closed Calendar Year 2023 at their all time high.

For SIP investors there should be no doubts whether to invest in up markets or down markets. SIP is a disciplined way of investing in equities at different market levels. It is not important at what level you invest. In this article, we will discuss scenarios of investing in up markets or down markets.

SIP when market is going up

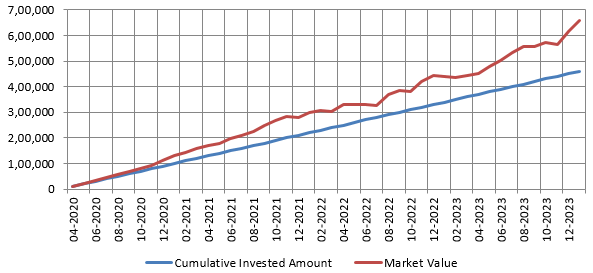

Investors may face the dilemma of whether to continue their SIPs when market is going up; should I buy at higher and higher prices? While the market may be at its all time high, do you know how much further market will rise? The chart below shows the growth of Rs 10,000 monthly SIP in Nifty 50 TRI from 1st April 2020 to 29th December 2023. Barring a few months from October 2021 to July 2022 during Russia’s invasion of Ukraine, the market was mostly rising. Let us see the growth of the SIP from April 2020 to December 2023.

Source: National Stock Exchange, Advisorkhoj Research. Period: 01/04/2020 to 01/01/2024. Disclaimer: Past performance may or may not be sustained in the future. The above illustration is purely for investor education purposes and not indicative of investment returns.

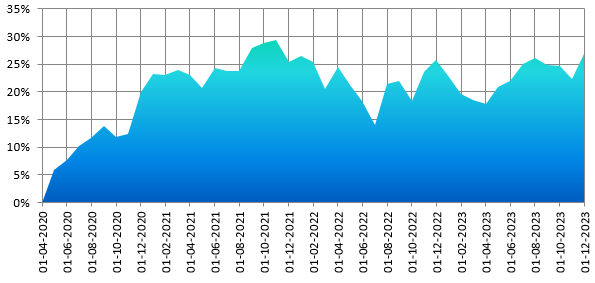

Let us now see, whether your risk increases or decreases if you are investing through SIP in rising markets. To understand this, let us introduce a concept called margin of safety. Margin of safety is the percentage by which the asset, Nifty 50 TRI in this case, will have to fall for you to make a loss in your SIP investment.

The chart below shows the margin of safety of your SIP investment over the same period. You can see that over this investment period, your margin of safety generally kept rising. As on 31st December 2023, Nifty will have fall by more than 30% for you to make a loss. Just to put this in context, the only time in the last 15 years when Nifty fell by more than 30%, was just after the outbreak of the COVID-19 pandemic. You can see that despite buying at higher and higher prices, your risk of making an actual loss actually kept declining. Why does the margin of safety in SIP improve over time in rising markets? This is because the gap between current market price and your average cost of acquisition increases over time.

Source: National Stock Exchange, Advisorkhoj Research. Period: 01/04/2020 to 01/01/2024. Disclaimer: Past performance may or may not be sustained in the future. The above illustration is purely for investor education purposes and not indicative of investment returns.

SIP when market is going down

This is the scenario in which many investors tend to panic. When you see your investment fall in value, you may be scared to invest more and may even consider stopping your SIP. However, stopping your SIP is counter-productive to your financial interest. When market is falling, your SIP enables you to acquire more units at the same cost. Units acquired at lower NAVs will give higher returns when the market eventually recovers. We will illustrate this by continuing with our previous example.

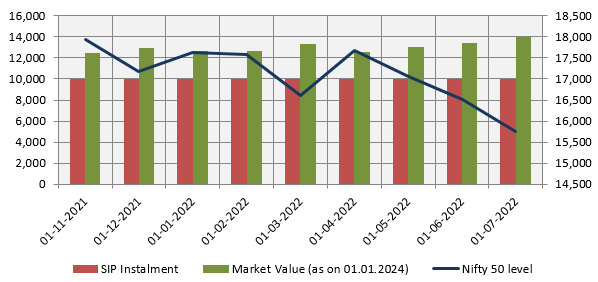

Let us the see the results of our Rs 10,000 monthly SIP in Nifty 50 TRI for investments made in the period from 1st November 2021 to 1st July 2022. During this period Nifty fell by nearly 15% due to the concerns of Fed Tapering, outbreak of high infectious Omicron strain of COVID and Russia’s invasion of Ukraine in February 2022. The chart below shows the current value (as on 29th September 2023) of units purchased with each monthly SIP instalment from November 2021 to July 2022. You can see that despite the sharp correction, all the SIP instalments grew in value. Further observe that lower Nifty falls, higher is your growth. The reason is very simple – lower your cost, higher your profits.

Source: National Stock Exchange, Advisorkhoj Research, as on 1st January 2024. SIP Period: 01/11/2021 to 01/07/2022. Disclaimer: Past performance may or may not be sustained in the future. The above illustration is purely for investor education purposes and not indicative of investment returns.

What you should do in volatile markets?

Markets have turned volatile over the past one month or so. Should you stop your SIP and wait for the correction to be over? At what level will the market bottom out? These questions should be irrelevant for SIP investors. SIPs make market timing irrelevant by averaging out your cost of acquisition. SIPs are designed to help you navigate the highs and lows, and average your costs. When markets rise, your SIP instalment will buy less; when market dips, your SIP instalment will buy more. Do not stop your SIPs due to market levels or movements. In market corrections, SIPs take advantage of volatility by bringing down the average cost of acquisition of your mutual fund units which will boost your portfolio returns over long investment tenures. Remain disciplined in your SIPs to create wealth over long investment horizons.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Bajaj Finserv Limited ('Bajaj Finserv', 'BFS' or 'the Company') is a Core Investment Company (CIC) under RBI Regulations 2020 and the holding company for the various financial services businesses under the Bajaj Group. Its vision is to provide financial solutions for retail and SME customers through their life cycle - asset acquisition and lifestyle enhancement through financing, asset protection through insurance, family protection through life and health insurance, healthcare needs for the family, savings & investment products, wealth management, retirement planning and annuities. BFS, through its various businesses, provides these solutions to over 100 million customers.

Investor Centre

Follow Bajaj Finserv

More About Bajaj Finserv

POST A QUERY