Bajaj Finserv Savings Plus: Highly convenient option for getting higher returns from your idle funds

Key Highlights:

- Most retail investors keep funds idle in their savings bank account.

- The interest on savings bank account bank account balances are lower than the inflation rate

- Bajaj Finserv Savings+ provides convenient and more productive option for parking your surplus / idle funds

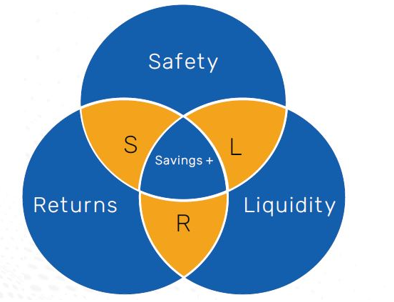

- High degree of capital safety, liquidity and instant (within seconds) redemption facility for redemptions up to Rs 50,000.

Many investors have substantial amounts lying idle in their savings bank accounts – as on 14th June 2024, र 25,35,399 Crores were deployed in savings and current account. Interest on savings bank balance is currently around 3%. Savings bank interest is taxable under the head “Income from other sources”. On a post tax basis, the yield on your savings bank balances is around 2% (for investors in the highest tax brackets). If we compare this with the CPI inflation rate (5.08% in June 2024, as per Ministry of Statistics and Programme Implementation, GOI) then the real rate of return is negative. Mutual funds provide solutions for deploying your idle funds for different investment tenures.

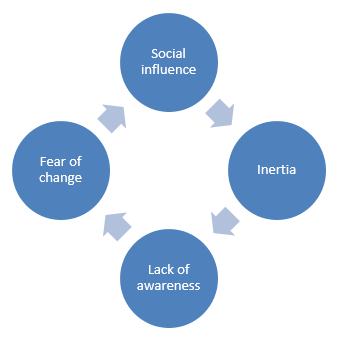

Why are investors not finding alternatives for their idle funds?

In India, we have savings mindset since ancient times. However, this needs to get changed to an investment mindset. There are several reasons why investors continue to keep their idle funds in savings accounts:-

Liquid funds as alternatives to savings bank

Liquid funds are debt mutual fund schemes invest primarily in money market instruments like treasury bills, certificate of deposits, commercial papers, treasury bills etc, that have a residual maturity of less than or equal to 91 days, with the objective of providing investors an opportunity to earn more returns on very short term deposits, high degree of capital safety and liquidity.

Why you should park your idle money in liquid funds?

- Current yields: Yields of 91 day Treasury Bills at 6.78% (source: RBI, as on 5th July 2024) are versus savings bank interest rate of just 3% (source: 3%). Yields of 1 month and 3 months Commercial Papers and Certificates of Deposit are 6.7 – 7.2% (source: CRISIL). You can get much better returns on the idle funds lying in your savings bank account by investing them in liquid funds.

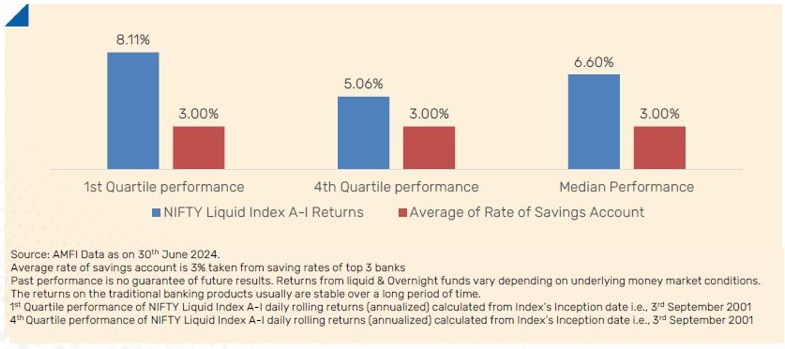

- Historical liquid fund returns are higher than savings bank accounts: 94.0% of times NIFTY Liquid Index A-I* has shown an outperformance compared to a savings account return within a span of more than 22yrs* (see the chart below).

- Liquidity: Since liquid funds invest in papers which mature within 3 months they have high liquidity. Moreover as per SEBI’s circular on risk management framework for liquid and overnight funds (2019), liquid funds must hold 20% of their assets in liquid assets (i.e. assets which can be very quickly converted in cash e.g. are TREPs, CBLOs, T-Bills, G-Secs and repos on G-Secs).

- High degree of safety: Since liquid funds invest in very short maturity instruments, the price sensitivity of these instruments to interest rate changes is extremely low. In other words, liquid funds have low interest rate risk. SEBI has also initiated some regulatory measures to reduce the credit risk in liquid funds. SEBI has mandated that 20% of the AUM of liquid funds will be held in risk-free instruments like G-Secs, T-Bills, TREPs, etc. Among other papers, SEBI has also capped exposure to single sectors at 20%.

Despite these obvious benefits investors deprive themselves of availing them because of the reasons mentioned above

A solution – Bajaj Finserv Savings+

How does Bajaj Finserv Savings+ work?

Bajaj Finserv Savings+ which addresses the concerns which retail investors have with regards to their savings:-

- WHAT IS IT: Savings+ is a unique product which allows retail investors to manage their idle money smartly

- WHAT DOES IT DO: It helps retail investors determine the surplus cash available in their savings account and invest it into Bajaj Finserv’s Liquid & Overnight Funds

- COMPETITIVE RETURNS: Liquid funds have generated 7.17%* return as compared to 3% in Savings accounts

- EASE OF WITHDRAWAL: Investors can instantly redeem up to Rs 50,000 within a few seconds. The funds will be credited to your savings bank account

Source: *Liquid Fund Category Average Reg-Growth from 1st July 23rd to 30th June 24 Source: ICRA MFI

Sweep-in facility through Account Aggregator

Several banks provide sweep-in facility whereby the excess amount in your savings bank account is swept into a Fixed Deposit to enable investors to get higher interest rates of their investments. Bajaj Finserv Mutual Fund also offers sweep-in facility for Bajaj Finserv Savings+ product, through which excess amounts lying in your savings bank account can be transferred to your Bajaj Finserv Savings+ account. To enable this Bajaj Finserv has tied with Perfios which is a digital platform providing account aggregator services. Account aggregators like Perfios are digital platforms which have access to your financial information and acts like your financial dashboard.

To sign up with Perfios, you need to open your Bajaj Finserv Savings+ account on Bajaj AMC portal. Once you enter your mobile number and validate it with via a One-Time Password (OTP), Perfios pulls up the basic details of all your bank accounts where your number is registered. You can link anyone of your existing savings bank accounts to Savings+ account. You will be prompted about the extra funds you have in your account based on analysis of last 6 months bank statements. You can change the amount, if you want to invest a lower or higher amount. You can then decide which scheme you want to invest in and transfer the excess funds into your Savings plus account.

Why park your idle funds in Bajaj Finserv Savings+?

- Smart and disciplined way of managing idle money

- Bajaj Finserv’s Liquid and overnight funds provide high degree of capital safety and liquidity, along with higher yields compared to savings bank account

- No minimum balances and hidden charges unlike traditional banking services

- Allows investment for different time horizons

- Flexible like a lumpsum with SIP-like discipline

- End-to-end digitally enabled

- Instant Redemption in under a few seconds

Investors should consult their financial advisors or mutual fund distributors if Bajaj Finserv Savings+ is suitable for parking their idle funds.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Bajaj Finserv Limited ('Bajaj Finserv', 'BFS' or 'the Company') is a Core Investment Company (CIC) under RBI Regulations 2020 and the holding company for the various financial services businesses under the Bajaj Group. Its vision is to provide financial solutions for retail and SME customers through their life cycle - asset acquisition and lifestyle enhancement through financing, asset protection through insurance, family protection through life and health insurance, healthcare needs for the family, savings & investment products, wealth management, retirement planning and annuities. BFS, through its various businesses, provides these solutions to over 100 million customers.

Investor Centre

Follow Bajaj Finserv

More About Bajaj Finserv

POST A QUERY