Bajaj Finserv Nifty Next 50 Index Fund: Low cost investment in emerging leaders

Bajaj Finserv Mutual Fund has launched a new passive fund offer, Bajaj Finserv Nifty Next 50 Index Fund. Nifty Next 50 comprises of 51st to 100th stocks by market capitalization. Nifty Next 50, along with Nifty 50 represents the universe of large cap stocks in India. While Nifty 50 and Sensex are the two most popular benchmark indices for passive funds, Nifty Next 50 provides the opportunity to invest in large cap stocks which are not part of Nifty 50 or the Sensex. In this article we will review Bajaj Finserv Nifty Next 50 Index Fund NFO. The NFO will open for subscription on 22nd April 2005 and will close on 6th May 2005.

Why invest in Nifty Next 50 Index?

- Nifty Next 50 index constituents are all large cap stocks. Investment in Nifty Next 50 will provide the stability of large caps to your portfolio.

- Nifty 50 stocks are leaders in their respective industry sectors. Nifty Next 50 has served as a stepping stone, with 44 of its stocks making their way into Nifty 50 over the past 15 years. Nifty Next 50 stocks have significant revenue and EPS growth potential.

- Nifty Next 50 Index provides exposure to unique industries that are not present in Nifty 50 e.g., Consumer Electronics, Airlines, Auto Components & Equipment, E-commerce, General Insurance, Breweries & Distilleries, Personal Care, Diversified Retail, Heavy Electrical Equipment etc. Nifty Next 50 Index can provide richer diversification to your portfolio, presenting unique growth opportunities in the long-term.

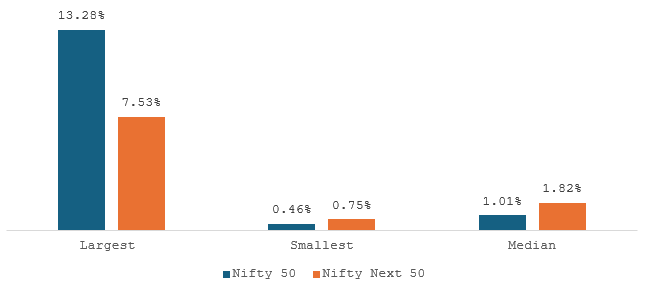

- Nifty Next 50 provides more balanced exposure to different index constituents (underlying stocks) – lower concentration risk, despite having the same number of stocks.

Source: NSE, as on 28th February 2025

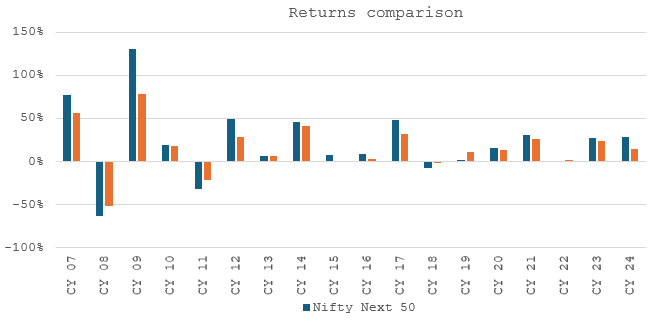

- Nifty Next 50 outperformed average large cap stocks in most years. Nifty Next 50 outperformed average large cap stocks in most years.

Source: NSE, as on 28th February 2025

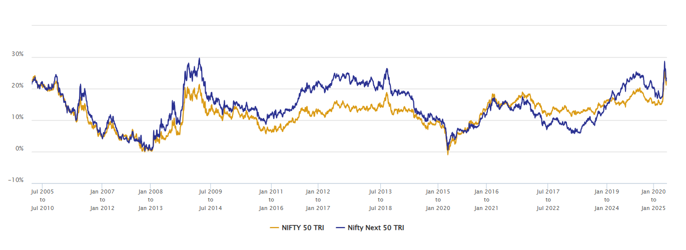

- Nifty Next 50 has given relatively steady returns in the long term. The chart below shows the 5 year rolling returns of Nifty Next 50 TRI versus Nifty 50 TRI over the last 20 years. You can see that returns barely ever dipped below zero. You can also see that the Nifty Next 50 TRI outperformed Nifty 50 TRI for most periods.

Source: Advisorkhoj Research, as on 31st March 2025

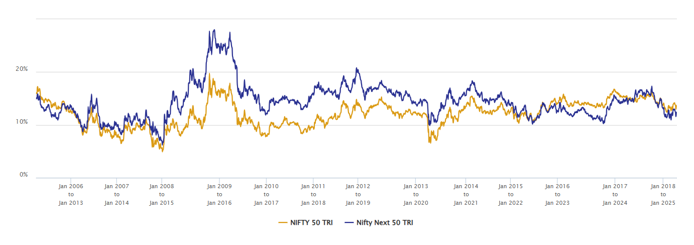

- The chart below shows the 7 year rolling returns of Nifty Next 50 TRI versus Nifty 50 TRI over last 20 years. You can see that the returns were always positive and outperformance of Nifty Next 50 TRI was even more consistent.

Source: Advisorkhoj Research, as on 31st March 2025

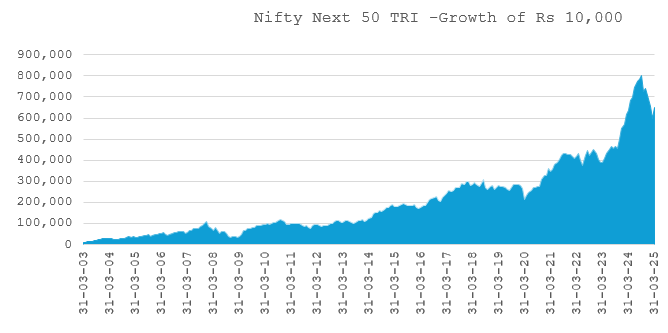

Wealth creation track record

The chart below shows the growth of Rs 10,000 investment in Nifty Next 50 TRI over the last 22 years. Your investment would have grown at a CAGR of 20.9% to nearly Rs 6.5 lakhs.

Source: Advisorkhoj Research, as on 31st March 2025

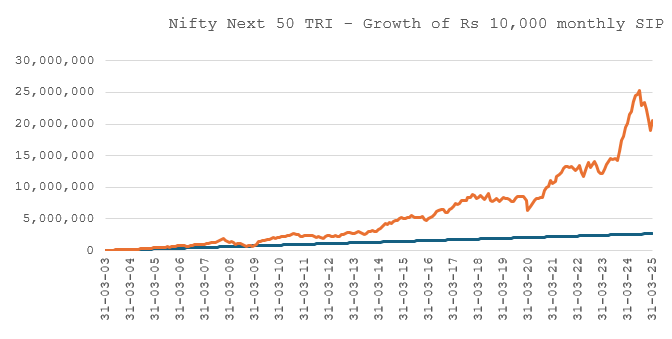

Suitable for SIP

The chart below shows the growth of Rs 10,000 monthly SIP in Nifty Next 50 TRI over the last 22 years. With a cumulative investment of Rs 26.5 lakhs you could have accumulated a corpus of Rs 2.05 crores.

Source: Advisorkhoj Research, as on 31st March 2025

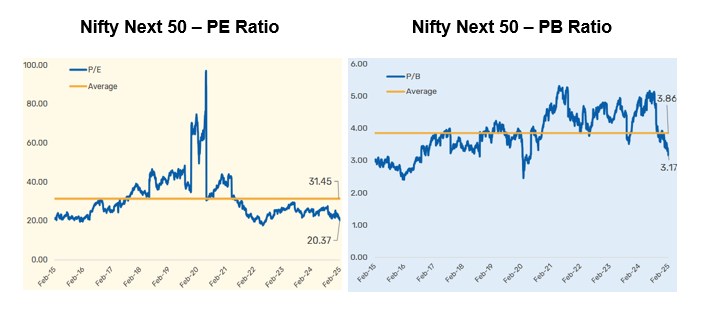

Why invest in Nifty Next 50 TRI now?

- Valuations are attractive after the recent correction. Currently Nifty Next 50 PE and PB ratios are both below their historical average

Source: NSE, Bajaj Finserv MF, as on 28th February 2025

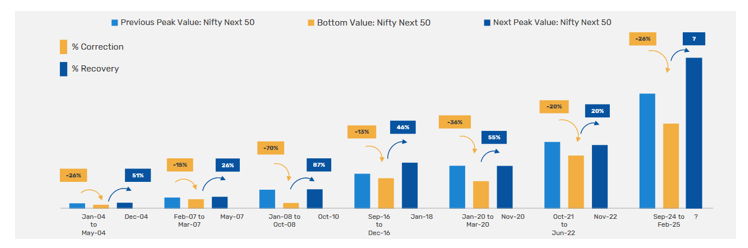

- Deep corrections in the past have been followed by strong recovery. Nifty Next 50 had a drawdown of more than 25% from its 52-week high to the market bottom. Even though market has recovered from the lows, it is still much below the 52-week high.

Source: NSE, Bajaj Finserv MF, as on 28th February 2025

Why invest in Nifty Next 50 TRI now?

- Invest in high growth companies that have historically been stepping stones to Nifty 50

- Low-cost investment

- No fund manager bias

- Focus on delivering a disciplined passive investment strategy, aligning with long-term wealth creation goals

- You do not need demat and broking account to invest in Bajaj Finserv Nifty Next 50 Index Fund

- You can invest in Bajaj Finserv Nifty Next 50 Index Fund from your savings account through Systematic Investment Plan

Who should invest in Bajaj Finserv Nifty Next 50 Index Fund?

- Investors seeking capital appreciation over long investment tenures

- Investors who invest in the large cap stock exposure

- Investors having a long-term investment horizon (minimum 5 years)

- Investors with high-risk appetite

- Investors can invest in lump sum or SIP depending on their investment needs

- Investors do not need demat accounts to invest in this fund

Investors should consult their financial advisors or mutual fund distributors if Bajaj Finserv Nifty Next 50 Index Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Bajaj Finserv Limited ('Bajaj Finserv', 'BFS' or 'the Company') is a Core Investment Company (CIC) under RBI Regulations 2020 and the holding company for the various financial services businesses under the Bajaj Group. Its vision is to provide financial solutions for retail and SME customers through their life cycle - asset acquisition and lifestyle enhancement through financing, asset protection through insurance, family protection through life and health insurance, healthcare needs for the family, savings & investment products, wealth management, retirement planning and annuities. BFS, through its various businesses, provides these solutions to over 100 million customers.

Investor Centre

Follow Bajaj Finserv

More About Bajaj Finserv

POST A QUERY