Bajaj Finserv Nifty 50 Index Fund: Low cost investment in market leaders

Bajaj Finserv Mutual Fund has launched a new passive fund offer, Bajaj Finserv Nifty 50 Index Fund. Nifty 50 or simply Nifty (as it is popularly referred to) is the leading equity market index of India. It is considered to be the barometer of Indian stock market. Nifty movement usually represents market sentiment – bullish or bearish. Nifty 50 is one of the most popular benchmark indices for passive funds (ETFs and index funds). Bajaj Finserv Nifty 50 Index Fund NFO will open for subscription on 25th April 2005 and will close on 9th May 2005.

The case for Indian equities

India is the 5th largest economy in the world (source: World Bank). IMF forecasts India to be the 3rd largest economy by 2030. India aims to become a $5 Trillion. Since 2000, India has attracted more $1 Trillion of Foreign Direct Investments (source: Ministry of Commerce and Industry, 12th December 2024). With shifts in global trade, India has the potential of becoming an even more attractive destination for FDI and Foreign Portfolio Investments (FPI).

Why invest in Nifty 50?

- Nifty 50 represents the pulse of Indian market

- Nifty 50 contributes 53% to the market capitalization of Nifty 500 (top 500 companies by market capitalization)

- Nifty 50 contributes 41% to net profits of Nifty 500

- Nifty 50 companies are industry leaders

- Nifty 50 companies are top contributors in terms of employment generation

- FIIs prefer Nifty 50 companies for their governance, liquidity, and growth and may reinvest in these companies as markets recover

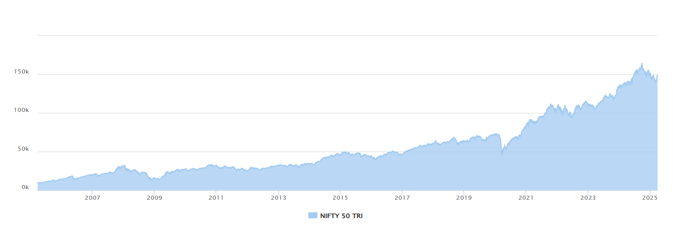

- Rs 10,000 invested in Nifty 50 TRI has multiplied 15X in the last 20 years. Nifty 50 TRI has given 14.42% CAGR returns in the last 20 years.

Source: NSE, Advisorkhoj, as on 31st March 2025

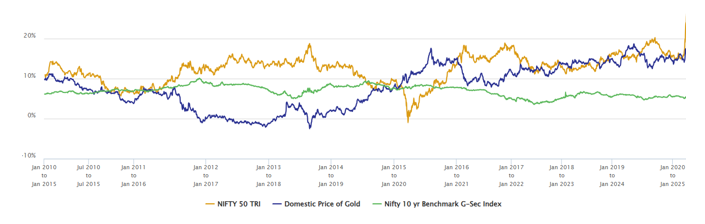

- Post 2008 Global Financial Crisis, Nifty 50 has outperformed other asset classes e.g. Fixed Income, Gold etc over long investment tenures. The chart below shows the 5 year rolling returns (rolled daily) of Nifty 50 TRI versus Domestic Price of Gold (MCX Spot Prices) and Nifty 10-year Benchmark G-Sec Index since 1st January 2010.

Source: NSE, MCX, Advisorkhoj, as on 31st March 2025

Why is this a good time to invest in Nifty 50?

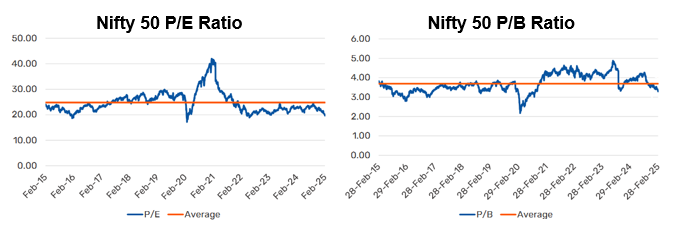

- Valuations are attractive after the recent correction. Currently Nifty Next 50 PE and PB ratios are both below their historical average.

Source: NSE, Bajaj Finserv MF, as on 28th February 2025

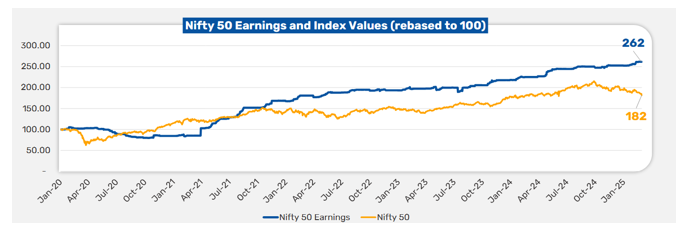

- Despite the correction, strong earnings and a widening valuation gap (see the chart below) create a suitable investment opportunity in Nifty 50 Index for long-term investors.

Source: NSE, Bajaj Finserv MF, as on 28th February 2025

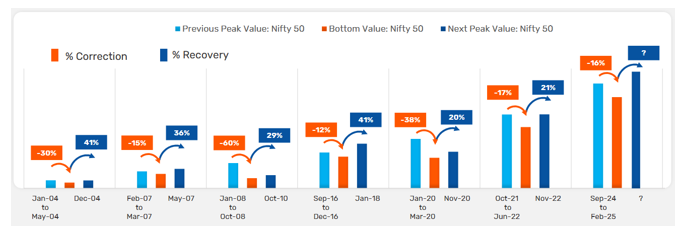

- Deep corrections in the past have been followed by strong recovery. Nifty 50 had a drawdown of more than 15% from its 52-week high to the market bottom. Even though market has recovered from the lows, it is still much below the 52-week high.

Source: NSE, Bajaj Finserv MF, as on 28th February 2025

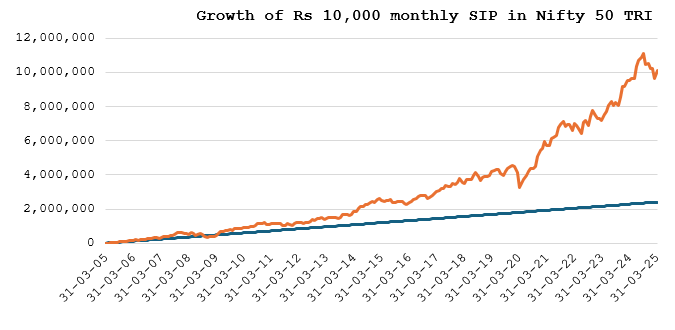

Suitable for SIP

The chart below shows the growth of Rs 10,000 monthly SIP in Nifty 50 TRI over the last 20 years. With a cumulative investment of Rs 24.1 lakhs you could have accumulated a corpus of Rs 1.02 crores.

Source: NSE, Advisorkhoj, as on 31st March 2025

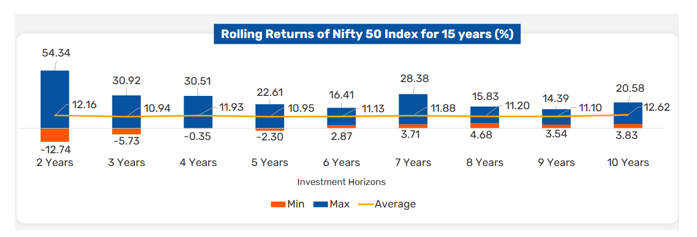

Relatively more stable returns in the long term

The chart below shows the average, maximum and minimum rolling returns of Nifty 50 for different investment tenures over the last 15 years. You can see that Nifty did not give negative returns beyond 5 years holding period

Source: Bajaj Finserv MF, as on 28th February 2025

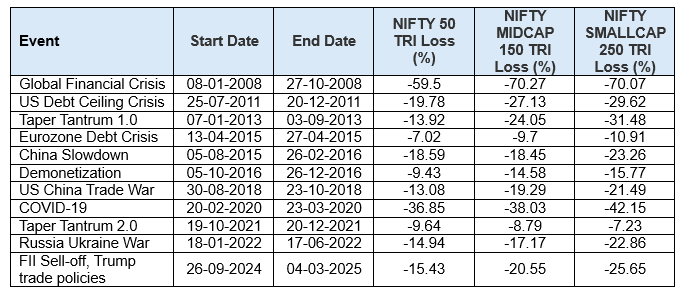

Relatively smaller drawdowns

The table below shows the major market drawdowns in the last 20 years. You can see Nifty experienced smaller drawdowns compared to other market indices.

Source: Bajaj Finserv MF, as on 31st March 2025

Why invest in Bajaj Finserv Nifty 50 Index Fund?

- Relatively lower expense ratio than actively managed funds

- No fund manager bias and minimal intervention

- Focus on delivering a disciplined passive investment strategy, aligning with long-term wealth creation goals

- You do not need demat or trading accounts to invest in this fund

- You can invest from your regular saving through Systematic Investment Plan (SIP).

Who should invest in Bajaj Finserv Nifty 50 Index Fund?

- Investors seeking capital appreciation over long investment tenures

- Investors who invest in the large cap stock exposure

- Investors having a long-term investment horizon (minimum 5 years)

- Investors with high-risk appetite

- Investors can invest in lump sum or SIP depending on their investment needs

- Investors do not need demat accounts to invest in this fund

Investors should consult their financial advisors or mutual fund distributors if Bajaj Finserv Nifty 50 Index Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Bajaj Finserv Limited ('Bajaj Finserv', 'BFS' or 'the Company') is a Core Investment Company (CIC) under RBI Regulations 2020 and the holding company for the various financial services businesses under the Bajaj Group. Its vision is to provide financial solutions for retail and SME customers through their life cycle - asset acquisition and lifestyle enhancement through financing, asset protection through insurance, family protection through life and health insurance, healthcare needs for the family, savings & investment products, wealth management, retirement planning and annuities. BFS, through its various businesses, provides these solutions to over 100 million customers.

Investor Centre

Follow Bajaj Finserv

More About Bajaj Finserv

POST A QUERY