Bajaj Finserv Multi Cap Fund: Combining a Contrarian strategy in Multi Cap Investment

The Bajaj Finserv AMC has launched a New Fund Offer - the Bajaj Finserv Multi Cap Fund on the 6th of February & the NFO will remain open till the 20th of February 2025. The Bajaj Finserv Multi Cap Fund, an equity fund will invest across market cap segments with a contrarian investment strategy. In this article we shall review the Bajaj Finserv Multi Cap Fund.

What is contrarian investing?

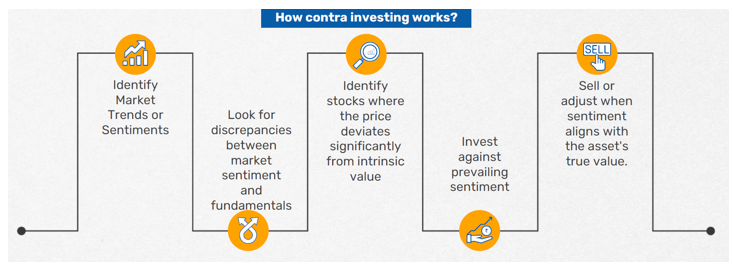

Contrarian investing goes against market trends to find undervalued opportunities, leveraging inefficiencies for long-term gains. Contrarian strategy involves investing in mispriced assets caused by emotion-driven market behaviours like panic-driven sell-offs, recession fears, and regulatory setbacks that drive the stock prices below the intrinsic value. The stocks are then sold or adjusted when market sentiments align with the assets true value. Since contrarian investors buy stocks at deep discounts relative to their intrinsic value, they can get good returns in the long term.

Source: Bajaj Finserv Asset Management Company

Current Market context

The volatility that started in September 2024 continued throughout January 2025, with the Union Budget approaching. Even though the Union Budget FY26 was like an elixir directed at easing the tax burden especially for the middle class with a probability of giving a boost to consumption, markets kept falling after Trump’s trade tariff announcements that may potentially start a trade war. With RBI’s Monetary Policy scheduled for February and the uncertainties around global macro economical forces, markets could still remain volatile in the H1 of the current year. This market condition presents the opportunity to invest across market caps with contra strategy to earn potential alphas.

The nature of Equity Markets

A balanced approach to investing across the market cap can provide a diversified portfolio for investors, since:

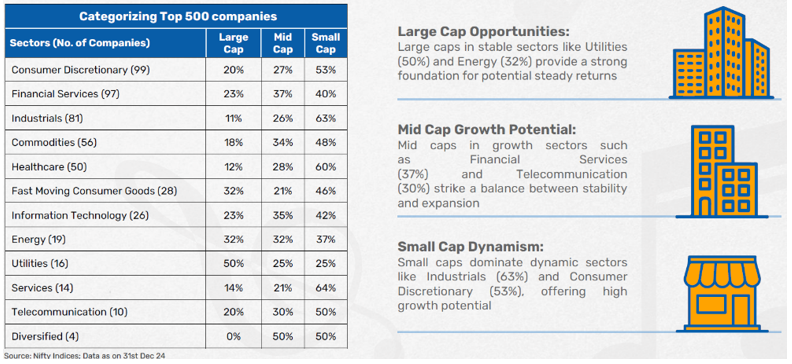

- Opportunities for investment are spread across market cap:

Source: Bajaj Finserv Asset Management Company

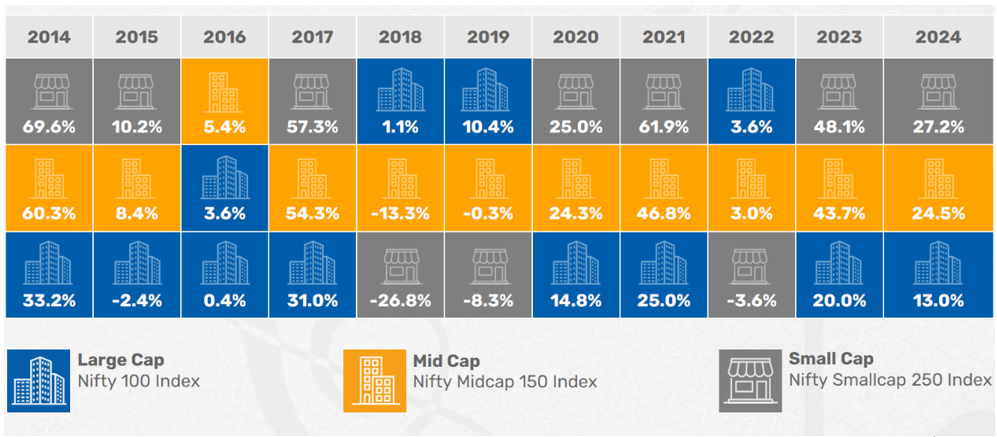

- Winners keep rotating between market cap segments depending on market conditions / investment cycles.

Source: Bajaj Finserv AMC. ICRA MFI Data as on 31st Dec 24. Disclaimer: Past performance may or may not be sustained in future

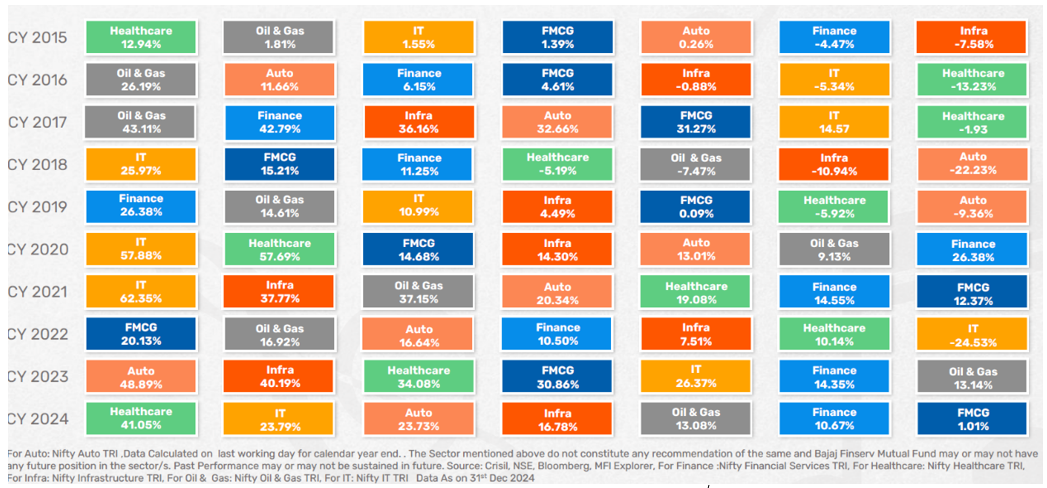

- Winners continually rotate among various sectors, making broad sector exposure an important factor to consider, when aiming to enhance opportunities

Source: Bajaj Finserv Asset Management Company

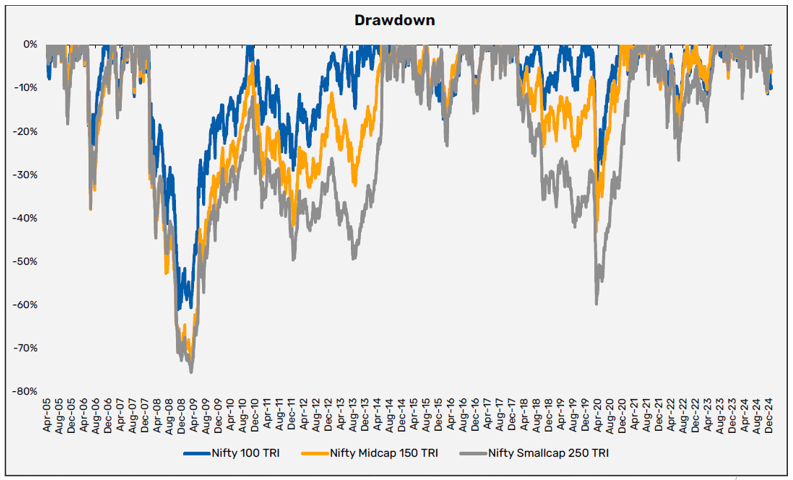

Drawdown analysis of Large, Mid and Small Cap companies

- Large caps tend to fall less during market corrections, offering greater stability and resilience to a portfolio.

- Mid-caps strike a balance between growth potential and moderate drawdowns, making them ideal for capital appreciation in the long term.

- Small caps, while experiencing higher drawdowns, offer exceptional recovery potential and opportunities for exponential long-term growth as compared to large and mid-caps.

The chart below illustrates the drawdown of the broad indexes in the last two decades. (Nifty 100 TRI representing the Large Cap, the Nifty Midcap 150 TRI, representing the Midcap segment and the Nifty Smallcap 250 TRI to represent the small cap segment)

Source: ICRA MFI & Internal Analysis, As on 31st December 24 | Past performance may or may not be sustained in future

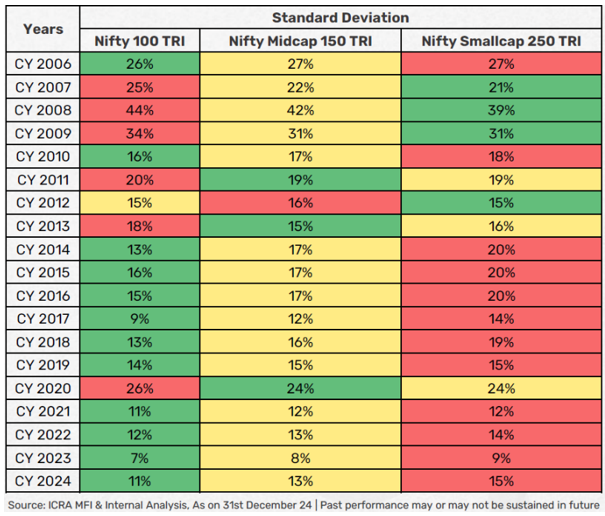

Volatility Analysis: Large, Mid and small Caps.

- Large caps exhibit lower volatility, providing a stable foundation and consistent performance for risk-averse investors.

- Mid-caps offer moderate volatility, delivering an optimal blend of stability and growth opportunities for a balanced portfolio.

- Small caps, with higher volatility, present dynamic opportunities to capitalize on market trends and achieve superior long-term returns.

Why contra is a good strategy in volatile markets?

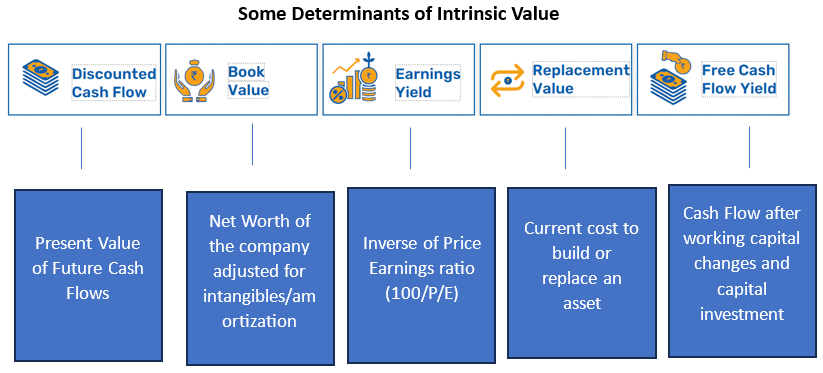

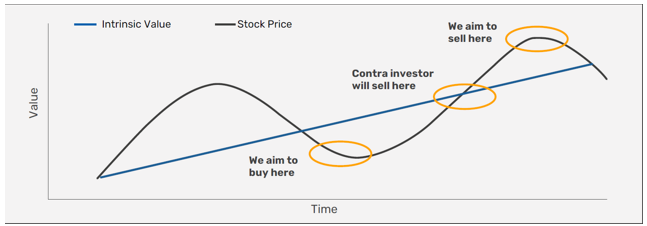

Contrarian investment involves going against the market trends or the sentiments of the majority of investors and try to buy stocks which have been neglected. In markets near its highs, contra funds can buy stocks with strong earnings growth potential at relatively low prices. Since these are usually stocks, which are underappreciated and trading at low prices, they are relatively less affected by volatility. Once the stock is able to unlock its growth potential, it can create high alphas for investors. A critical aspect of contra investing is the intrinsic value of an asset. Intrinsic Value is an asset's true worth based on fundamentals, not market price.

Margin of Safety is the gap between an asset's intrinsic value and market price, minimizing risk and boosting returns.

Source: Bajaj Finserv Asset Management Company

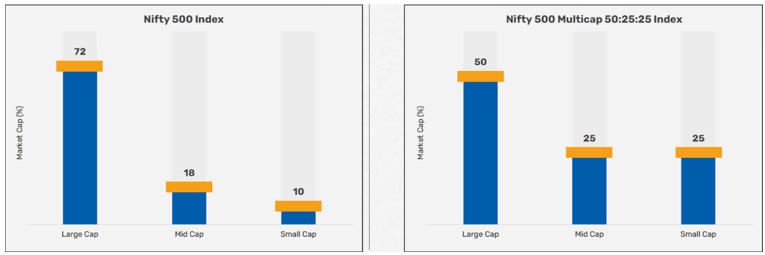

Why invest in Multicap funds

Indian equity markets are driven by a diverse mix of large, mid, small, and micro-cap companies, highlighting the value of broad exposure. As per SEBI’s mandate a multi cap fund should invest minimum 25% of their assets in each of the three market capitalization segments i.e. minimum 25% in large cap (top 100 stocks by market cap), minimum 25% in midcap (101st to 250th stocks by market cap) and minimum 25% in small cap (251st to 500th stocks by market cap). A Multicap strategy is a good investment since:

- A balanced combination of large, mid and small cap companies offers investors a diversified and growth-oriented approach to portfolio construction. The chart below shows the allocation across the market capitalisation of the broad market Nifty 500 index vis-vis the Nifty 500 Multicap 50:25:25 benchmark. The multi cap benchmark has a balanced exposure of large, mid and small cap companies.

Source: ICRA MFI & Internal Analysis, as on December 31, 2024

Why aim for a Contrarian strategy in Multi Cap investment?

Combining contrarian and Multi cap strategy has its benefits and can potentially generate alphas even in volatile markets for the following reasons:

Rule-Based Allocation: The SEBI-mandated 25% allocation across Large, Mid, and Small Caps will ensure a disciplined framework, providing equal opportunities to discover contrarian ideas across all market cap segments.

Covers Diverse Contrarian Themes: A Multi Cap Fund employing a contrarian strategy can capitalize on themes like the business cycle, special situations, turnarounds, and undervalued stocks, ensuring a holistic and diversified approach to investing.

Maximizes Market Cycles: The Multi Cap structure in a Fund will ensure the flexibility to align with evolving market dynamics, whether it’s undervalued large caps in a downturn or high-growth small caps during a recovery.

Superior Long-Term Growth: The ability to mix contrarian insights with disciplined exposure across market caps positions a Multi Cap Fund to deliver healthy long-term returns, leveraging under-priced opportunities others may overlook.

Bajaj Finserv Multi Cap Fund

Investment Philosophy

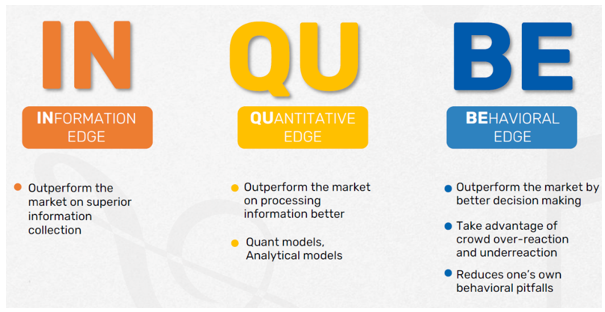

The investment policy of the fund is based on the Unique INQUBE philosophy, where:

Source: Bajaj Finserv Asset Management Company

Stock selection strategy: The Bajaj Finserv Multicap fund aims to maintain a portfolio of ~40-100 stocks selected from the broad universe of Large, mid and small cap companies from a broader universe of ~1150 companies.

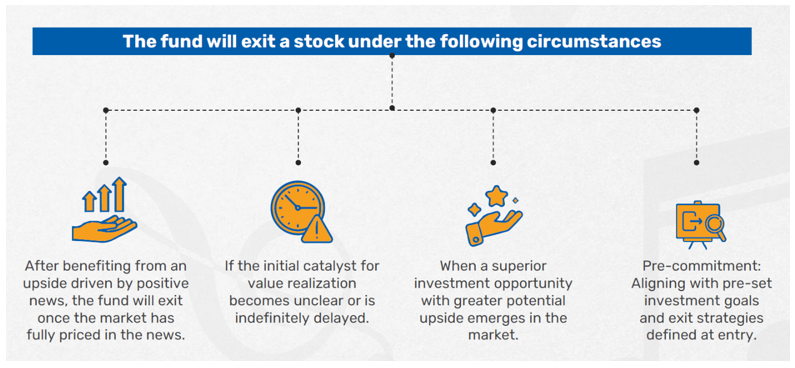

Strategy for stock exit:

Unlike pure contra funds that exit stocks upon reaching intrinsic value, Bajaj Finserv Multi Cap Fund will allow for sustained exposure, enabling the portfolio to ride the full growth wave. (See illustration)

The slide is illustrative to explain how the AMC intends to pursue contrarian investment strategy in Bajaj Finserv Multi Cap Fund. There is no assurance or guarantee that the AMC will accomplish this with every investment that is undertaken in this scheme.

Source: Bajaj Finserv Asset Management Company

Why invest in Bajaj Finserv Multi Cap Fund?

- Disciplined diversification across market caps and sectors

- Aim to capture growth across all market segments

- Benefit of contrarian strategy by investing in undervalued companies

Who should invest in the Bajaj Finserv Multi Cap Fund?

- Investors looking for sound investment opportunities in a one stop solution with disciplined exposure to large cap, mid cap and small cap segments times of volatility

- Investors aiming to invest in undervalued opportunities, capitalizing on earnings growth and valuation multiple re-rating

- Investors with a long-term investment horizon of 5+ years to realise the full potential of contrarian opportunities

- Investors with a high- risk investment appetite

Consult an AMFI certified mutual fund distributor or your financial planner to understand if the Bajaj Finserv Multi Cap Fund aligns with your investor profile.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Bajaj Finserv Limited ('Bajaj Finserv', 'BFS' or 'the Company') is a Core Investment Company (CIC) under RBI Regulations 2020 and the holding company for the various financial services businesses under the Bajaj Group. Its vision is to provide financial solutions for retail and SME customers through their life cycle - asset acquisition and lifestyle enhancement through financing, asset protection through insurance, family protection through life and health insurance, healthcare needs for the family, savings & investment products, wealth management, retirement planning and annuities. BFS, through its various businesses, provides these solutions to over 100 million customers.

Investor Centre

Follow Bajaj Finserv

More About Bajaj Finserv

POST A QUERY