Bajaj Finserv Multi Asset Allocation Fund: An all weather multi asset allocation fund

Market context

Indian equities have retreated from their record highs. Foreign Institutional Investors' (FII) outflows and profit booking at higher levels have dragged the Nifty 50 down by around 1,000 points but Nifty is getting buying support around the 25,000 level. The trailing twelve months PE multiple of Nifty as on 30th September 2024 was 24.26, which is above the 10 year historical average PE. In these market conditions asset allocation plays an important in providing stability to your portfolio. Bajaj Finserv Multi Asset Allocation Fund invests in 3 asset classes e.g. equity, fixed income, commodities (gold, silver), with the aim of providing reasonable returns across different market conditions. Within equity, the fund invests in both growth and high dividend yield stocks. In this article we will review Bajaj Finserv Multi Asset Allocation Fund.

Why is asset allocation important?

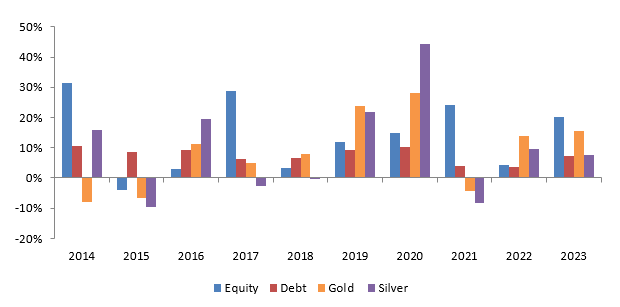

- Winners keep changing among asset classes depending on investment cycles (see the chart below). In the last 10 years, equity was the top performer in 4 years, debt in 1 year, gold in 3 years and silver in 1 year. A mix of asset classes will provide stability in different market conditions.

Source: Bajaj Finserv MF, as on 31st December 2023. Equity: Nifty 50, Debt: Short Duration Debt Index, Gold: MCX Spot Price, Silver: MCX Spot Price

- Winners keep rotating even within asset classes. In equity winners kept rotating among market capitalization and industry sectors (see the chart below). Diversifying across market cap segments and industry sectors can reduce unsystematic risks and improve portfolio performance across different market cycles.

Source: Bajaj Finserv MF, as on 31st Dec 2023. For Large Cap: Nifty 50 TRI, For Midcap: Nifty Midcap 100 TRI, For Small Cap: Nifty 250 Small Cap TRI, For Finance: Nifty Financial Services TRI, For Healthcare: Nifty Healthcare TRI, For Infra: Nifty Infrastructure TRI, For Oil & Gas: Nifty Oil & Gas TRI, For IT: Nifty IT TRI.

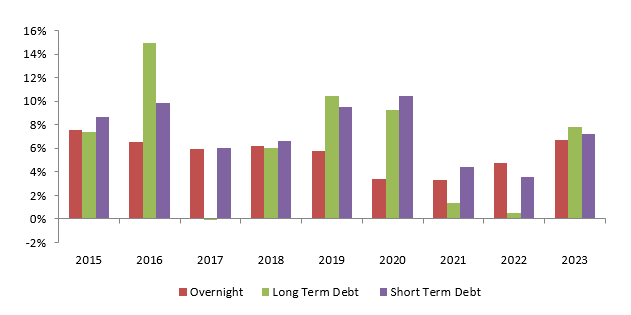

- Winners keep changing among asset classes depending on investment cycles (see the chart below). In the last 10 years, equity was the top performer in 4 years, debt in 1 year, gold in 3 years and silver in 1 year. A mix of asset classes will provide stability in different market conditions.

Source: Bajaj Finserv MF, as on 31st Dec 2023. For Overnight: Nifty 1 Date Rate Index, For Long Term Debt: Crisil 10 Year Gilt Index, For ShortTerm Debt: Crisil Short Term Bond Fund Index.

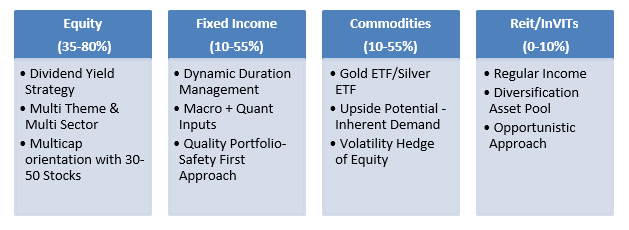

Bajaj Finserv Multi Asset Allocation Fund

The NFO of this fund was launched in May this year. The fund had a very successful NFO and currently a little over Rs 1,000 crores of AUM. The multi asset allocation strategy of the fund is depicted in the table below.

The fund determines asset allocation based on the following factors:-

- Macro-Economic: The fund managers look at inflation, interest rates, corporate earnings growth and balance sheet health to determine equity, debt and commodities allocations

- Valuation: Valuation is also an important factor in asset allocation. The fund managers look at the fundamentals,intrinsic value and dividend yield opportunities.

- Behavioural: Behavioural edge is a key element in Bajaj Finserv MF's INQUBE investment philosophy. The fund manager aims to take advantage of crowd over-reaction and under-reaction, reversal and momentum to make calibrated decisions and avoid behavioural pitfalls.

Dividend Yield Opportunity in current market conditions

Retail investors in India have traditionally growth as investment strategy, as far as equity investments. For the benefit of all readers, growth strategy refers to investing in stocks which are likely to have high Earnings per Share (EPS) growth. These companies plowback the profits into their businesses with the aim of growing their revenues and profits in the future.

Dividend paying companies, on the other hand, payout a significant percentage of their profits as dividends to the shareholders. The characteristics of these companies are as follows:-

- Stable Business Models

- Sustainable Growth

- Accountable Management

- Low Volatility

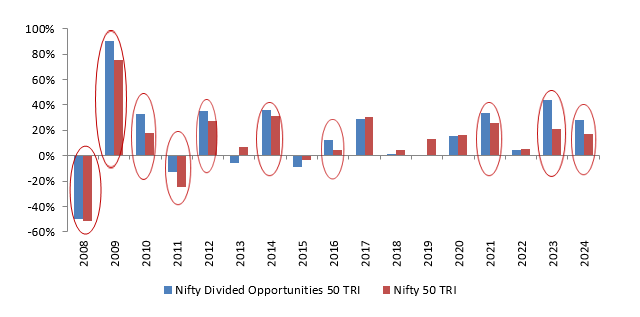

High dividend yield stocks refer to the stocks in which the ratio of dividend to the share price is higher compared to peers. Dividend yield stocks tend to outperform the broad market in Up-Trending and Down Trending Markets (see the chart below).

Source: National Stock Exchange, as on 15th October 2024.

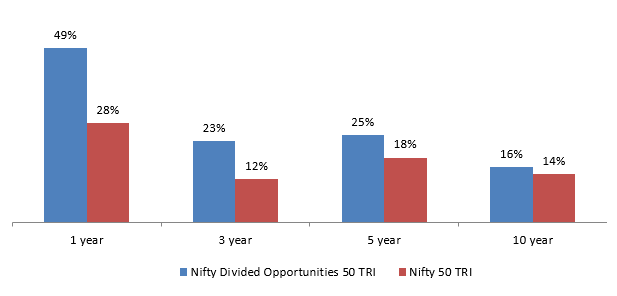

Nifty Dividend Opportunities 50 index has outperformed Nifty 50 TRI over different investment periods (see the chart below).

Source: National Stock Exchange, as on 15th October 2024.

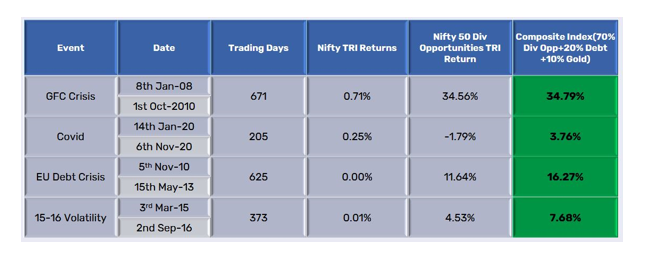

A dividend yield strategy in a multi asset allocation framework has the potential of reducing downside risks in volatile markets. In the table below, we have shown how Nifty 50, Nifty Dividend Opportunities 50 and a composite index made up of 70% Nifty Dividend Opportunities 50, 20% debt and 10% gold, would have performed in the different volatile market scenarios where we saw deep corrections (drawdowns).

Source: Bajaj Finserv MF, as on 31st Dec 2023.

Why is dividend yield strategy suitable in current market conditions?

- The US Federal Reserve cut interest rates by 50 bps in the FOMC meeting in September. In the last MPC meeting RBI has changed its monetary policy stance from "withdrawal of accommodation" to "neutral". We can expect interest rates to come down in the future. High dividend yield stocks become attractive in falling interest scenario

- High dividend yielding companies are trading at attractive valuations. The TTM PE multiple of Nifty Dividend Opportunities 50 index is 19.69, while that of Nifty 50 is 24.26 (source: National Stock Exchange, as on 30th September 2024).

- Dividend Yield based Investing has the potential to minimise impact against volatility (refer to the table above).

- Compounding Effect of Growth and Reinvestmentof Dividend in Bajaj Finserv Multi Asset Allocation Fund

- Capital Gains Tax applicability in MF happens on redemption

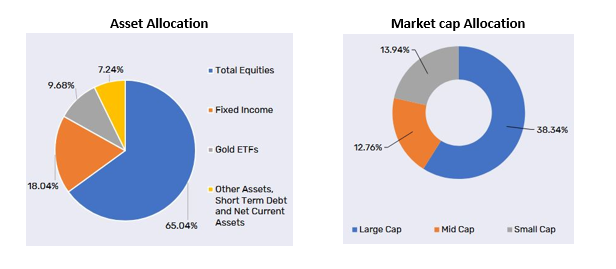

Current portfolio positioning

Source: Bajaj Finserv MF, as on 31st August 2024.

Who should invest in Bajaj Finserv Multi Asset Allocation Fund?

- Investors who are aiming to get reasonable returns

- Investors who want to benefit from professional asset allocation

- Investors who want to invest in an “All Weather Fund” which aims to provide stability and reasonable across different market conditions

- Investors looking for lower volatility versus a pure equity fund

Investors should consult their financial advisors or mutual fund distributors if Bajaj Finserv Multi Asset Allocation Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Bajaj Finserv Limited ('Bajaj Finserv', 'BFS' or 'the Company') is a Core Investment Company (CIC) under RBI Regulations 2020 and the holding company for the various financial services businesses under the Bajaj Group. Its vision is to provide financial solutions for retail and SME customers through their life cycle - asset acquisition and lifestyle enhancement through financing, asset protection through insurance, family protection through life and health insurance, healthcare needs for the family, savings & investment products, wealth management, retirement planning and annuities. BFS, through its various businesses, provides these solutions to over 100 million customers.

Investor Centre

Follow Bajaj Finserv

More About Bajaj Finserv

POST A QUERY