Bajaj Finserv Multi Asset Allocation Fund NFO: A good fund in current market conditions

Bajaj Finserv MF is launching a new fund, Bajaj Finserv Multi Asset Allocation Fund. This is a hybrid fund which will invest across multiple asset classes e.g. equity, fixed income (debt), commodities (e.g. gold, silver) and other asset classes (e.g. REITs, InvITs). The NFO will open for subscription on 13th May 2024 and close on 27th May 2024. In this article we will review this NFO.

Importance of asset allocation

Risk diversification is one of the most important investment principles. Each asset class has unique risk and return characteristics. If you are over-invested in one particular asset class, you may end up either taking too much risk or getting sub-optimal returns. Asset allocation refers to the strategy of diversifying your investments over different asset classes e.g. equity, fixed income, gold, real estate etc. The main purpose of asset allocation is balance risk and returns.

Winners rotate across asset classes

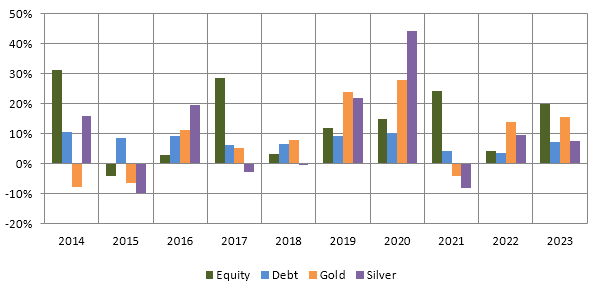

There is low correlation between returns of different asset classes in different market conditions; equity and precious metals (e.g. gold, silver) are usually counter-cyclical to each other i.e. gold outperforms when equity underperforms and vice versa (see the chart below). Equity and gold have low correlation with fixed income. Multi Asset Allocation will keep you disciplined in your investments and provide you a more stable investment experience viz. if one asset class underperforms, the outperformance of another asset class will balance the risks.

Source: Advisorkhoj Research, Bajaj Finserv MF As on 31st Dec 2023, Equity: Nifty 50, Debt: Nifty Short Duration Debt Index, Gold: MCX Spot Price, Silver: MCX Spot Price. Disclaimer: Past performance may or may not be sustained in the future

Winners rotate across market cap segments

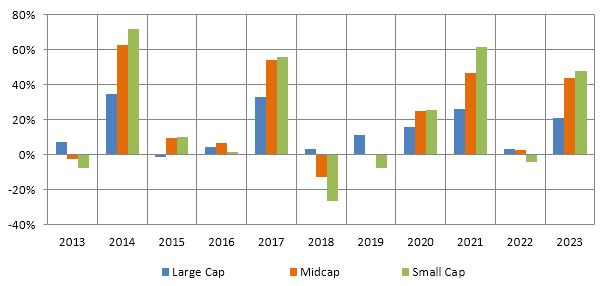

One market cap segment cannot keep outperforming or underperforming across all market conditions or investment cycles. Historical data shows that winners rotate across different market cap segments – see the chart below.

Source: Advisorkhoj Research, as on 31st Dec 2023. Large cap: Nifty 100 TRI, Midcap: Nifty Midcap 150 TRI, Small cap: Nifty Midcap 150 TRI.

Winners rotate across industry sectors

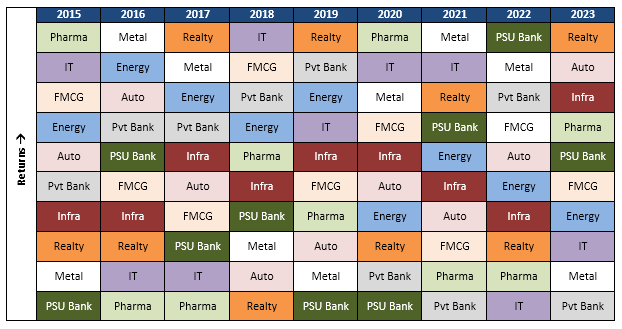

Like market cap segments, winners also keep rotating across industry sectors (see the chart below). Some sectors may outperform in some quarters or years, and others may outperform in other quarters or years.

Source: National Stock Exchange sector indices, as on 31st Dec 2023. Disclaimer: Past performance may or may be sustained in the future.

Winners rotate within debt as an asset class

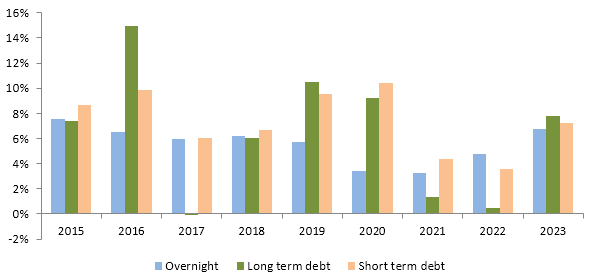

Similar to equities, winners rotate across different duration profiles within debt as an asset class depending on interest rate cycles. In rising interest rate regimes, shorter duration debt funds outperform longer duration funds. In falling interest rate regimes, longer duration funds outperform.

Source: National Stock Exchange sector indices, as on 31st Dec 2023. Overnight: Nifty 1D Rate Index, Long term debt: CRISIL 10 Y Gilt Index, Short term debt: Crisil Short term bond index. Disclaimer: Past performance may or may be sustained in the future.

Why multi asset allocation?

In conventional asset allocation, we diversify across equity and debt asset classes. However, in certain investment cycles e.g. economic slowdown / uncertainty coupled with high inflation, both equity and debt can underperform. Diversifying across three or more asset classes can bring stability to your investment portfolio in different investment / market cycles.

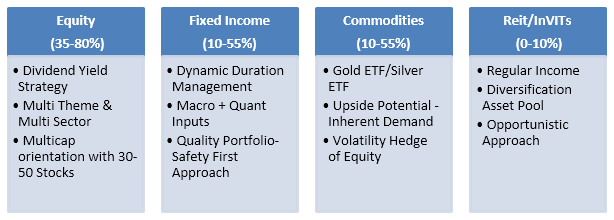

Multi Asset Allocation funds are hybrid mutual fund schemes which invest in 3 or more asset classes. According to SEBI regulations multi asset allocation funds must invest minimum 10% each in at least 3 asset classes. Apart from the two most popular asset classes, fixed income and equity, these schemes invest in asset classes like gold, real estate investment trusts (REIT), infrastructure investment trusts (InvIT), international equities etc. The fund manager decides the proportional allocation to each asset class based on the market conditions with the objective of balancing risks and returns.

Bajaj Finserv Multi Asset Allocation Fund – Asset Allocation

How the fund will determine asset allocation?

Equity Strategy

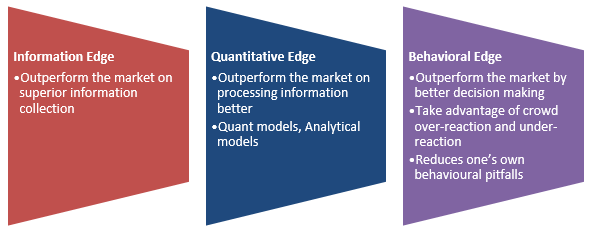

Bajaj Finserv Investment Philosophy – INQUBE

Fixed Income Strategy

- Dynamic Duration Profile

- High Credit Quality Orientation

- Investment Mix of Sovereign & High-Quality Corporate Bonds

- Interest Rate Outlook

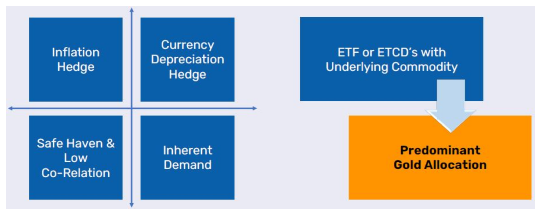

Commodities Strategy

Why invest in Bajaj Finserv Multi Asset Allocation Fund?

- The average long term equity allocation is likely to be 65 to 70 %

- The fund’s equity strategy will follow growth and dividend payout investing strategy

- Reduced extremities in performance

- Low Volatility vis a vis Pure Equity Funds

- Relatively smoother risk experience

- All weather investment avenue

- Aiming Reasonable Return

- Equity Taxation Status

Who should invest in Bajaj Finserv Multi Asset Allocation Fund?

- Investors looking for a long-term strategic allocation to different asset classes

- Investors looking for relatively stable returns with low downside risks

- Investors with high to very moderate to high risk appetites

- Investors with long investment tenures. We recommend minimum 3 years investment tenures for this scheme.

Investors should consult with their financial advisors or mutual fund distributors if Bajaj Finserv Multi Asset Allocation Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Bajaj Finserv Limited ('Bajaj Finserv', 'BFS' or 'the Company') is a Core Investment Company (CIC) under RBI Regulations 2020 and the holding company for the various financial services businesses under the Bajaj Group. Its vision is to provide financial solutions for retail and SME customers through their life cycle - asset acquisition and lifestyle enhancement through financing, asset protection through insurance, family protection through life and health insurance, healthcare needs for the family, savings & investment products, wealth management, retirement planning and annuities. BFS, through its various businesses, provides these solutions to over 100 million customers.

Investor Centre

Follow Bajaj Finserv

More About Bajaj Finserv

POST A QUERY