Bajaj Finserv Large Cap Fund NFO: Invest in the champions of corporate India

Bajaj Finserv MF has launched a New Fund Offer, Bajaj Finserv Large Cap Fund. This is the third equity product offering by Bajaj Finserv. The fund will invest in the top 100 companies by market capitalization. The NFO has opened for subscription on 29th July 2024 and will close on 12th August 2024. In this article, we will review this NFO.

About Large Cap Funds

SEBI classifies the top 100 companies by market capitalization as large cap companies. As per SEBI’s mandate large cap fund must invest at least 80% of their assets in large cap companies or stocks. Large cap funds have traditionally been one of the most popular categories of equity mutual funds. As per June AMFI data, large cap is the third largest category among actively managed equity funds in terms of AUM. These funds are very popular with both seasoned and new investors.

Characteristics of large cap stocks

- Large cap companies are the biggest companies in India in terms of revenues and profit after tax (PAT).

- Large cap companies are industry leaders (market share leaders) in their respective industry sectors.

- Large cap stocks can be proxy plays for several sectors e.g. power, paints, IT software, e-commerce, NBFCs, PSU and private sector banks etc, since they dominate these sectors in terms of market cap, revenues and PAT.

- The core sectors of the Indian economy like coal, oil and gas, petroleum products, steel, cement, power etc are dominated by large cap companies.

- Large caps contribute more than 30% of the revenue to India’s Nominal GDP. Large cap companies have extensive operations, creating millions of jobs. Large caps lead innovation in IT, automotive, and aerospace sectors. They enhance India’s trade balance and foreign exchange through significant exports.

Why invest in large caps?

- India was the fastest growing G-20 economy in FY 2024. As per IMF’s forecast India will continue to be fastest growing (7% real GDP growth, source: Press Information Bureau, GOI, 17th July 2024). IMF forecasts that India will be the 3rd largest economy of the world by 2030.

- Large caps are likely to be major beneficiary from India's GDP growth through increase consumer demand and expanded investment opportunities.

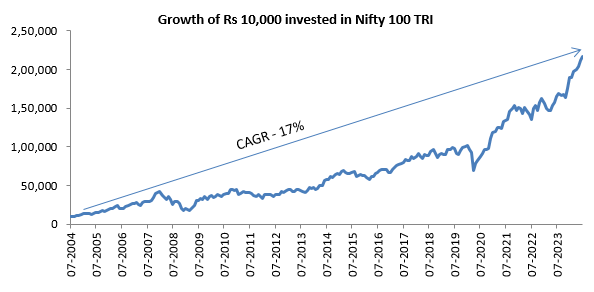

- Wealth creation potential of large caps. The chart below shows the growth of Rs 10,000 investment in Nifty 100 TRI over the last 20 years.

Source: National Stock Exchange, Advisorkhoj Research, as on 28th June 2024.

- Large caps usually have large percentage of institutional (FIIs and DIIs) ownership compared to midcaps and small caps. Large caps are well researched and provide better visibility of earnings compared to midcaps and small caps.

- Since large caps have large percentage of institutional ownership, they are traded in large volumes in the stock market and are highly liquid. Midcaps and small caps, on the other hand, have higher percentage of promoter ownership. Since midcaps and small caps have smaller percentage of free-floating shares, they trade on thinner volumes compared to large caps and are hence, less liquid compared to large caps.

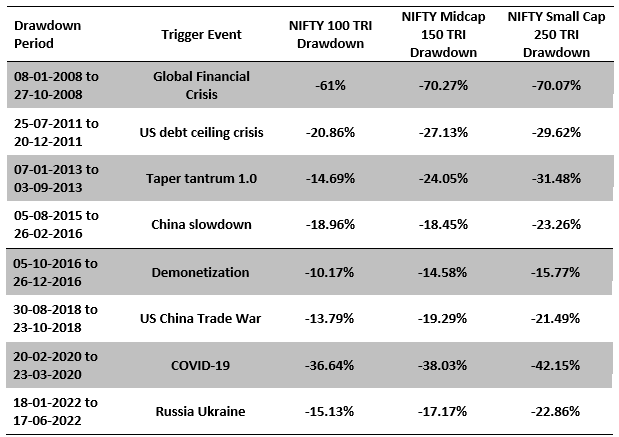

- Large cap funds are less volatile than midcap and small cap funds. Historically large cap stocks have seen lesser drawdowns (correction from market tops) in bear or highly volatile markets. The table below shows the biggest drawdowns in the market over the last 20 years. You can see that large caps (represented by Nifty 100 TRI) had smaller drawdowns compared to midcaps (represented by Nifty Midcap 150 TRI) and small caps (represented by Nifty Small Cap 250 TRI).

Source: National Stock Exchange, Advisorkhoj Research.

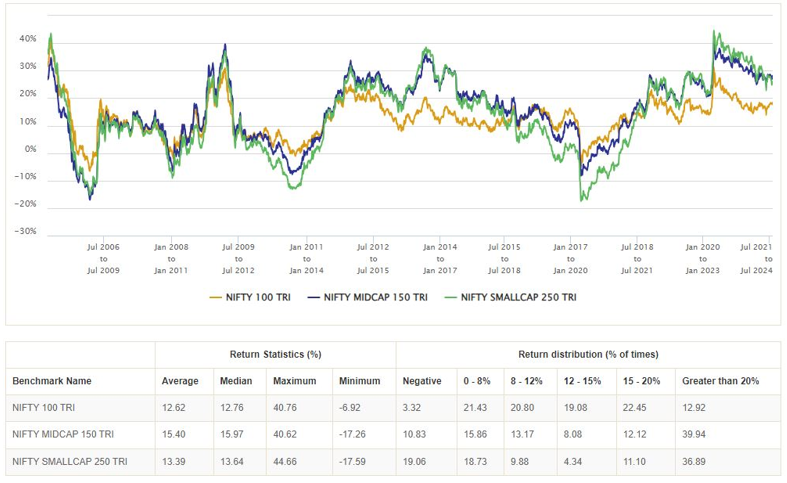

- Superior consistency in performance: The chart below shows the 3 year rolling returns of Nifty 100 TRI versus Nifty Midcap 150 and Nifty Small 250 TRI indices respectively. You can that fluctuations / variations in returns in different market conditions is much lower in large caps compared to midcaps and small caps. As such, large cap funds can be suitable investment options for new investors.

Source: National Stock Exchange, Advisorkhoj Research.

Why invest in large caps now?

- The prolonged bull market has seen midcaps and small caps outperforming large cap funds. As a result, we have seen huge inflows in midcap and small cap funds over the past year or so. As per AMFI monthly data, the assets under management (AUM) of the midcap fund category crossed the AUM of the large cap fund for the first time in history in May 2024. The AUM of small capfunds crossed the AUM of most diversified equity funds (source: AMFI, as on 28th June 2024).

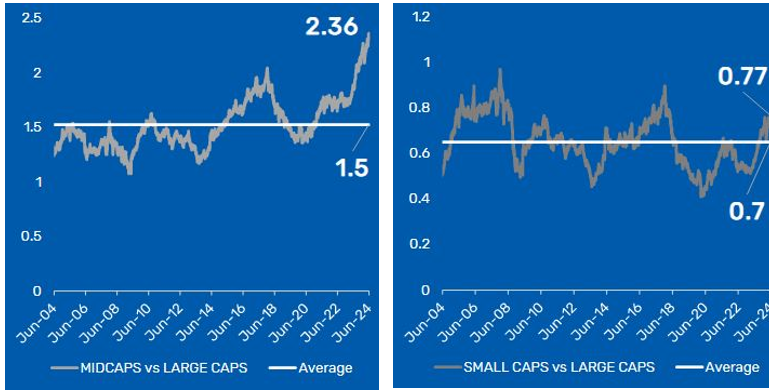

- The relative strength of midcap vis-à-vis large caps is at 2.3X and small caps vis-à-vis large caps at 0.7X. The current relative strength, when compared to the long-term media indicates that any mean reversion would be largely positive for large cap stocks

Source: Bajaj Finserv MF, as on 30th June 2024

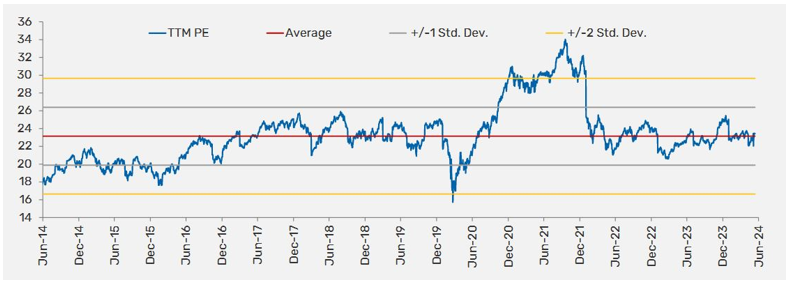

- Valuations are reasonable: The chart below shows the trailing 12 months (TTM) Price Earnings Ratio of Nifty 100 TRI. The valuations have been range bound around the long-term average for the last 2 years, indicating that large caps are fairly valued.

Source: Bajaj Finserv MF, as on 30th June 2024

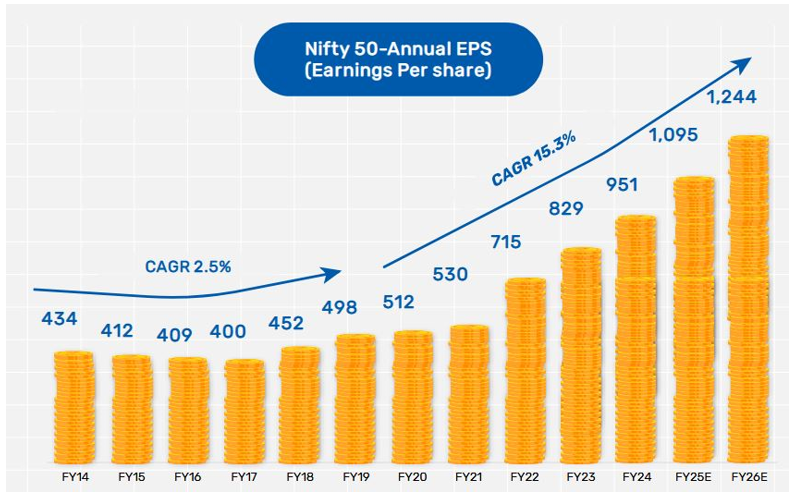

- Earnings growth picking up: Nifty 50 earnings per share (EPS) which was stagnant for a fairly long period of time have bounced back post COVID. Nifty EPS is expected to grow at 14 – 15% over the next 2 years.

Source: Bajaj Finserv MF, as on 30th June 2024

About Bajaj Finserv Large Cap Fund

- The fund will have a highly concentrated portfolio with high conviction in stock selection

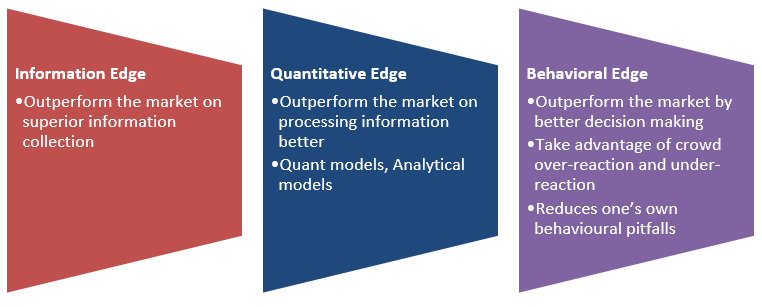

- The fund will have high active share with aim to outperform the benchmark index over long-term

- INQUBE Investment Philosophy

Who should invest in Bajaj Finserv Large Cap Fund?

- Investors who are looking for capital appreciation with a long-term investment horizon.

- Those who are looking to build their core portfolio with large-cap stocks.

- Those who have an investment horizon of more than 3 years.

- The fund is suitable for first-time or new investors

- You can invest in this fund either in lump sum or SIP depending on your financial situation or investment needs

- Investors should consult with their financial advisors or mutual fund distributors if Bajaj Finserv Large Cap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Bajaj Finserv Limited ('Bajaj Finserv', 'BFS' or 'the Company') is a Core Investment Company (CIC) under RBI Regulations 2020 and the holding company for the various financial services businesses under the Bajaj Group. Its vision is to provide financial solutions for retail and SME customers through their life cycle - asset acquisition and lifestyle enhancement through financing, asset protection through insurance, family protection through life and health insurance, healthcare needs for the family, savings & investment products, wealth management, retirement planning and annuities. BFS, through its various businesses, provides these solutions to over 100 million customers.

Investor Centre

Follow Bajaj Finserv

More About Bajaj Finserv

POST A QUERY