Bajaj Finserv Large and Mid Cap Fund rounds up a strong One year: A promising fund for long term investors in current market conditions

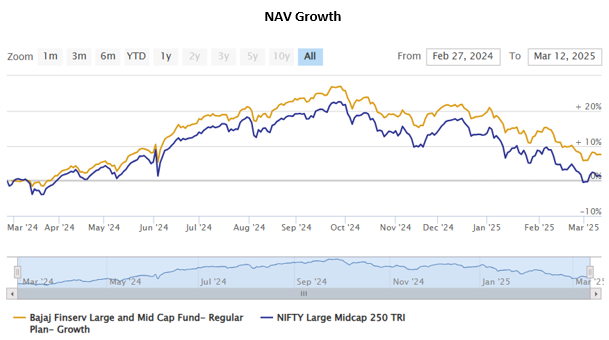

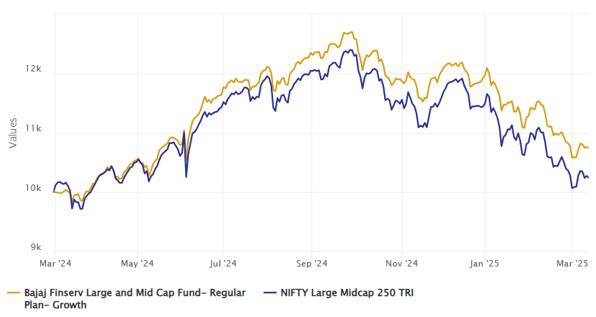

Bajaj Finserv Large and Mid Cap Fund has recently completed one year since it was launched in February 2024. The fund has outperformed its benchmark index creating alpha for investors in difficult market conditions (see the chart below). The fund was also able to lower downside risks for investors in volatile conditions. In this article, we will discuss why the fund can be suitable investment option for long term investors, especially in the current market context.

Source: Advisorkhoj Research, as on 12th March 2025

Current market context

The market has been highly volatile for the past 5 – 6 months. Foreign Institutional Investors have been selling Indian equities on a net basis. FII sell-off has intensified in CY 2025, since the start of the second Trump Administration in January 2025. Concerns about the economic impact of Trump Administration’s trade policies is causing the market to be jittery. The Dow Jones is down 7% in the last 1 month, while the tech heavy NASDAQ is down 10% (source: Bloomberg, as on 12th March 2025).

The inflationary impact of tariffs on the US economy and possibility of global trade war (retaliatory tariffs imposed by China, EU and Canada on US exports) has made global risk sentiments to be risk-off. This has affected Indian equities also, with the Nifty 50 closing February almost 5% down from its all time high. While the FII sell-off impacted large cap stocks more in the initial phase of the correction, small and midcaps saw sharper declines than large caps in January and February. Among the three market cap segments, small caps have been the most volatile last 2 months (down 20%, source: NSE as of 28th February 2025).

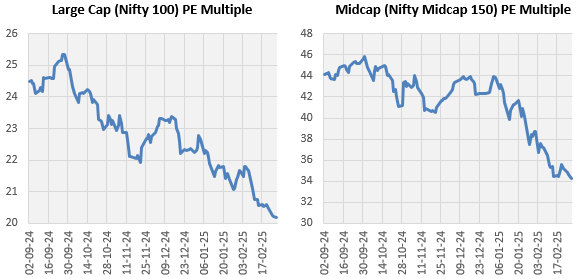

Valuations have come down

The deep correction has eased valuations and bringing them to more reasonable levels, especially in large cap segment Midcap valuations have also eased (see the chart below). Large and midcaps have also been less volatile compared to small caps, in the last 2 months.

Source: NSE. Period: 1st September 2024 to 28th February 2025

While valuations have moderated, the biggest risk factor for global and Indian equities in current market conditions is that uncertainty gripping the global economy. In these market conditions, large and midcap funds, at current levels, may provide attractive investment opportunities to long term investors

About Bajaj Finserv Large and Mid Cap Fund

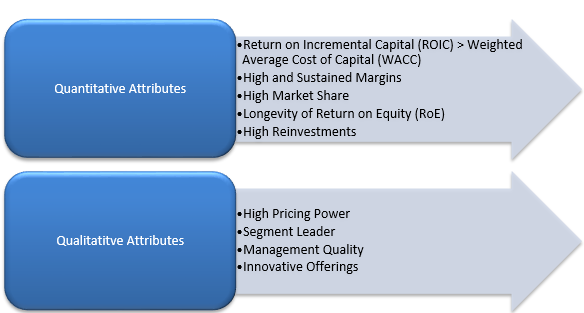

The current portfolio has 69 stocks across large and midcap segments. The fund invests in companies that have long term and durable competitive advantage vis-à-vis their competitors, which Warren Buffet calls as economic moat. Equity investing based on economic moat tends to offer following benefits: -

- Enduring Advantage

- Stability amid fluctuations

- Potential profitability

- Long-term growth

- Quality over size

Stock Selection Process: Select such companies that have:

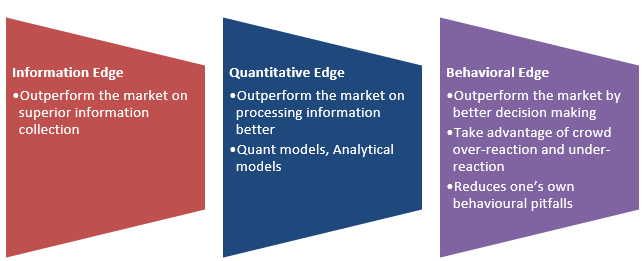

Bajaj Finserv Investment Philosophy – INQUBE

Bajaj Finserv Large and Mid Cap Fund – Outperformed the benchmark index

The chart below shows the growth of Rs 10,000 investment in Bajaj Finserv Large and Mid Cap Fund versus its benchmark index Nifty Large Midcap 250 TRI. You can that the fund has outperformed its benchmark and created alpha for investors.

Source: Advisorkhoj Research, as on 12th March 2025

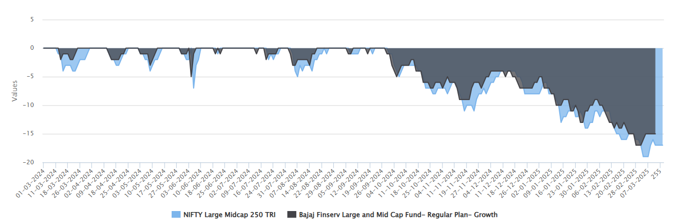

Limited downside in volatile market conditions

The chart below shows the drawdown of Bajaj Finserv Large and Mid Cap Fund versus its benchmark index Nifty Large Midcap 250 TRI since the inception of the fund. You can see that the fund was able to limit downside risks in corrections.

Source: Advisorkhoj Research, as on 12th March 2025

Superior risk adjusted returns

Market capture ratio is a measure of the performance of a mutual fund scheme relative to its benchmark index in rising and falling markets. Up Market Capture Ratio tells us how much percentage of the market’s upside was captured by the fund, while Down Market Capture Ratio tells us how much percentage of the market’s downside was arrested by the fund. Up-Market Capture Ratio and Down-Market Capture ratio can give us a sense of risk adjusted returns. We looked at the market capture ratios of Bajaj Finserv Large and Mid Cap Fund over the last 1 year.

The Up Market Capture Ratio of Bajaj Finserv Large and Mid Cap Fund was 115% which implies that if the benchmark index went up by 1% in a month, then the scheme’s Net Asset Value (NAV) went up by 1.15%. The Down Market Capture Ratio of the fund was 90% which implies that if the benchmark index went down by 1% in a month, then the scheme’s Net Asset Value (NAV) went down by 0.9% only. The market capture ratios of Bajaj Finserv Large and Mid Cap Fund are a clear indication of the potential of the fund to give superior risk adjusted returns of the fund.

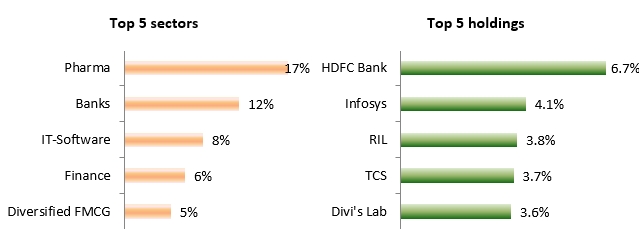

Current portfolio positioning

The fund has 54% allocation to large cap and 35% allocation to midcap. The large cap tilt is prudent in current market conditions. About 6% of the fund’s assets are in cash equivalents ready to be deployed in the right investment opportunities. The fund is well diversified across industry sectors and in terms of concentration risk – top 5 stocks comprise less than 25% of the total scheme portfolio asset value.

Source: Bajaj Finserv MF Factsheet, as of 28th February 2025

Why invest in Bajaj Finserv Large and Mid Cap Fund

Who should invest in Bajaj Finserv Large and Mid Cap Fund?

- Investors looking for capital appreciation and wealth creation.

- Investorshavinga 5 year plus investment horizon in this scheme.

- This fund can be suitable for new or first-time investors

- Investors with very high-risk appetite.

- Investors can invest in this scheme either through lump sum or SIP depending on your investment needs.

Investors should consult with their financial advisors or mutual fund distributors if Bajaj Finserv Large and Mid Cap Fund will be suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Bajaj Finserv Limited ('Bajaj Finserv', 'BFS' or 'the Company') is a Core Investment Company (CIC) under RBI Regulations 2020 and the holding company for the various financial services businesses under the Bajaj Group. Its vision is to provide financial solutions for retail and SME customers through their life cycle - asset acquisition and lifestyle enhancement through financing, asset protection through insurance, family protection through life and health insurance, healthcare needs for the family, savings & investment products, wealth management, retirement planning and annuities. BFS, through its various businesses, provides these solutions to over 100 million customers.

Investor Centre

Follow Bajaj Finserv

More About Bajaj Finserv

POST A QUERY