Bajaj Finserv Healthcare Fund: Invest in the growing healthcare sector in India

Bajaj Finserv MF has launched a new fund offer (NFO) Bajaj Finserv Healthcare Fund. This is a thematic fund which will invest in the pharma, healthcare and allied themes. Healthcare is a popular investment theme. Nifty Healthcare TRI has outperformed the broad market index Nifty 500 TRI over the last 5 years - 24.34% CAGR (Nifty Healthcare TRI) versus 19.47% CAGR (Nifty 500 TRI) returns*. The NFO will open for subscription on 6th December 2024 and will close on 20th December 2024. We will review Bajaj Finserv Healthcare Fund NFO in this article.

*As on 30th November 2024 (source: National Stock Exchange)

Drivers of long term growth in Indian healthcare sector

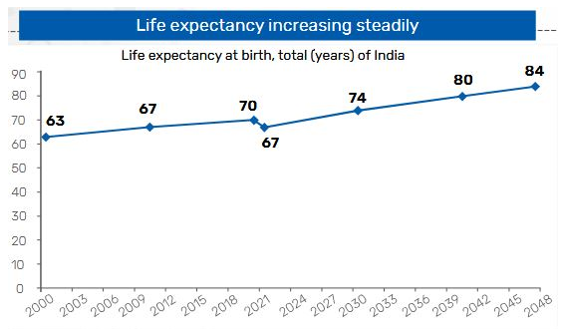

- Life expectancy is increasing in India. Average life expectancy at birth in 2000 was 63 years, which is expected to increase to 84 years by 2048. Longer life spans fuels healthcare sector.

Source: PHD Research Bureau projections for the years 2030, 2040 and 2047

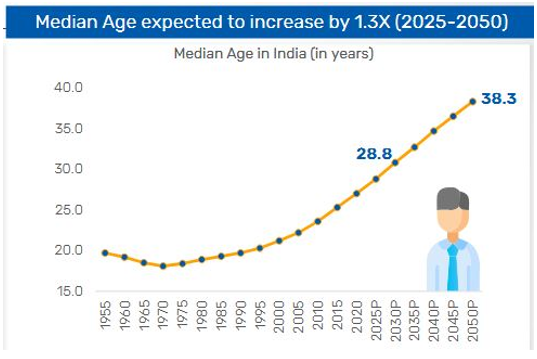

- Ageing population over time is a natural phenomenon in a young country with improving healthcare facilities. The median age expected to increase by 1.3X (2025-2050). Aging population boosts demand for age-related healthcare services.

Source: World meter

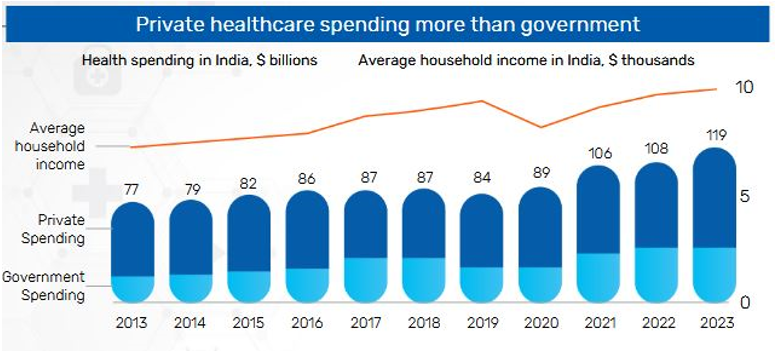

- Private healthcare expenditure outstrips Government spending on healthcare in India. Growing per capita income will drive personal healthcare investment.

Source: S&P Household Income Projections; Fitch Solutions Health Expenditure

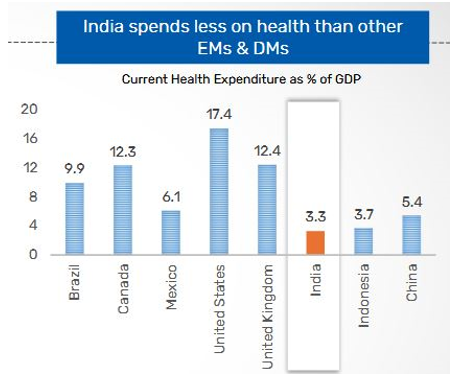

- India spends less on health than other EMs & DMs (see the chart below).There is scope for significant growth in healthcare expenditure in India compared to other major economies.

Source: WHO, Data as of 2021. DM – Developed Market and EM – Emerging Market

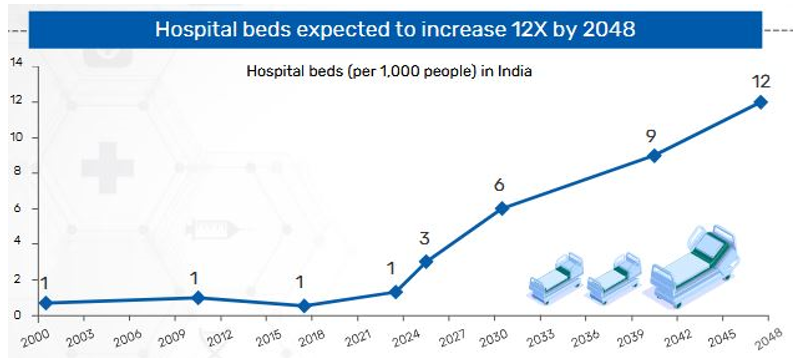

- Healthcare infrastructure is improving in India. Hospital beds expected to increase 12X by 2048 (see the chart below). Number of Doctors increased 1.1X in 4 years. No of medical colleges in India increased by 1.8X to 758 in FY 24 (in 8 years). Healthcare infrastructure is expanding with growing investments in Tier 2-6 cities for multispecialty hospitals, diagnostics, specialty clinics etc.

Source: PHD Research Bureau projections for the years 2030, 2040 and 2047

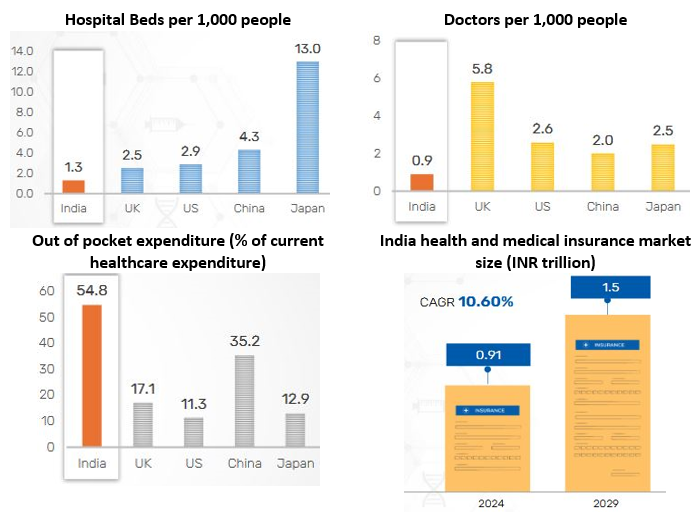

Long run way for growth

India has a long way to match the healthcare infrastructure standards of developed economies. Under-penetration of health insurance in India results in significantly higher out of pocket expenses compared to developed economies. There is huge growth potential for healthcare and allied sectors in India.

Source: HFS Research, Mordor Intelligence, IBEF, Data as on 2024

Opportunities in Healthcare sectors

Healthcare as an investment theme

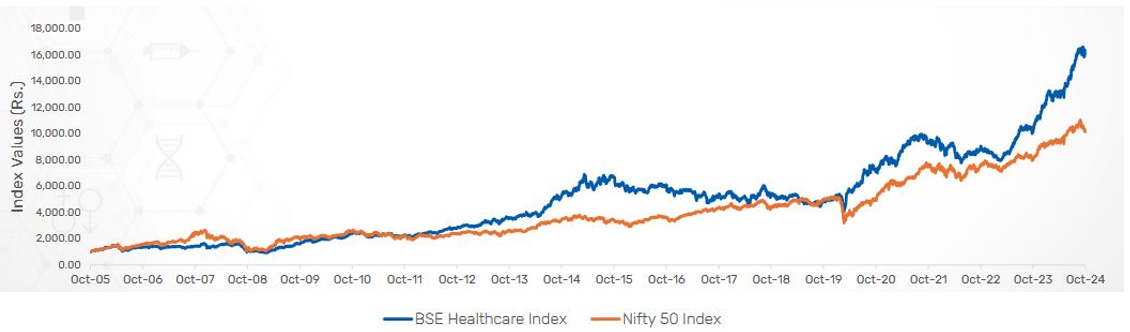

- Healthcare outperformed the broad market (represented by Nifty 50) over long investment tenure.

Source: ICRA MFI Explorer, Data as on 31st October 2024

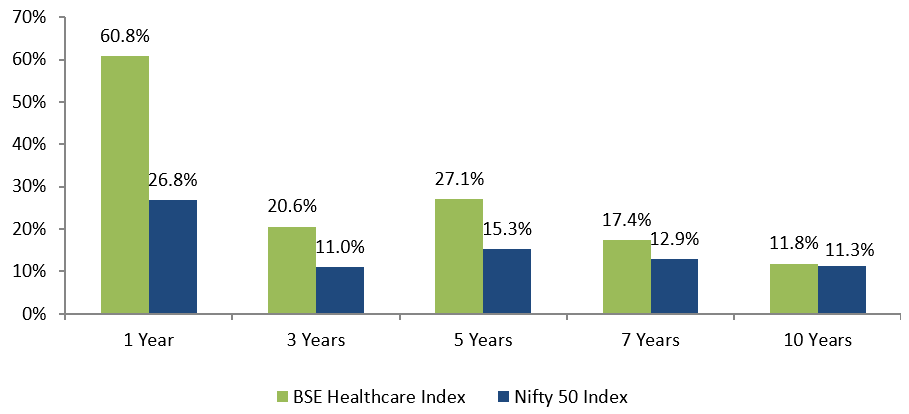

- Healthcare has outperformed the broad market index (Nifty 50) over different investment periods. You can see that healthcare has outperformed Nifty 50 both in the short term (1 year) and long term (5 years plus).

Source: ICRA MFI Explorer, Data as on 31st October 2024

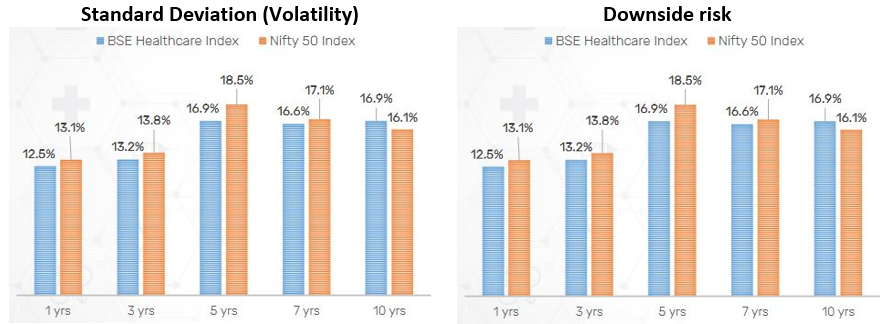

- Healthcare as an investment theme has lower volatility and downside risks compared to the broad market (see the charts below).

Source: ICRA MFI Explorer, Data as on 31st October 2024

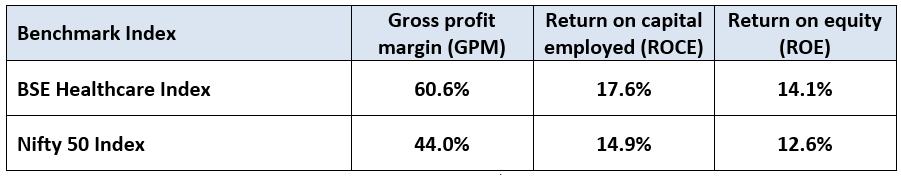

- Healthcare as an investment theme has more robust fundamentals compared to the broad market (see the table below).

Source: ACE Equity, Data as on 30th September 2024

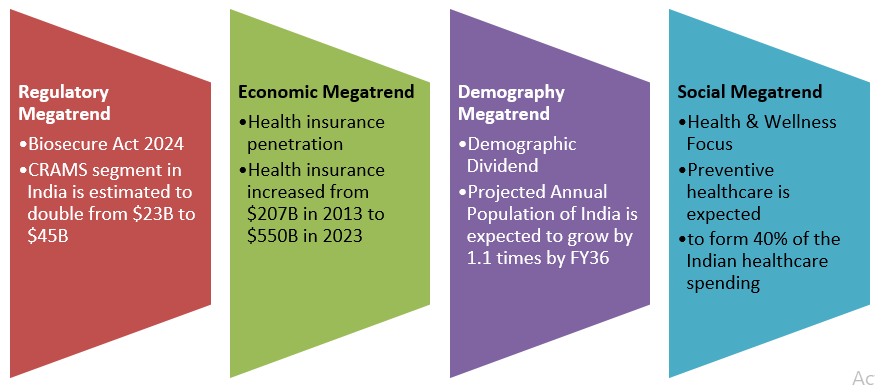

Bajaj Finserv Healthcare Fund will invest in the Megatrends in healthcare sector

Source: News article – Financial Express, IRDAI, National Commission on Population, Nykaa RHP

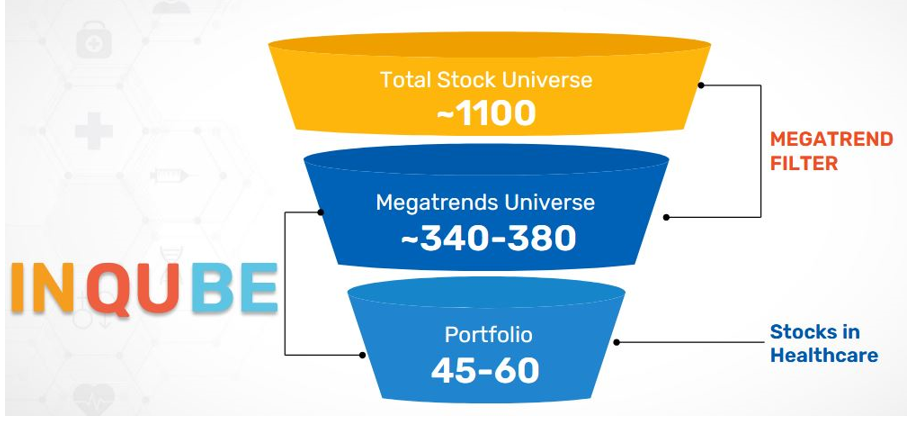

Bajaj Finserv Healthcare Fund – Portfolio Construction

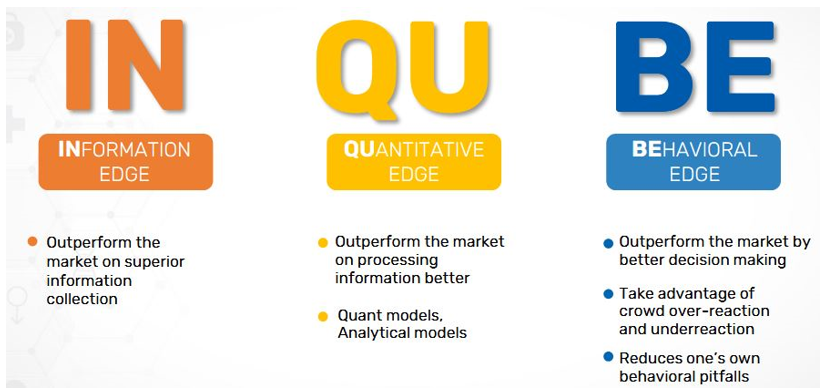

Bajaj Finserv Healthcare Fund - INQUBE Investment Philosophy

Why invest in Bajaj Finserv Healthcare Fund?

- Healthcare sector has low correlation with the broader market. The fund can add diversification to your investment portfolio

- Investment in MEGATRENDS by identifying the potential growth stories. MEGATRENDS can provide long term (spanning multiple investment cycles) secular growth opportunities

- The fund targeting future profit pool companies thereby creating wealth creation potential for investors

- The fund has the potential to create wealth over long-term by riding the healthcare boom

Who should invest in Bajaj Finserv Healthcare Fund?

- Investors looking to diversify their equity portfolio with healthcare and wellness industries

- Investors looking for tactical allocation in their overall equity investment portfolio

- Investors with a higher risk appetite

- Investors with an investment horizon of 5+ years

- Investors should consult their financial advisors or mutual fund distributors if Bajaj Finserv Healthcare Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Bajaj Finserv Limited ('Bajaj Finserv', 'BFS' or 'the Company') is a Core Investment Company (CIC) under RBI Regulations 2020 and the holding company for the various financial services businesses under the Bajaj Group. Its vision is to provide financial solutions for retail and SME customers through their life cycle - asset acquisition and lifestyle enhancement through financing, asset protection through insurance, family protection through life and health insurance, healthcare needs for the family, savings & investment products, wealth management, retirement planning and annuities. BFS, through its various businesses, provides these solutions to over 100 million customers.

Investor Centre

Follow Bajaj Finserv

More About Bajaj Finserv

POST A QUERY