Bajaj Finserv Flexicap Fund: A Megatrend Lens to India Investment Opportunity

Key Highlights

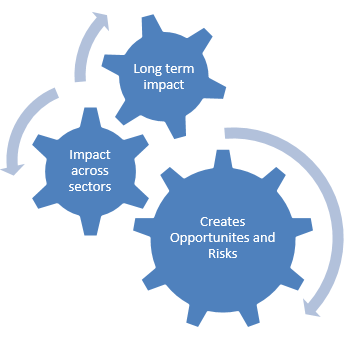

- A megatrend is a strong force that has the power to shape the world. It occurs on a large scale and affects human beings, transcending borders and factors that divide them.

- Bajaj Finserv Flexicap Fund, which has recently completed 1 year, invests in companies that can benefit from megatrends. These companies are likely to have higher earnings growth potential relative to peers

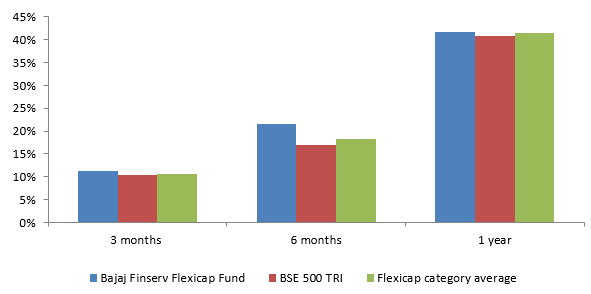

- The fund has outperformed the benchmark (BSE 500 TRI) and the flexicap funds category average returns

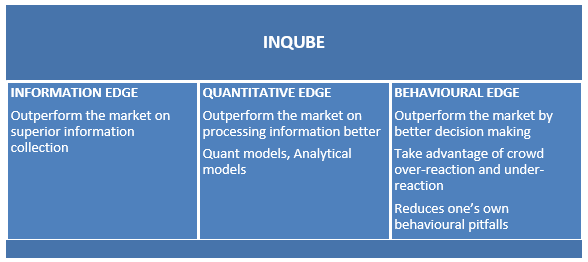

- Identification / selection of megatrends and stock selection using the AMC’s INQUBE philosophy can have the potential of creating alphas in investors’ portfolios.

About Bajaj Finserv Flexicap Fund

The strategy of the fund is to create a diversified portfolio of such companies across who have the business model that are likely to benefit from the structural changes in the society called megatrends. A Megatrend is a powerful long-term change that affects economies, businesses, and companies. It comes about on account of transformational shifts happening due to changes occurring on account of technology, regulation or society. The fund manager will seek to invest in companies operating in sectors having large & expanding opportunity with strong growth potential. The fund is market cap and sector agnostic. Though the fund has just completed one year, its performance has caught our attention.

Track record of outperformance

Source: Advisorkhoj Research as on 27th August 2024

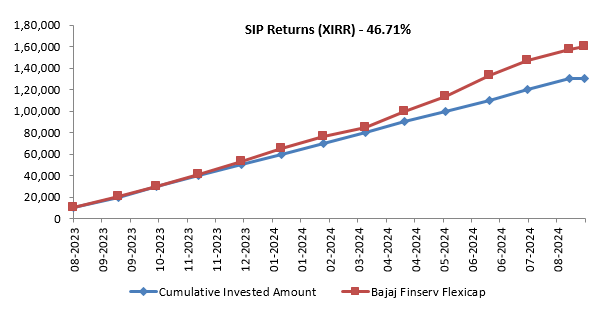

SIP Performance

The chart below shows the growth of Rs 10,000 monthly SIP since the inception of the scheme. The SIP returns since inceptions show the wealth creation potential of the fund for long term investors.

Source: Advisorkhoj Research as on 27th August 2024

Why invest in Megatrends?

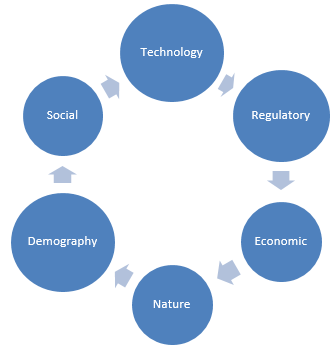

Source of megatrends

What are the current megatrends?

- Technology - Digitization & Tech Transformation e.g. UPI transactions may surge to $3 trillion by 2026

- Regulatory - Resurgence of Indian Manufacturing e.g. the PLI Scheme seeks to make India a global manufacturing hub.

- Economic – Formalization e.g. the Buy Now Pay Later business is expected to grow fivefold by FY26

- Nature - Green Consciousness & Sustainability Focus e.g. India's EV production is expected to rise from 0.6 million units in FY21 to approximately 16.90 million units by FY30

- Demographic Dividend e.g. the e-commerce customer base is expected to grow by 2.7 times by FY25

- Social – Rising Consumerism and Urbanization e.g. eating out expense may rise 2.4 times by FY25.

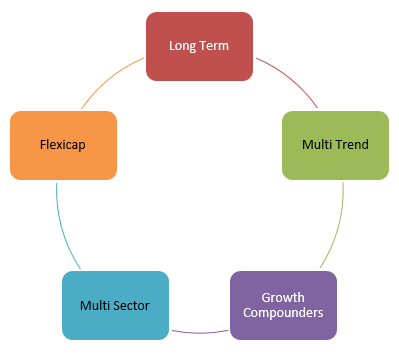

Bajaj Finserv Flexicap Fund – Portfolio Characteristics (5 in 1)

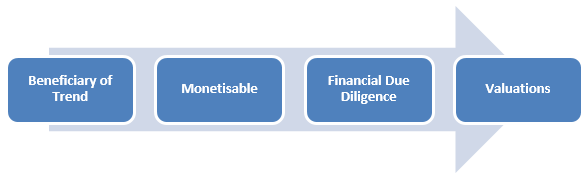

Bajaj Finserv Flexicap Fund – Trend Assessment and Stock Selection Process

INQUBE Investment Philosophy

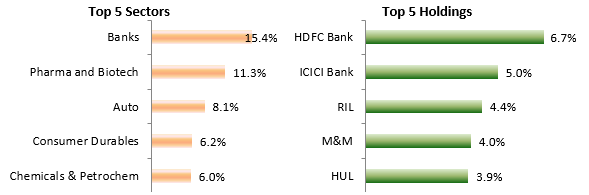

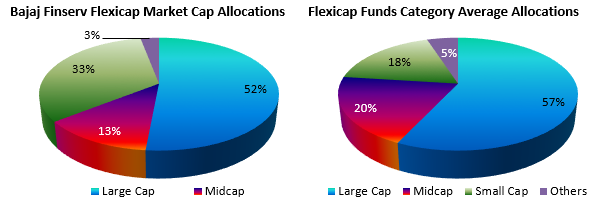

Current portfolio positioning

Source: Bajaj Finserv AMC Fund Factsheet, as on 31st July 2024

Bajaj Finserv Flexicap Fund has significantly higher small cap allocations compared to the peer average. The higher small cap allocations of the fund create the potential of higher alphas and capital appreciation for the investors.

Source: Bajaj Finserv AMC Fund Factsheet, Advisorkhoj Research as on 31st July 2024

Why invest in Bajaj Finserv Flexicap Fund?

- The fund ignores Noise, focuses on stories likely to benefit fromlong term trends

- It seeks to utilize holistic opportunity rather than view the portfolio from the market cap lens

- The fund makes targeted trend-based resource allocation

- It focuses on tracking profit movement

Who should invest inBajaj Finserv Flexicap Fund?

- Investors with investment horizon of 5 years plus for long term wealth creation

- Investors seeking to participate in high growth themes that can benefit from megatrends

- Investors with very high risk appetites

- Investors should consult their financial advisors or mutual fund distributors if Bajaj Finserv Flexicap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Bajaj Finserv Limited ('Bajaj Finserv', 'BFS' or 'the Company') is a Core Investment Company (CIC) under RBI Regulations 2020 and the holding company for the various financial services businesses under the Bajaj Group. Its vision is to provide financial solutions for retail and SME customers through their life cycle - asset acquisition and lifestyle enhancement through financing, asset protection through insurance, family protection through life and health insurance, healthcare needs for the family, savings & investment products, wealth management, retirement planning and annuities. BFS, through its various businesses, provides these solutions to over 100 million customers.

Investor Centre

Follow Bajaj Finserv

More About Bajaj Finserv

POST A QUERY