Bajaj Finserv Consumption Fund: Invest in India Consumption Story

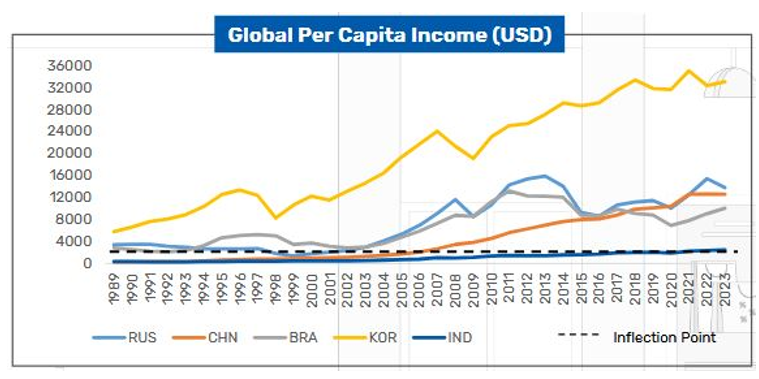

The India Consumption Story is an integral part of the India Growth Story, since India is largely a domestic consumption based economy. In FY 2023-24, India’s private final consumption expenditure (at constant 2011-12 prices) is around 56% of the GDP (source: Economic Survey). As per PHD Chamber of Commerce and Industry estimates, India’s per capita income by 2047 will be USD 19,416 (source: Bajaj Finserv MF) which will still be below South Korea’s current per capita income (around USD 30K as per World Bank 2023). There is huge potential and long runway for consumption growth in India. Bajaj Finserv MF has launched a new fund, Bajaj Finserv Consumption Fund which will invest in the domestic consumption theme. The NFO has opened for subscription on 8th November and will close on 22nd November.

What is driving consumption growth?

- India is the fifth largest consumer market after United States, EU, China and Japan (source: World Bank, 2023). India’s rural FMCG market is expected to grow to $100 billion by 2025. It is the second largest smartphone market in the world (projected to grow to $90 billion by 2032). India’s food services market is estimated to grow $125 billion by 2029. We are the largest 2 wheeler market in the world, mainly driven by rural and semi urban demand.

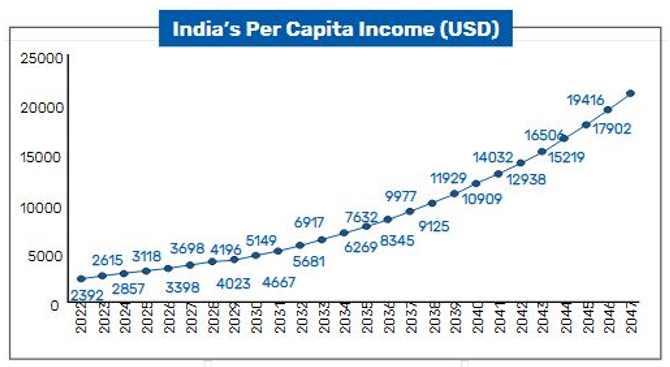

- Rising income on a per capita basis is the main driver of consumption growth in India. India’s per capita GDP grew from sub $1,000 levels in the mid 2000sto around $2,857 in 2024 (source: PHD Research Bureau). Over the next 23 years, per capita is expected to grow at around 8.7% to $19,416 by 2047.

Source: PHD Research Bureau, Bajaj Finserv MF

- Per capita income of up to $2,000 is an inflection point because income up to $2,000 mostly spent on basic needs; as it keeps growing above $2,000 discretionary spending rises. After crossing the inflection, per capita income can rise at faster rate based on historical per capita income growth of emerging economies like South Korea, China and Russia. We have already crossed the inflection point and are on the cusp of a major consumption upcycle, signs of which are clearly visible in growth and consumption trends.

Source: World Bank, Bajaj Finserv MF

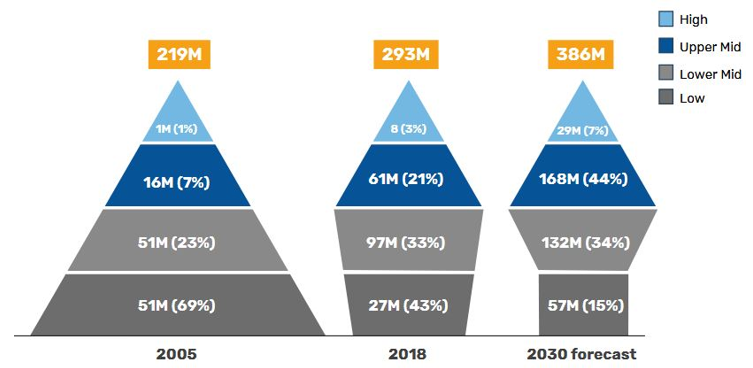

- The percentage of the population in the low income bracket is decreasing, while the percentage of population in the upper middle and high income brackets are increasing. With an increase in affluent household in India, the consumption of branded and luxury goodsareexpected to pick up significantly. We are seeing shifts in consumption trends towards higher quality braded goods and preference for luxury brands among affluent customers.

Source: Bajaj Finserv MF

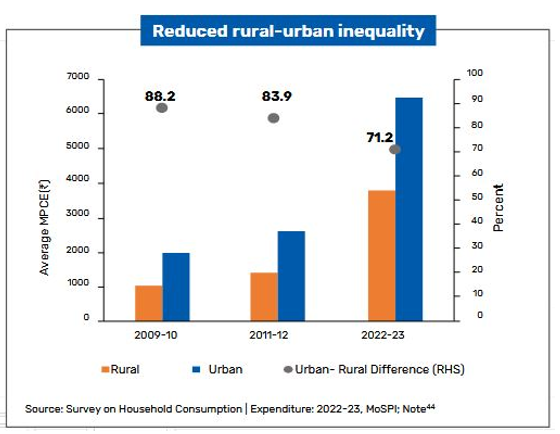

- Reduced rural urban divide is another driver of consumption growth in India. Rise in rural consumption and reduced rural-urban inequality has helped household consumption to increase.

Source: Bajaj Finserv MF

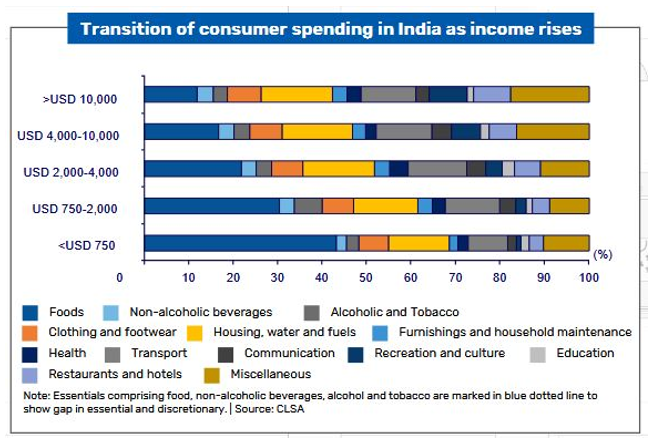

- With the rise in income, Indian consumers spend a higher proportion of their income beyond necessities like food and clothing.

Source: Bajaj Finserv MF

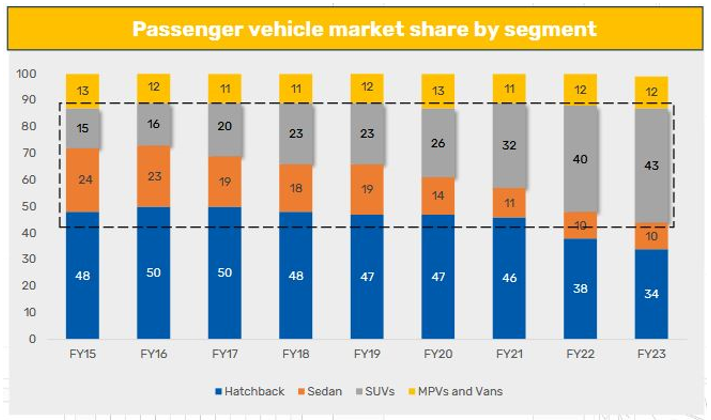

- Consumption trend is shifting from quantity to quality. The market share of hatchback cars has declined from 48% to 34%, while share of sedans and SUVs increased from 39% to 53%. The SUV segment enjoyed the highest market share growth from 15% to 43%.

Source: Bajaj Finserv MF

- Quick commerce (a type of e-commerce with emphasis on quick deliveries) has seen explosive growth from just $40 million of gross merchandize value in 2019 to $2.4 billion in 2023. Quick commerce is the fastest growing retail channel and expected to grow at CAGR of 60 – 80% by 2028.

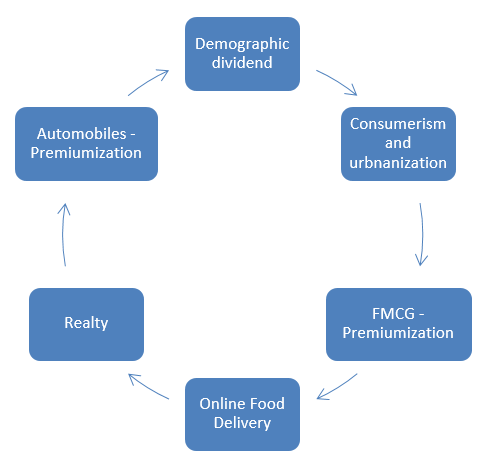

Megatrends in consumption

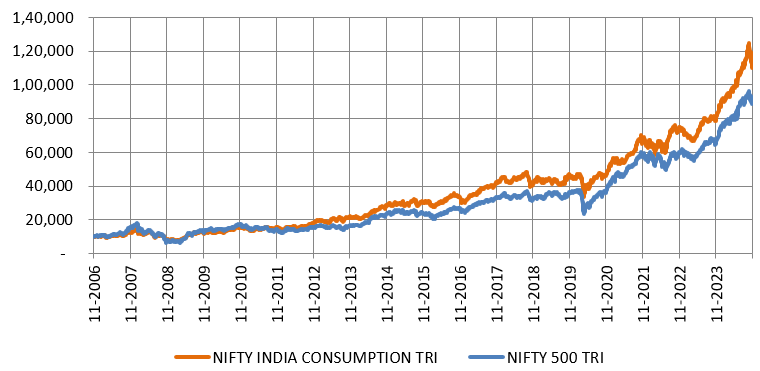

Consumption as an investment theme has outperformed the market

The chart below shows the growth of Rs 10,000 investment in the Nifty India Consumption TRI versus the broad market index Nifty 500 TRI. You can see that the Nifty India Consumption TRI has outperformed Nifty 500 TRI.

Source: National Stock Exchange, as on 31.07.2024.

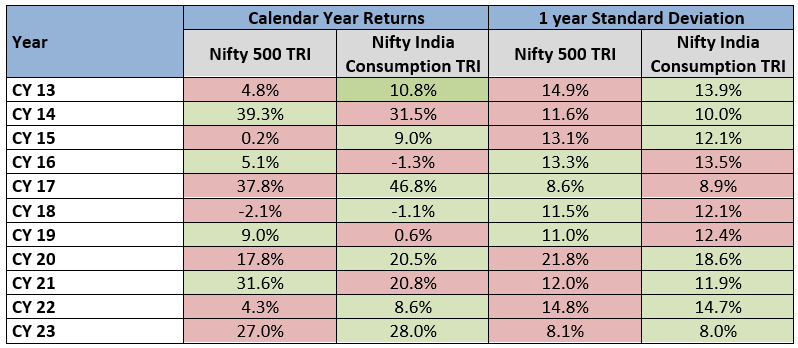

Lower volatility compared to the broad market index

The consumption theme (Nifty India Consumption Index) despite outperforming the broad market (Nifty 500) in most years had lower volatility compared to the broad market.

Source: Bajaj Finserv, as on 31.12.2023.

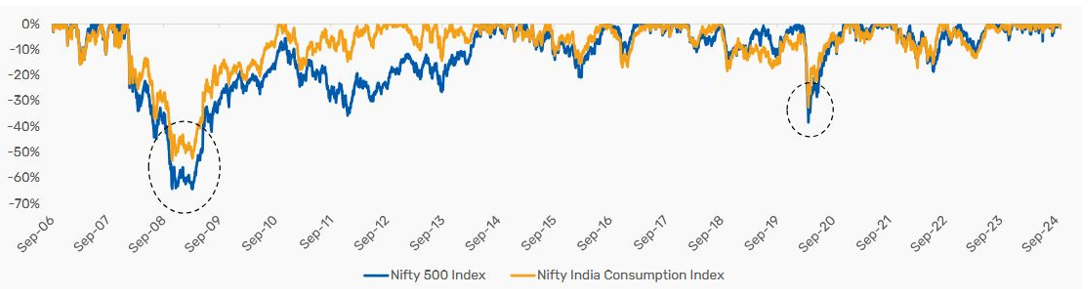

Smaller drawdowns relative to broad market index

The chart below shows the drawdowns of Nifty 500 versus Nifty India Consumption Index over the last 18 years. You can see that the Nifty India Consumption experienced smaller drawdowns compared to the broad market. We have circled the two biggest drawdowns viz. the 2008 Global Financial Crisis (Nifty India Consumption index drawdown was -53%, versus Nifty 500 index drawdown of -64%) and 2020 COVID-19 Pandemic crash (Nifty India Consumption index drawdown was -38%, versus Nifty 500 index drawdown of -32%).

Source: Bajaj Finserv, as on 30.09.2024

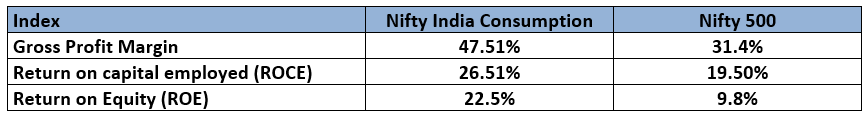

Stronger fundamentals compared to the broad market index

Source: Source: Bajaj Finserv, as on 31.08.2024

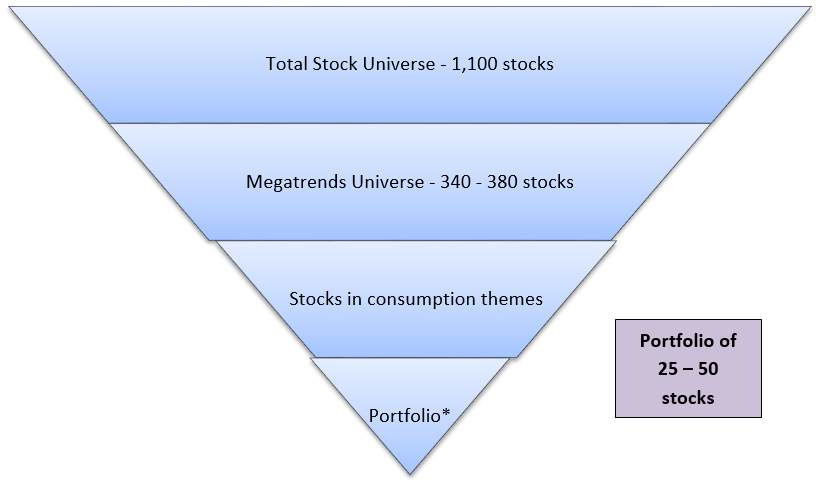

Investment strategy of Bajaj Finserv Consumption Fund

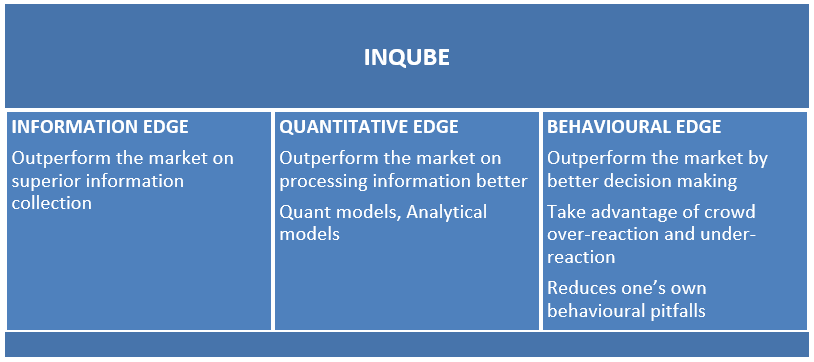

INQUBE Investment Philosophy

Why invest in Bajaj Finserv Consumption Fund?

- Bajaj Finserv Consumption is a TRUE TO LABEL consumption fund

- Consumption is a sector that has demonstrated long term return potential and at the same time has witnessed lower drawdowns during down cycle. This makes it an important diversifier in an investor’s portfolio

- The fund will invest in Consumption MEGATRENDS by identifying the potential growth stories.

- The fund is market cap agnostic. It will have the flexibility to investment across the market cap segments

- The fund will targeting future profit pool companies which can be potential wealth multipliers for investors

Who should invest in Bajaj Finserv Consumption Fund?

- Investors looking for capital appreciation over long investment tenures from India’s consumption growth theme

- Investors looking to do lumpsum investments

- Investors with higher risk appetites

- Investors looking for tactical allocation in their overall equity portfolio

- Investors with minimum 5 year investment tenures

Investors should consult their financial advisors or mutual fund distributors if Bajaj Finserv Consumption Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Bajaj Finserv Limited ('Bajaj Finserv', 'BFS' or 'the Company') is a Core Investment Company (CIC) under RBI Regulations 2020 and the holding company for the various financial services businesses under the Bajaj Group. Its vision is to provide financial solutions for retail and SME customers through their life cycle - asset acquisition and lifestyle enhancement through financing, asset protection through insurance, family protection through life and health insurance, healthcare needs for the family, savings & investment products, wealth management, retirement planning and annuities. BFS, through its various businesses, provides these solutions to over 100 million customers.

Investor Centre

Follow Bajaj Finserv

More About Bajaj Finserv

POST A QUERY