Should you invest in Balanced Advantage Funds

Balanced advantage funds, also known as dynamic asset allocation funds, are a type of hybrid mutual funds. Hybrid funds invest across multiple asset classes e.g. equity, debt etc. These funds provide asset allocation or risk diversification benefits to your portfolio. Different asset classes have different risk / return characteristics. Asset allocation aims to balance risk and returns to achieve financial goals. Hybrid funds provide investors active risk management through asset allocation. There are different types of hybrid funds with different asset allocations, which may be suitable for investors with different risk profiles. In this article, we will discuss about Balanced Advantage Funds.

What are Balanced Advantage Funds?

Balanced advantage funds use dynamic asset allocation strategy. In this asset allocation strategy, the asset allocation changes depending on market conditions. For example, a balanced advantage fund may reduce its equity allocations and increase itsdebt allocations as equity valuations increase. When equity valuation decreases, the fund may increase its equity allocation and reduceits fixed income allocation. SEBI has not mandated upper or lower asset allocation limits for dynamic asset allocation funds.

How do Balanced Advantage Funds work?

The asset allocation of Balanced Advantage Funds is determined by a dynamic asset allocation model. Each Balanced Advantage Fund has its own dynamic asset allocation model. Most Balanced Advantage Funds follow counter-cyclical dynamic asset allocation models. These models use the age old investment wisdom, “buy low, sell high”. While the logic of buying low and selling high is intuitive, let us understand how dynamic asset allocation model works in the context of the equity market.

Investors should understand that the equity market moves in a cycle (market cycle) depending on economic growth and expectations of corporate earnings growth i.e. profits of corporations. As earnings grow, the share price of companies rises. Investors expect even higher earnings in the future and share prices rises further. Beyond a point, earnings growth cannot keep pace with the growth in share price. At this point the valuations of the stocks become expensive. Ratios like Price to Earnings or Price to Book are used to measure valuations. Counter-cyclical dynamic asset allocation model will decrease its net equity allocations and increase its debt allocation as equity valuations increases (becomes expensive). By lowering net equity allocations when the market is high, the dynamic asset allocation reduces downside risk, when the market corrects after peaking. You should note that the net equity allocation is the unhedged equity allocation of the balance advantage fund. We will discuss more on this in the next section.

When valuations become high, the market starts to peak. When the economic cycle turns i.e. slowdown or recession, we will also see a reversal in the market cycle; prices start falling. Investors rush to sell their stocks. Corporate earnings start slowing or fall. Investors expect to earnings to fall further and stock prices fall further. As stock prices fall, the valuations (PE, PB etc.) also decrease. Counter-cyclical dynamic asset allocation model will increase its net equity allocations and decreases its debt allocation as equity valuations fall (becomes expensive). At a certain point of time, the valuations look attractive (cheap). By increasing equity allocations when valuations are low, the dynamic asset allocation model generates risk adjusted returns for the investor. The market will usually bottom out when valuations are very low and start rising again. This investment cycle keeps repeating.

Hedging and equity taxation

Balanced advantage funds usually cap their debt allocation to 35% so that the scheme can enjoy equity taxation. What will the fund do if the dynamic asset model is suggesting less than 65% equity exposure? Balanced advantage funds use hedging to reduce the net equity allocation, but keep the gross equity exposure above 65% to ensure equity taxation. Short term capital gains in equity oriented funds (investment holding period of less than 12 months are taxed 15% (plus applicable surcharge and cess).

Long term capital gains in equity oriented funds (investment holding period of 12 months or more) are tax free up to Rs 1 lakh and taxed at 10% (plus applicable surcharge and cess) thereafter. Balanced advantage funds use derivatives (equity related securities like futures and options) to hedge their equity exposure. For example, you have bought shares of company ABC at Rs 100; you willalso sell futures of ABC at Rs 100. If the share price as well future price ABC falls to 90, you will make a loss of Rs 10 in your stock, but a profit of Rs 10 on your futures position. Hedging makes your combined position market neutral; you will not make a losseven if the price falls. The dynamic asset allocation model will increase hedging (i.e. sell more futures) to reduce net equity allocation and decrease hedging (i.e. sell less futures) to increase net equity allocation.

Arbitrage

Balanced Advantage Funds also generate additional income from their hedged exposure using arbitrage. Arbitrage is a strategy of generating risk free profits by taking advantage of market inefficiencies or price differences in different capital market segments.

Let us see how arbitrage works with the help of an example of a typical arbitrage strategy known as cash and carry arbitrage. In cash and carry arbitrage you buy the stock in the cash or spot market and simultaneously sell the futures of the same underlying stock in the F&O (futures and options) market.

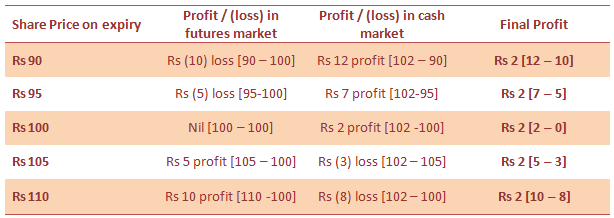

Let us assume the price of a stock in the cash market is Rs 100 and its price in the F&O market is Rs 102. You should know that on expiry of the futures, the cash price and futures price will always converge. The table below shows different price movement and profit / loss scenarios of the combined position. You can see that cash and carry arbitrage enabled you to lock-in profit irrespective of price movement.

Disclaimer: The above analysis is purely illustrative for investor education purposes only. You need to consider several factors like transaction costs, impact cost for large orders etc., in arbitrage trading.

Benefits of Balanced Advantage Funds

- These funds can be less volatile than aggressive hybrid funds because they tend to have lower equity allocations at market peaks. Consequently in corrections they may have lesser drawdowns.

- Since Balanced Advantage Funds can be relatively less volatile compared to equity funds and aggressive hybrid funds, they can be suitable for new investors who have not experienced market volatility.

- Balanced Advantage Funds reduce equity allocation when valuations are high and increase it when valuations are low, generating potential risk adjusted returns for investors over sufficiently long investment tenures.

- Balanced Advantage Funds can enjoy equity taxation if their average gross (hedged and un-hedged) equity exposure is 65% or more. However, investors should consult with their financial advisors about the tax treatment of their mutual fund schemes and make informed investment decisions.

- You need to have long horizon to invest in these schemes. Financial advisors recommend minimum 3 to 5 year investment tenures for this scheme.

You should discuss with your financial advisor, if Balanced Advantage Funds are suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Axis Mutual Fund launched its first scheme in October 2009 Since then Axis Mutual fund has grown strongly. We attribute our success thus far to our 3 founding principles - Long term wealth creation, Outside in (Customer) view and Long term relationship. Come join our growing family of investors and give shape to your desires.

Quick Links

Other Links

Follow Axis MF

POST A QUERY