SBI Balanced Advantage Fund: Strong risk adjusted returns in difficult market conditions

SBI Mutual Fund launched SBI Balanced Advantage Fund in August of 2021. The scheme manages its asset allocation dynamically based on valuations and some other parameters. SEBI does not have asset allocation upper and lower limits for dynamic asset allocation funds or balanced advantage funds. In other words, equity and debt allocations of the scheme can range from 0 – 100% depending on market conditions. Since its inception the scheme has given 13.27% CAGR returns, outperforming Nifty 50 TRI over the same period. This is very strong risk adjusted performance since the risk profile of SBI Balanced Advantage Fund is lower than equity index like Nifty.

Current economic context

Supported by positive global cues, Indian equities are trading at their all-time highs and there are concerns about valuations. The Nifty and Sensex are trading at PE multiples of 23 – 25. In late February, SEBI issued an advisory on froth building in midcap and small cap stocks after which we saw volatility in these stocks. From global macro perspective, economists are forecasting slowdown as we approach the end of the high interest rate cycle, signs of which are clearly visible in developed markets. However, the outlook of Indian equities in long term is positive. India is the fastest growing G20 economy and is expected to outperform in the medium to long term as well.

In current market conditions, investors should focus on asset allocation to provide stability to their portfolios. A dynamic asset allocation approach, which changes asset allocation according to market conditions can be suitable for investors when there are uncertainties in the short to medium term. Balanced advantage funds are hybrid schemes which dynamically manage their asset allocations in equity and debt depending on market conditions. For example, if valuations are high the fund may reduce their equity allocations and increase their debt allocations. If the market falls and valuations are low, the fund may increase their equity allocation and reduce their debt allocations.

Why invest in Balanced Advantage Funds?

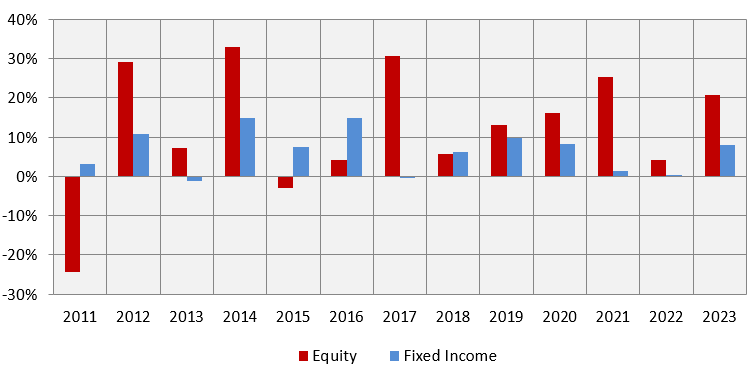

The age-old stock market wisdom, “buy low, sell high”, is easy to understand but difficult to execute for most investors. However, there is sufficient anecdotal evidence that suggests that many retail investors do the opposite. Behavioural factors e.g. greed and fear, herd instincts etc often drive investment decisions, as a result you may get sub-optimal returns. Timing the market i.e. predicting when / at level prices will peak or bottom is very difficult because short term prices are driven by sentiments, rather than fundamentals. Even predicting which asset class (i.e. equity, debt etc) will outperform or underperform in the short term is difficult because winners keep rotating between asset classes (see the chart below).

Source: National Stock Exchange, Advisorkhoj Research, 1st Jan 2011 to 31st December 2023. Equity: Nifty 50 TRI; Debt: Nifty 10 year benchmark G-Sec Index. Disclaimer: Past performance may or may not be sustained in the future.

SBI Balanced Advantage Fund uses a systematic valuation-based approach which is suitable for generating consistent and risk adjusted returns across different market conditions over sufficiently long investment tenures.

Asset allocation of the SBI Balanced Advantage Fund

- Net long Equity: This is the un-hedged equity exposure of the fund. Net equity allocation is determined by the fund managers, using parameters such as Sentiment Indicator, Valuations & Earnings Drivers. The net long equity allocation of the scheme is aimed at providing long term capital appreciation (wealth creation) for investors.

- Debt: Debt allocation is also determined by the fund manager using the above parameters and capped at 35% to ensure equity taxation. The debt allocation will provide stability in volatile markets.

- Arbitrage: This is the fully hedged equity component but generates arbitrage (risk-free) profits based on price differences in cash and futures market or corporate actions. The arbitrage component reduces the net long equity exposure and at the same time, helps to keep the gross equity exposure above 65%, which enables equity taxation.

- The net equity allocation of SBI Balanced Advantage Fund (as on 29th February 2024) was 34% versus 51% average for the Balanced Advantage Fund category.

Portfolio construction strategy

The scheme has a quantitative framework the top-down investment strategy in terms of the market cap allocation, investment style (growth / value / quality), sector preference etc. Stock selection is based on fund manager conviction. The fund manager uses model portfolios based on the highest conviction ideas of the SBI MF analyst team. The debt portion of the scheme portfolio is of high credit quality / sovereign securities to maintain liquidity. The fund managers actively manage duration to generate alpha across the yield curve.

How has SBI Balanced Advantage Fund performed?

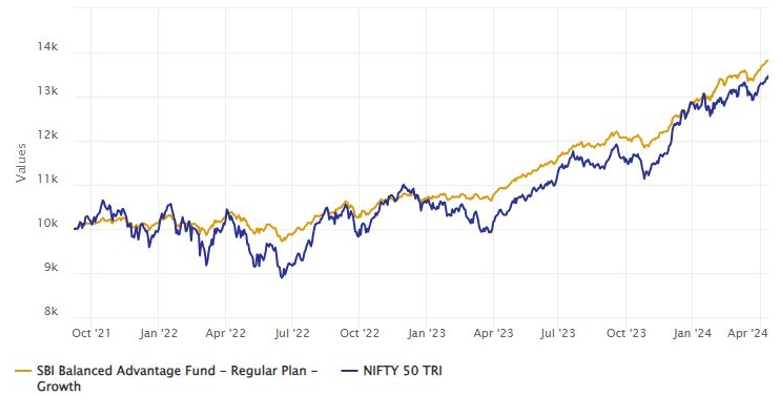

SBI Balanced Advantage Fund has not yet completed 3 years since launch. However, we have experienced different market conditions since the launch of the fund including periods of high volatility. Since the launch of the SBI Balanced Advantage Fund, the scheme has been able to outperform Nifty 50 TRI. This is very strong performance, especially in terms of risk adjusted returns, because the risk profile of Nifty 50 TRI is higher (more risk) compared to SBI Balanced Advantage Fund.

Source: Advisorkhoj Research, as on 10.04.2024

How has SBI Balanced Advantage Fund performed in different market conditions?

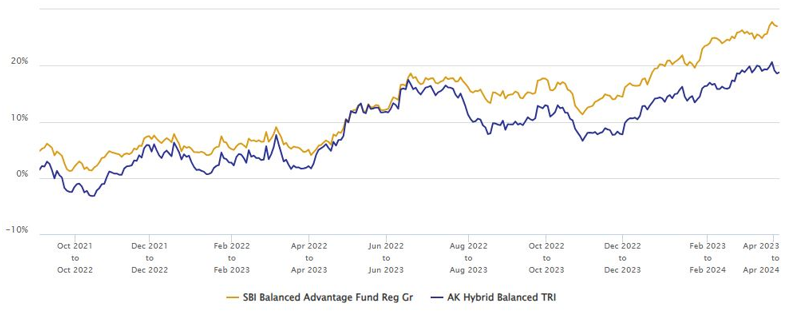

We have discussed several times in our blog that rolling returns is the most unbiased measure of a scheme’s performance. For a balanced advantage fund, rolling returns assume even greater importance because the performance of the scheme in volatile markets is important for investors looking for stability in volatile conditions. The chart below shows the 1 year rolling returns of SBI Balanced Advantage Funds versus our benchmark balanced index (AK Hybrid Balanced TRI). Our balanced index comprises of 50% Nifty 50 as proxy for equity as an asset class and 50% Nifty 10-year benchmark G-Sec as proxy for debt as an asset class. We rebalance the index monthly. You can see that SBI Balanced Advantage Fund has outperformed our benchmark index across different market conditions.

Source: Advisorkhoj Rolling Returns, as on 10.04.2024

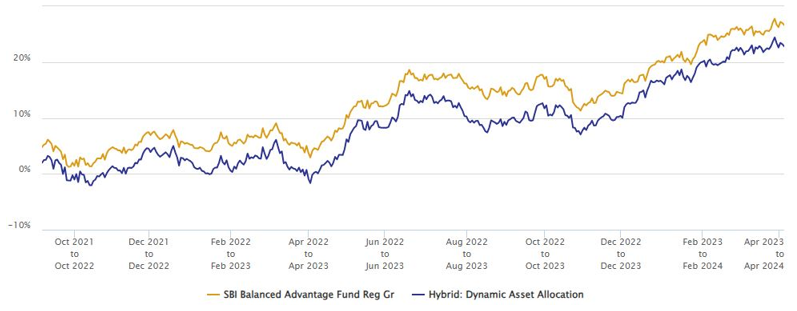

How has SBI Balanced Fund performed versus peers in different market conditions?

The chart below shows the 1 year rolling returns of SBI Balanced Advantage Fund versus the category average since inception. You can see that the scheme has outperformed the category average across different market conditions over 1 year investment tenures since inception.

Source: Advisorkhoj Rolling Returns, as on 10.04.2024

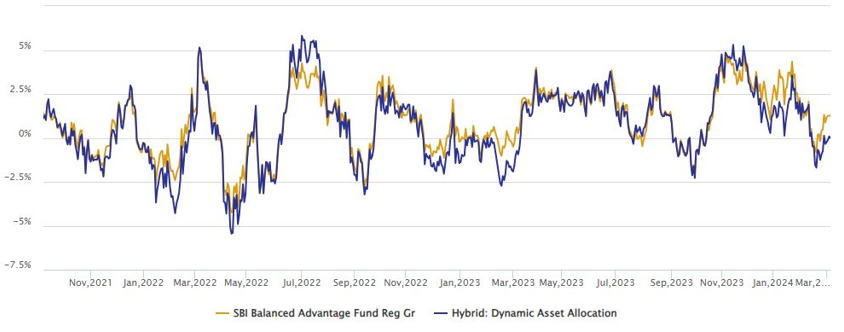

Downside risk protection

The chart below shows the 1 month rolling returns of SBI Balanced Advantage Fund versus the category average since inception. Over shorter investment tenures the effect of volatility on performance is more pronounced. You can see that downside (negative returns) of SBI Balanced Advantage Fund over 1 month tenures are lower than the category average – superior downside risk protection or better stability.

Source: Advisorkhoj Rolling Returns, as on 10.04.2024

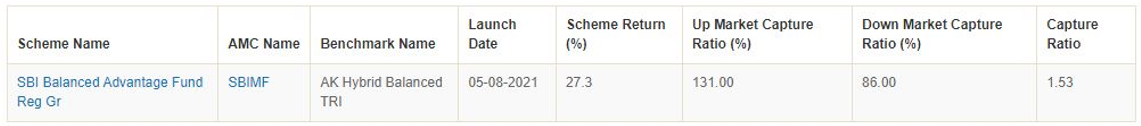

The table below shows the up market and down-market capture ratios of SBI Balanced Advantage Fund over the last 1 year. You can see that SBI Balanced Advantage Fund was able to limit downside risks by 14% in down markets. This is another data point that suggests that the fund provides downside risk protection in volatile markets and potential of risk adjusted returns.

Source: Advisorkhoj Market Capture Ratio, as on 31.03.2024

Why invest in SBI Balanced Advantage Fund?

- Equity valuations seem over-stretched. In such market conditions a systematic model based asset allocation approach seems suitable.

- Dynamically managed Asset allocation basis the market outlook will remove emotional biases and balance risk / reward.

- The uniqueness of the asset allocation range i.e., from 0 – 100% for both debt & equity will provide flexibility across different market conditions.

- Expertise of SBI Mutual Fund investment team.

Who should invest in SBI Balanced Advantage Fund?

- Investors looking for long term risk adjusted returns.

- Investors are looking for a dynamic solution for the right mix of debt and equity.

- Investors who do not have high risk appetites. This scheme is suitable for investors with moderately high-risk appetites.

- Investors with minimum 3 – 5 years of investment horizon

Investors should consult with their financial advisors or mutual fund distributors if SBI Balanced Advantage Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- Know your mutual fund tax obligations to manage your investments effectively

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Long Term Equity Fund: A consistent fund for your tax saving needs

- SBI Energy Opportunities Fund NFO review: Investing in Indias energy sector

- SBI Nifty 50 Equal Weight Index Fund: A good index fund for long term investments

- Capture the potential of multiple asset classes with SBI Multi Asset Allocation Fund

- Should you invest in SBI Equity Savings Fund

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY