Axis MF launches Axis S&P 500 ETF Fund of Fund

Mutual Fund

(An open ended fund of fund investing in Exchange Traded Funds replicating S&P 500 TRI, subject to tracking errors)

Highlights:

- Category: An open ended fund of fund investing in Exchange Traded Funds replicating S&P 500 TRI, subject to tracking errors

- Benchmark: S&P 500 TRI (INR)

- Fund Manager: Mr. Vinayak Jayanath

- NFO open date: 22nd March 2023

- NFO close date: 05th April 2023

- Minimum Investment: Rs. 500 and in multiples of Re. 1/- thereafter

- Exit Load:

If redeemed/switched-out within 30 Days from the date of allotment - 0.25%

If redeemed/switched-out within 30 Days of allotment - Nil

Mumbai, March 22, 2023M: Axis Mutual Fund, one among the fastest growing fund houses in India, announced the launch of their New Fund Offer - Axis S&P 500 ETF Fund of Fund (an open ended fund of fund investing in Exchange Traded Funds replicating S&P 500 TRI, subject to tracking errors). The new fund will adhere to the S&P 500 TRI (INR) benchmark. Mr. Vinayak Jayanath would be managing the fund and the minimum investment amount is Rs. 500 and in multiples of Re. 1/- thereafter. The exit load is as mentioned below:

- If redeemed/switched-out within 30 Days from the date of allotment - 0.25%

- If redeemed/switched-out within 30 Days of allotment - Nil

Understanding a Fund of Fund

Unlike a regular mutual fund that invests in distinct asset classes, a Fund of Fund invests in schemes of its own or other fund houses. In the case of international Fund of Funds, the fund manager invests in units of offshore mutual fund schemes by ensuring that the target fund’s investment philosophy and risk profile matches with that of the fund’s mandate. Fund of Funds can be an interesting entry point for new as well as seasoned investors. In addition to diversification, investors may also benefit from the meticulously structured risk mitigation techniques.

Axis S&P 500 ETF Fund of Fund

Following a passive investment strategy, the Axis S&P 500 ETF Fund of Fund endeavours to invest at least 95% of the net assets in units/shares of overseas Exchange Traded Funds replicating S&P 500 TRI, subject to the availability of Eligible Investment Amount and the remaining in Debt and Money Market investments. The indicative list of overseas Exchange Traded Funds in which the Scheme proposes to invest is as follows

- iShares Core S&P 500 UCITS ETF

- HSBC S&P 500 UCITS ETF

- SPDR® S&P® 500 UCITS ETF

The list of overseas Exchange Traded Funds provided is indicative and the Scheme can invest in any other overseas Exchange Traded Fund which shall have similar investment objective, investment strategy and benchmark. (Please refer to SID for detailed Asset Allocation & Investment Strategy and other scheme related features available at www.axismf.com)

Therefore, the investment objective of the newly launched fund is to replicate the performance of the S&P 500 TRI by investing in Exchange Traded Funds replicating S&P 500 TRI, subject to tracking errors. However, there can be no assurance that the investment objective of the Scheme will be achieved. Given the mutual fund structure, investors can look to invest through various systematic options like SIPs, STP’s & lumpsum investments.

Some Key Attributes of the Fund include:

- Global Exposure: Since the S&P 500 index tracks the performance of 500 large companies listed on the US stock exchange, investors can gain global exposure. Furthermore, the index evolves as the US markets evolves with changing sectoral dynamics

- Sector Agnostic Representation: The Index potentially aims to provide broad based exposure across all sectors

- Low Cost Passive Exposure: Avenue to take low cost exposure in US market and also potentially benefit from INR depreciation

Chandresh Nigam, MD & CEO, Axis AMC said, “ETFs are soon becoming popular amongst the various vehicles of investing in passive strategies in India. In India, Fund of Funds can be considered as an interesting entry point for investors with a longer investment horizon and who wish to diversify their portfolio from a global standpoint. With the launch of the Axis S&P 500 ETF Fund of Fund, we are seamlessly enabling global exposure through passive strategies. The new scheme’s approach aligns with our philosophy of ‘Responsible Investing’ and we believe, will be a notable addition to our portfolio of products.”

The NFO opens for subscription from March 22, 2023 to April 05, 2023.

For more information, please visit www.axismf.com.

Sources: Axis AMC Research data as on 15th March, 2023

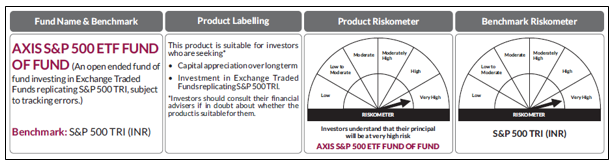

Product Labelling and Riskometer: Axis S&P 500 ETF Fund of Fund (An open ended fund of fund investing in Exchange Traded Funds replicating S&P 500 TRI, subject to tracking error)

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

(The product labelling assigned during the New Fund Offer is based on internal assessment of the Scheme Characteristics or model portfolio and the same may vary post NFO when actual investments are made)

Note: Investors will be bearing the recurring expenses of the scheme in addition to the expenses of other schemes in which Fund of Funds scheme makes investment

About Axis AMC: Axis AMC is one of India`s fastest growing assets managers offering a comprehensive bouquet of asset management products across mutual funds (https://www.axismf.com/), portfolio management services and alternative investments (https://www.axisamc.com/homepage).

Disclaimer: This press release represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s).

The information set out above is included for general information purposes only and does not constitute legal or tax advice. In view of the individual nature of the tax consequences, each investor is advised to consult his or her own tax consultant with respect to specific tax implications arising out of their participation in the Scheme. Income Tax benefits to the mutual fund & to the unit holder is in accordance with the prevailing tax laws as certified by the mutual funds consultant. Any action taken by you on the basis of the information contained herein is your responsibility alone. Axis Mutual Fund will not be liable in any manner for the consequences of such action taken by you. The information contained herein is not intended as an offer or solicitation for the purchase and sales of any schemes of Axis Mutual Fund.

Past performance may or may not be sustained in the future.

Stock(s) / Issuer(s)/ Top stocks mentioned above are for illustration purpose and should not be construed as recommendation.

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Axis Mutual Fund: Equity and Debt Market Outlook October 2024

Oct 23, 2024

-

Axis MF: Fixed income outlook October 2024

Oct 9, 2024

-

Axis Mutual Fund Launches Axis Nifty500 Value 50 Index Fund

Oct 3, 2024

-

Megatrend Investing: Why One Should Have a Systematic Investment Plan (SIP) in Flexi Cap Funds

Oct 1, 2024

-

Kotak Small Cap Fund: Proven Process, Seamless Transition and Stellar Performance

Sep 30, 2024