Interest Rate Outlook: Debt investors should consider long term Mutual Fund income funds

In its last monetary policy review on August 5 the RBI kept the repo rate unchanged at 8%, as was widely expected. Governor Rajan reiterated the central bank’s commitment to bringing down inflation, signalling a pause in rate actions in the short term. However, some banks have started cutting fixed deposit rates for certain maturities, taking advantage of rush of funds into fixed deposits after the union budget. In the union budget the holding period for long term capital gains has been increased from 12 months to 36 months, removing the tax advantage which Fixed Maturity Plans (FMPs) enjoyed over Bank Fixed Deposits. Flush with inflow of funds into Fixed Deposits, State Bank of India has cut FD rates by 50 bps in the middle of July. With the repo rate unchanged in this monetary policy review, other banks may soon follow suit by announcing fixed deposit rate cuts. While this may not be great news for fixed deposit investors, for debt investors with 2 to 3 years time horizon long term income funds can be good investment options.

Interest rate outlook

The benchmark 10 year government bond yield is at 8.8%, which is nearly at its 5 years historical high. Please see the chart below for the 10 government bond yield from Aug 2009 to Aug 2014.

Usually the 9% level is a good entry point for long term debt fund investors, because the rates usually soften from this point. Though the RBI governor has not given indications with regards to timelines for further rate action, investors should follow the policy actions of the Central Government, especially with regards to fiscal deficit. The Government has set progressively lower fiscal deficit targets for the next three fiscal years, starting with this year, as part of the fiscal consolidation roadmap. As the Government implements the fiscal deficit reduction measures, the inflation is likely to come down and provide the necessary impetus for RBI to cut interest rates. Bond prices have an inverse relationship with interest rates. As interest rate goes down bond prices increase, leading to higher potential returns from long term income funds over the next 2 to 3 years. Long term income funds have long duration bonds in their portfolio and therefore re-investment risk is lower compared to short term income or debt funds.

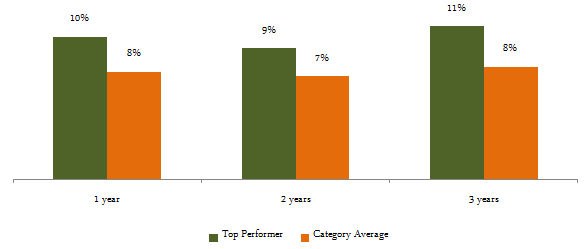

However, investors should be careful in selection of long term income funds. While long term income funds category has given trailing one year average returns of 7.7% the performance differentials between top and bottom performers have been quite significant. The chart below shows the trailing annualized 1 year, 2 years and 3 years returns of top performers and category.

Top Long Term Income Funds

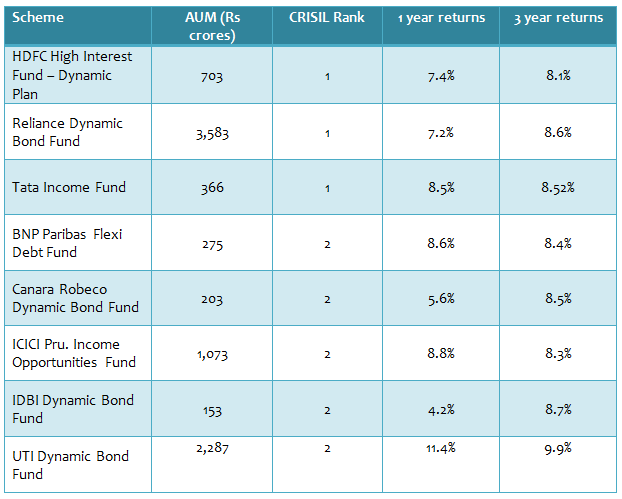

The table below shows some top long term income funds, based on the CRISIL’s most recent ranking for the quarter ended June 2014.

Investment Horizon

Let your tax status determine your investment horizon. Two important changes were announced in capital gains tax of debt funds in the recent Union Budget:-

- The holding period for long term capital gains was increased from 12 months to 36 months. Therefore, if the investor redeems his or her debt fund units before 36 months, the capital gains will be taxed at the applicable income tax rate of the investor.

- While in the previous tax regime, long term capital gain was taxed at 10% without indexation and 20% with indexation, in this budget long term capital gains tax for debt funds was increased to 20%. However, indexation benefits have been allowed when computing long term capital gains.

Investors in the 10% tax bracket can invest with 2 to 3 year time horizon. However, investors in 20% and 30% tax brackets should have a minimum investment of 3 years, so that they can avail the benefits of long term capital gains tax with indexation.

Conclusion

In this article, we have discussed how long term income funds can be good investment options for debt investors, given the current interest rate environment. Investors should bear the tax consequences in mind in making their investment decisions and consult with their financial advisers if long term income funds are suitable for their investment portfolio.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Motilal Oswal Mutual Fund launches Motilal Oswal Nifty MidSmall IT and Telecom Index Fund

Oct 29, 2024 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Nifty MidSmall India Consumption Index Fund

Oct 29, 2024 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Nifty MidSmall Healthcare Index Fund

Oct 29, 2024 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Nifty MidSmall Financial Services Index Fund

Oct 29, 2024 by Advisorkhoj Team

-

Zerodha Mutual Fund launches Zerodha Gold ETF FoF

Oct 25, 2024 by Advisorkhoj Team